Computer Modelling Group: Quality Compounding Star at the Horizon (UPDATE)

Simulating Success in a Complex World - an Update on this Quality Stock

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way—hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to fuel more, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support!

Come join the conversation on our Global Quality Investing Discord App here and hop on board my Substack for free if you haven’t yet—let’s grow this journey together!

Introduction

I’ve learned over the years that investing in niche, mission-critical businesses can be a game-changer, provided they’re led by a team with vision and execution chops. My first deep dive into Computer Modelling Group (CMG) last year was one such moment, a wake-up call to the power of specialized software in the energy sector. CMG’s reservoir simulation tools are the “eyes” for engineers navigating the subsurface blindfold, and their pivot to a broader, acquisition-fueled platform is reshaping their story. For those new to my work, check out my investment framework and grab this free How to Spot Quality Stocks Guide.

Today, CMG boasts a market cap of CAD 581M and an Investment Readiness Score of 86.3. They’re the gold standard in reservoir simulation, serving ~650 clients in 60 countries, from supermajors to universities. But with oil prices softening and energy transition momentum shifting, is CMG’s CMG 4.0 strategy an opportunity to compound value or a trap in a cyclical industry? I have updated my prior deep dive. Let’s dig in after their somewhat disappointing last earnings.

History of the business

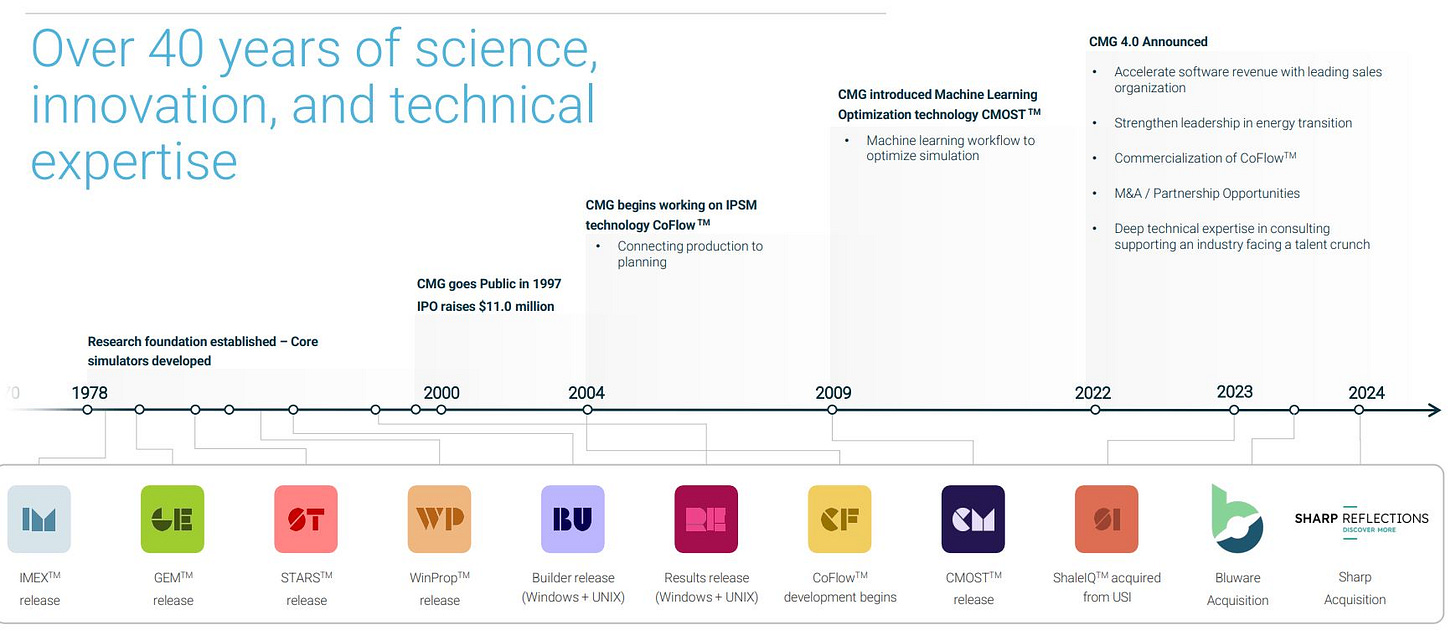

Founded in 1978 as a University of Calgary research foundation, CMG pioneered reservoir simulation with Alberta government backing to tackle Canada’s complex oil sands. Their first simulator, STARZ, introduced in the 1980s, revolutionized steam-assisted gravity drainage for heavy oil recovery.

By 1997, CMG went public on the TSX, and over 47 years, they’ve built a global footprint, with 100% of supermajors using their software. Key milestones include:

2000s: Expanded into unconventional assets like U.S. shale, boosting simulation demand.

2010s: Early mover in carbon capture and storage (CCS) simulation, starting with a Japanese client in 1994, cementing leadership in energy transition.

2022: Launched CMG 4.0 under CEO Pramod Jain, shifting from organic growth to a platform strategy via acquisitions like Bluware (2023) and Sharp Reflections (2024).

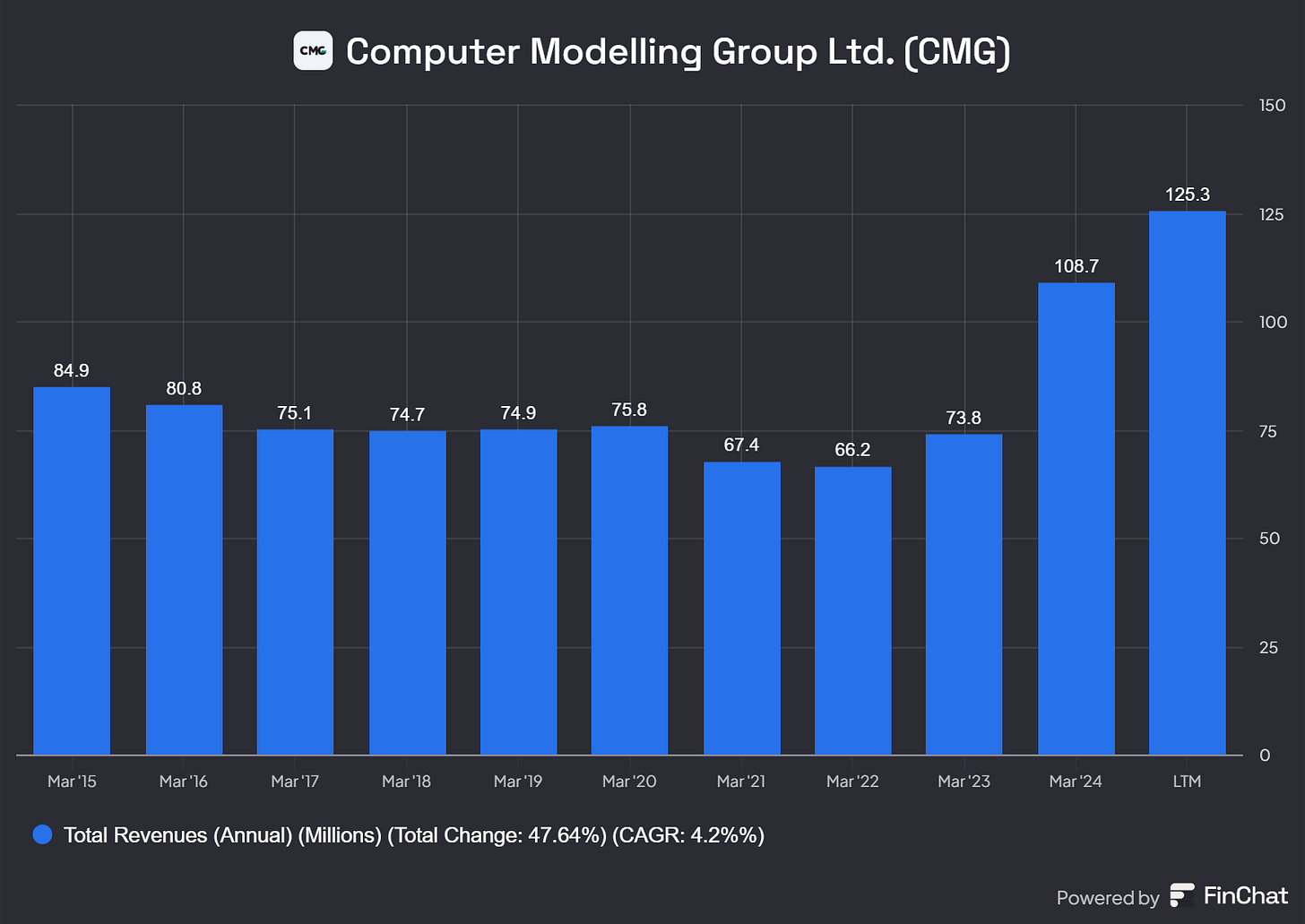

2025: FY25 revenue hit C$129.4M (up 19%), with 34% Adjusted EBITDA margin, despite organic growth challenges.

CMG’s resilience shines through decades of oil price volatility, driven by their focus on complex recovery techniques like enhanced oil recovery (EOR) and unconventionals, where simulation is non-negotiable. Their pivot to seismic solutions via acquisitions shows innovation beyond their core.

Source: IR Presentation CMG

Management

Pramod Jain – CEO (since 2022, 0.12% interest in CMG) Mr. Jain is a software executive and professional engineer with over 15 years of international leadership experience focused on corporate growth and innovation. Mr. Jain is transforming the business: focus on long-term, focus on capital allocation (M&A), align the interest of management with the shareholders, reduce dilution of the number of stocks and add ROIC as a metric internally for the board. Just read the CEO letter to shareholders (first pages of the annual report 2024) and you probably will get as excited as I am. Here you can listen to a great interview from 2023 with Pramod Jain:

John Mortimer – Chief Technology Officer (since 2022, 0.01% interest in CMG). As the Chief Technology Officer for CMG, John Mortimer is responsible for the advancement, innovation, and enhancement of CMG’s core software offering.

Sandra Balic – Chief Financial Officer (joined in 2009, 0.33% interest in CMG). Sandra is a Chartered Professional Accountant with more than 15 years of experience in accounting and financial management and holds a Bachelor of Management, Advanced Accounting degree from the University of Lethbridge.

Mohammad Khalaf – Head of Corporate Development (since 2022). Mohammad’s background in mergers & acquisitions and strategy, more than 7 years experience as VP M&A at one of the six OpCo’s of Constellation Software, will support business growth through effective capital allocation for new initiatives.

Next to these three chief executives CMG has hired Constellation Software knowledge in their Board of Directors:

Mark Miller – Chairman of the Board of Directors (since 2019). Miller is Chief Operating Officer at Constellation Software.

John Billowits – Member of the Board of Directors (since 2021) and also a board member at Constellation software and a private investor.

An overview on their Senior Management and Core Leadership Team:

Source: IR Presentation

It is clear that as of 2022 Computer Modelling Group started a new strategy and that their structure follows this strategy, hence in 2022 they have announced their new structure.

Culture

CMG’s shift from a research-heavy, university-rooted mindset to a performance-driven culture under CMG 4.0 is notable. With ~300 employees across 11 global offices, they’re fostering a client-facing roadmap, tying compensation to company, team, and individual goals. Their seeding strategy, donating software to 200 universities, builds loyalty among future engineers, a moat I admire. Governance is solid, with no major red flags in executive pay or related-party transactions. Employee retention in niche fields like reservoir engineering is critical, and CMG’s investment in training and thought leadership (e.g., CCS webinars) supports talent development. I’ve learned to value cultures that balance science and commerce—CMG’s on the right path.

CMG’s market

Imagine a company that creates super-smart computer programs that help energy companies figure out exactly where and how to dig for oil and gas underground - almost like a high-tech treasure map for energy exploration. Computer Modelling Group (CMG) is that kind of tech company, creating special software that helps energy companies make smarter decisions about finding and extracting valuable resources from deep beneath the Earth's surface. CMG is active in a niche market.

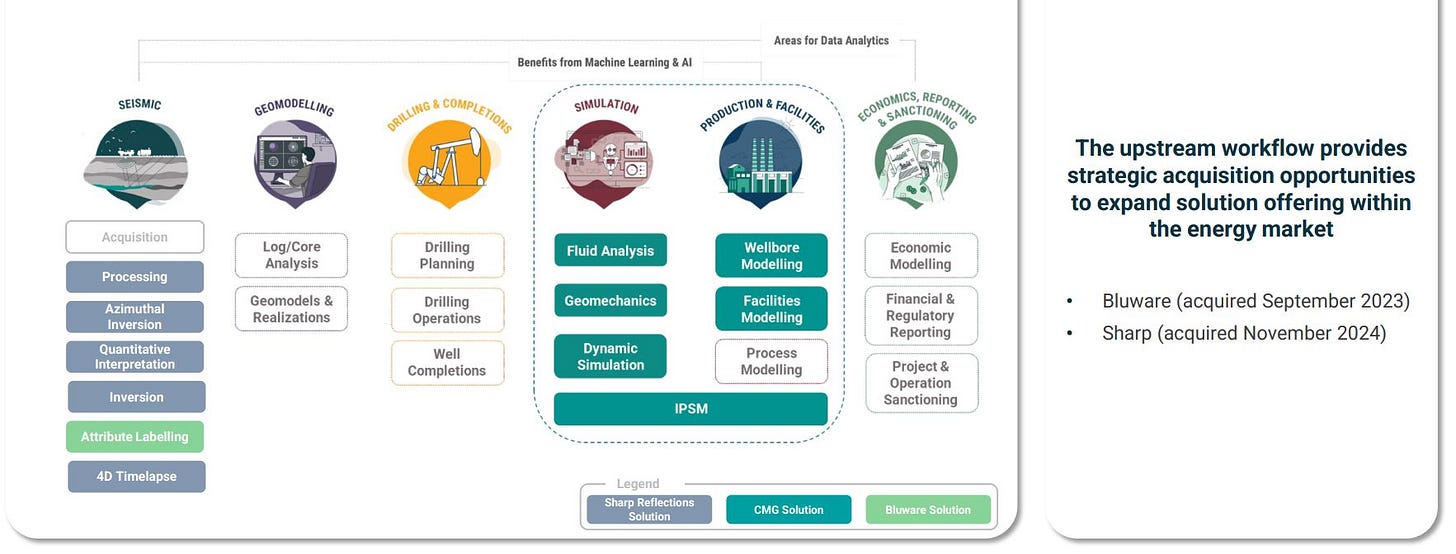

Computer Modelling Group (CMG) has two main business units that serve different parts of the energy market:

CMG Segment: This is like the company's main superpower. They make special computer programs that help oil and gas companies figure out the best ways to get oil and gas from underground. Their software shows what's happening deep beneath the Earth's surface. This helps energy companies make better decisions about where to drill and how to get the most oil and gas out of the ground safely.

BHV Segment: This is CMG's newer superpower. They got this when they bought the company Sharp Reflections in November 2024. BHV makes software that helps energy companies understand pictures of what's under the ground. So it helps companies find where the oil and gas might be in the first place.

CMG is also starting to use its software and services to help with new types of energy, like storing carbon underground or finding places for geothermal energy. This shows they're trying to help with cleaner energy solutions too. Here is where their software is used:

Market characteristics

Niche Expertise: CMG develops complex software that simulates underground reservoirs, which is crucial for oil and gas extraction.

Recurring Revenue: The company benefits from a high contract renewal rate (over 98%), providing stable, predictable income.

Global Reach: CMG serves clients in 58 countries, indicating a broad international market.

Energy Transition: The company is adapting to the changing energy landscape by offering solutions for carbon capture, hydrogen, and geothermal energy.

Computer Modelling Group (CMG) primarily serves the energy industry, with a focus on oil and gas companies. Their main customers include:

International oil companies: CMG has a diverse customer base of international oil companies in approximately 60 countries.

Heavy oil producers: As of 2016, 100% of the top-20 Canadian heavy oil producers were using CMG's software.

Energy transition companies: CMG is expanding its services to companies involved in carbon capture and storage (CCS) projects, as well as other energy transition initiatives.

Exploration and production companies: The BHV segment serves companies involved in seismic interpretation and energy exploration.

Research institutions and universities: CMG provides support and software to educational and research partners in the energy industry.

CMG's software and services are used globally, with the company having sales and technical support services based in Calgary, Houston, London, Dubai, Bogota, and Kuala Lumpur.

Company’s Strategy

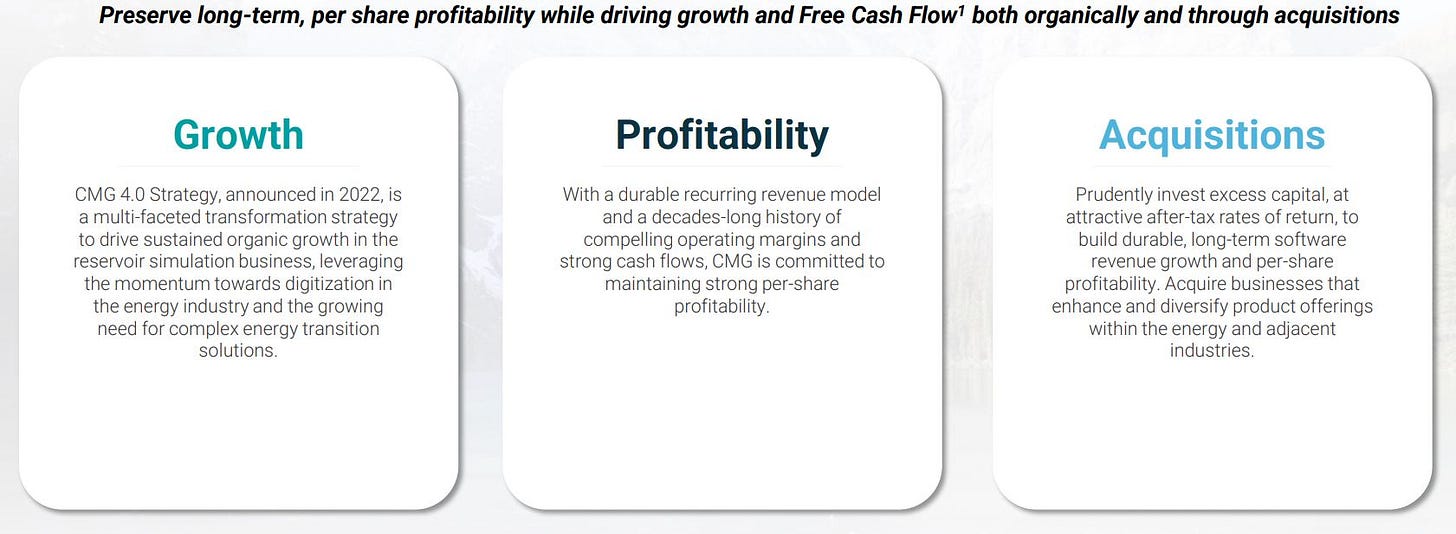

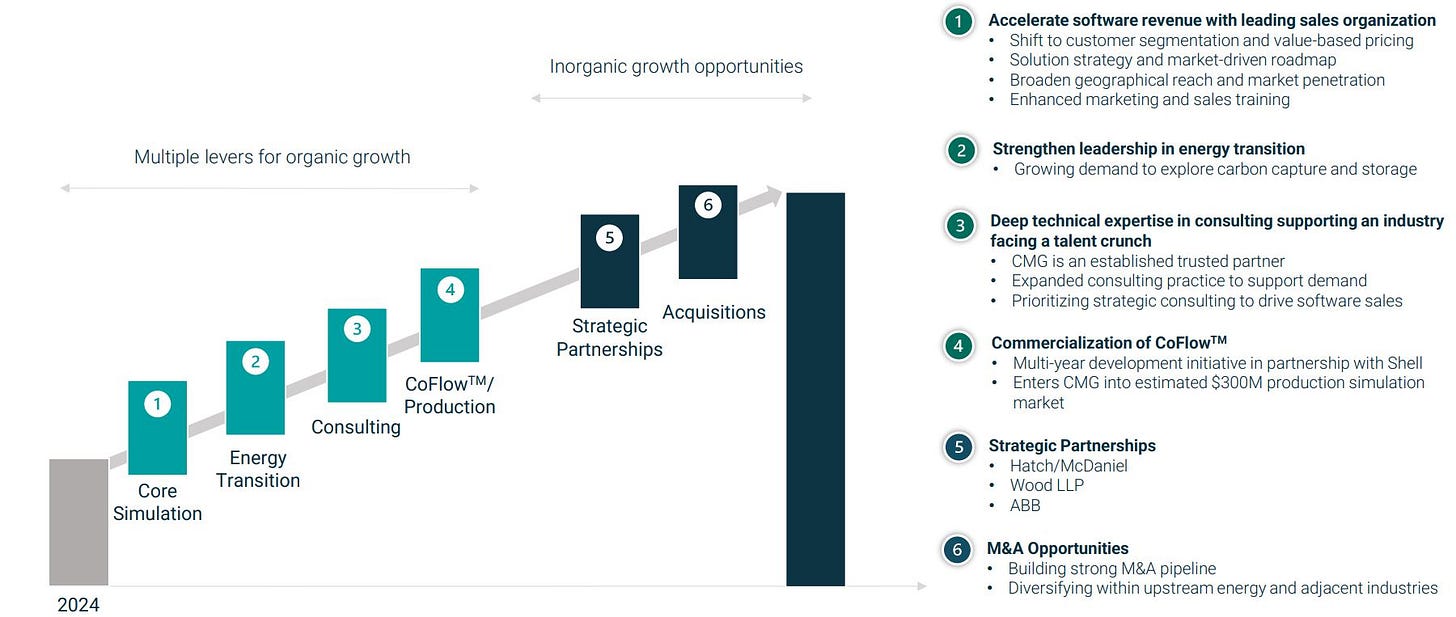

Computer Modelling Group (CMG) has a strategy called CMG 4.0, which they announced in 2022. This strategy is like a roadmap for how the company wants to grow and become more successful. It focuses on three main things:

Source: IR Presentation

One big part of CMG's strategy is moving their software to the cloud. This means customers can use CMG's programs over the internet instead of installing them on their own computers. This cloud strategy helps CMG's customers work more efficiently and access the latest software updates easily.

CMG is also focusing on new energy solutions, like helping companies store carbon underground or find places for geothermal energy. This shows they're adapting to changes in the energy industry.

With the new strategy CMG focuses on multiple levers for organic growth and inorganic grouwth opportunities.

Source:IR Presentation

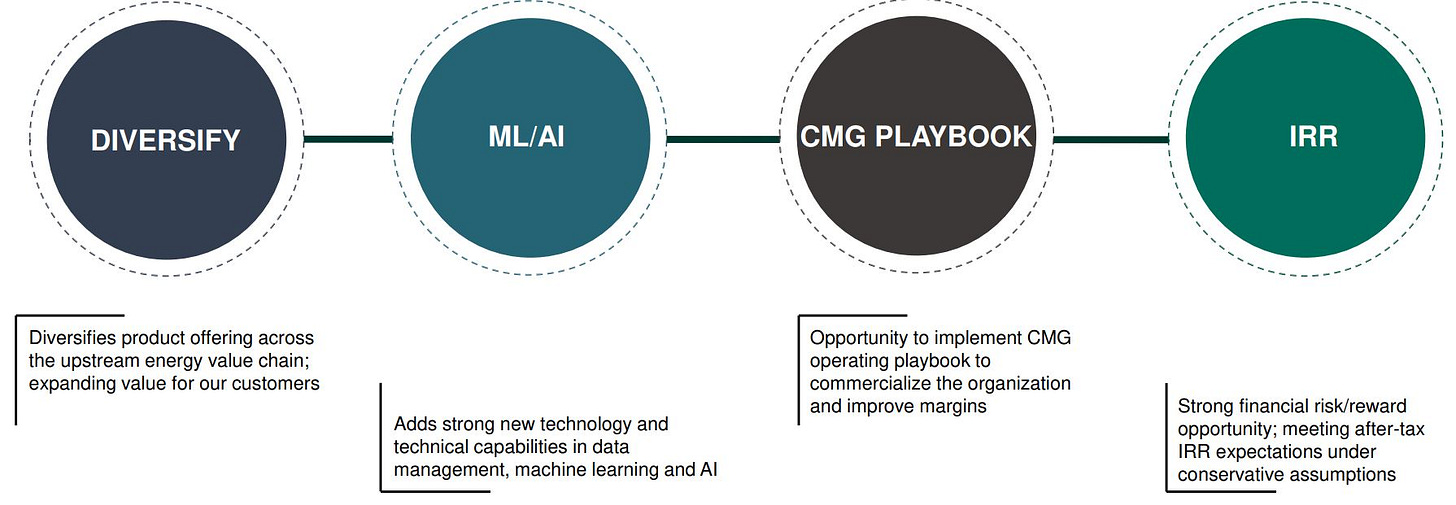

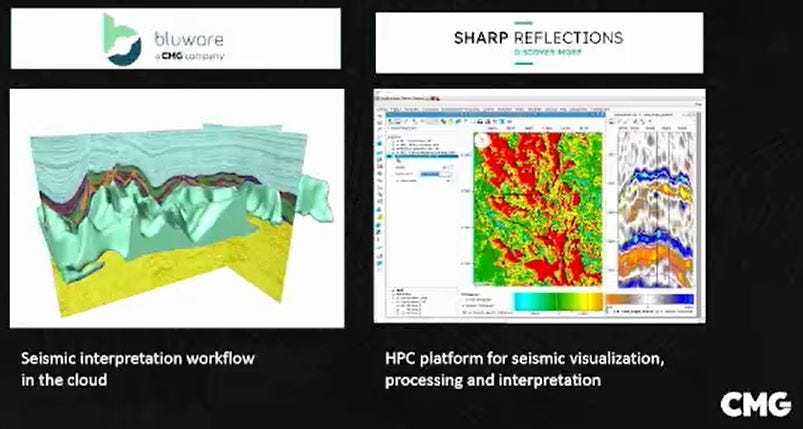

CMG acquired Bluware-Headwave Ventures Inc. in 2023 and Sharp Reflections GmbH in 2024.

Bluware is an open-source software and services company specializing in cloud and interactive deep learning solutions for subsurface decision-making, including seismic interpretation. With huge data interpretation could take up to 8 months. Bluware developed interactive AI, which means the user is still training the machine. It is a labeling tool which gives guidance back to the computer and which saves the user a lot of interpretation time. Here is the logic provided for the Bluware acquisition:

Source: Webcast Bluware

Sharp a cloud-based seismic processing and interpretation platform. Built on modern advancements in high performance computing, it combines prestack seismic data visualization, processing, and interpretation. They serve a global customer base with a lot of supermajors as their customer. Revenue breakdown is 69% software and 31% services and total recurring revenue of 69%. This recurring revenue tells how mission critical CMG is to their customers and how sticky the business is.

With these two acquisitions you can see in below overview that CMG bought themselves into to Seismic market, while opportunities for acquisitions remain in Geomodelling, Drilling & Completions and Economics, Reporting & Sanctioning:

Source: IR Presentation

Moat Analysis

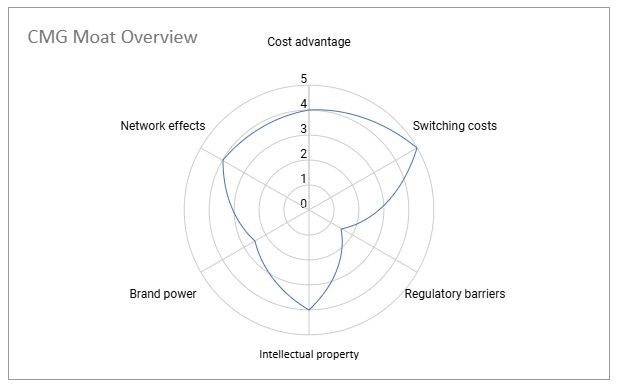

Brand Power: CMG’s 47-year reputation as the “gold standard” in simulation is unmatched, with 100% supermajor adoption. The brand however is more functional than iconic, so a moderate brand name.

Network Effects: University seeding creates a user base loyal to CMG’s tools, reinforcing market dominance.

Switching Costs: High—engineers trained on CMG’s software face steep retraining costs, and data integration locks in clients.

Cost Advantage: Scale in R&D and global sales lowers per-unit costs versus smaller rivals.

Regulatory Barriers: Minimal, though CCS projects face stringent monitoring, favoring CMG’s proven solutions.

Intellectual Property: Proprietary simulators (STARZ, GEM) and Bluware’s VDS format are hard to replicate.

Business Model

Computer Modelling Group (CMG) is a software company that makes money by creating and selling special computer programs for the oil and gas industry. Here's how their business model works.

License Sales: CMG sells licenses to use their software. Companies pay to use these programs. There are different types of licenses:

Annuity License Agreements: these include a term-based software license bundled with maintenance. These agreements provide customers with rights to use the software for a fixed term, typically one year, but could be shorter or longer, and include maintenance consisting of customer support and unspecified upgrades.

Perpetual License Agreements: perpetual license agreements grant the customer the right to use the then-current version of software license in perpetuity. This revenue stream is recorded under “Perpetual license” revenue and is recognized at a point in time, upon delivery of the licensed product. Customers purchasing perpetual licenses may also enter into a separate maintenance and support agreement giving them access to customer support and software upgrades. The majority of customers who have acquired perpetual software licenses subsequently purchase a maintenance package.

Because of the revenue recognition and the timing of billings it is best to analyze annual earnings and don’t get distracted by quarterly swings.

Looking at the revenue trend you can clearly see the impact of the new strategy where revenue has grown by a CAGR of 28% since 2022 towards end of 2024.

Customers

CMG has around 650 different customers in 57 countries. 450 of these customers are Oil & Gas customers and around 200 customers are universities. Universities are very important as CMG wants students to get used to their software even before they start working in the Oil & Gas industry. The geographical revenue split for CMG you can see in below map:

Source: Annual Needham Growth Conference

Europe is CMG’s competitive homeground, where CMG wants to get more market share. Europe is less about Oil & Gas but really about energy transition. There is a lot of activity happening in their CCS space, especially in the Northsea. So CCS is a real growth opportunity for CMG. Each different geography has a different geological and hence has a different trend.

Finally, and a very important metric to me: the Net Promotor Score (NPS) which is 68% for CMG, compared to a B2B software average of 41%. This means CMG adds more perceived value to their customers versus their competitors.

Risks

There are several key risks to consider regarding an investment in Computer Modelling Group:

Technological disruptions: As a software and consulting technology company, CMG faces risks related to rapid technological changes and potential disruptions in the industry.

Cybersecurity threats: Given the nature of CMG's business, cybersecurity risks could pose significant threats to the company's operations and reputation.

Regulatory changes: The energy industry, which CMG serves, is subject to evolving regulations that could impact the company's business model and growth strategy.

Economic uncertainties: Fluctuations in the global economy and energy markets could affect CMG's client base and revenue streams.

Execution risks: The success of the CMG 4.0 Strategy depends on effective implementation across multiple growth levers, including core simulation, CoFlow commercialization, energy transition consulting, and strategic partnerships.

Acquisition risks: Part of the CMG 4.0 Strategy involves potential acquisitions, which carry inherent risks such as integration challenges and potential overpayment.

Market competition: As CMG expands into new markets and technologies, it may face increased competition from established players and new entrants.

Talent retention: The success of CMG's consulting practice and software development relies on retaining skilled professionals in a competitive job market.

To mitigate these risks CMG needs to maintain robust risk management practices, diversify its product offerings, implement strong security protocols, and maintain a solid financial position.

Valuation

In order to have an understanding of the valuation of the company it is good to look from multiple angles.

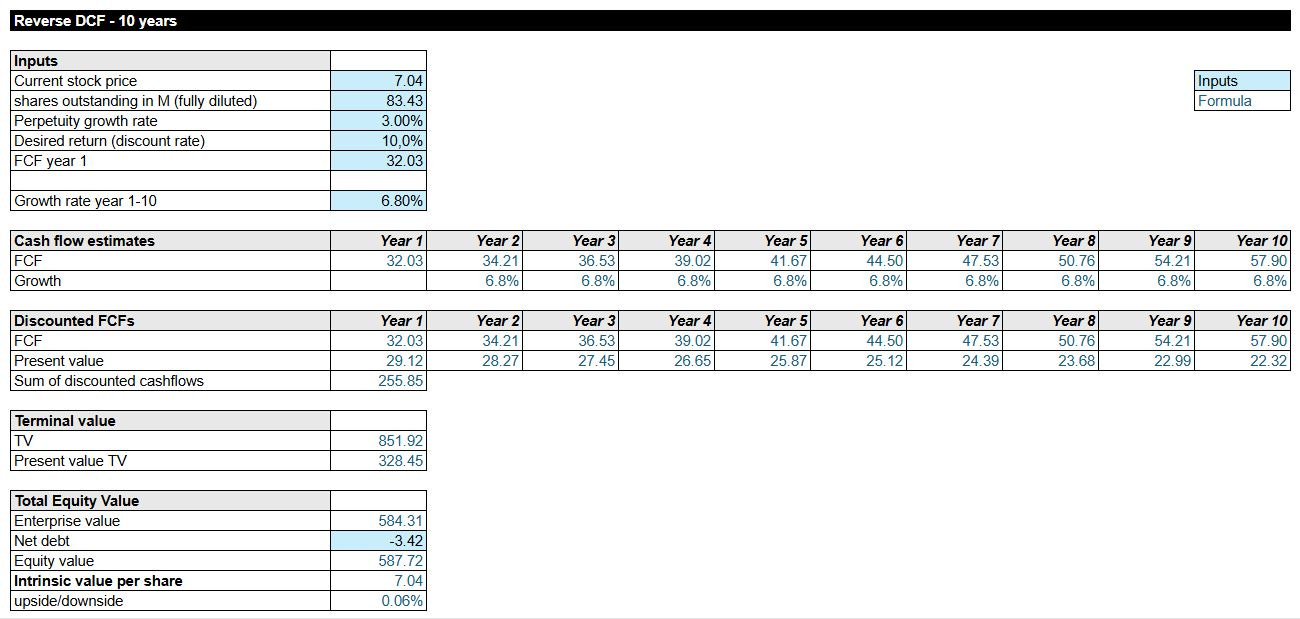

Reverse DCF

Starting with known data points and working backwards to assess market expectations and judge whether these expectations are realistic.

Let’s first have a look at the reverse DCF:

As you can see the company should grow it’s free cash flow by 6.8% annually in order to get a desired return of 10% per year. Given the strategy where the company wants to grow organically and inorganically I expect they will grow closer towards 12% next years given the new strategy is bearing fruit. So it looks like there is a significant margin of safety at a stock price of 7.04 CAD.

DCF Model: What’s the Intrinsic Value?

Next, I calculate CMG’s intrinsic value using my 14.2% FCF growth base case, which equals 12% revenue growth, to see where it stands.

The DCF suggests CMG is undervalued by 62%, yielding just a 16.9% annual return over ten years, including dividends, which sounds very interesting to me. Exploring the bear and bull case as well:

The bull case at 16.7% FCF growth offers an intrinsic value of CAD 13.5 and a sweet 18.7% return.

The bear case at 10.6% FCF growth drops to CAD 9.00 intrinsic value with still a 14.4% return.

Given these outcomes, CMG feels very attractive to me with a buy below price of CAD 8.10 to earn a 16% annual return if the base case scenario comes true. Most important to reach the case is that Strategy 4.0 is implemented well and Jain allocates the capital towards M&A to reach the expected growth.

FCF yield

If the Free Cash Flow yield is lower than historical average it might suggest overvaluation. Let’s have a look for CMG.

In 2025 CMG had a Free Cash Flow of 28.5M CAD. Based on current market cap of close to 581M CAD, this is 4.9%. This is slightly above a 10 year bond of ~4.5% and the expectation is the gap will only become wider as Free Cash Flow for CMG will increase.

Final Conclusion

CMG’s strategy, high-level management, high NPS and sticky software are all I’m looking for. It could have been better is the company was led by the founder and the CEO had a higher ownership in the company. But you can’t have it all!

The organic decline we have seen last year is driven by external markets in a somewhat cyclical market, however in the long-term CMG’s 4.0 Strategy should bear fruit. Expect more capital allocation towards M&A and as soon as CMG will announce the next acquisition, I wouldn’t be surprised if the stock will gain given the current low valuation.

Hopefully you have enjoyed this deep dive update. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

Wonderful. Thank you!