Adobe vs. ServiceNow: The Quality Investing Showdown

Announcing the Winner in a Battle of Tech Titans Through Financial Fortitude and Market Trends

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way—hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to support more content, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support! Let’s grow this journey together—join the conversation on our Global Quality Investing Discord App and subscribe to my Substack for free if you haven’t yet!

Hello, fellow quality investors!

Welcome to another thrilling showdown at Compound & Fire! Today, I dive into the realm of tech giants with two powerhouse contenders: Adobe Inc. and ServiceNow. Adobe Inc., a long-standing leader in digital media, marketing, and creative solutions like Photoshop, Acrobat, and Experience Cloud, has carved a legacy of innovation and consistent value creation. ServiceNow, a rising star in cloud-based IT service management, automates workflows and enhances enterprise operations with AI-driven solutions for IT, HR, and customer service. Both companies represent the pinnacle of their respective niches, offering unique opportunities for quality investors.

This Quick Scan pits their financial strengths and weaknesses against each other to determine which might better fortify my investment portfolio. Adobe’s established dominance contrasts with ServiceNow’s rapid growth and strong balance sheet, while challenges like high stock-based compensation and low insider ownership in both companies raise questions. With Adobe’s proven track record and ServiceNow’s emerging potential, this battle promises insights into which company stands taller. Let’s explore their metrics and finally announce the ultimate winner!

Quick Scan Overview: Investment Readiness Scores

This Quick Scan assesses companies across three key areas: Company Snapshot, Financial Health & Performance, and Shareholder Value & Suitability. Each metric is weighted based on its impact on long-term value creation, contributing to the final Investment Readiness Score. A score above 80 flags the company as a candidate for in-depth quality investing analysis by Compound & Fire, shared on Substack and in my global quality investing app on Discord.

Adobe Inc - Quick Scan

For a better picture of the Quick Scan click here. The calculation of the IRS score is available in our Discord app

Summary and Highlights: Adobe Inc. presents a mixed bag in this Quick Scan. On the negative side, I note high goodwill and intangibles at 44.9% of assets, a significant stock-based compensation (SBC) of 8.8% of revenue (though not unusual for software/tech), and low insider ownership at just 0.17%. However, there are strong positives: a reduction in shares outstanding (cannibalistic approach), high gross margins, an impressive ROIC of 25.4%, a low capex/sales ratio, and a net cash balance. These factors suggest robust efficiency and shareholder focus, despite some concerns.

ServiceNow - Quick Scan

For a better picture of the Quick Scan click here. The calculation of the IRS score is available in our Discord app

Summary and Highlights: ServiceNow also has its strengths and weaknesses. Negatively, I observe low insider ownership at 0.16%, a notable increase in shares outstanding by 21.8% in recent years, and a very high SBC of 15.9% of revenue. On the positive side, the company boasts a strong balance sheet with strong revenue growth, a net cash position and very low goodwill/intangibles at just 7.3% of total assets. Additionally, an adjusted ROIC of 16.7% and net income margin of 18.8%, after capitalizing and depreciating R&D expenses over three years, highlight solid operational performance.

The Big Picture: Investment Readiness Check

Both Adobe and ServiceNow demonstrate quality traits, but their scores tell a different story. Adobe’s Investment Readiness Score of 81.6 edges out ServiceNow’s 72.9, reflecting a stronger overall profile despite its challenges. The key differentiator lies in shareholder value metrics and capital efficiency, where Adobe’s share reduction and higher ROIC give it an advantage.

What’s the Verdict?

After a close and insightful battle, I declare Adobe Inc. as the winner of this Quick Scan, with an Investment Readiness Score of 81.6 compared to ServiceNow’s 72.9. Adobe’s combination of high ROIC, share reduction, and net cash position provides a solid foundation for long-term value creation, outweighing concerns around goodwill and SBC. Meanwhile, ServiceNow, despite its strong balance sheet and growth potential, falls short of the 80-point threshold, prompting me to remove it from my watchlist. Adobe, however, retains its place on my watchlist and deserves a deeper dive when time permits, given its promising metrics, though the Discord Community will decide the priority and the order of the Watchlist candidates first. This outcome underscores Adobe’s stability and growth potential, while ServiceNow’s current profile suggests a need for further maturation before reconsideration.

Winner: Adobe Inc.

But is the market telling a different story? Let’s explore.

Market Reality Check: FCF Yield

Adobe Inc ($ADBE): FCF yield of 5.87%, reflecting a solid cash-generating profile and an attractive valuation. Compared to the 10-year U.S. bond yield of 4.2%, this suggests potential undervaluation. Adobe’s seemingly cheap FCF yield might reflect market fears around AI disrupting its business model. A deeper dive is warranted to assess whether this fear is justified or if it presents a buying opportunity.

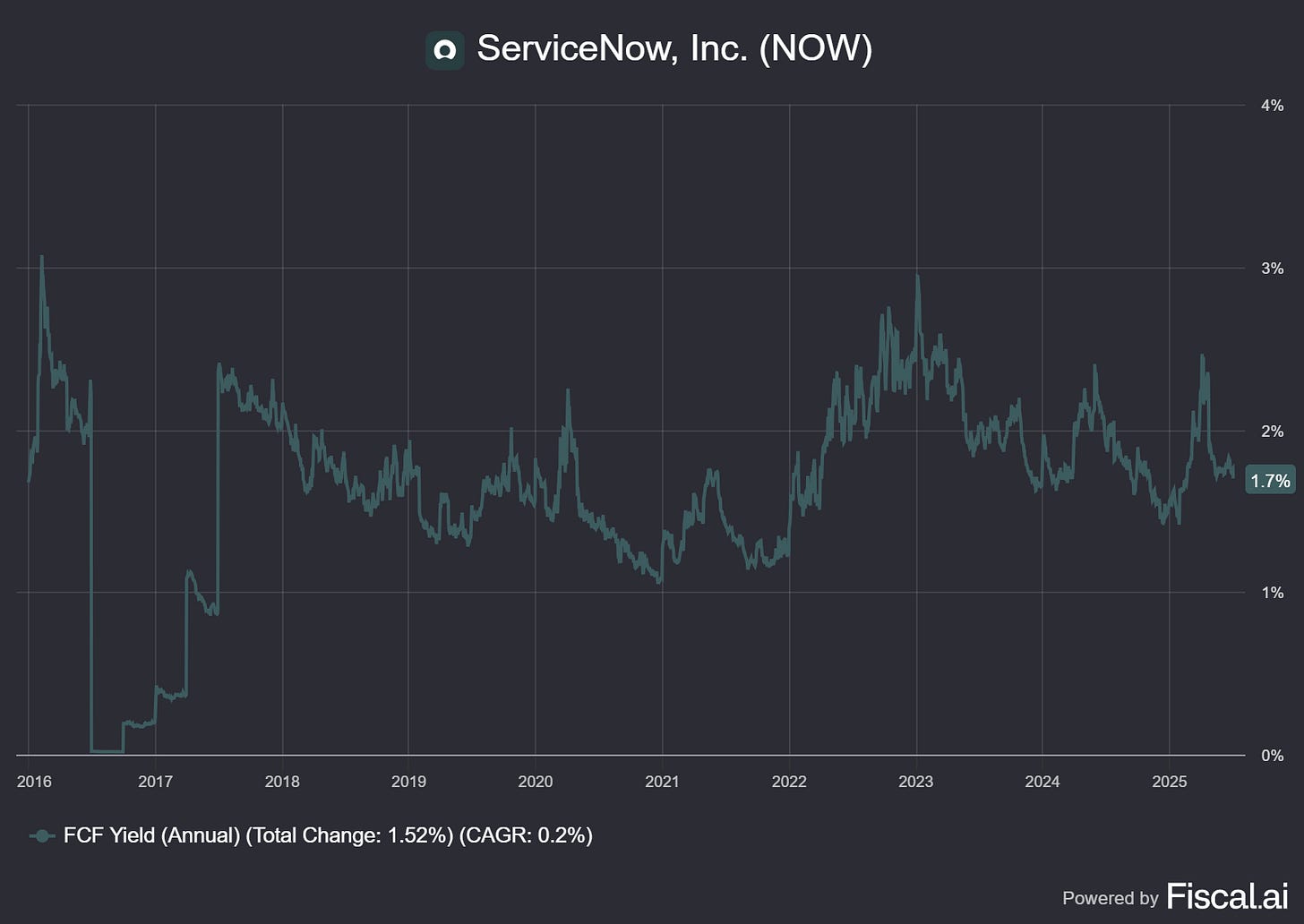

ServiceNow: FCF yield of 1.7%, indicating a lower yield. Against the 4.5% bond yield, this points to (significant) overvaluation, likely driven by growth expectations..

Analysis: Adobe’s 5.9% FCF yield aligns with its stable, innovation-driven profile, while ServiceNow’s 1.7% yield suggests a higher valuation premium, possibly reflecting optimism about its AI-driven growth despite challenges like high SBC. The 4.5% US bond yield indicates Adobe may offer a premium over a risk-free benchmark, while ServiceNow appears richly valued. I’ll keep an eye on AI trends and their impact on Adobe’s creative software dominance, as this could influence its valuation and justify its current yield. For ServiceNow, I’ll monitor its efforts to reduce share dilution and improve insider ownership, which could reshape its investment case in the future.

Which of the two US companies aligns with your strategy? Share your thoughts in the comments below or join the debate on my Global Quality Investing Discord.

The chart above tells a striking story over the past decade. ServiceNow has emerged as the big winner in share price performance, with a total change of 1,451.5% and a CAGR of 29.7%, dwarfing Adobe’s 423.4% total change and 17.0% CAGR. This divergence highlights ServiceNow’s meteoric rise, driven by its rapid growth in the IT service management space, while Adobe’s more measured ascent reflects its mature market position. Despite this, my Quick Scan favors Adobe for its investment readiness, suggesting the market may be overvaluing ServiceNow’s growth trajectory relative to its fundamentals, but a deep dive analysis only could give answer here. The contrast underscores the importance of looking beyond share price trends to assess true quality investment potential.

Join the Quality Edge!

My Quick Scan serves as a starting point to spotlight quality investment candidates. Adobe Inc. earns a place on my Watchlist for a deep-dive exploration, while ServiceNow is removed due to its score falling below the 80-point threshold. I’m excited to analyze Adobe’s innovation-driven growth, competitive moat, and compounding potential, while keeping an eye on market perceptions around AI’s impact on its business. Stay tuned for the detailed report on Substack and my Global Quality Investing Discord. The tech software space offers rich opportunities, and Adobe stands out as a leader worth watching. Until next time, keep compounding!

Share this article

If you enjoyed reading my article, feel free to share it with friends:

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.