Adding to my position on Computer Modelling Group ($CMG.to)

After buying a first position in December I am increasing my stake and have add shares at 9.30 CAD.

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early. Join for free if you haven’t subscribed yet.

In December I have started a position in Computer Modelling Group and last month I shared a deep dive. Today the stock is down on their 3Q earnings update. Here is a summary on their update:

CMG's Q3 2025 saw a revenue increase to $35.8 million, up from $33.0 million in Q3 2024. This reflects a slight decrease of 1% in the Reservoir and Production (R&P) segment revenue, offset by a 9% contribution from the Seismic segment, which included 6% growth from acquisitions. Year-to-date revenue reached $95.8 million, compared to $76.4 million in the prior year, with the Seismic segment contributing 22% (21% from acquisitions).

Operating profit for Q3 2025 increased significantly to $11.2 million, a 37% rise YoY, while the year-to-date operating profit decreased by 2% to $25.3 million. Net income for the quarter was $9.6 million, a 71% increase YoY, but year-to-date net income decreased by 9% to $17.3 million. EPS for Q3 2025 was $0.12, up 71% YoY, but year-to-date EPS decreased by 13% to $0.21.

The R&P segment experienced a revenue decline of 1% in Q3, while the Seismic Solutions segment saw a 26% increase in revenue, driven by both organic growth (9%) and acquisitions (17%). The company is focusing on shifting its revenue mix towards recurring software revenue to enhance profitability and free cash flow, with acquisitions playing a key role in this long-term strategy. They are prioritizing customer support to drive software adoption and focusing on key product development opportunities.

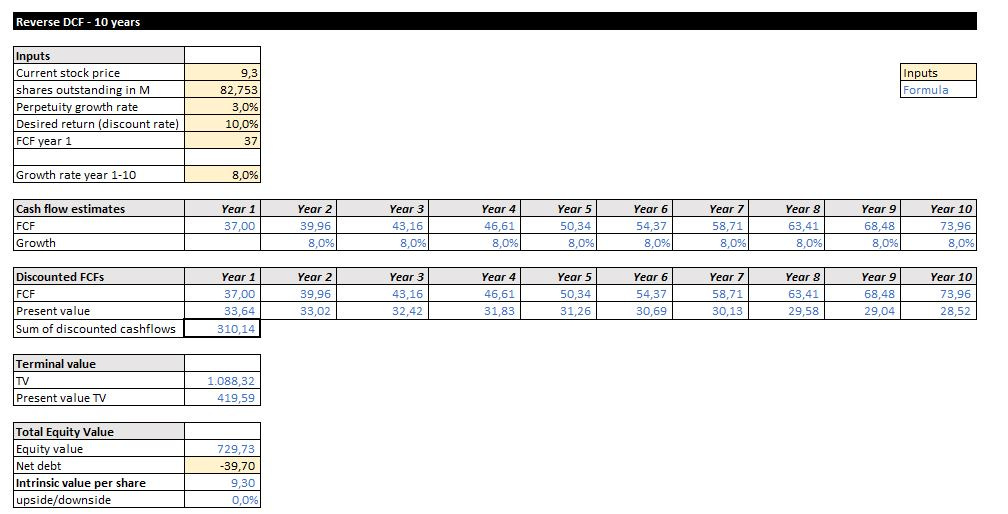

Based on their release I have updated my reversed DCF and at the current purchase price of 9.30 they have to grow 8% the next 10 years.

CEO Jain is targeting a low double digit increase. He still has to prove he will manage this, but as I believe in his strategy I think the current share price gives a margin of safety for the long-term and gives me the opportunity to increase my stake from around 5.2% (smallest position) towards 8.0%.

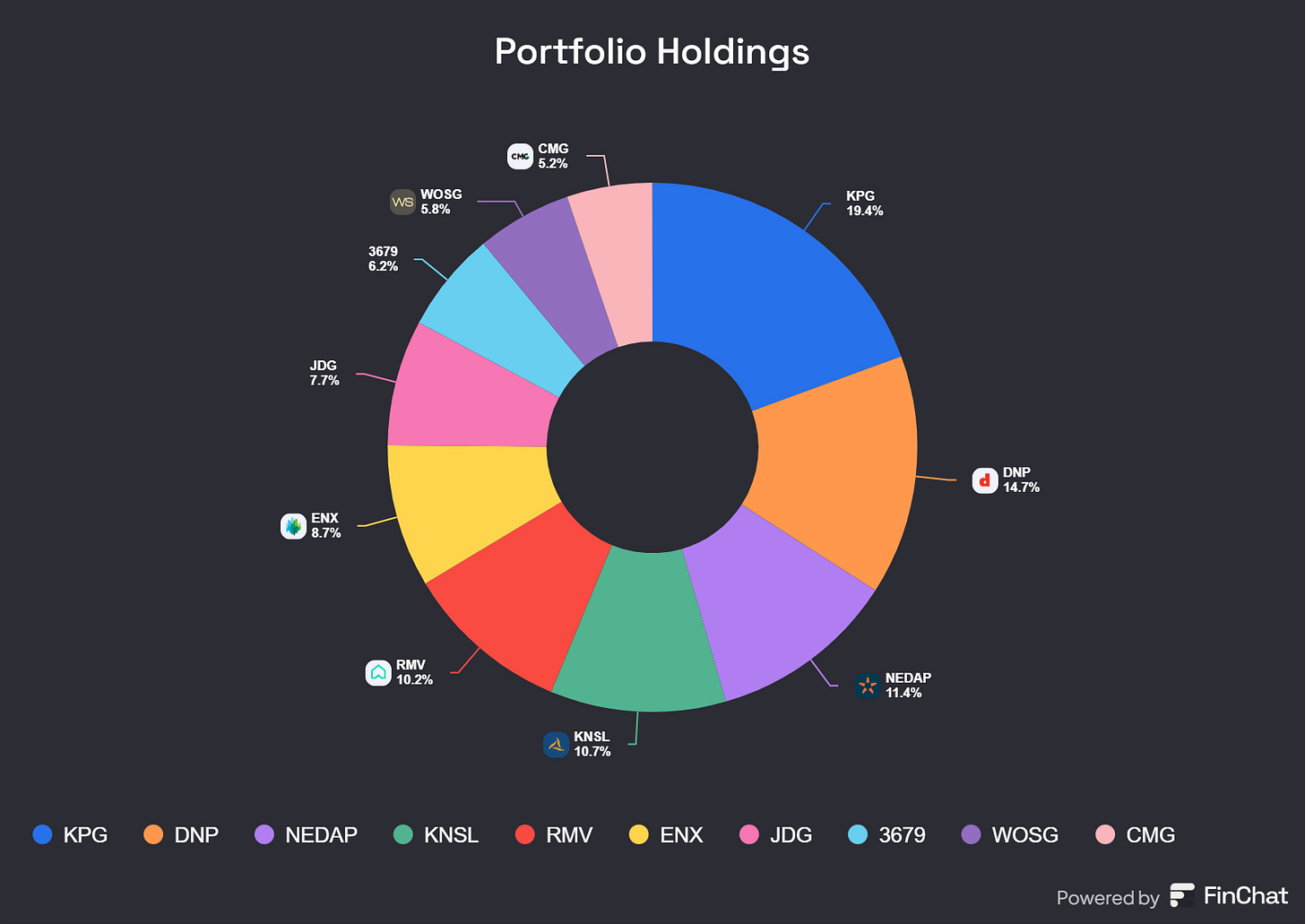

My portfolio before the addition:

Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

on monday we can even buy it at a lower price.

You are doing an amazing job. Thanks for sharing all the insights. I love your work and it motivates me to do more.

Thanks!