ASML: The Semiconductor King Powering the AI Revolution

A Deep Dive into a Moat-Driven Leader in Semiconductor Innovation

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way—hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to fuel more, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support!

Come join the conversation on our Global Quality Investing Discord App here and hop on board my Substack for free if you haven’t yet—let’s grow this journey together!

In this deep dive I will jump into portfolio position ASML. A Dutch company which manufactures photolithography machines for microchip production.

General information

Name: ASML

Logo:

ISIN: NL0010273215

Ticker: ASML

Country: The Netherlands

Current market cap (May 02, 2025): 241.7B EUR

Share price (May 02, 2025): 608.90 EUR

Outstanding shares: 393.3 million

Free float: 392.08 million

Average daily volume: 1.02M

About: ASML, headquartered in Veldhoven, Netherlands, is a global leader in photolithography systems for the semiconductor industry. Founded in 1984, it designs and manufactures machines critical for producing integrated circuits (microchips). Its cutting-edge extreme ultraviolet (EUV) lithography technology enables the creation of smaller, more powerful chips, driving innovation in electronics. ASML collaborates with major chipmakers like TSMC, Samsung, and Intel, supporting advancements in AI, 5G, and beyond.

Quick Scan

"Protecting your money is like guarding a castle: it's easier to keep invaders out than to reclaim lost territory.”

That is why I look for moat companies which protect my castle. I want to minimize the risk of losing money and maximize the chance a company is compounding. Compounding is like a snowball rolling downhill, getting bigger and faster as it goes, just as a company's profits grow faster when they reinvest their earnings into high-return projects, making even more money to reinvest again and again.

Balance sheet

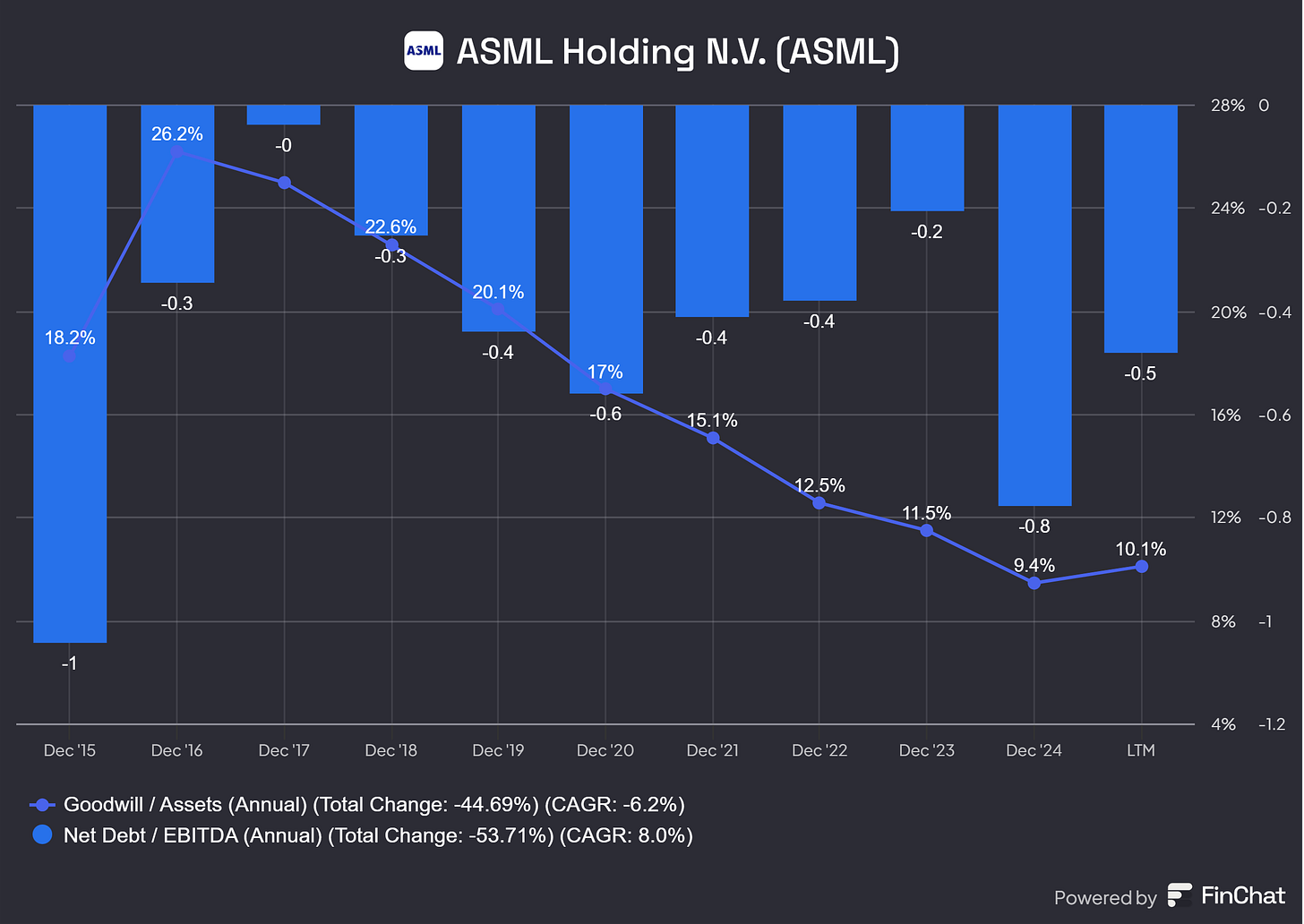

A low Net debt / EBITDA ratio indicates that a company can repay its debt faster, potentially leading to better long-term shareholder return:

Net debt / EBITDA: -0.5x (Net debt / EBITDA < 4x ✅)

A rule of thumb suggests that companies with a goodwill to assets ratio higher than 30% should be carefully analyzed to ensure the risk of potential write-offs is low:

Goodwill / Total assets: 10.1% (Goodwill / Total assets <30% ✅)

Impairments last 10 years: 0 (Impairments / Goodwill < 10% ✅)

This seems like a healthy balance sheet!

Cash Flow

“A business that doesn't take any capital and grows and has almost infinite Returns on required Equity capital is the ideal business” (Warren Buffett)

That is why I look for asset-light companies.

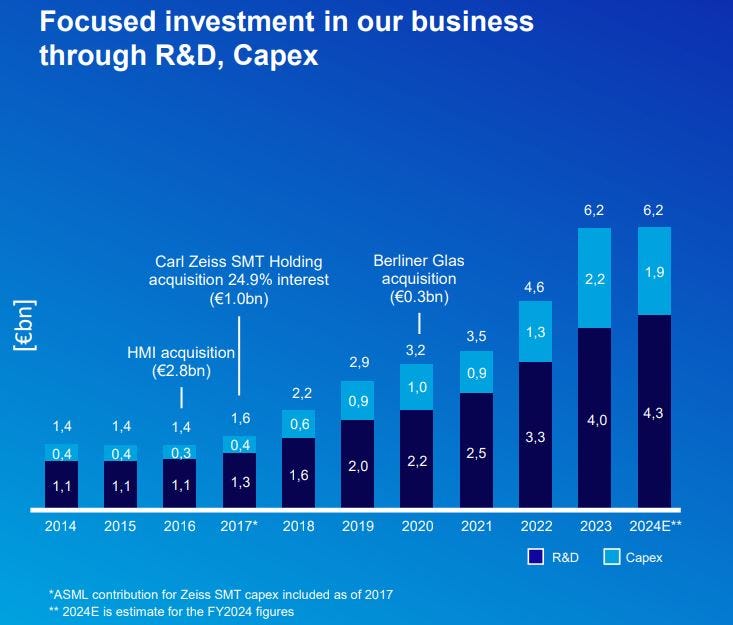

ASML’s capex is primarily driven by investments in capacity expansion, technology development, and infrastructure to support future growth, particularly in EUV (extreme ultraviolet) lithography and AI-driven demand. These align with growth/development capex, which typically includes expenditures on new facilities, equipment, and R&D infrastructure. Maintenance capex, covering routine upkeep of existing assets, is generally a smaller portion for high-tech firms like ASML, which prioritize innovation and scaling.

In their annual report they say:

“We expect that our capital expenditures (purchases of property, plant and equipment) in 2025 will be approximately €2.0 billion. These expenditures are expected to mainly consist of further expansion and upgrades of facilities.”

That is why I think it is better to take the Depreciation figure as a guidance for maintenance Capex. This was 787.3M in 2024.

Maintenance Capex / Sales: 2.8% (Capex / Sales <5% ✅)

Capex / Operating Cash Flow 18.5% (Capex / Operating Cash Flow <25% ✅)

Operating Cash Flow (OCF) / Net Income 130% (OCF / Net Income >80% ✅)

AMSL is a capital-light company as their maintenance capex is low. The Operating Cash Flow versus Net Income for this strong moat company is high, which means ASML turns profit into cash.

Capital Allocation

“Capital allocation is the CEO’s most important job” (Warren Buffett)

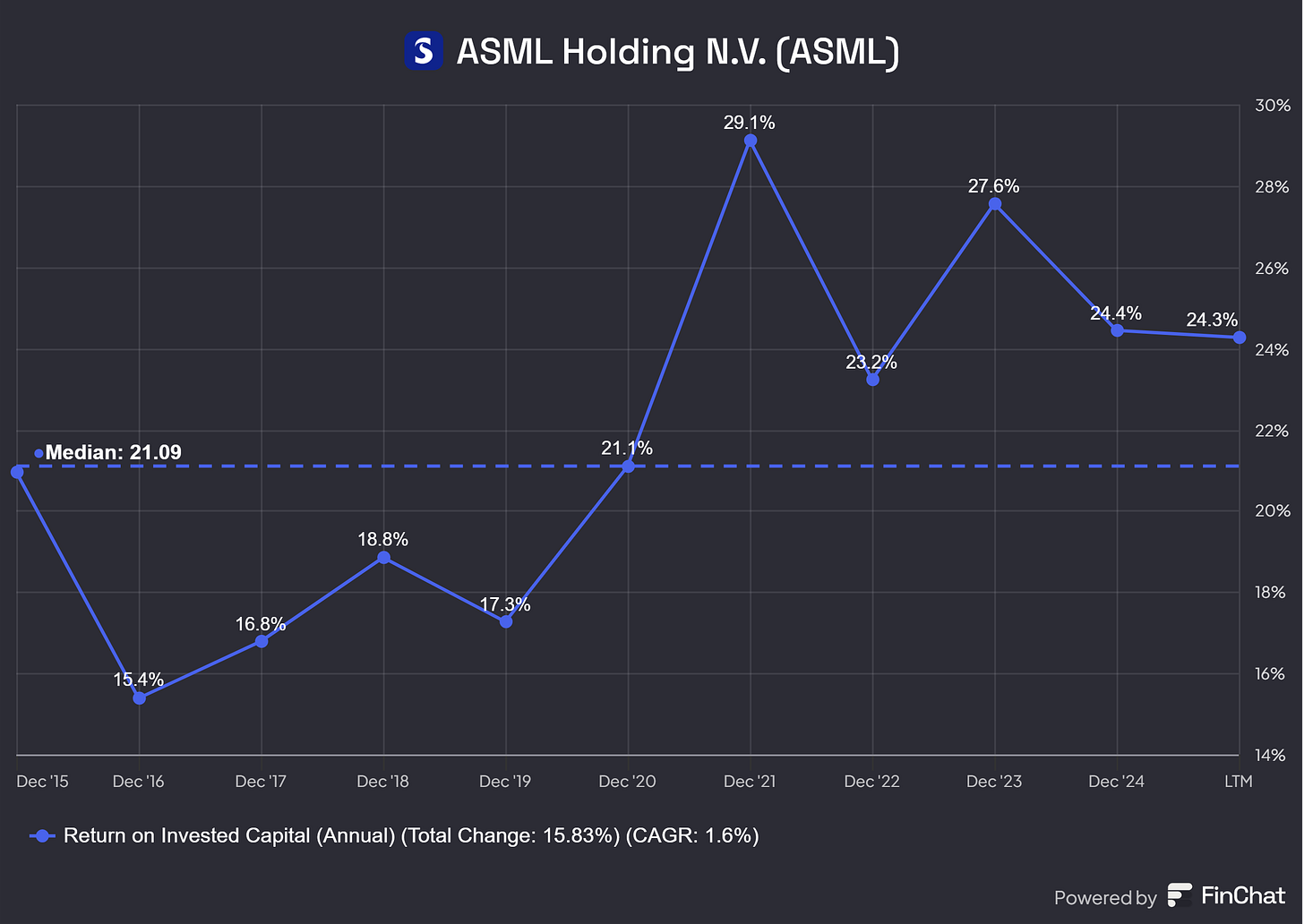

The metric which most often tells most about capital allocation is ROIC.

Return on Invested Capital (5Yr. Average): 23.6% (ROIC >15% ✅ )

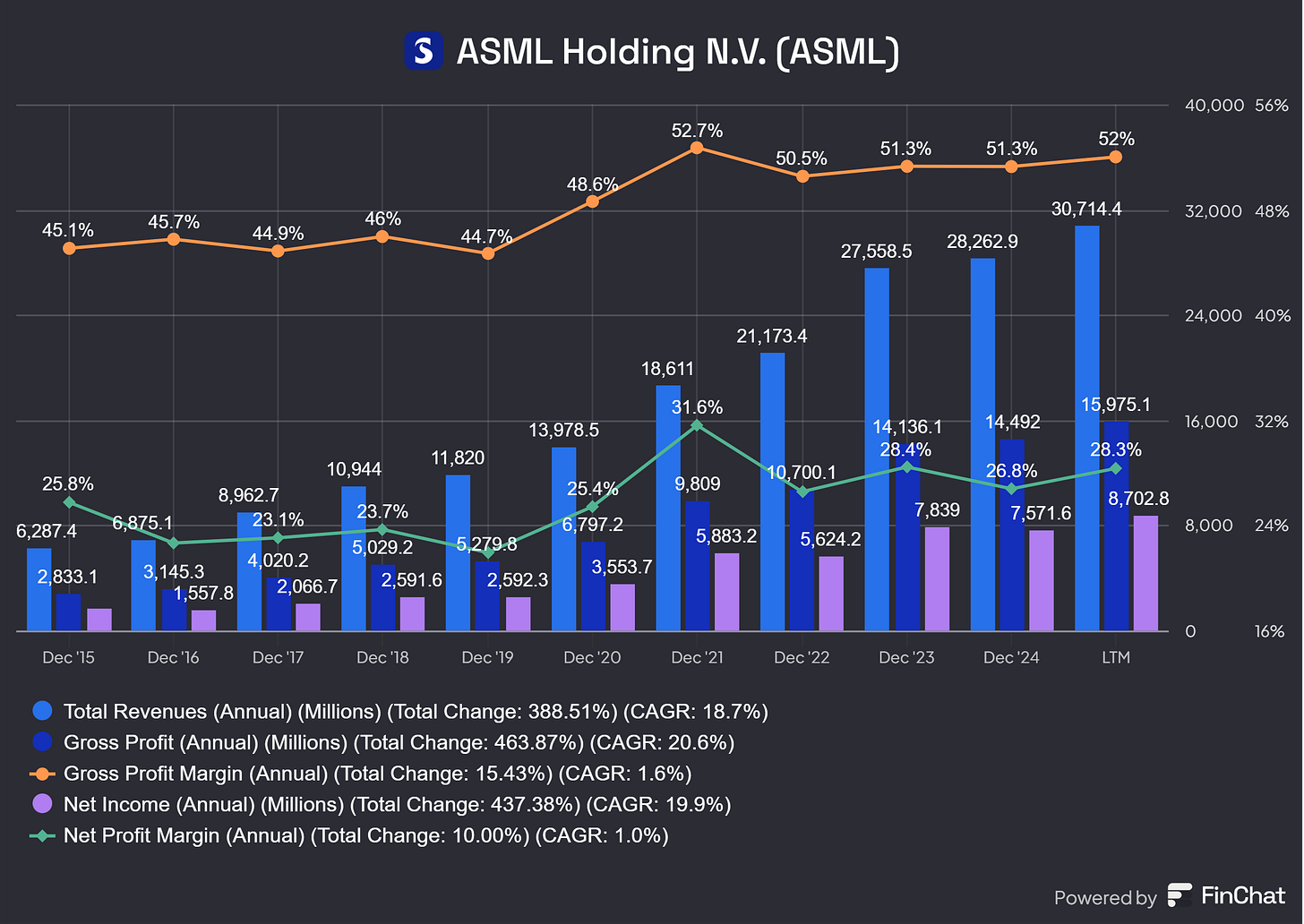

Profitability

A high gross margin provides significant insights into a company's competitive advantage and potential for long-term shareholder returns.

Gross margin: 52.0% (Gross Margin >40% ✅)

Net margin: 28.3% (Net margin >10% ✅)

Stock-Based Compensation (SBC)

“95% of Restricted Stock Units (RSUs) are sold on vest, which potentially defeats the purpose of giving employees long-term skin in the game” (Bill Gurley, a well-known venture capitalist).

“Companies offering stock-based compensation plans can benefit shareholders through higher stock prices, but only if the level of dilution is not excessive.”

Two different views, but opposite. In general I want to see the stock-based compensation below 5%, else it will dilute my stake in a company.

SBC to revenue: 0.6% (SBC < 5% ✅)

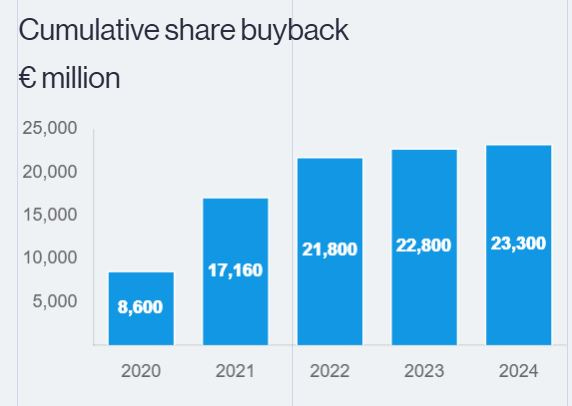

Change in Shares Outstanding 10 yrs: -8.7% (Change in Shares Outstanding <10% ✅)

ASML is buying back shares and has reduced the number of shares outstanding. In November 2022, ASML announced the current up to €12.0 billion 2022-2025 share buyback program of which they expect a total of up to 2.0 million shares will be used to cover employee share plans.

In 2024 they have repurchased 574,925 shares for a total consideration of 500M euro. In 2023 this was 1.6M shares for a total consideration of 1B euro. In 2022 the total consideration since the announcement was 200M, which gives a total of 1.7B euro for 2022-2024 and this means there is 10.3B left under the current plan for 2025.

Source: Website ASML

This year ASML already bought back shares for a total consideration of 3.5B. If they continue this pace, they might repurchase the remainder 6.8B, which would reduce the outstanding shares this year by more than 4%.

Conclusion Quick-Scan

ASML a strong moat company, with a robust balance sheet and capital-light operations. Its high ROIC of 23.6% and high margins make it a promising candidate for long-term compounding, especially as they increased buybacks at more depressed share price levels. The Investment Readiness Score comes in at 85.1 and would have been even higher if management would own a bigger stake in the company.

Management & Leadership

Peter Wennink had served as ASML's CEO since 2013, steering the company to a dominant position in the semiconductor equipment industry. Under his leadership, ASML became the sole supplier of extreme ultraviolet (EUV) lithography machines, essential for producing advanced semiconductor chips.

In April 2024, Christophe Fouquet succeeded Wennink as CEO. Fouquet, who previously led ASML's EUV business, continues the company's strategic focus on innovation and customer-centric growth. He has been with ASML for over 17 years, starting from a management position in product and marketing. He has a Masters in Physics for Grenoble INP - UGA. Previously, he has worked at KLA-Tencor, and Applied Materials in the product and marketing departments. His appointment ensures continuity in leadership and reinforces ASML's commitment to technological advancement. Recently, Fouquet shared on his LinkedIn about The ASML board meeting to discuss the idea of ‘AI everywhere’, and how ASML can focus on the global shift and innovation to benefit customers.

ASML’s executive bench beyond the CEO is exceptionally well‑matched to the company’s technology‑driven model. Roger Dassen, who joined ASML as CFO in 2018, holds a master’s in economics and business administration (1988), a post‑master’s in auditing (1990), and a PhD in business and economics (1995) from the University of Maastricht. Before that, he spent over twenty years at Deloitte Touche Tohmatsu—culminating as Global Vice Chair of Risk, Regulatory & Public Policy—and today also serves as a professor of auditing at the Free University of Amsterdam.

Frédéric Schneider‑Maunoury, ASML’s COO since 2010, graduated from École Polytechnique (1985) and École Nationale Supérieure des Mines de Paris (1988) and brought to ASML leadership roles at the French Ministry of Trade and Industry and at Alstom—experience that proved crucial in ramping complex EUV production lines. Wayne Allan, appointed in 2023 as Chief Strategic Sourcing & Procurement Officer, spent the first decade of his career as a production operator at Micron Technology before rising to Senior Vice President of Global Manufacturing—a trajectory that now informs ASML’s supplier‑engagement and procurement strategies.

Jim Koonmen, Chief Customer Officer since 2024, holds dual M.S. degrees in Management and Aeronautics & Astronautics from MIT’s Sloan School and School of Engineering (both 1994) and previously led ASML’s Applications business and the Cymer Light Source division—roles that ensure customer insights shape the rollout of next‑generation lithography systems.

ASML's ownership structure is predominantly institutional, with institutions holding 58.8% and the general public owning 41.1%. Individual insiders possess a modest 0.0226% stake in the company, with the majority (0.009% going to Ex-CEO, Weenink). While insider ownership is limited, ASML aligns executive incentives with shareholder interests through long-term incentive plans tied to company performance. Return on Average Invested Capital is one of their main metrics.

Compensation Policy Shift

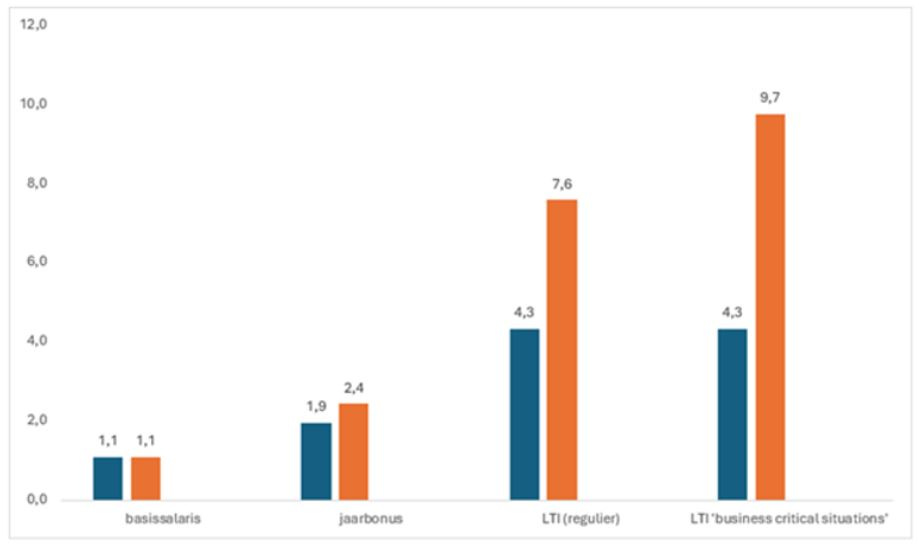

In March 2025, ASML’s new management proposed a significant update to its 2025 Remuneration Policy, increasing maximum executive bonuses from 5.8 times base salary under the prior policy to 9.3 times, with a “Business Critical Situation” clause potentially raising it to 11.3 times—nearly doubling potential payouts. This shift aims to attract and retain talent but introduces ambiguity in bonus criteria, raising concerns about governance and alignment with shareholders. Given ASML’s modest insider ownership and the long tenure of executives like Fouquet, such aggressive compensation may prioritize executive gain over shareholder value, a development that warrants caution despite ASML’s focus on ROAIC in its incentive plans. The VEB illustrates this shift in a graph comparing the old (blue) and new (orange) bonus structures, highlighting the significant increase in potential payouts

Source: Vereniging van Effectenbezitters (VEB)

Market Attractiveness & Growth Potential

The semiconductor industry’s value chain spans multiple layers: design (e.g., ARM’s IP cores), software (e.g., Cadence’s EDA tools), equipment (ASML’s lithography machines), foundries (TSMC, Intel), and packaging. ASML sits at the heart of this ecosystem, supplying the critical lithography tools that enable chipmakers to produce advanced nodes, positioning it to capture significant value as demand for AI, 5G, and automotive chips surges.

The semiconductor manufacturing equipment market is distinguished by exceptionally high barriers to entry—combining advanced optics, precision engineering, and decades of R&D—and is forecast to grow from roughly $121.7 billion in 2024 to over $270 billion by 2030, representing a 10.5% CAGR. Some analysts project even faster expansion (12.4% CAGR to $314 billion by 2030).

Within this market, ASML stands alone as the only company capable of delivering EUV lithography systems, the critical enabler for nodes below 7 nm used in flagship smartphone SoCs, high‑performance data‑center processors, and AI accelerators. This monopoly on EUV—combined with roughly 90% share in advanced deep‑UV (DUV) tools—cements ASML’s strategic position in the multi‑billion‑dollar photolithography segment.

Tailwinds

Generative AI and high‑performance computing deployments are driving an outsized surge in demand for cutting‑edge semiconductors. Industry forecasts anticipate semiconductor revenue growth north of 15% in 2025, powered by data‑center expansion and specialized AI ASICs. Cloud service providers and hyperscalers are investing heavily in new AI‑optimized infrastructure, boosting requirements for advanced nodes and the lithography tools to make them.

Concurrently, the 5G chipset market is set to nearly double from $43.87 billion in 2025 to over $300.88 billion by 2032 at a 31.7% CAGR, reflecting the proliferation of enhanced mobile broadband and ultra‑reliable low‑latency communications. The automotive sector is also becoming a major semiconductor consumer: the autonomous vehicle chips market alone is projected to expand at around 8.7% annually through 2032, as ADAS features and self‑driving capabilities proliferate. Cloud computing and edge data center build‑outs further compound these drivers, underscoring the multi‑industry nature of semiconductor demand:

Source: ASML Investors Day November 2024

These demand drivers underscore why ASML’s products are at the heart of the semiconductor boom. Let’s explore the tools that make this possible.

ASML’s Technological Arsenal: Powering the Semiconductor Revolution

To grasp ASML’s unrivaled dominance in the semiconductor industry, we must explore its portfolio of lithography systems, metrology tools, and software that enable chipmakers to craft the intricate circuits driving AI, 5G, and autonomous vehicles. At the core is the lithography process: a marvel of precision where light projects a mask’s circuit pattern through advanced optics onto a photoresist-coated silicon wafer. After development and etching, this forms one of 30-40 layers in a modern chip, each requiring atomic-scale accuracy. ASML’s machines execute this feat, powering the chips in everything from smartphones to self-driving cars.

ASML’s crown jewel is its Extreme Ultraviolet (EUV) lithography systems, the only tools capable of patterning features as small as 2-8 nanometers, essential for cutting-edge chips in AI accelerators, flagship smartphones, and data-center processors. These systems generate EUV light by blasting 30-micrometer tin droplets with a high-power CO2 laser 50,000 times per second, creating a plasma that emits 13.5 nm light—invisible to the human eye and absorbed by nearly everything, requiring a vacuum environment and reflective optics. This technology, rooted in research inspired by X-ray astronomy and nuclear fusion, turns science fiction into reality. The NXE series powers high-volume production for clients like TSMC and Samsung.

Source: ASML Investors Day Nov 2024

The EXE series and High-NA EUV systems (e.g., TWINSCAN EXE:5000) target sub-2 nm nodes. The mirrors in these machines, crafted by Carl Zeiss, are among the smoothest surfaces ever created, with imperfections less than 50 picometers—if scaled to Germany’s size, the largest bump would be under 1 mm high. Each EUV system consumes 1 megawatt of power, enough for 1,000 households, yet the energy-efficient chips they produce help reduce global power consumption. ASML’s sustainability efforts, like optimizing manufacturing processes, further mitigate this environmental footprint. With EUV, ASML holds a monopoly, aligning wafers with less than 2 nanometer precision—equivalent to positioning a golf ball on a green with a margin of error smaller than a human hair.

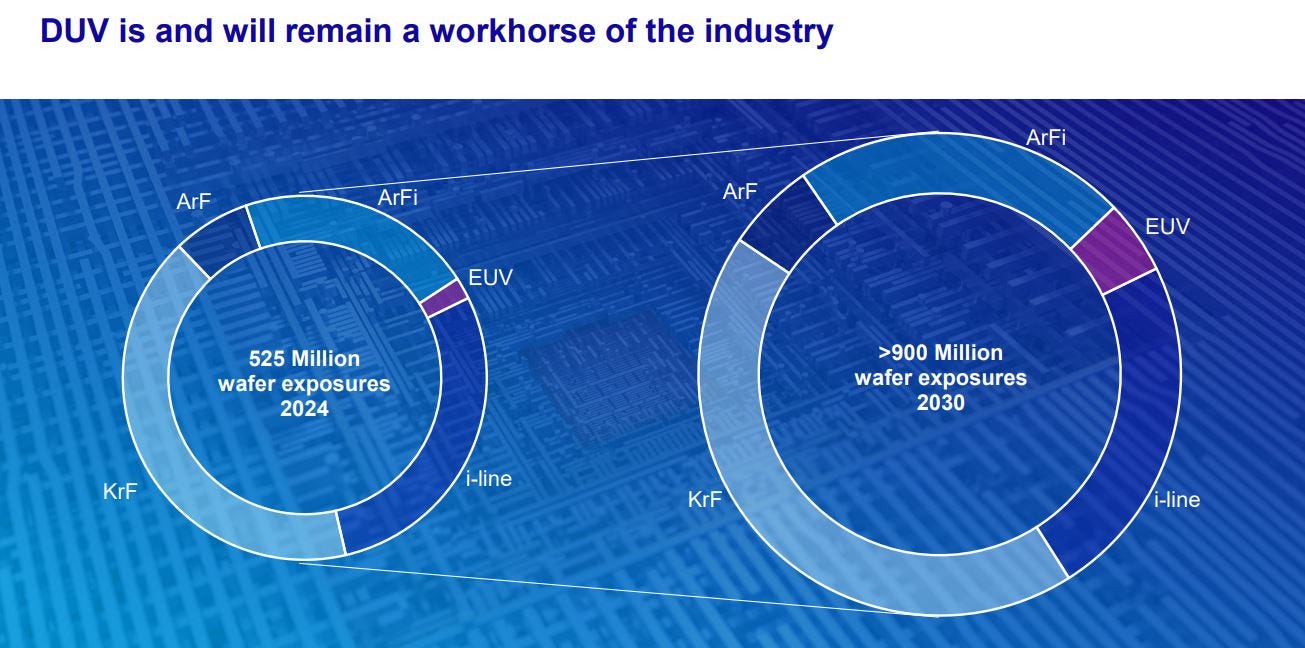

Complementing EUV, ASML’s Deep Ultraviolet (DUV) systems remain the workhorse for chips from 7 nm to legacy 32 nm nodes, serving diverse applications like IoT, automotive, and 3D NAND memory. The TWINSCAN NXT series uses 193 nm argon fluoride lasers with water immersion to process over 300 wafers per hour, while the TWINSCAN XT series supports cost-sensitive older nodes. DUV’s enduring relevance, as ASML’s Investors Day roadmap projects through 2030, ensures its role in the semiconductor ecosystem, from smart home devices to electric vehicles.

Source: ASML Investors Day Nov 2024

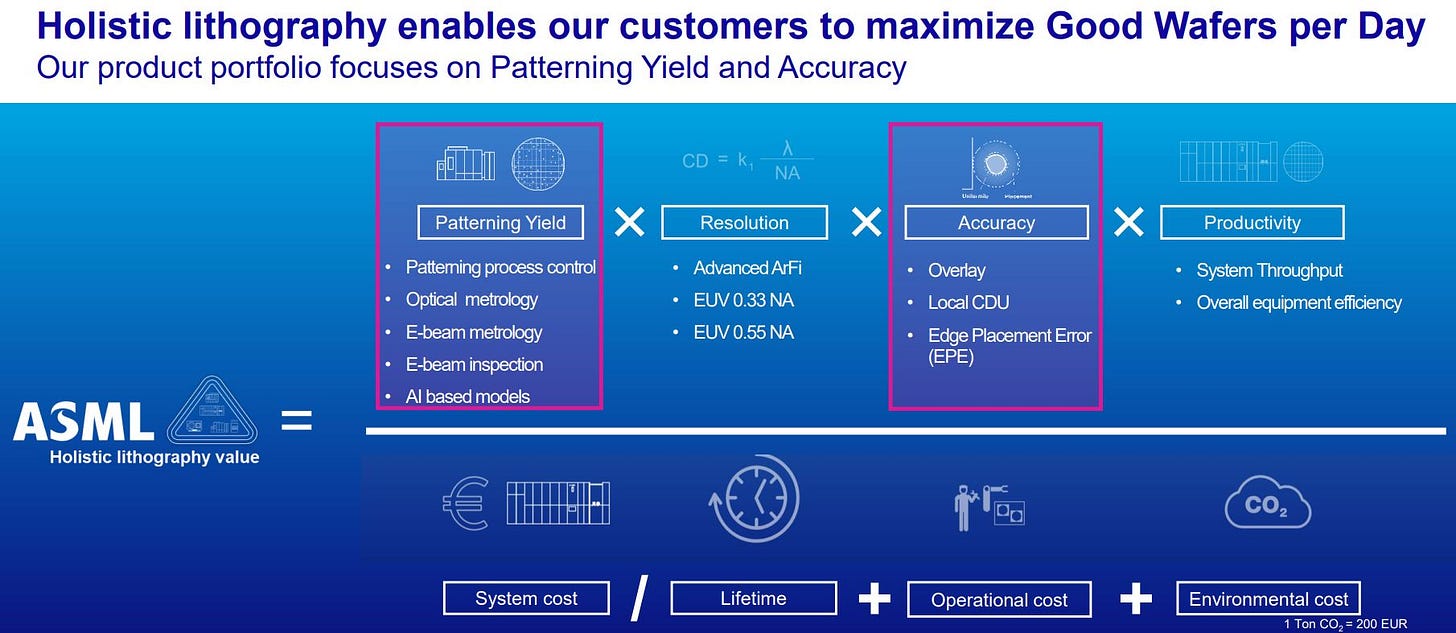

Beyond lithography, ASML’s metrology and inspection systems, such as YieldStar and HMI e-beam tools, ensure pattern accuracy and detect nanoscale defects, boosting chip yields. These are integral to ASML’s “Holistic Lithography” approach, which combines hardware, software, and metrology to maximize “Good Wafers per Day,” enhancing chipmakers’ productivity and cost-efficiency. The computational lithography software, with 45 million lines of code rivaling Windows 10’s complexity, uses AI-driven models to optimize patterning and correct distortions at atomic scales. Since 2010, this software has dramatically improved optical proximity correction accuracy, enabling both EUV and DUV systems to push smaller nodes while managing costs.

Source: ASML Investors Day Nov 2024

ASML also supports cost-effective production through refurbished systems and services, extending the life of older tools like the PAS 5500, particularly in markets like China with restricted EUV access. This diverse portfolio, backed by over 100,000 parts from 5,000 global suppliers, is assembled in cleanrooms over months, akin to building a space shuttle. This intricate ecosystem, visualized in ASML’s Investors Day presentations, positions ASML to capture the surging capital expenditures from chipmakers racing to meet AI and 5G demand. But who are these customers, and how much are they investing?

Chipmakers’ Spending Spree: Fueling ASML’s Growth

ASML’s revenue hinges on the capital expenditure (capex) of its key customers—TSMC, Samsung, Intel, and smaller players like SK Hynix and Micron—who are pouring billions into advanced chip production. TSMC, ASML’s largest customer, spent $30 billion in 2024, with 70-80% allocated to 3 nm and 2 nm nodes that rely on ASML’s EUV systems. For 2025, TSMC expects flat-to-slightly-higher capex ($30-32 billion), expanding to $35-40 billion by 2026 as it ramps up Arizona and Japan fabs, fueled by AI chip demand and $6.6 billion in CHIPS Act funding. By 2030, TSMC’s annual capex could hit $45 billion, doubling its advanced node capacity and driving demand for ASML’s High-NA EUV tools.

Intel, meanwhile, is betting big on its foundry ambitions, spending $25 billion in 2024 and planning $25-28 billion in 2025, supported by $8.5 billion in CHIPS Act grants. Its early adoption of High-NA EUV for the 1.4 nm node, starting in 2026, positions it as a key driver of ASML’s high-margin revenue. Samsung and others follow suit, with combined capex from these giants projected at $85-105 billion annually by 2030, translating to $17-31.5 billion in lithography spending—most of which flows to ASML’s EUV monopoly.

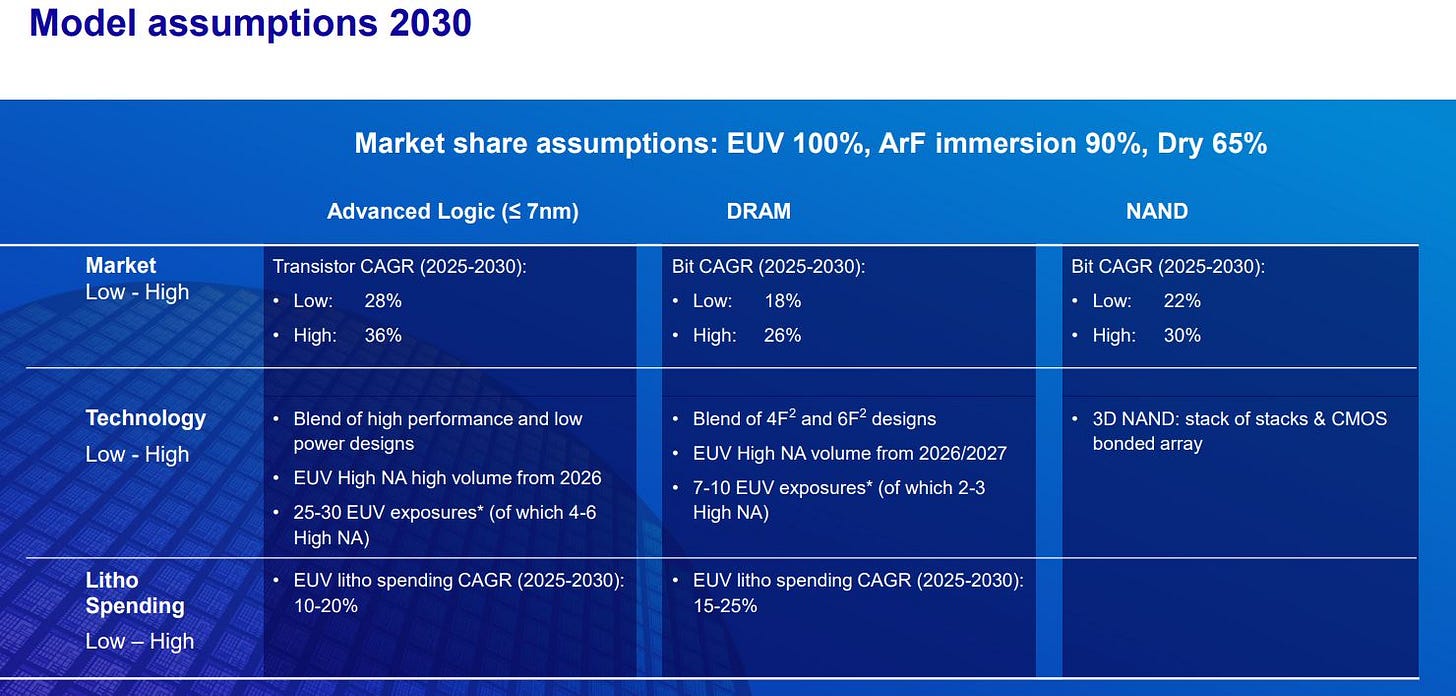

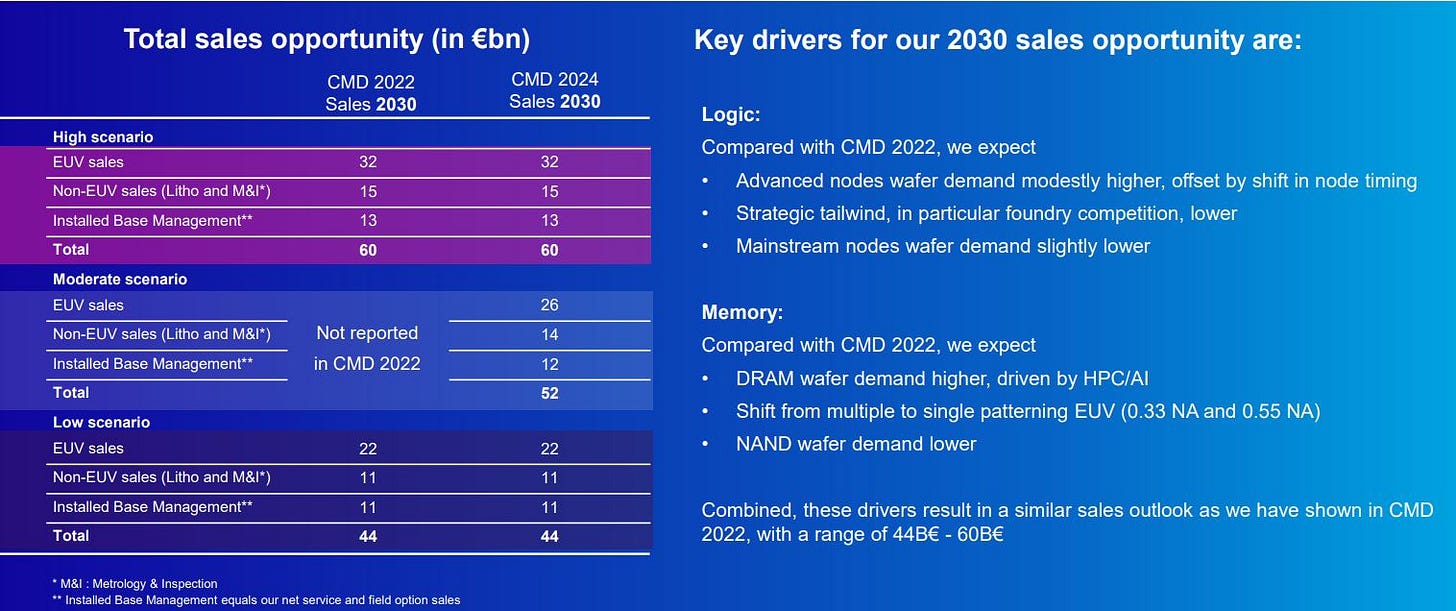

ASML’s 2030 revenue targets a range between €44B and €60B. Revenue was €28.3B in 2024, so for €44B this means a CAGR of 7.6% and for €60B this means a CAGR of 13.3%. With chipmakers committing billions, ASML’s 2030 revenue targets look ambitious but achievable.

ASML’s Path to €44B–€60B: Revenue Drivers for 2030

ASML’s 2030 revenue target of €44B–€60B, up from €28.3B in 2024, implies a CAGR of 7.6%–13.3%. This ambitious goal is supported by robust customer capex, rising semiconductor demand, and ASML’s operational strengths. Let’s explore the key drivers fueling this growth.

Customer Capex Alignment: Combined capex from TSMC, Samsung, and Intel is projected to reach $85B–$105B annually by 2030, with 20–30% allocated to lithography tools. This translates to $17B–$31.5B in lithography spending, of which ASML captures ~80% due to its EUV monopoly, supporting €13.6B–€25.2B in revenue from these customers alone. Additional contributions from SK Hynix, Micron, and others bolster this figure. The shift to advanced nodes (2 nm, 1.4 nm) and High-NA EUV increases lithography intensity, boosting ASML’s revenue per wafer, with double-digit CAGR projected for EUV spending in logic and DRAM from 2025–2030.

Source: ASML Investors Day November 2024

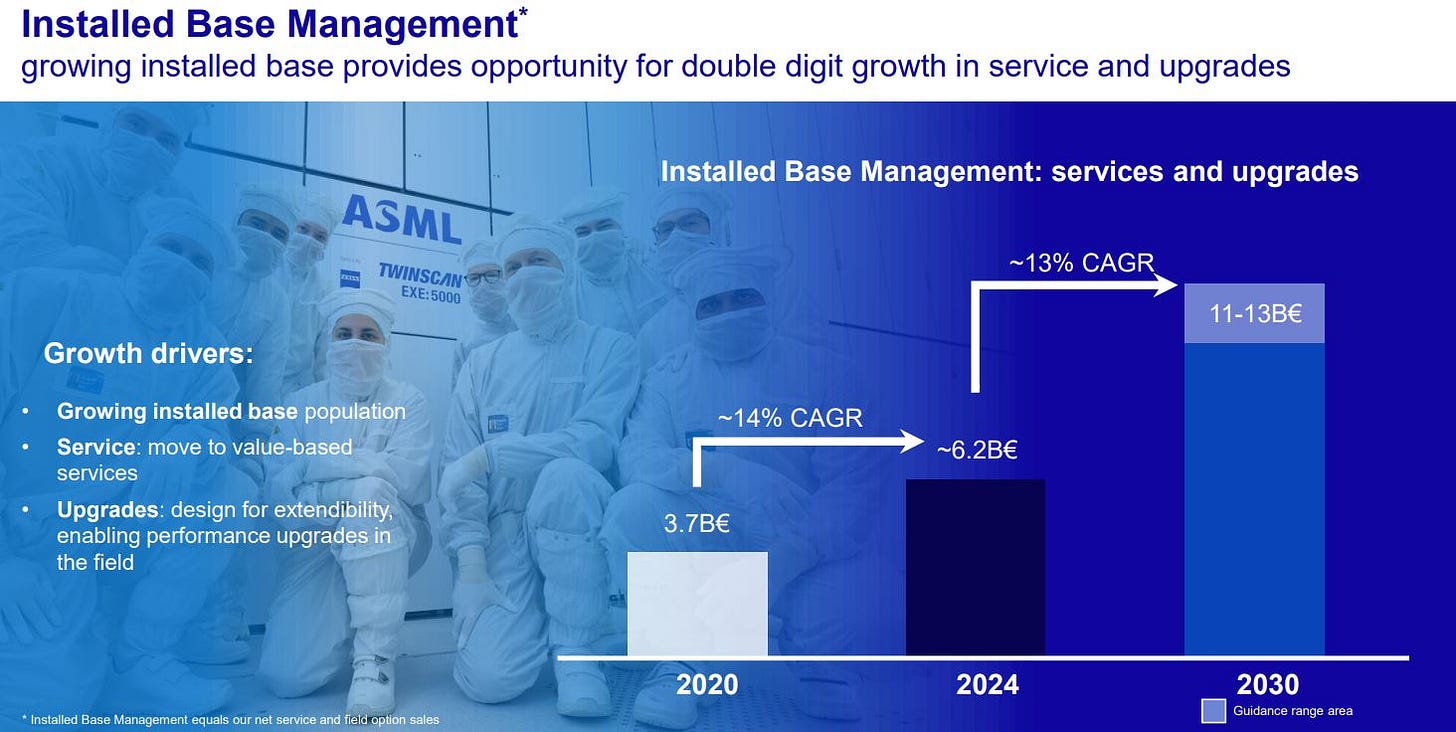

AI and Semiconductor Market Growth: ASML expects global semiconductor sales to surpass $1T by 2030, growing at 9% annually from 2025, driven by AI (40% of chip demand). This aligns with TSMC, Samsung, and Intel’s focus on AI chips, which rely on ASML’s most advanced EUV tools. The installed base growth, through services and upgrades, is expected to contribute €11B–€13B to 2030 revenue, complementing system sales.

Source: ASML Investors Day November 2024

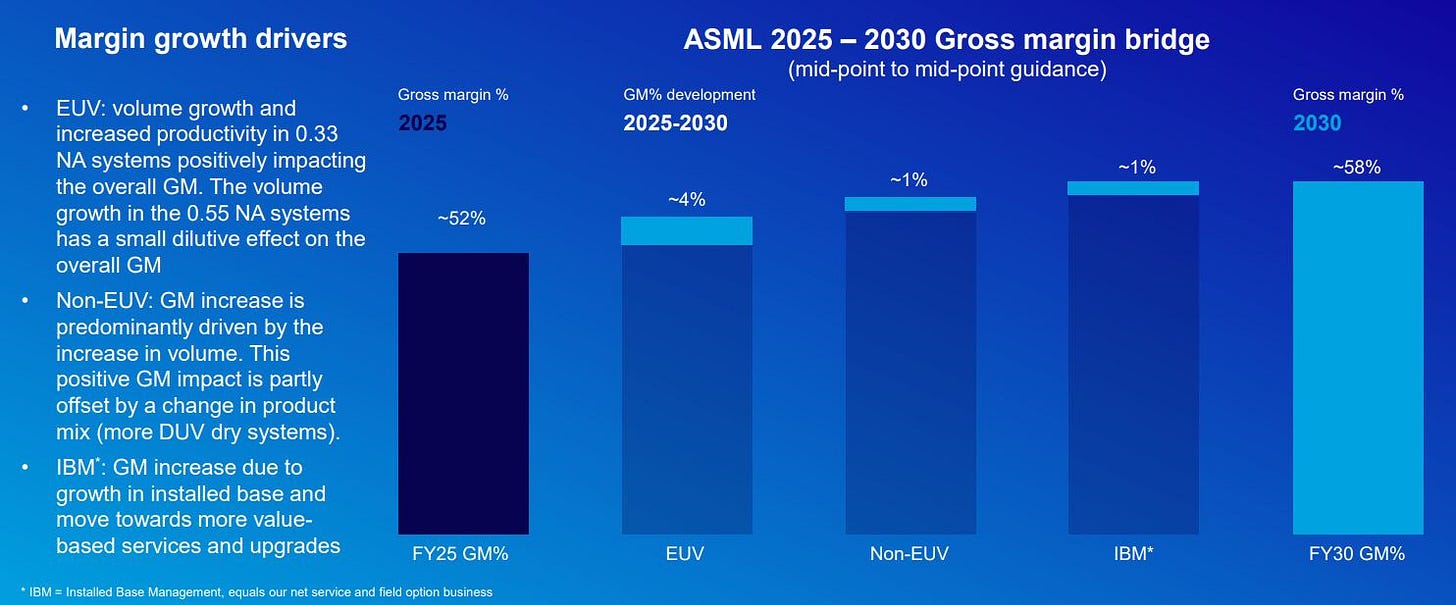

Margin Expansion: ASML projects gross margins of 56–60% by 2030, up from 51–53% in 2025, driven by higher-margin EUV and High-NA systems. This supports profitability even if revenue leans toward the lower end of the target.

Capacity Expansion: ASML plans to scale EUV capacity to 90 systems annually by 2025–2026 and High-NA EUV to 20 systems by 2027–2028, meeting customer demand and leveraging its €36B order backlog for revenue visibility.

With these drivers in place, ASML’s 2030 target appears achievable:

The target is ambitious but plausible, leaning toward the lower end (€44B–€50B) as more realistic. Assuming a 9–11% CAGR from €28.3B in 2024, ASML reaches €44B–€48B by 2030. The €60B scenario requires sustained high capex, flawless execution, and minimal geopolitical disruptions, which seems optimistic given China restrictions and tariff risks.

Customer capex trends support €44B–€50B, as TSMC, Samsung, and Intel’s $85B–$105B annual spending translates to €13B–€20B in ASML system sales, plus €10B–€15B from services and smaller customers.

But what’s the most realistic scenario? Let’s evaluate with bull, base, and bear cases.

Bull Case (€50B–€60B): Strong AI demand, successful High-NA EUV adoption, and stable global trade push ASML toward the high end. Intel’s foundry success and Samsung’s 2nm ramp-up could drive upside, with EUV deliveries reaching 80–90 units annually by 2030.

Base Case (€44B–€50B): Moderate AI growth, partial recovery in non-AI segments (e.g., Automotive, PCs), and steady capex from TSMC, Intel, and Samsung support the low-to-mid range. U.S. and EU fab growth offsets challenges elsewhere.

Bear Case (€40B–€44B): Tariff escalations, economic slowdown, or delays in 1.4nm/High-NA adoption cap growth. Overcapacity in memory or logic could lead to capex cuts, though ASML’s EUV monopoly provides a buffer.

My base case leans toward €44B–€50B, assuming a 9–11% CAGR from €28.3B in 2024, driven by customer capex and AI growth. ASML’s own €52B base case is slightly more optimistic, but risks like geopolitical tensions and customer concentration warrant caution.

Source: ASML Investors Day November 2024

Let’s explore these vulnerabilities further after examining ASML’s strategy and competitive moat.

Strategy & Business Model: The Engine Behind ASML’s Dominance

From a 1984 joint venture between Philips and ASM International, ASML overcame near-failures in the 1980s and 1990s to become the semiconductor industry’s linchpin. Supported by Philips through financial struggles, ASML launched the game-changing TwinScan in 2001 and mastered EUV lithography through acquisitions like Cymer (2013) and Hermes Microvision (2016). Today, its business model and strategic pillars fuel a compounding machine that balances innovation, customer collaboration, and financial discipline.

Business model

ASML’s revenue blends capital-intensive system sales—primarily high-end EUV and DUV scanners—with a high-margin installed-base services business. In 2024, system sales generated €21.7B (583 units), down slightly from €21.9B (600 units) in 2023, while services, including maintenance, upgrades, and field options, contributed €6.5B. This recurring service stream, akin to a SaaS annuity, cushions cyclical downturns in equipment orders, ensuring stable cash flows. Each system sale is backed by multi-year service agreements, locking in long-term revenue.

Strategic Pillars

ASML’s monopoly‑like edge in leading‑edge lithography rests on four interlocking strengths.

Technology Leadership: ASML invested €4.4B in R&D in 2024 (18% of sales), up from €4.0B in 2022, targeting High-NA EUV, wafer throughput, and AI-powered metrology. In Q1 2025, R&D spending reached €1.16B (~15% of revenue), reinforcing a decade-long innovation runway that competitors, constrained by complex optics, cannot match.

Customer Integration: Co-investment programs, like the €1.4B joint R&D with TSMC, Samsung, and Intel in 2012, and Intel’s High-NA collaboration for the EXE:5200, embed ASML’s tools into customer roadmaps, accelerating adoption and securing orders.

Operational Excellence: ASML optimizes its supply chain with partners like Zeiss and Trumpf, scaling EUV capacity to 90 units annually by 2025–2026 and High-NA to 20 units by 2027–2028. Manufacturing efficiencies drive gross margin growth (52% in 2024, targeting 56–60% by 2030).

Service Recurrence: With an installed base at 95% utilization, service revenue (~20% of sales, €6.5B in 2024) delivers high-margin, predictable cash flows. A 10,000-engineer service team ensures rapid maintenance and upgrades, fostering customer trust and business continuity. Logistically, ASML orchestrates a global supply chain, shipping High-NA machines in seven Boeing 747s, a feat that underscores its operational prowess and ability to meet complex customer needs.

Capital Allocation

ASML balances growth and shareholder returns with disciplined capital allocation. Free cash flow funds €4.4B+ in annual R&D and capacity expansion (e.g., new manufacturing facilities), while excess capital supports dividends and share buybacks. In 2024, ASML returned €1.6B to shareholders via dividends and €2.5B through buybacks, aligning with its commitment to deliver value while investing in long-term growth.

Operational Leverage & Backlog

A €36B order backlog at the end of 2024 provides revenue visibility and underscores customer stickiness. As production scales, efficiencies in manufacturing and service networks drive margin expansion, evidenced by a 52% gross margin in 2024 (up from 51.3% in 2023). This backlog, coupled with service revenue, hedges against semiconductor cyclicality, ensuring steady cash flows to fuel innovation and shareholder returns.

Source: ASML Investors Day November 2024

Competitive Landscape: An Unassailable Fortress

ASML’s dominance in lithography is a fortress built over decades, forged through relentless innovation and strategic partnerships. Its monopoly in extreme ultraviolet (EUV) lithography and near-total control of deep ultraviolet (DUV) markets create a competitive moat that rivals struggle to breach, securing ASML’s role as the semiconductor industry’s gatekeeper.

Monopoly in EUV and DUV

ASML is the sole global supplier of EUV systems, indispensable for chips at 7 nm and below, a position cemented by over 20 years of R&D and proprietary photonics expertise. The complexity of EUV—requiring vacuum-grade engineering and advanced optics—erects barriers no newcomer can scale. TSMC, Samsung, and Intel rely exclusively on ASML’s EUV tools, making it the de facto industry standard. In DUV, ASML commands ~90% market share, dwarfing Nikon and Canon. Nikon, the primary rival, focuses on lower-end systems and niche applications, while Canon’s dry DUV steppers and experimental nanoimprint technology lack the scale or customer integration to challenge ASML. Nikon’s 2008 exit from high-index immersion lithography and its planned 2028 reentry into ArF immersion—aiming for ASML compatibility rather than innovation—underscore ASML’s lead. Emerging technologies like nanoimprint or directed self-assembly remain far from commercial viability, posing no threat by 2030.

Moat Components

ASML’s competitive edge rests on four pillars:

Technology Moat: Continuous R&D (€4.4B in 2024) drives innovations like High-NA EUV and AI-driven metrology. The 2012 €1.4B co-investment from Intel, Samsung, and TSMC aligned foundries with ASML’s EUV roadmap, while its “holistic lithography” approach—integrating hardware, software, and metrology—maximizes chipmaker yields, a differentiator no rival matches.

Supply Chain Control: Exclusive partnerships with Zeiss (optics) and Trumpf (lasers), backed by a €1B stake in Zeiss SMT, secure critical components, raising the bar for competitors.

Customer Stickiness: Switching costs are astronomical—machines cost €50M–€350M and take years to integrate. ASML’s co-engineering tailors tools to each fab’s needs, ensuring loyalty and recurring service revenue.

Intellectual Property Moat: Over 33,000 patents, with 19,700 granted, cover everything from light sources to mask automation, deterring replication or litigation.

This fortress, built on technology, partnerships, and customer lock-in, positions ASML to maintain its lead, though risks like geopolitical tensions could test its resilience.

Valuation

In order to have an understanding of the valuation of the company it is good to look from multiple angles.

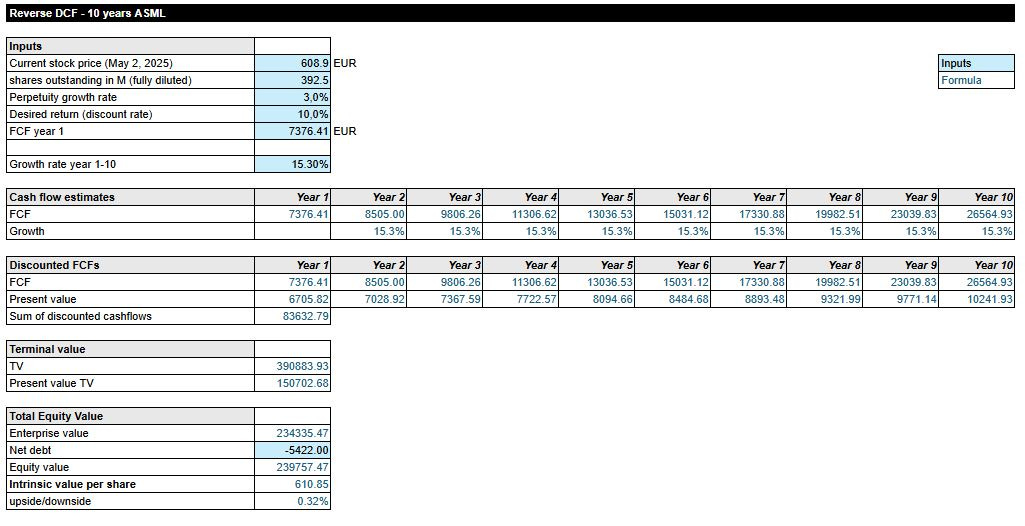

Reverse DCF - What Growth is Priced In?

Starting with known data points and working backwards to assess market expectations and judge whether these expectations are realistic.

Let’s start with a Reverse DCF to understand what growth rate ASML’s current stock price implies.

Revenue Forecast: I assume the high end of the base case for ASML, where revenue will grow towards 50B in 2030, a bit below ASML’s own mid range base case of 52B.

Gross margin and NOPAT: The gross margin in my model will grow towards 58%, which is the middle of the provided range by ASML of 56%-60% for 2030. Given their product mix changes and monopoly on EUV I expect they will reach this. I don’t make any adjustments to NOPAT. ASML is expensing all R&D costs and while capitalizing R&D could reflect ASMLs long-term value I maintain the unadjusted approach for simplicity and transparency. This avoids subjective adjustments like capitalization rates and amortization periods and ensures the growth assumptions are grounded in ASML’s official statements, fitting industry norms. Note that this approach is a conservative approach.

Unlevered Free Cash Flow (UFCF): From NOPAT, I subtract capex and the change in working capital. Given the expected growth my assumption is this will cost ASML annually cash which is seen in the change in net working capital in my model.

If you are interested in the forecast and valuation model in Google Sheets you can join my Discord app for free and get it. There will be more detailed information available in the app, also around other stocks.

Reverse DCF Outcome: Using ASML’s current market cap the Reverse DCF implies a 10-year UFCF growth rate of 15.3% to achieve a 10% annual return.

When I look at my first 6 years forecast till 2030, I end up at a slightly higher Unlevered Free Cash Flow of 15.3B versus 15.0B in below Reverse DCF in year 6. This proves that the market is currently expecting ASML to hit teir base case scenario.

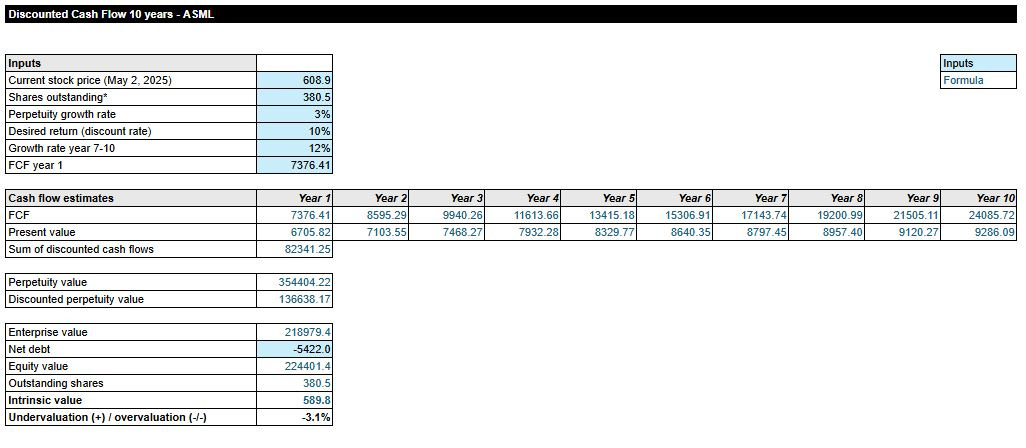

DCF Model: What’s the Intrinsic Value?

Now, let’s calculate ASML’s intrinsic value per share using my forecast till 2030 and for year 7 till 10 a 12% growth of unlevered free cash flow. Also note that for the shares outstanding I expect ASML to heavily buyback shares this year to end around 380.5M shares.

Also the DCF shows that ASML is currently valued according their base case scenario and investors at current stock prices will get close to 10% return on their investment. Why did I buy ASML shares on April 7 at a price of 515 euro? This is because of:

Assuming a base case scenario I would receive more than 11% on my investment

My model is conservative as I did not adjust for any R&D expenses

I wouldn’t be surprised if ASML will do better than the base case

Plus of course their strong moat, where I don’t see a risk to lose money on this investment

Forward P/E

ASML’s median forward P/E over recent years is 29.59, compared to 25.12 today. This shows ASML is not expensive compared to historical Forward P/E metrics.

Risks: Navigating Challenges to ASML’s Growth

Despite ASML’s formidable moat and growth potential, several risks could challenge its path to €44B–€60B by 2030. These vulnerabilities, ranging from geopolitical tensions to technological hurdles, require careful consideration.

Geopolitical and Trade Headwinds: ASML’s global operations face significant geopolitical risks, particularly from U.S. and Dutch export restrictions on advanced semiconductor equipment. In 2023, China accounted for 29% of ASML’s sales (€6.3B), peaking at 46% in Q3 2023, but this is expected to drop to 15% by 2030 due to bans on EUV and advanced DUV exports. This creates a €3B–€4B revenue headwind, requiring U.S. and EU customers to offset the loss. While unlikely by 2030, China’s development of domestic EUV alternatives could further pressure ASML’s market share. Additionally, a potential Taiwan Strait conflict would be catastrophic, as Taiwan accounts for 39% of global wafer production and a third of ASML’s fab customers, disrupting supply chains and orders.

Customer Concentration and Cyclicality: ASML’s reliance on TSMC, Samsung, and Intel, which represent ~70% of its revenue, exposes it to client-specific risks. Any capex cuts—due to economic slowdowns, overcapacity, or project delays (e.g., TSMC’s cautious 2025 guidance amid tariff uncertainties)—could significantly impact sales. The semiconductor equipment market’s boom-bust cycles amplify this vulnerability, with system sales (€21.7B of €28.3B in 2024) particularly sensitive to downturns. However, ASML’s €36B order backlog and growing service revenue (€6.5B in 2024) provide a buffer, smoothing volatility and ensuring multi-year revenue visibility.

Execution Risks in High-NA EUV: The High-NA EUV platform, critical for sub-2 nm nodes, carries execution risks due to its complexity and €350M price tag. While Intel’s early trials processed 30,000 wafers in a quarter, TSMC and others are adopting a cautious 12–18-month validation period, raising questions about yield, maintenance costs, and scalability. Dependencies on specialized pellicles, masks, and optics from suppliers like Zeiss increase the risk of delays or cost overruns, potentially affecting ASML’s ability to sustain premium average selling prices.

Technological and Market Uncertainties: ASML’s revenue projections assume sustained lithography intensity at advanced nodes (2 nm, 1.4 nm), but some analysts (e.g., SemiAnalysis) argue that intensity may plateau for gate-all-around transistors or 3D DRAM, capping growth. Macro uncertainties, including U.S. tariff hikes post-2024 election, could delay customer fab investments, as reflected in ASML’s cautious 2025 guidance (€30B–€35B). A slowdown in AI investment, if the current hype cycle cools, could also reduce demand for advanced nodes, though ASML’s EUV monopoly mitigates this risk.

While these challenges are significant, ASML’s technological leadership, customer stickiness, and robust backlog provide resilience. I think we have to weigh these risks against the company’s unparalleled position in the semiconductor value chain.

Final Conclusion

ASML stands as a cornerstone of the semiconductor industry, blending technological dominance with financial resilience, making it a compelling addition to my Compound & Fire portfolio. Here’s a summary of the key takeaways:

Unrivaled Moat and Market Position: ASML’s monopoly in EUV and 90% DUV market share, underpinned by 33,000+ patents and exclusive partnerships (e.g., Zeiss), create a fortress-like competitive edge, securing its role as the industry’s gatekeeper.

Robust Financials and Capital Efficiency: With a capital-light model, high margins and ROIC, ASML demonstrates exceptional efficiency, supported by a €36B backlog and disciplined capital allocation.

Growth Fueled by Secular Trends: Tailwinds from AI, 5G, and automotive chips, combined with customer capex, position ASML to achieve its €44B–€60Brevenue target for 2030, driven by EUV demand and margin expansion (56–60% by 2030).

Fair Valuation with Upside Potential: The Reverse DCF implies an 15.3% UFCF growth rate to justify the €608.90 stock price.

Risks to Monitor: Geopolitical tensions, customer concentration, and governance concerns could challenge growth, though ASML’s moat and backlog provide resilience.

ASML’s blend of innovation, financial strength, and market leadership makes it a high-quality compounder, well-positioned to benefit from the semiconductor boom. While risks warrant vigilance, I remain confident in its long-term potential, especially at my entry point, and will continue monitoring its execution and governance.

Hopefully you have enjoyed this deep dive. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

I hold shares of ASML and TSMC. Curious about your thoughts on TSMC.

Good (long) read…however, I do miss your thoughts about Huawei. You say China can’t be as fast as 2030, but recent history tells us that when they are cornered (like the US did and does), they get really quick really fast. They even stole / hired things and people for ASML if I got informed correctly.

You don’t consider Huawei as a risk for ASML’s dominance?

I do own ASML. Quite a lot - but got in on a waaaay higher price unfortunately…so I do hope they recover and soon :)