Judges Scientific ($JDG): A Closer Look At This Serial Acquirer

Last month I took a position in Judges Scientific and I just finished the deep dive written together with Compounding Quality (CQ). I hope you will enjoy it!

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early. Join for free if you haven’t subscribed yet and buy me a coffee at buymeacoffee.com/arnoldweenink—keeps this free for all!

Join our Global Quality Investing app on Discord here and join my Substack for free if you haven’t subscribed yet.

General information

First of all a warm thanks to Compounding Quality for giving me the freedom to share the deep dive on Judges Scientific. I have prepared the deep dive for Compounding Quality (CQ), which is a great Substack which I can really recommend, and CQ did the final editing. I am happy I can share this analysis with my readers, especially as Judges Scientific is part of the Compound & Fire portfolio! I hope you will enjoy this format and the complete analysis.

👔Company name: Judges Scientific PLC

✍️ ISIN: GB0032398678

🔎 Ticker: JDG

📚 Type: Owner-Operator Stock / Serial acquirer

📈 Stock Price: GPB 75

💵 Market cap: GPB 498 million

📊 Average daily volume: GBP 1.4 million

✍️Publication date: 16 February 2025

A special thanks to Pieter Slegers of Compounding Quality for trusting me in preparing a deep dive on Judges Scientific for his community and for being able to share the deep dive on my Substack as well!

Conclusion Investment Case

Judges Scientific is a UK-based serial acquirer of niche scientific instrument businesses. The company follows a decentralized buy-and-build strategy. This allows its subsidiaries to operate independently while benefiting from centralized financial discipline.

Judges Scientific operates in two key segments:

Material Sciences (53.3% of revenue): Producing specialized tools for testing and analyzing different materials

Vacuum (46.7% of revenue): Manufacturing equipment that creates airless environments for scientific research and industrial applications

Since 2005, Judges Scientific has acquired 25 companies, each with strong market positions and global customer bases. Its acquisitions typically have high gross margins and operate in specialized markets with high barriers to entry. The company generates revenue across North America (28%), Europe (25%), China/Hong Kong (14%), and the rest of the world (33%).

The business model can be summarized as follows:

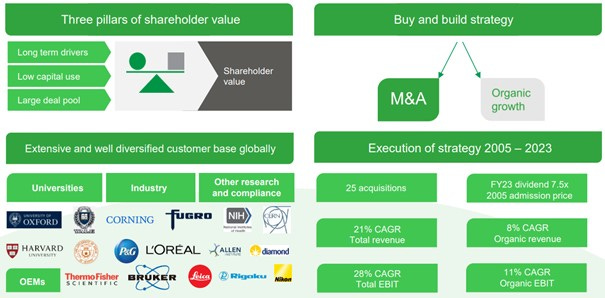

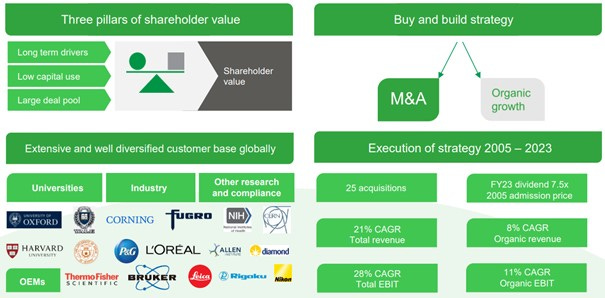

Source: Judges Scientific Investor Presentation

David Cicurel (73) is the CEO and founder of the company. He still owns 9.2% of Judges Scientific. The management team has a lot of experience in M&A, financial oversight, and the scientific instrument industry.

Judges Scientific’s competitive advantage comes from its disciplined acquisition model. They focus on high-margin niche markets and strong cash generation. The company maintains a high Return on total Invested Capital (Organic ROTIC: 33.5%, Total ROTIC 20.7%).

The biggest risks include macroeconomic uncertainty, potential acquisition missteps, and CEO succession planning. However, the company’s decentralized structure and strong financial discipline mitigate many of these concerns.

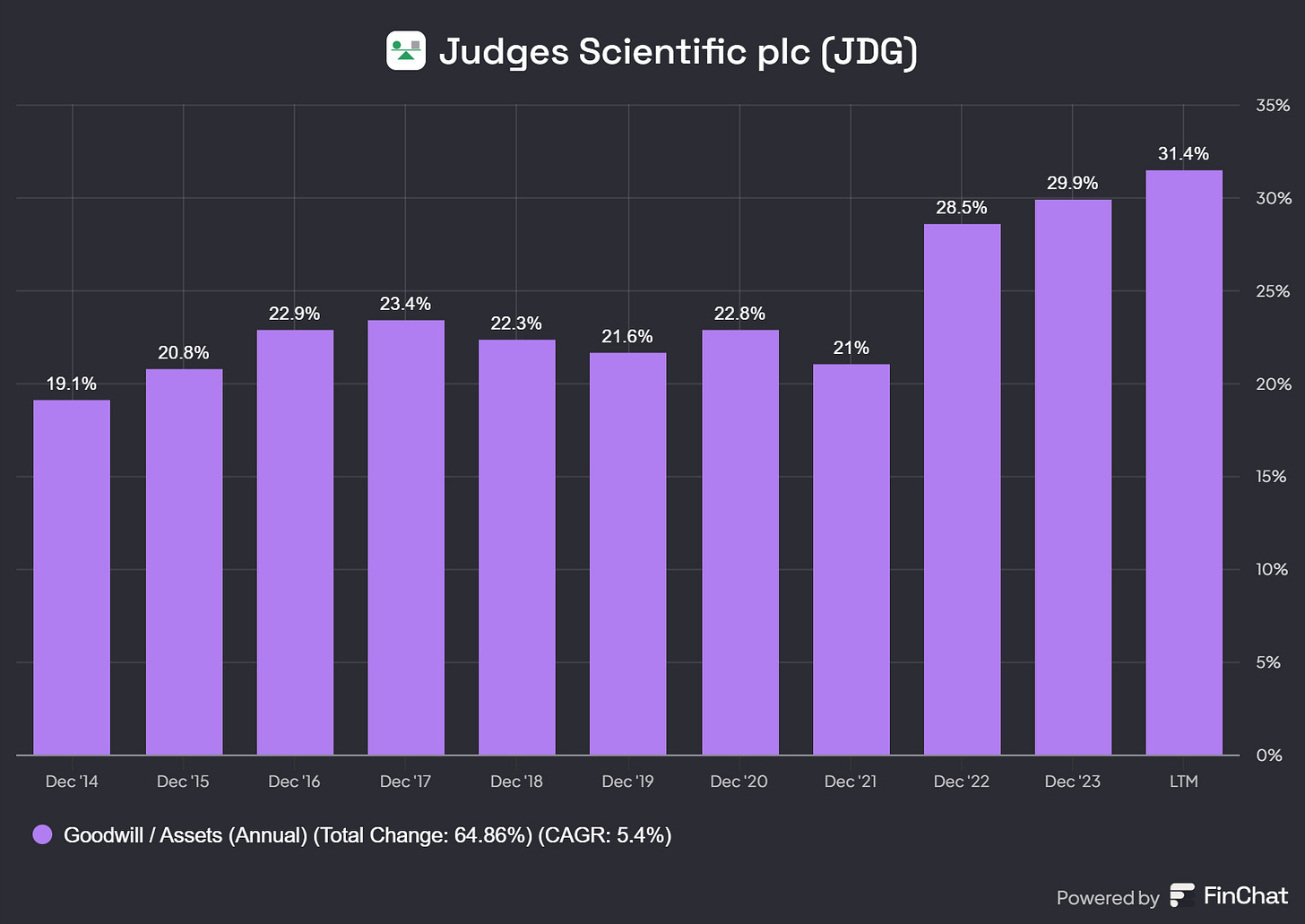

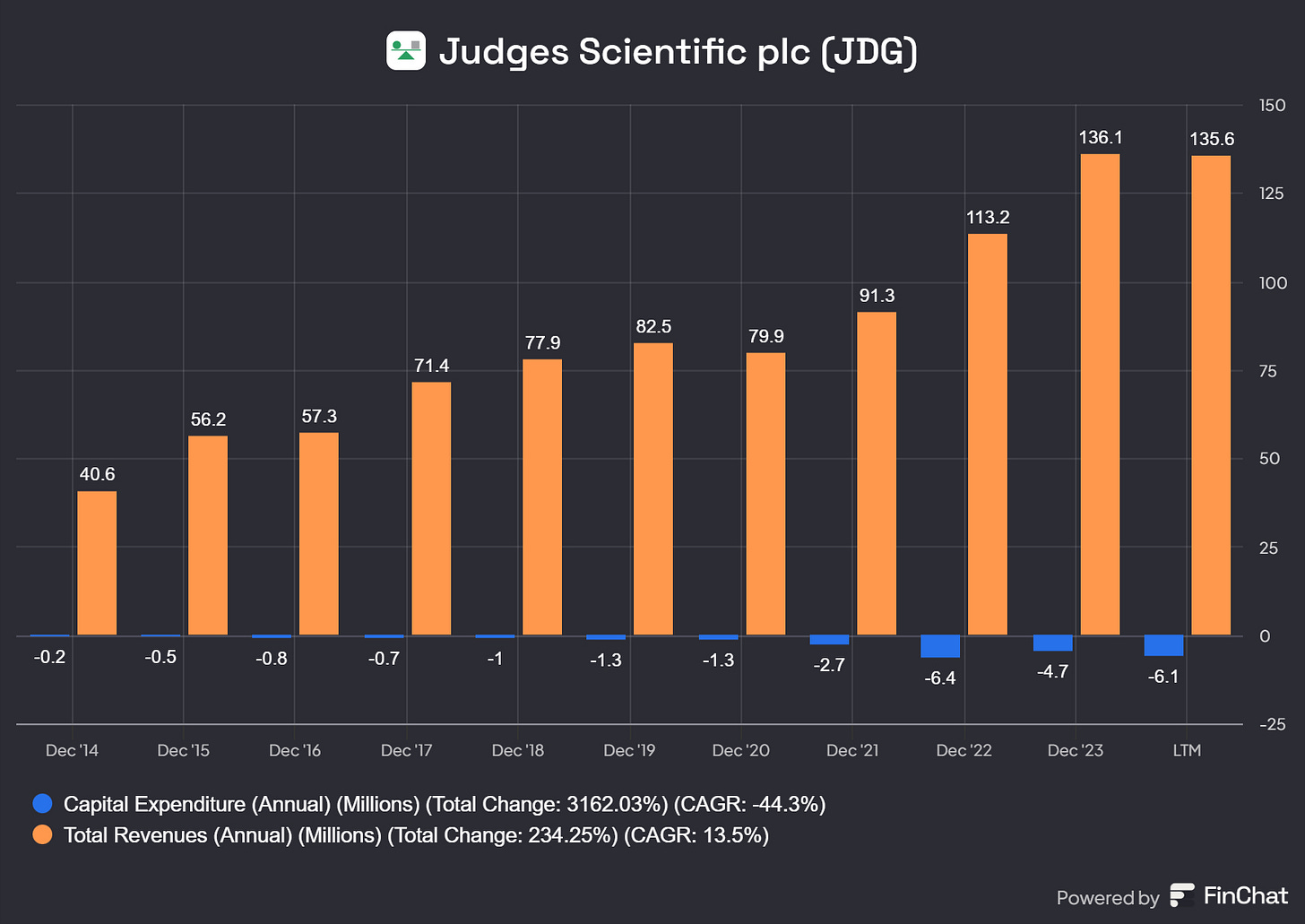

Judges Scientific has a strong balance sheet with Net Debt/FCF at 3.6x and Interest Coverage of 11.5x. Its disciplined acquisition strategy justifies a Goodwill/Assets ratio of 31.4%.

Judges is a very profitable company. The Gross Profit Margin is 69.0% and the Adjusted Operating Profit is 25.5% (2023).

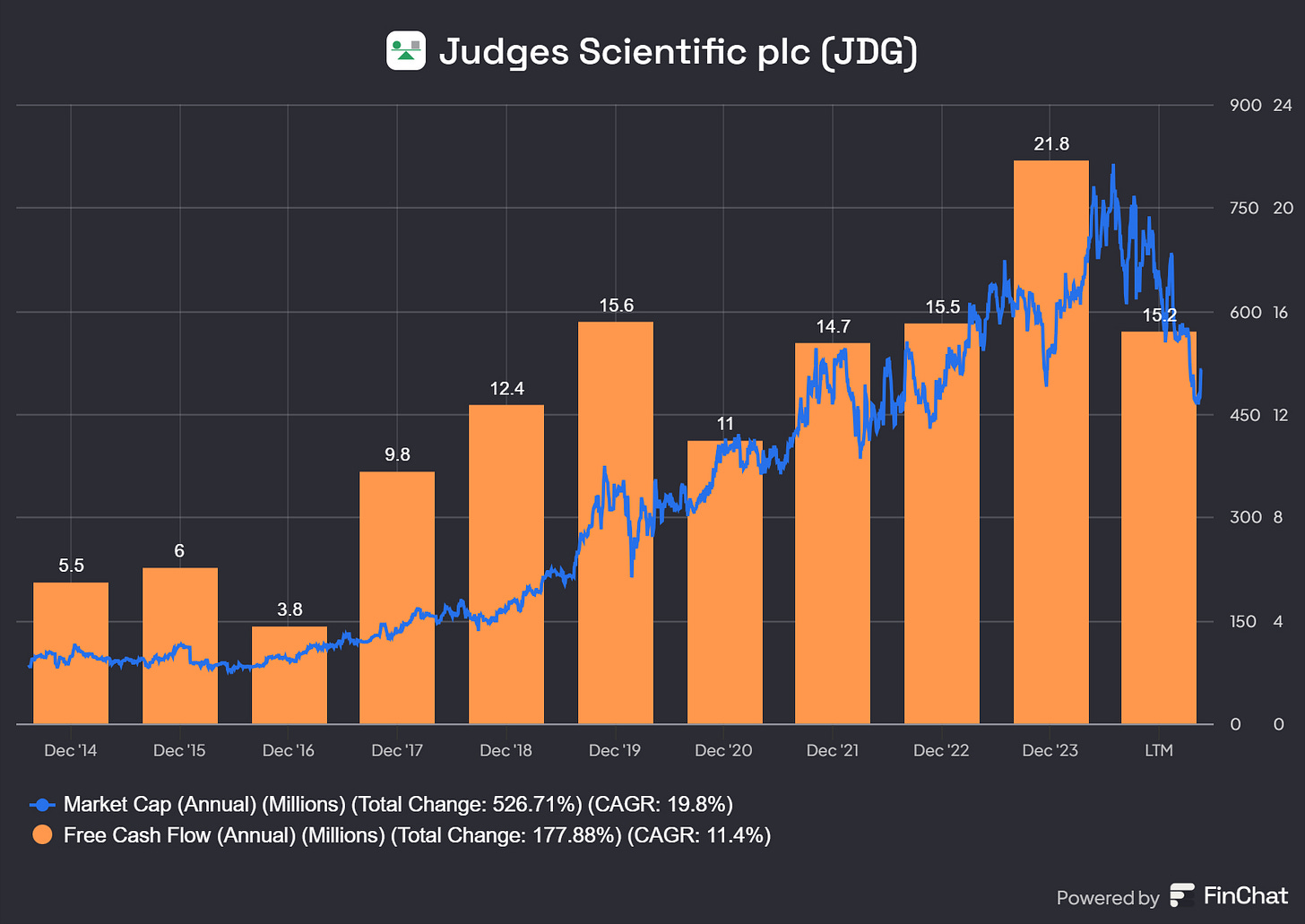

The serial acquirer grew attractively in the past (5-year Revenue CAGR: 10.8% and 5-year FCF CAGR: 12.0%). I expect the company to increase its EBIT and Free Cash Flow by 10%-16% in the future.

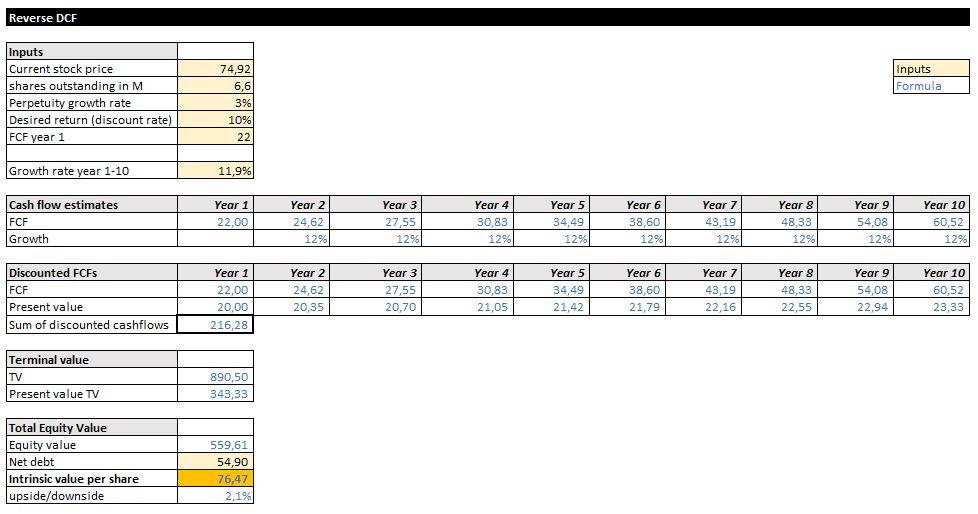

Judges is currently trading at attractive valuation levels. The stock currently trades at a FCF Yield of 4.4% versus a 5-year historical average of 3.2%. Our Earnings Growth Model suggests a yearly return of 12.1%, while our Reverse DCF indicates Judges Scientific needs to grow FCF by 12.0% annually to deliver a 10% shareholder return.

The business created a lot of value for shareholders in the past. Over the past 5 and 10 years, the company has compounded its Owner’s Earnings at a CAGR of 13.2% and 12.6%, respectively. The stock price managed to grow by 26.2% since the IPO in 2007.

Quality Score

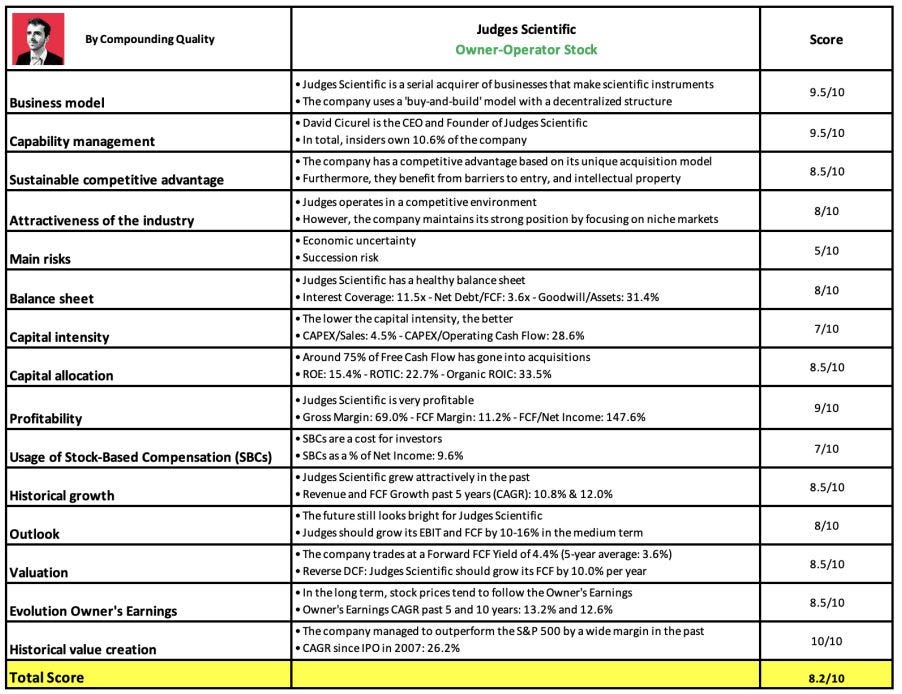

Every company gets a Quality Score based on 15 metrics. Finally, the company gets a ‘Total Quality Score’ which is calculated by taking the sum of the score of all 15 metrics and dividing it by 15.

As you can see in the table below Judges Scientific gets a Total Quality Score of 8.2/10.

Source: prepared by Compounding Quality

1. Do I Understand The Business Model?

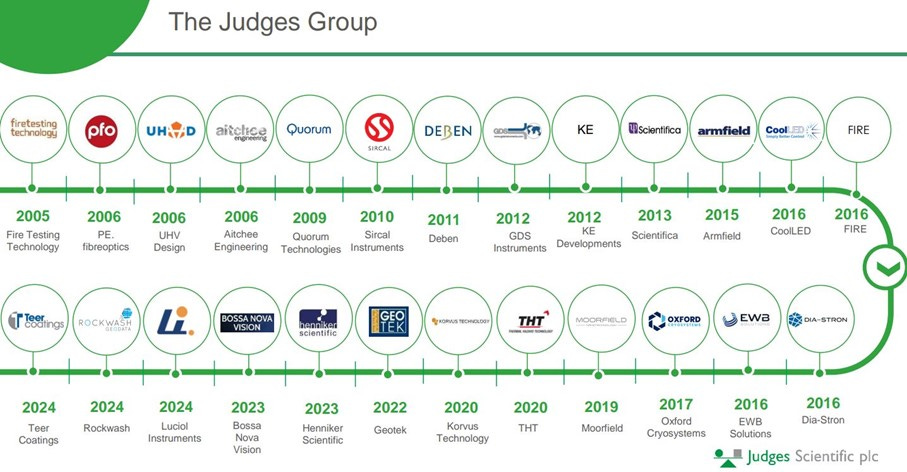

Judges Scientific was founded in 2002 by David Cicurel. He is also the CEO of the company. In 2005, the company started buying other businesses that make scientific tools. Since then, JDG has bought 25 companies.

David Cicurel isn’t just the CEO, he also owns part of the company. He owns 9.2% of its shares. This means we’re talking about an Owner-Operator company.

Here is a list of all the companies they have bought so far:

Judges Scientific follows a "buy-and-build" model. This means it buys and grows small and medium-sized businesses that make scientific tools.

These businesses create, build, and sell tools used for scientific research, measuring things, and analyzing data. These tools are very important for studying nature, running experiments, and learning more about science.

A decentralized buy-and-build strategy can be summarized as follows: A buy-and-build strategy with a decentralized structure means that a company buys smaller businesses and lets them run independently. Each business has its own way of doing things, but they all work together to help the bigger company grow. The main company doesn't control every detail, but instead, it supports each business to be successful on its own.

Judges Scientific operates in two main operating segments: Material Sciences and Vacuum. -

Material Sciences (53.3% of revenue): This segment creates special tools and machines. These tools help scientists and engineers’ study and test different materials. Think of them as super-strong magnifying glasses and advanced gadgets. They let people look very closely at materials to see what they are made of and how they work.

They make tools that help geologists (rock scientists) study the Earth o

They create machines that prepare tiny samples for looking at under super-strong microscopes

They have equipment that can put very thin layers of material on surfaces (kind of like painting, but on a tiny scale)

They make machines that can change the surface of materials to give them special properties

They create tools that test how strong, flexible, or durable different materials are

These tools and machines are used in many industries. They help make new phones and computers, create better car parts, and even study rocks from space!

Vacuum segment (46.7% of revenue): This segment makes special equipment that creates spaces with almost no air. It's like a super-clean, empty room where scientists can do experiments or make things without dust or air causing problems.

They make machines that can suck out all the air from a space, creating a vacuum

They create tools to measure and control these airless spaces.

Their equipment is used in making computer chips (the brains of your phone and laptop)

Scientists use their tools for experiments where they need a super-clean environment

Factories use their technology to make all sorts of things without air getting in the way

This vacuum technology is very important. It’s used to make modern gadgets, carry out advanced science experiments, and even package certain types of food.

Judges Scientific looks for successful, profitable businesses in niche scientific instrument markets. They usually buy these businesses for 3-6 times their EBIT (profit before interest and taxes). After buying them, JDG helps them grow by offering guidance, expertise, and money while keeping strong financial controls in place.

The main goal of Judges Scientific is to create value for its shareholders. They do this by using their “buy-and-build” strategy. This means they carefully buy and grow scientific instrument businesses that have a long future ahead.

Judges Scientific focuses on two things: -

Helping its existing businesses grow

Buying top-quality companies with strong reputations worldwide.

Judges Scientific aims to make steady profits and generate cash. This cash is used to pay off debt, help their businesses grow, and pay higher dividends to shareholders.

What we really like is that Judges Scientific’s headquarters only has six employees. This means their subsidiaries are very independent, and decisions are made locally instead of everything being controlled from the top. It’s a similar workflow as Berkshire Hathaway.

Judges Scientific: a buy-and-build group in the scientific instrument market

Source: Judges Scientific Investor Presentation

How does Judges Scientific Make Money?

Judges generates revenue using their buy-and-build strategy in the scientific instrument sector.

Here is how they grow:

Organic Growth: Judges Scientific helps its existing businesses grow by creating new products, expanding into new markets, and improving how they operate

Acquisitions: The company buys successful and profitable businesses in niche scientific instrument markets. These businesses start adding to Judges Scientific’s income right away

Judges Scientific makes money from many places around the world. They earn a lot in North America, Europe, China, Hong Kong, India and other areas.

The company's subsidiaries create, produce, and sell different types of scientific instruments. Its customers include schools, research centers, and businesses.

Their diverse range of products and presence in many countries help protect them from problems in certain industries.

Also, working with the public sector gives them stability during tough times. The scientific instruments they make are important for research and development, which usually keeps going, even when the economy is struggling.

Companies & Products

With a buy-and-build strategy, Judges Scientific has acquired multiple companies with different products.

Below you can see an overview of the revenue by geography and revenue by company:

Source: JS Annual Report 2023

Scientifica, GDS Instruments, Geotek, Quorum Technologies, and THT are five of their biggest subsidiaries in terms of revenue.

To understand them better, it's helpful to look at these five companies briefly, along with the year each was acquired:

Scientifica (Acquired in 2019) – Specializes in scientific equipment for research

GDS Instruments (Acquired in 2017) – designs and manufactures advanced geotechnical testing systems for soil and rock mechanics research

Geotek (Acquired in 2018) – Provides geotechnical and scientific instruments

Quorum Technologies (Acquired in 2020) – Focuses on instruments for materials science and research

THT (Acquired in 2021) – Creates high-tech products for industrial applications

It’s important to highlight that every acquisition possesses over the following characteristics:

All active in a niche industry

(Global) market leaders, hence selling globally

Highly experienced and strong reputations in the market

Scientifica

Scientifica makes advanced equipment for scientists studying the brain and heart. Their tools help researchers see tiny details in living tissues, especially in brain and heart science.

They're experts in methods that allow scientists to watch brain cells work, take super-clear pictures of living tissue, and even control cells with light. It's like they're creating the microscopes and gadgets of the future, helping us understand how our bodies work. They sell their products in over 40 countries, but everything is made in the UK.

GDS Instruments

GDS makes high-tech tools for testing soil and rocks. Think of smart machines that can squeeze, shake, and analyze dirt and stones to see how they react under different conditions.

These tools help engineers design safer buildings, bridges, and even wind turbines that can handle earthquakes and strong winds. One of their coolest products is a machine that shakes soil like wind and waves do, helping to test how the ground under a wind turbine might react.

Most of their customers are universities and research labs (60%), with some big companies (30%) and global testing firms (10%) also using their equipment. They sell their products worldwide, with 85% of their sales coming from outside the UK. GDS is known for making top-quality tools.

Geotek

Geotek is like a Swiss Army knife for studying the Earth. They focus on three main areas:

Making special tools for scientists to study rocks and sediments, including machines that can ‘see’ inside rocks without breaking them open.

Providing a service where they bring their high-tech equipment to examine rock samples for clients, kind of like a mobile science lab.

Having a special team that goes on expeditions to collect samples from deep under the ocean, including things like methane ice. These projects are usually big, often done for governments, and can take up to a year to complete.

Quarom Technologies

Quorum Technologies helps scientists see incredibly tiny things. They make tools that prepare samples for electron microscopes, which can see things much smaller than regular microscopes. This is crucial for research in areas like fighting diseases, ensuring food safety, and developing new materials for electronics. They're experts in making sure scientists have perfect samples to look at under these powerful microscopes. They've been doing this for over 25 years and sell their UK-made products worldwide through a network of distributors.

Thermal Hazard Technologies (THT)

THT is the go-to company for machines that measure heat in chemicals and batteries. Their tools, called calorimeters, work like super-sensitive thermometers that can detect tiny heat changes.

This is important for ensuring chemicals are safe and for developing better, safer batteries for electric cars.

Their top product, the Accelerating Rate Calorimeter (ARC), is the best in the world for this kind of measurement. They've recently made a new tool for testing large batteries used in electric vehicles. With over 25 years of experience, THT serves over 300 leading companies worldwide, including car manufacturers, battery makers, pharmaceutical companies, and universities.

Key Metrics

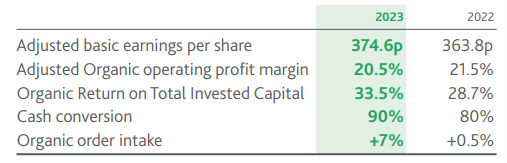

Here are the five key performance indicators used by Judges Scientific:

Source: JS Annual Report 2023

What we like to see is a high Return on the Total Invested Capital (ROTIC), which should be higher than the Weighted Average Cost of Capital (WACC) to create value for shareholders. In 2023, Judges Scientific had an organic return of 33.5% (this excludes the Geotek acquisition. The total ROTIC including acquisition is 20.7%), and in 2022, it was 28.7%. Both are well above their WACC of 9.2%.

For companies that buy other businesses often, it's important to have a high cash conversion rate, meaning the business doesn't need a lot of money to operate. Judges Scientific’s cash conversion rate equals 90%.

An increase in organic order intake means the company is growing by itself, without acquisitions. This was the case in 2022 and 2023. However, in 2024, there was a 4% drop in organic order intake during the first half of the year.

It improved in Q3, showing a 4.2% increase compared to 2023, including a big coring contract. Excluding this contract, the order intake was down by 1.6%. This shows that the overall level of orders across Judges Scientific hasn't fully recovered to the usual growth pattern.

The Adjusted basic earnings per share for 2023 were 374.6p, up from 363.8p in 2022. However, for 2024, Judges Scientific expects earnings to be between 270p and 300p, a decline of 20% to 27%. This decline is caused by:

Push out of two big orders, including a Core Expedition of the Geotek subsidiary (~5-7M GBP)

Tough comparison period for 2023 where demand was high after the Covid period and companies buying more inventory

Difficult market in China, with the economy changing to a consumption economy and China pushing for local suppliers

Market & Distribution

Judges Scientific mainly depends on its subsidiaries to market and distribute scientific instruments.

Their products are sold worldwide to a variety of markets, with a strong focus on exports.

Key points of their marketing and distribution strategy include:

Global reach: More than 85% of their sales come from outside the UK. In 2023, the sales were split as follows:

North America: 28%

Rest of Europe: 25%

Rest of the World: 23%

China/Hong Kong: 14%

UK: 10%

Target markets: The company's products are sold to various sectors, including:

Higher education institutions

Scientific communities

Manufacturers

Regulatory authorities

Niche market focus: Judges Scientific buys businesses that have strong reputations in niche markets around the world. This strategy helps them keep a strong position in the market and manage inflationary pressures effectively.

Subsidiary-driven approach: Each company that Judges Scientific acquires usually keeps its own marketing and distribution channels. They make use of their strong reputations and customer relationships in their specific niche markets.

Export-oriented: The Group is known for being a strong exporter, with its UK-based subsidiaries helping drive export sales growth.

Direct sales: A large part of their revenue comes directly from end-users, with around 60% from universities and 30% from corporations.

Trade shows and exhibitions: The company takes part in industry events to display its products, as shown by the mention of exhibition costs in their financial report.

This marketing and distribution strategy enables Judges Scientific to have a diverse global presence. It also allows them to take advantage of the specialized knowledge and strong market positions of their subsidiary companies.

Regulation

Regulation is important for Judges Scientific for several reasons:

Regulatory compliance: As a company in the scientific instrument sector, following regulatory standards is crucial. Judges Scientific emphasizes "ensuring global regulatory compliance" as part of its commitment to product quality

Environmental regulations: The company follows the UK's Climate-related Financial Disclosure Regulations, which require them to report on climate-related financial and sustainability information

Quality certifications: Many of Judges Scientific's businesses are ISO 9001 certified, and one also has ISO 14001 certification, showing their commitment to quality management and environmental standards

Ethical standards: The company has a zero-tolerance policy on bribery and corruption and follows anti-bribery laws. They also comply with the Modern Slavery Act and international human rights standards

Market access: Since 85% of their products are exported, compliance with international regulations is essential for market access and operations

Customer requirements: Many of Judges Scientific's customers are regulatory authorities, making it important for the company to meet or exceed regulatory requirements

Corporate governance: As an AIM-listed company, Judges Scientific must follow corporate governance standards, including the QCA Corporate Governance Code

Regulation is crucial for Judges Scientific as it ensures the company maintains high standards of quality, ethics, and environmental responsibility, which are vital for its global operations and reputation in the scientific instrument sector.

Overall Score – Business Model: 9.5/10 Judges Scientific uses a decentralized buy-and-build model. They acquire small and medium-sized businesses that make scientific instruments. Judges helps them grow and uses its cash flow to acquire more companies.

2. Is Management Capable?

Judges Scientific is an Owner-Operator Stock.

The company was founded in 2002 by David Cicurel, who is still the CEO. Before starting Judges Scientific, Cicurel worked as a turnaround specialist and an active value investor, managing his own funds.

Fun fact: Cicurel has attended the annual meeting of Berkshire Hathaway for over 10 years in a row.

Today, Cicurel owns 9.2% of Judges Scientific, and insiders collectively own around 10.6% of the company.

Source: Finchat

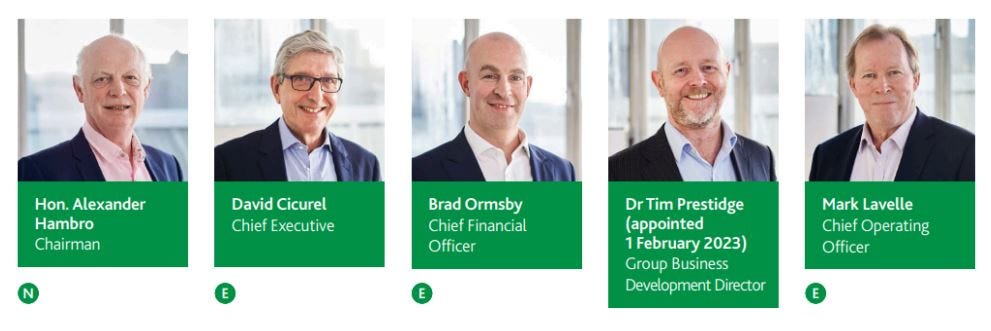

The board of Judges Scientific combines international business, investor, and financing experience across both public and private markets.

In addition to CEO David Cicurel, the board includes:

Brad Ormsby (Group Finance Director): A Chartered Accountant with extensive senior finance and operational experience from PwC and Eurovestech plc. He led Kalibrate Technologies plc's IPO before joining Judges in 2015.

Mark Lavelle (Chief Operating Officer): Brings significant experience from PerkinElmer and Halma plc, where he held senior roles such as Managing Director and Division Lead. His background with Halma plc, a successful serial acquirer, is especially valuable. Lavelle frequently visits Judges’ subsidiaries and plays a crucial role in the company.

Tim Prestidge (Group Business Development Director): Has over 22 years of leadership and innovation experience, having held senior positions in FTSE100 and FTSE250 industrial businesses.

Alexander Hambro (Chairman): Recently retired at the end of 2024, and will be succeeded by Ralph Elman, who has been with Judges Scientific for several years.

This diverse mix of experience gives Judges Scientific a well-rounded leadership team to guide the company forward.

The excellent culture at Judges Scientific can be best explained by the following values:

Entrepreneurial spirit: Employees are encouraged to act like entrepreneurs, treating the business as if they are its owners. This decentralized decision-making is key to Judges Scientific's success, as highlighted in the book The Outsiders

Long-term focus: The company values employee tenure and promotes long-term decision-making, focusing on sustainable growth rather than short-term gains

Transparency and honesty: Judges Scientific fosters a culture of transparency, honesty, and ethical behavior throughout the company

Employee ownership: About 40% of employees are shareholders through the company’s Share Incentive Plan, giving them a direct stake in the company’s success.

Diversity and inclusion: The company supports equal opportunities for all employees and strives to create an inclusive work environment

Professional development: Judges Scientific invests in leadership development programs and skills training for staff at all levels

Ethical standards: The company has a zero-tolerance policy on bribery and corruption and adheres to high ethical standards

Pride in work: Employees are encouraged to take pride in their work and understand the positive impact their products have.

This strong culture has helped Judges Scientific successfully acquire and integrate businesses while allowing those businesses to maintain their unique identities and continue growing.

3. Does The Company Have A Sustainable Advantage?

Judges Scientific has a sustainable competitive advantage due to its unique acquisition model and focus on niche scientific instrument companies.

The companies they acquire usually have strong advantages for several reasons:

Specialized products: Judges Scientific targets businesses that produce scientific equipment for niche markets with few or no direct competitors

Established market position: The acquired companies typically have an established product range and a global customer base

High barriers to entry: The scientific instruments they make are often specialized and complex, which makes it hard for new competitors to enter the market

Strong profit margins: Judges Scientific focuses on businesses that already generate sustainable profits and strong cash flow

Intellectual property: Many of these businesses own intangible assets like patents or proprietary technology, further strengthening their competitive advantage

Customer relationships: The acquired companies often have long-lasting relationships with universities, research facilities, and industry customers around the world

This combination of specialized products, strong customer relationships, and high barriers to entry helps Judges Scientific maintain a competitive edge in the market.

Companies with a sustainable competitive advantage are often characterized by the following:

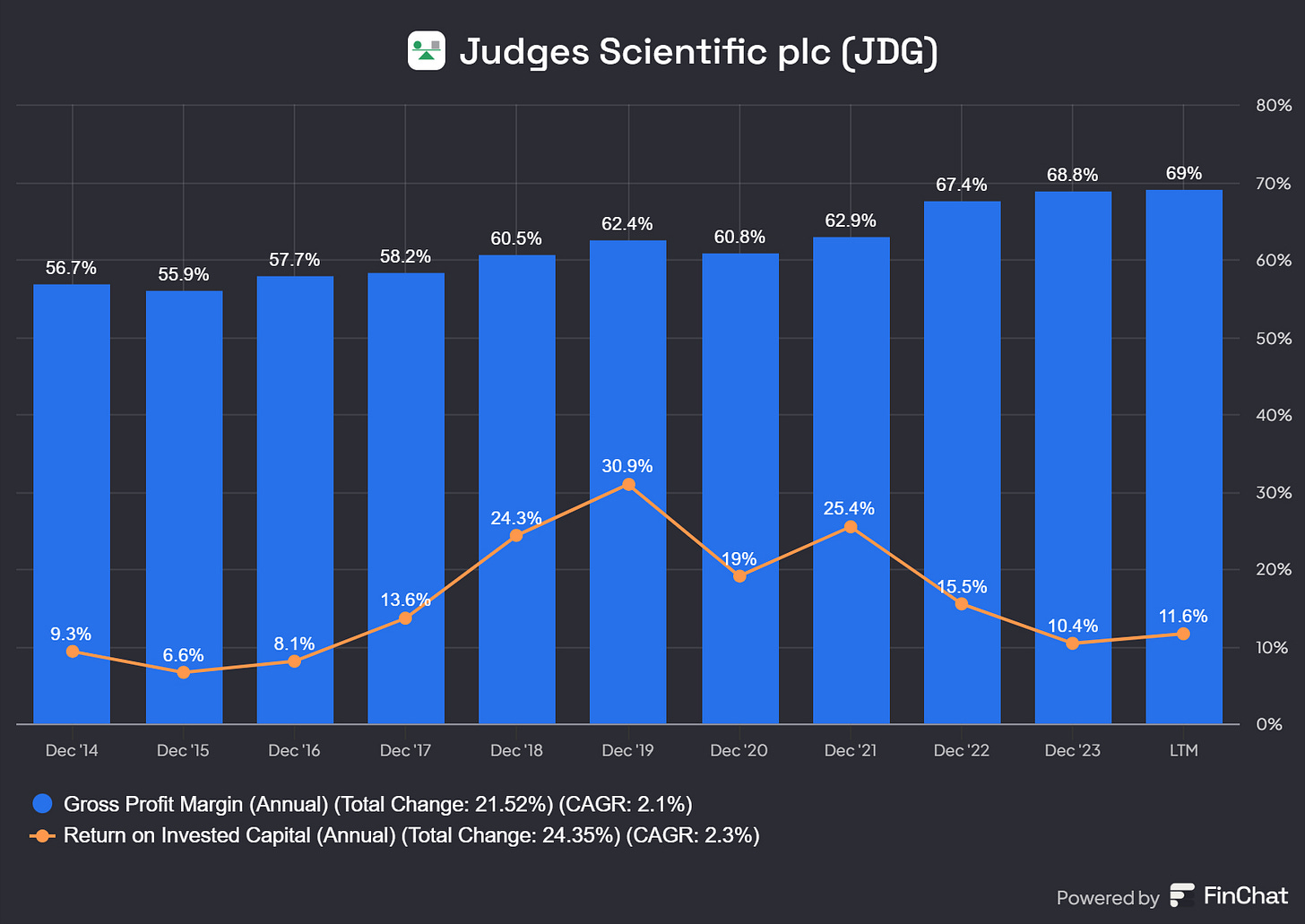

Gross margin: 69.0% (Gross Margin > 40% ✅)

ROIC (5-Year average): 15.4% (ROIC > 15% ✅)

Source: Finchat

Judges Scientific closely tracks the return it generates on the capital invested in its subsidiaries.

The annual Return on Total Invested Capital (ROTIC) is probably the best metric to look at for Judges Scientific. The annual ROTIC is calculated by comparing attributable earnings (excluding central costs, adjusting items, and before interest, tax, and amortization or EBITA) with the total capital invested. This includes plant and equipment, net current assets (excluding cash), unamortized intangible assets, and goodwill (as recognized at the initial acquisition date), along with any acquisition costs and any increases in acquisition consideration after the acquisition date.

The annual Return on Total Invested Capital (ROTIC) for 2023, based on organic growth, was 33.5% (compared to 28.7% in 2022). These are high ROTIC metrics, which we consider very favorable.

4. Is The Company Active In An Attractive End Market?

Judges Scientific operates in a competitive environment.

The company is active in a specialized market: The scientific instrument industry has both large, well-established players and smaller, more specialized companies, all vying for market share.

Large competitors: They face competition from big multinational companies like Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer. These companies have wide product ranges and a global presence. However, Judges Scientific focuses on specific sub-markets within the scientific instrument sector, offering highly specialized instruments for their target audience.

Emerging companies: Judges Scientific also competes with new companies entering their niche markets, which adds to the competitive pressure.

Judges Scientific needs to keep innovating as it can impact their market share and pricing power.

Despite the competitive environment, Judges Scientific maintains its position through several strategies:

Focus on niche markets: By concentrating on specific sub-markets, Judges Scientific differentiates itself with specialized instruments that meet unique customer needs, rather than competing broadly with large players

Strategic acquisitions: The company strengthens its market position and expands its product portfolio by acquiring specialized businesses, which also extends its reach into new markets

Innovation investment: Judges Scientific consistently invests in research and development to create new products and technologies, fostering revenue growth and ensuring a competitive edge

Specialized expertise: Their focus on niche scientific instrumentation allows them to develop deep expertise, resulting in greater efficiency in product development, manufacturing, and customer service

In addition to these strategies, Judges Scientific mitigates competition risks by analyzing market and scientific trends before making acquisitions, focusing on small, specialized niches.

They also ensure they remain responsive to customer needs, tailoring product development to meet market demands wherever possible.

5. What Are The Main Risks For The Company?

The main risks for an investment in Judges Scientific include:

Economic uncertainty: Budget deficits and economic instability could pressure research budgets, potentially reducing demand for scientific instruments

Market volatility: Slower trading and order delays have led to lower earnings expectations for 2024, highlighting the market's volatility

Acquisition risks: Judges Scientific's strategy of serial acquisitions carries the risk of integration challenges and the performance of acquired businesses not meeting expectations

Dependency on key contracts: Large contracts, such as Geotek's coring expeditions, can heavily influence revenue recognition and financial results, creating risks if these contracts face delays or cancellations

Global market conditions: With its international presence, Judges Scientific faces risks related to economic and political instability, including the potential for tariffs on exported products

Supply chain disruptions: Although supply chain issues from the COVID-19 period have eased, any future disruptions could impact operations

Competition: In niche scientific instrument markets, Judges must continuously innovate and maintain operational efficiency to stay ahead of competitors

Financial risks: Debt used for acquisitions exposes the company to interest rate risks and potential covenant breaches, which could affect financial flexibility

Climate-related risks: Ongoing efforts to integrate climate-related risk management could impact future operations and investment strategies

Technological changes: Advances in scientific instrumentation could require significant investment in research and development to remain competitive

Succession risk: With CEO David Cicurel at 73, succession planning is critical. Finding a suitable replacement for such a pivotal role could be challenging, and the transition may affect the company's performance

6. Does The Company Have A Healthy Balance Sheet?

Judges Scientific has an ‘OK’ balance sheet.

Here’s what the numbers look like:

Interest Coverage: 11.5x (Interest Coverage > 15x? ❌)

Net Debt/FCF: 3.6x (Net Debt/FCF < 4 ✅)

Goodwill/Assets: 31.4% (Goodwill/Assets not too large? < 20% ❌)

Judges Scientific ensures that the goodwill on its balance sheet is justified by paying fair prices for acquisitions, typically within a range of three to seven times EBIT. Three and seven are the outliers. On average they are paying 4 to 6 times EBIT.

The fact that the company has never had to impair goodwill suggests that its acquisitions have so far generated the expected cash flows, providing confidence in its acquisition strategy and management of goodwill.

The goodwill/assets ratio increased after Judges Scientific acquired Geotek, their largest acquisition to date at a consideration of GBP 80 million. Judges Scientific acquired Geotek for approximately 7x normalized EBIT, which is at the high end of their usual acquisition range. However, Geotek operates in a niche market with very little competition, making it a highly strategic addition to the group.

Source: FinChat

Judges Scientific often buys other companies, so it’s important to check if they stay within their bank covenants. They use loans (debt) to buy businesses. With the earnings pressure they might face in 2024, we want to see if they can still meet these rules.

Here are the main bank covenants:

Their gearing (the level of debt) should not be more than 3 times their Adjusted EBITDA (a measure of earnings).

Their interest coverage (how easily they can pay interest on their debt) should be at least 3 times.

At the end of 2023, Judges' gearing ratio was 1.38x, which is well below the 3.0x limit. Even in the worst-case scenario, where their earnings drop by 30%, the gearing ratio would rise to 1.79 by mid-2024. This still stays below the 3.0 rule.

So, even if their earnings fall, Judges Scientific is likely to stay well within the bank rules. This shows that Judges is careful with their finances.

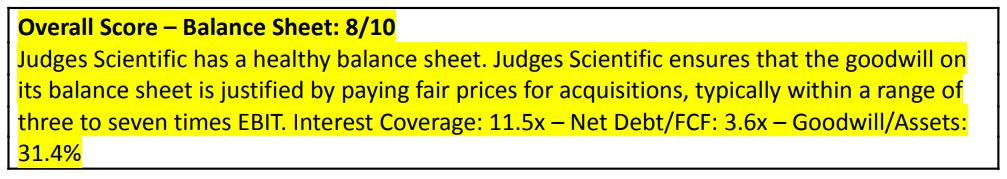

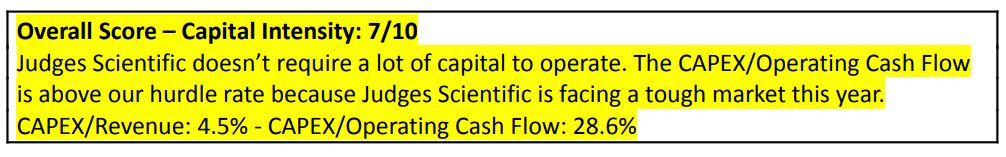

7. Does The Company Need A Lot Of Capital To Operate?

The less money a company needs to run its business, the better. It's ideal to invest in companies that don’t need a lot of capital to grow or keep things running.

We look for companies where:

CAPEX/Sales (capital spending compared to sales) is less than 5%.

CAPEX/Operating Cash Flow (capital spending compared to cash generated from operations) is less than 25%.

Here’s how things look like for Judges Scientific:

CAPEX/Sales (2023): 4.5% (CAPEX/Sales < 5%? ✅)

CAPEX/Operating Cash Flow: 28.6% (CAPEX/Operating CF? < 25% ❌)

Here is an overview on Capex and Revenue:

Source: FinChat

The CAPEX/Operating Cash Flow ratio for 2024 is a bit higher at 28.6%. This is mainly because Judges Scientific is facing a tough market this year. The ratio is usually below the hurdle rate of 25%.

8. Is The Company A Great Capital Allocator?

Judges Scientific’s strategy is to create good returns by carefully acquiring companies, with a focus on growing earnings and cash flows from its existing businesses. The company aims to buy companies at up to seven times EBIT.

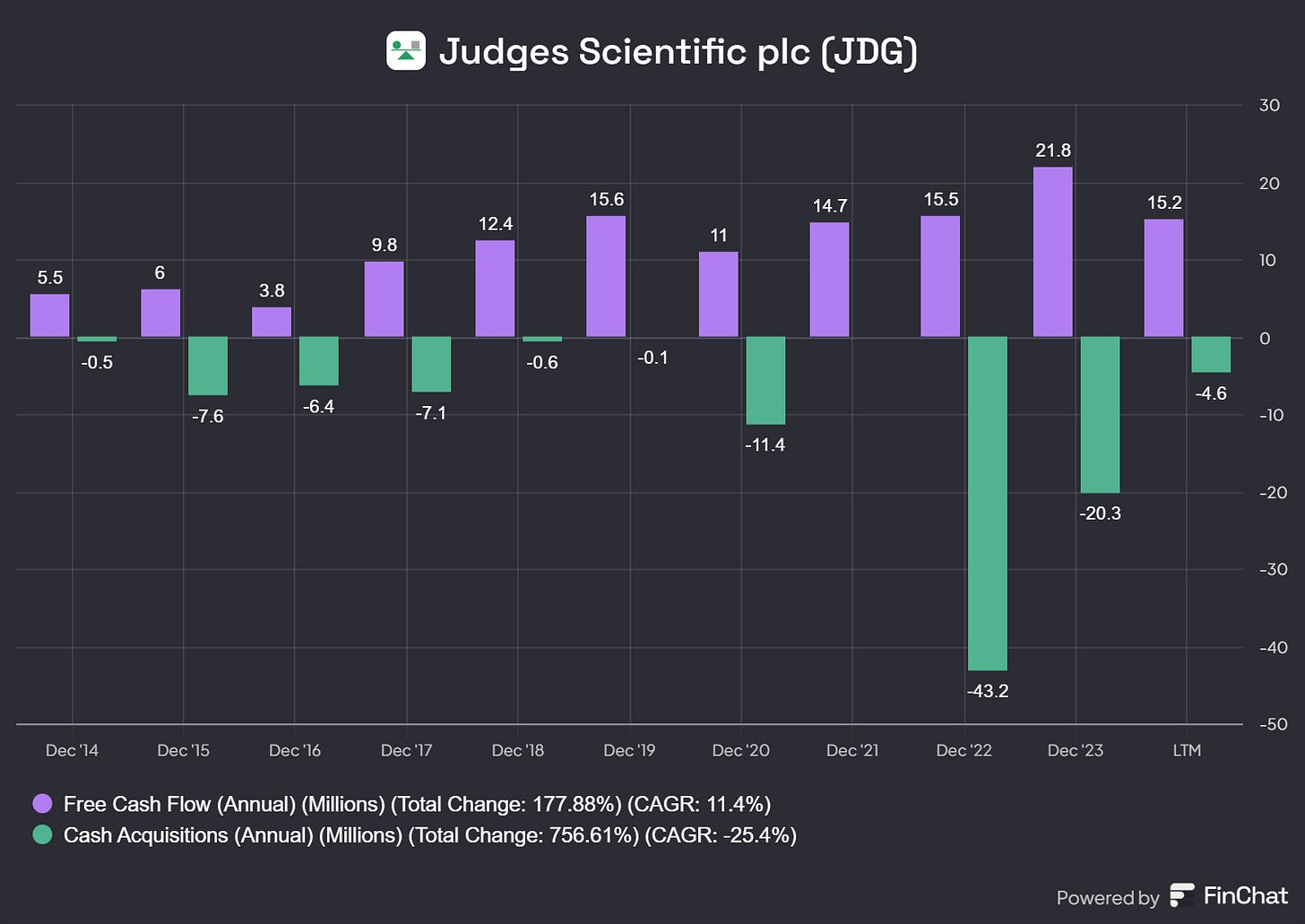

Judges Scientific uses its capital in three main ways:

Acquiring companies: Over the last ten years, around 75% of free cash flow has gone into buying new companies. This percentage varies each year, but they will likely continue to reinvest a high portion of their cash into acquisitions in the future.

Paying down debt

Dividend: They pay out about 50% of their earnings as a dividend, which is considered a high payout for a company that acquires a lot of businesses

Here is an overview on Free Cash Flow and Cash Acquisitions:

Source: FinChat

Here’s what the numbers look like for Judges Scientific:

ROE (2023): 15.4% (ROE > 15%? ✅)

Return on Total Invested Capital (2023): 22.7% (ROTIC > 15%? ✅)

Organic Return on Total Invested Capital (2023): 33.5% and Return on Total Invested Capital: 20.7% (> 15%? ✅)

The (organic) return on total invested capital shows that Judges Scientific is very good at allocating capital.

Given this, we would prefer to see a lower dividend payout, with the company instead using that cash to grow its business even more. This would help increase long-term value for shareholders. After a talk with the CEO the chance is very slim that they will decrease the dividend, as it is one of their promises to keep the dividend growing by 10 percent a year. But we can reinvest the dividend in Judges Scientific if we like.

9. How Profitable Is The Company?

The higher the profitability, the better.

Here’s what things look like for Judges Scientific:

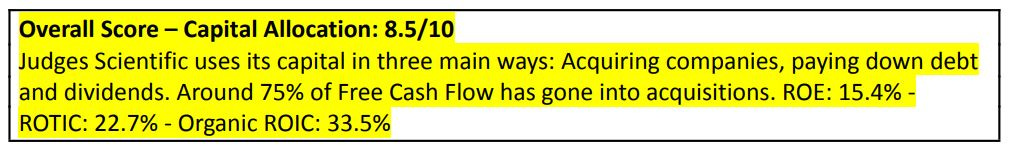

Gross Margin: 69% (Gross Margin > 40%? ✅)

Adjusted Operating Margin: 26% (Adj. Operating Margin > 15%? ✅)

For Judges Scientific, it's important to look at the Adjusted Operating Margin because the company often acquires other businesses. When they do, they may have significant amortization costs related to the intangibles (like customer relationships or patents) from the acquisition.

Excluding this amortization gives a clearer picture of the company's operational profitability.

Amortization is a non-cash expense and reflects how the value of the acquired intangibles is used over time. This is different from goodwill, which is not amortized. So, Adjusted Operating Profit helps show the company's real performance without the effect of these non-cash costs.

Net Profit Margin: 7.0% (Profit Margin > 10%? ❌)

Free Cash Flow Margin: 11.2% (Free Cash Flow Margin > 10%? ✅)

As you can see, the Net Profit Margin for Judges Scientific is low, but the Free Cash Flow (FCF) margin is very high. How is that possible?

The reason is that Judges Scientific aggressively amortizes Intangible Assets. Amortization is a non-cash expense. This means it reduces the company's Net Income but doesn't actually take cash out of the business. As a result, while Net Income goes down, Free Cash Flow stays strong.

That's why we'll focus more on Free Cash Flow in this case. It’s a better way to see the real value the company is creating because it reflects the cash the company generates, which is what truly matters for investors.

Here is an overview on the Gross Profit Margin and Free Cash Flow Margin:

Source: FinChat

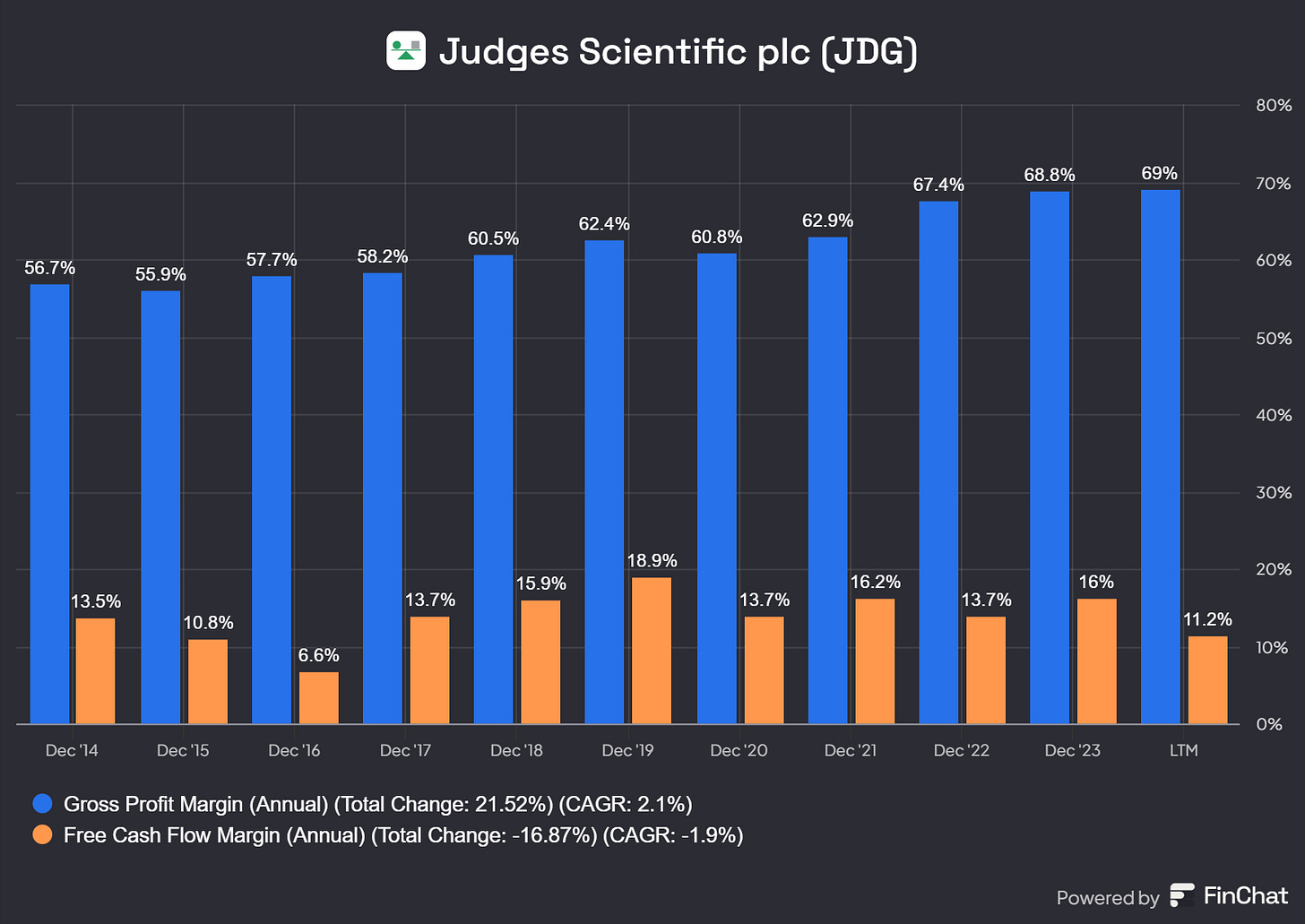

10. Does The Company Pay A Lot Stock-Based Compensation?

Stock-based compensation is a cost for shareholders and should be treated accordingly.

The numbers for Judges Scientific look as follows:

SBCs as a % of Net Income (2023): 9.6% (SBCs/Net Income < 10%? ✅)

Avg. SBCs as a % of Net Income past 5 years: 5.9% (SBCs/Net Income < 10%? ✅)

In 2023, Stock-based compensation (SBC) was 1.2M GBP, compared to a Net Income of 9.5M GBP. The Net Income in 2023 was lower than the prior year due to higher amortization (around 4M GBP) and higher interest expenses (about 4M GBP), mainly from the increased debt after acquiring Geotek.

Over the last five years, the average SBC has been 5.9%, which is well below the 10% threshold. Last year, the total SBC was 1.2M GBP, and with a current market cap of 570M GBP, this represents about 0.2% dilution. This explains why the number of shares outstanding is increasing, but at a very slow pace.

Here is an overview of the total and weighted shares outstanding:

Source: FinChat

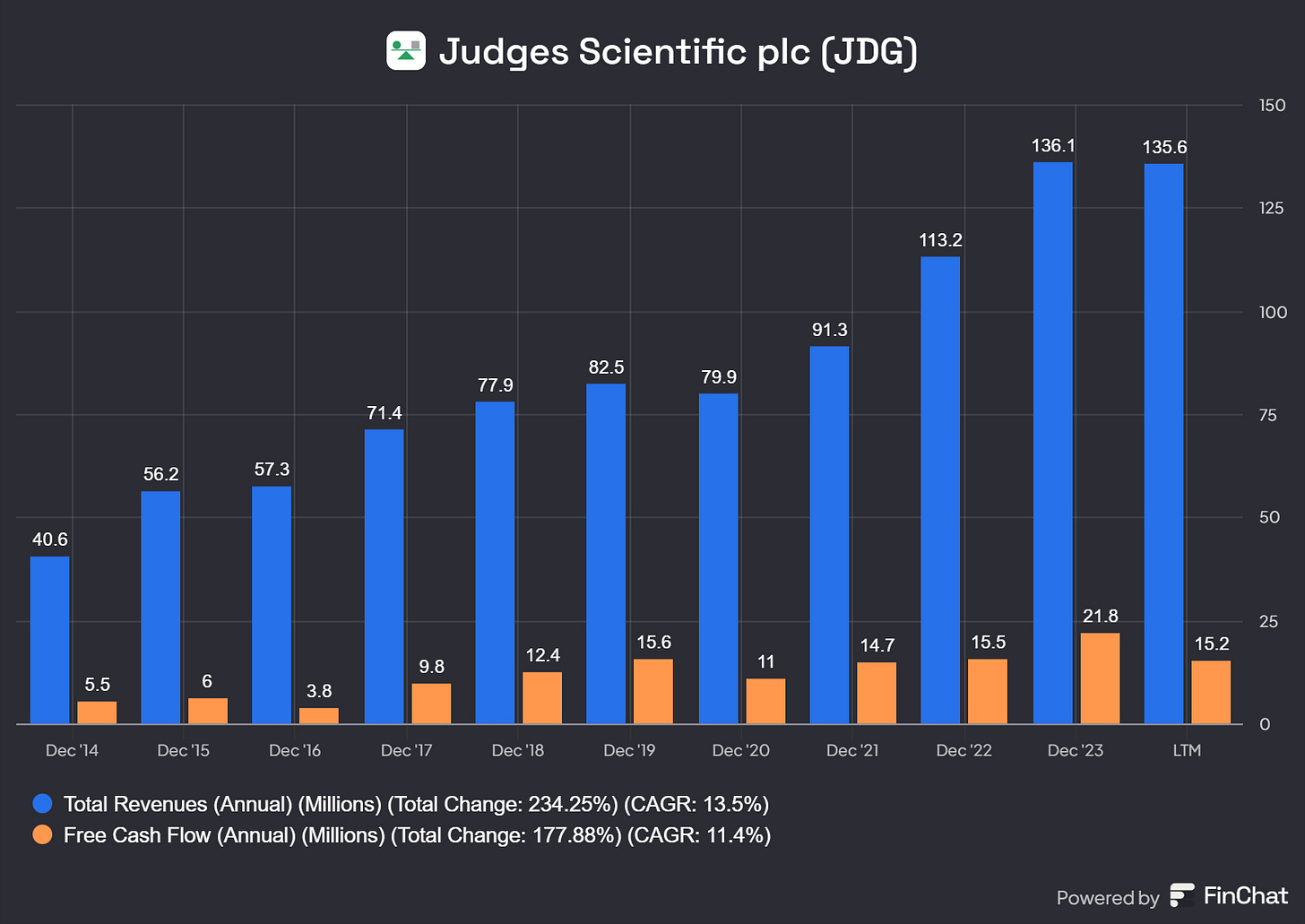

11. Did The Company Grow Actively In The Past?

Growth is the key factor for long-term shareholder value creation.

For Judges Scientific, growth has been driven by acquisitions and operational improvements. Normally, we would look at EPS Growth, but, as mentioned before, Free Cash Flow (FCF) is a more reliable metric for this company.

That's why we'll focus on FCF Growth rather than EPS Growth.

This gives a clearer picture of Judges Scientific's ability to generate cash and reinvest it into further growth.

Here’s what the historical growth for Judges Scientific looks like:

Revenue Growth past 5 years: 10.8% (Revenue growth > 5%? ✅)

EBITA Growth past 5 years (CAGR): 18.7% (EBITA growth > 7%? ✅)

FCF Growth past 5 years (CAGR): 12.0% (FCF growth > 7%? ✅)

Judges Scientific has shown solid growth in the past, with some impact from COVID in 2020 and 2021.

However, by 2023, Free Cash Flow reached a high level. If we calculate the Free Cash Flow Compound Annual Growth Rate (CAGR) for 2024, it might not look as good due to the current tough market conditions.

That said, given Judges Scientific's strategy and its ability to adapt, we expect the company to grow at a slightly faster rate in the long run. Their approach to acquisitions and efficient operations should support steady growth moving forward.

Source: FinChat

12. Does The Future Look Bright?

When looking for investments, it's important to focus on companies that grow at strong rates. Judges Scientific operates in markets with clear, long-term trends that should drive its growth:

Global Expansion of Higher Education: As more universities and research institutions expand globally, demand for scientific instruments increases. Judges Scientific benefits from this trend

Process Optimization and Control: Many industries are looking for ways to improve efficiency and quality. Measurement tools that support this need are in demand, and Judges Scientific's products serve these requirements

Scientific Research Growth: The continuous pursuit of scientific discovery and innovation drives demand for instruments across academic, corporate, and industrial sectors. This is a major growth driver for Judges Scientific

These long-term trends suggest that Judges Scientific is well-positioned to grow in the coming years.

Analysts expect Judges Scientific to grow their revenues at a CAGR of 4.6% in the next two years. I expect Judges Scientific to grow their revenue by 10% in the medium term and their EBIT and Free Cash Flow between 10%-16%.

Here is why I think Judges Scientific can keep growing at attractive rates:

Secular Growth Trend: The market Judges Scientific operates in is expected to grow steadily over time, creating favorable conditions for the company

Acquisitions Strategy: The company grows by acquiring and improving scientific instrument businesses. With over 2,000 privately held businesses in the UK alone, around 100 of them become available for acquisition each year. Judges Scientific focuses on acquiring only the best companies

Niche Markets with High Barriers to Entry: Judges Scientific focuses on specialized markets where there are high barriers to entry, helping them maintain strong profitability and consistent cash flow

Track Record of Free Cash Flow Growth: Over the past 5 years, Judges Scientific has achieved a 12% annual growth in Free Cash Flow per share. Looking over the past decade, the growth rate was even higher, at just over 20% per year

Favorable Market Growth: The market Judges Scientific operates in is expected to grow at a compound annual growth rate (CAGR) of 6.5% until 2028, providing an optimistic outlook for the company’s future

Source: The Business Research Company

13. Does The Company Trade At A Fair Valuation?

We use three valuation methods to see whether Judges Scientific is undervalued:

Compare the FCF yield with its historical average

FCF Growth model

Reverse Discounted-Cash Flow

A comparison of the multiple with its historical average

In 2025, Judges Scientific expects to generate £22.0 million in Free Cash Flow (FCF). This results in a FCF yield of 4.4% for the company. Looking ahead, if Judges can increase its FCF to £27.1 million in 2026, the FCF yield for 2026E would rise to 5.5%.

Over the past decade, Judges Scientific has had an average Forward FCF yield of 5.2%. However, in the last five years (since 2020, following the impact of COVID), the average Forward yield has decreased to 3.6%.

Free cash flow growth model

This model shows you the yearly return you can expect as an investor.

We calculate the expected return in the following way:

Expected yearly return = FCF Per Share Growth + Dividend Yield +/- Multiple Expansion (Contraction)

Here are the assumptions I use:

FCF Per Share Growth: 12% per year

Dividend yield: 1.3%

Price/FCF to decrease from 22.7x to 20.0x over the next decade

Expected yearly return = 12.0% + 1.3% - 0.1* (20.0x-22.7x)/22.7x = 12.1%

An expected yearly return of 12.1% looks reasonable to us.

Reverse DCF

Charlie Munger once said that if you want to find the solution to a complex problem, you should invert. Always invert. Turn the problem upside down.

A reverse DCF shows you the expectations implied in the current stock price.

You try to determine for yourself whether these expectations are realistic or not.

Judges Scientific expected Free Cash Flow for 2025 equals GBP 22M. It’s important to note that the expected Free Cash Flow for 2024 is lower, at 16.5M GBP. So for 2025, a recovery towards the 2023 levels is expected.

Our Reverse DCF indicates that Judges Scientific should grow its Free Cash Flow by 12.0% per year to return 10% per year to shareholders.

The year 2025 will be crucial to determine if Judges Scientific can return to its 2023 levels and continue growing from there. Between 2014 and 2019, the company achieved a 23% growth rate in Free Cash Flow. Given the 6.5% organic growth in their market and the company’s focus on acquisitions, Judges Scientific could potentially achieve a growth rate near 13.5% per year moving forward.

Source: FinChat

Judges Scientific:

Forward FCF Yield: 4.4% (higher than its historical average? > 3.6%? ✅ )

Free Cash Flow Growth Model: 12.1% (Yearly return > 10%? ✅)

FCF-Growth Reverse DCF: 12.0% (Realistic growth expectations? ❓)

14. How Did The Owner’s Earnings Of The Company Evolve In The Past?

Over time, stock prices tend to follow the Owner’s Earnings of a company (FCF Growth + Dividend Yield).

That’s why we want to invest in companies that managed to grow their Owner’s Earnings at attractive rates in the past.

The Owner’s Earnings of Judges Scientific is calculated as follows:

Owner’s Earnings = FCF Growth + Dividend Yield

Judges Scientific:

CAGR Owner’s Earnings past 5 years: 13.2% (CAGR Owner’s Earnings > 12% ✅)

CAGR Owner’s Earnings past 10 years: 12.6% (CAGR Owner’s Earnings > 12% ✅)

15. Did The Company Create A Lot Of Shareholder Value In The Past?

We want to invest in companies that managed to compound at attractive rates in the past.

Ideally, the company returned more than 12% per year to shareholders since its IPO.

Here’s what the performance of Judges Scientific looks like:

YTD: -13.0%

CAGR Since IPO in 2007: 26.2% (CAGR since IPO > 12%? ✅)

Since its IPO, Judges Scientific is outperforming the S&P500 by a wide margin:

Source: FinChat

Hopefully you have enjoyed this deep dive of Judges Scientific. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

Thanks for sharing. in your screenshot you show a ROIC of only 12% while you mention at the beginning an organic ROTIC: 33.5% and Total ROTIC 20.7%. Shouldnt these metrics be really similar?