Dino Polska: Master Capital Allocator

Dino Polska is on a mission to roll-out their store plan for Poland. Cash is allocated in growth capex returning more cash in the future.

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early.

This community is free, but if you’d like to support my time in providing deep analysis, you can Buy Me a Coffee. Every contribution helps keep this community thriving and is highly appreciated!

Join our global quality investing app on Discord here and join my Substack for free if you haven’t subscribed yet.

General information

Name: Dino Polska

Logo:

ISIN: PLDINPL00011

Ticker: DNP.WA

Country: Poland

Current market cap: 46.5B PLN

Share price: 475.00 PLN

Outstanding shares: 98.04 million

Free float: 48.04 million

Average daily volume: 241.54k

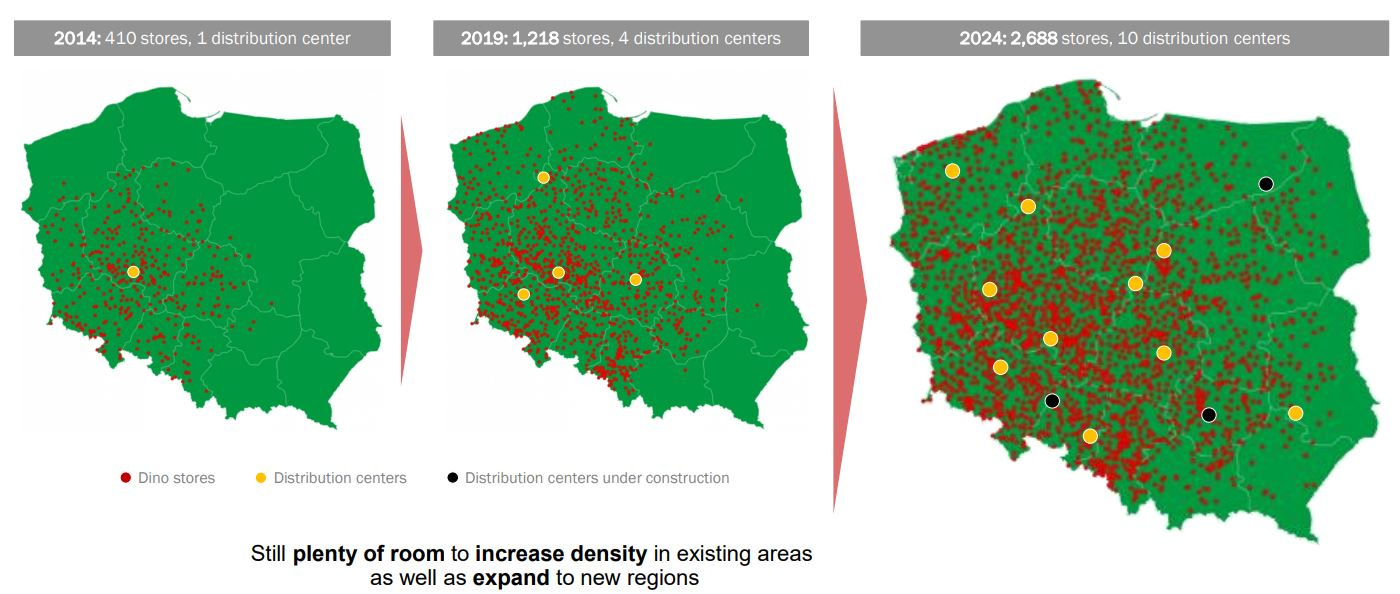

About: Dino Polska (Ticker: DNP.WA, ISIN: PLDINPL00011) is a Polish grocery retailer specializing in medium-sized supermarkets tailored for rural and suburban areas. Founded in 1999 by Tomasz Biernacki, the company has grown into a powerhouse with 2,340 stores as of early 2025. Dino Polska stands out as an owner-operator stock in the competitive grocery sector. Its rapid expansion and unique real estate strategy make it a compelling case for quality investors.

Source: Dino Preliminary Results 2024

Quick Scan

"Protecting your money is like guarding a castle: it's easier to keep invaders out than to reclaim lost territory.”

That is why I look for moat companies which protect my castle. I want to minimize the risk of losing money and maximize the chance a company is compounding. Compounding is like a snowball rolling downhill, getting bigger and faster as it goes, just as a company's profits grow faster when they reinvest their earnings into high-return projects, making even more money to reinvest again and again.

Balance sheet

A low Net debt / EBITDA ratio indicates that a company can repay its debt faster, potentially leading to better long-term shareholder return:

Net debt / EBITDA: 0.1x (Net debt / EBITDA < 4x ✅)

Dino boasts a near-debt-free balance sheet, a rarity in retail. With 95% of its stores owned outright, the company’s asset base is solid, reducing leverage risks.

A rule of thumb suggests that companies with a goodwill to assets ratio higher than 30% should be carefully analyzed to ensure the risk of potential write-offs is low:

Goodwill / Total assets: 0.6% (Goodwill / Total assets <30% ✅)

Impairments last 10 years: 0 (Impairments / Goodwill < 10% ✅)

Cash Flow

“A business that doesn't take any capital and grows and has almost infinite Returns on required Equity capital is the ideal business” (Warren Buffett)

That is why I look for asset-light companies.

Capex* / Sales: 1.2% (Capex / Sales <5% ✅)

Capex* / Operating Cash Flow 19.4% (Capex / Operating Cash Flow <25% ✅)

*I have excluded the growth capex, because Dino Polska is investing it’s cash in new supermarkets. Only maintenance Capex should be counted here.

Operating Cash Flow (OCF) / Net Income 126% (OCF / Net Income >80% ✅)

Source: Dino Preliminary Results 2024

Capital Allocation

“Capital allocation is the CEO’s most important job” (Warren Buffett)

The metric which most often tells most about capital allocation is ROIC.

Return on Invested Capital: 18.9% (ROIC >15% ✅ )

Profitability

A high gross margin provides significant insights into a company's competitive advantage and potential for long-term shareholder returns.

Gross Margin: 23.3% (Gross Margin >40% ❌)

Net margin: 5.1% (Net Margin > 10% ❌)

In general I like to see higher gross margins, but for supermarkets the margin metric is less relevant, as it is all about volumes and the inventory turnover.

Stock-Based Compensation (SBC)

95% of Restricted Stock Units (RSUs) are sold on vest, which potentially defeats the purpose of giving employees long-term skin in the game (Bill Gurley, a well-known venture capitalist).

Companies offering stock-based compensation plans can benefit shareholders through higher stock prices, but only if the level of dilution is not excessive.

Two different views, but opposite. In general I want to see the stock-based compensation below 5%, else it will dilute my stake in a company.

SBC: 0% (SBC < 5% ✅)

No SBC programs exist, aligning management and shareholder interests without diluting equity— a Buffett-approved trait.

Change in Shares Outstanding 10 yrs: 0% (Change in Shares Outstanding <10% ✅)

I love to see no change in outstanding shares. Often management is “printing” new shares, which is diluting shareholders. This is another sign of aligned interest between management and shareholders!

Conclusion Quick-Scan

The quick scan shows a almost perfect score for Dino Polska! Only the margins are below my target, but considering the type of business this is no dealbreaker at all. Hence I continue my analysis of the company.

Management

Tomasz Biernacki, the founder and CEO, owns 51.2% of Dino Polska, cementing its owner-operator status. His net worth is estimated at $6.2 billion, reflecting the company’s success since its 1999 inception.

Leadership Track Record: Biernacki’s frugality is legendary—he once personally selected the cheapest basket maker for store garbage collection. His strategic vision transformed Dino from one store to 2,340, with a 2010 partnership with Enterprise Investors fueling early growth. The 2017 IPO further solidified his long-term focus, delivering a 44.2% CAGR to shareholders since then.

If you want to read more about Biernacki, I can highly recommend this article.

Market Attractiveness

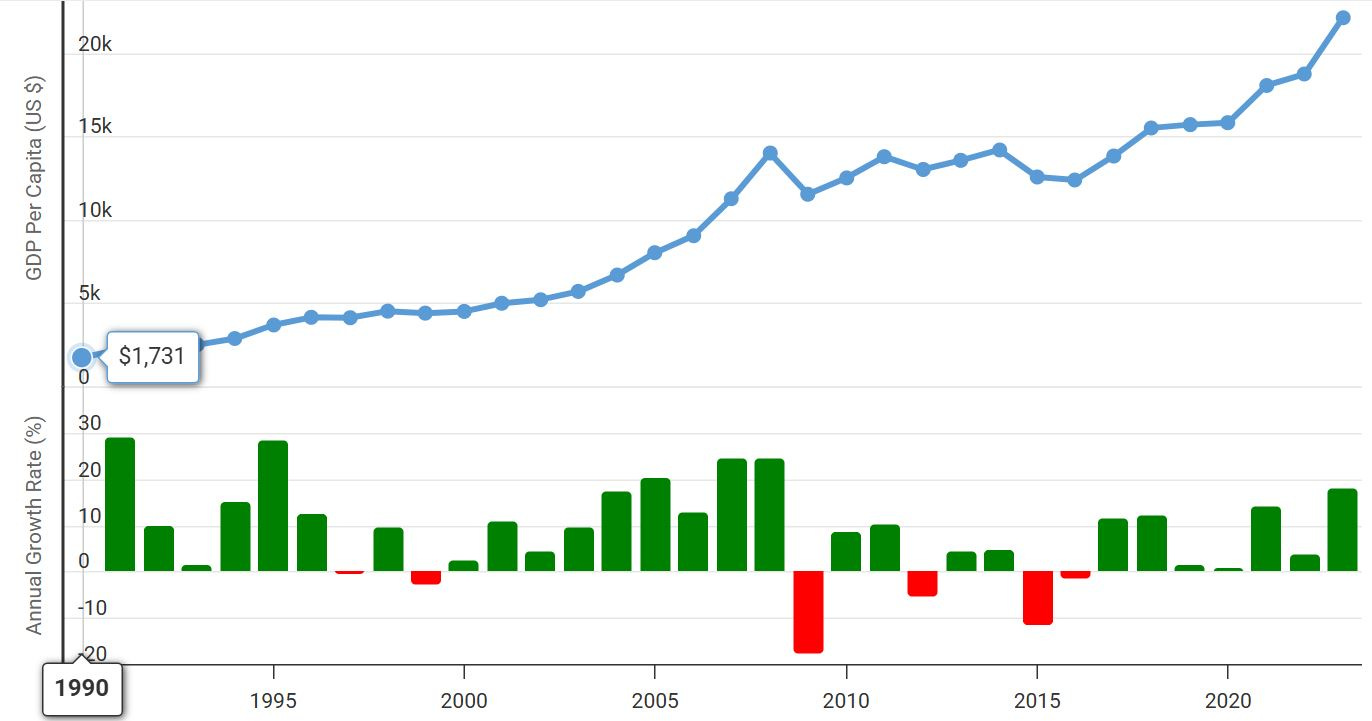

Poland’s grocery market is ripe for growth, with GDP per capita rising from $1,731 in 1990 to over $20,000 today. The sector has grown at a 5.4% CAGR since 2009, with a projected 7.4% CAGR through 2027, fueled by inflation and rising consumer spending. Dino, with a 5% market share (third behind Biedronka’s 23.4%), targets rural and suburban niches, avoiding direct clashes with urban giants. Expansion into Czech Republic, Slovakia, and Lithuania could add 50% to its total addressable market (TAM) of 90.1 billion PLN.

Source: Macrotrends.net

Company’s Strategy

Dino’s strategy centers on organic growth, aiming for a 20% annual store increase. Management prioritizes eastern Poland expansion before considering international moves, leveraging its scalable model. The focus on owning real estate and direct supplier relationships ensures cost efficiency and long-term stability, positioning Dino as a compounding machine.

Source: Dino Preliminary Results 2024

Business Model

Dino operates standardized 400-square-meter stores offering 5,000 products, 95% of which are brand-name goods. Owning 95% of its real estate since 2010 via Krot-Invest gives it a cost edge over leasing competitors. Daily fresh product delivery, eight distribution centers, solar energy which is powering the stores, and direct sourcing from producers enhance margins (25% gross, 10% EBIT at maturity). Targeting 3,500 residents per store, Dino avoids urban saturation, achieving a 20.5% pre-tax IRR per store.

Source: Dino Preliminary Results 2024

Valuation

In order to have an understanding of the valuation of the company it is good to look from multiple angles.

Reverse DCF

Starting with known data points and working backwards to assess market expectations and judge whether these expectations are realistic.

Let’s first have a look at the reverse DCF:

In the Free Cash Flow number I am adding back their growth CapEx as if Dino Polska would stop allocating cash to growth, the Free Cash Flow would increase significantly and they can allocate the capital in a different way.

As you can see the company should grow it’s free cash flow by 9.5% annually in order to get a desired return of 10% per year. Given the strategy where the company wants to grow organically by expanding their supermarket network I expect they will grow faster, making Dino an interesting company to invest in for the long-run.

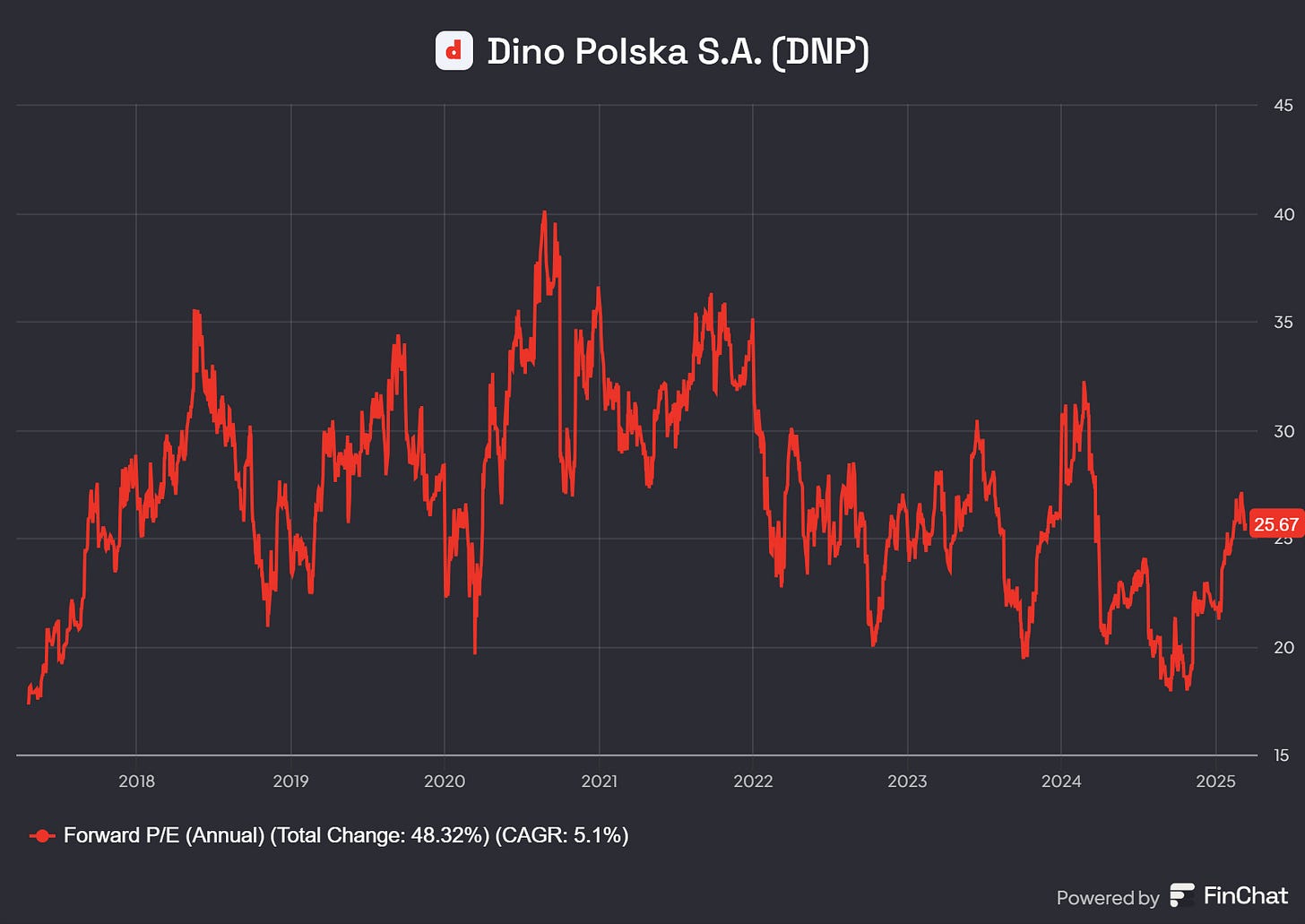

Forward P/E

The forward P/E of Dino Polska has increased in recent months, as the company is posting improved earnings and the price war with competitors seems to be less extensive. This resulted in improved earnings and Dino increasing their speed in opening new stores, while they were conservative early 2024.

The average Forward P/E last 8 years was 27.7, which means that Dino is still a bit below their average at the moment. Luckily for Compound & Fire I have been able to add shares when the forward P/E was below 20 (!).

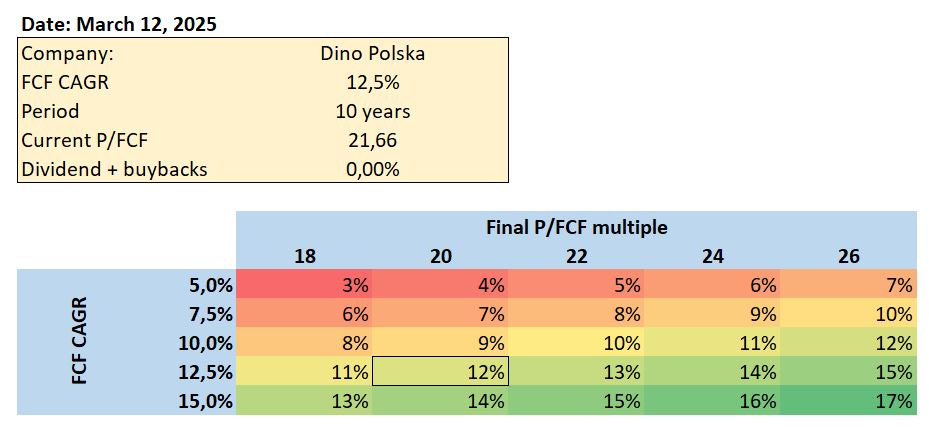

Heatmap

The heatmap for Dino Polska shows the return which one might expect depending on the growth in free cash flow and the growth or decline in the price to cash flow.

For Dino Polska the expected return with a 12.5% annual growth of the free cash flow and a decrease of the Price / Free Cash Flow ratio towards 20 (currently 21.7) will result in an annual return of 12%. A 12% return the next 10 years is not bad at all.

Risks

Internal Risks: 40% of stores are under three years old, delaying full profitability. Management’s focus on growth over margins could strain operations.

External Risks: Rising competition from Biedronka or regulatory changes in Poland could erode market share. Currency fluctuations (PLN vs. USD) pose a translation risk.

Final Conclusion

The quick scan resulted in an almost perfect score for Dino Polska

Very strong CEO with aligned interest to shareholders

7.4% CAGR for the market projected

Continuation of Dino’s chain roll-out

Strong and simple to understand business model

Average valuation - potentially returning 12% per year

Hopefully you have enjoyed this deep dive. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

I linked to your post in my Monday emerging market links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-17-2025

HOWEVER, there is a comment thread here you should be aware of - "...my understanding Tomasz owns the construction company that builds the stores..." (here in Asia, that would be a big red flag to look into more deeply): https://mindfulcompounding.substack.com/p/a-deep-dive-of-dino-polska-dnpwa/comment/68097060

I've posted my other concerns below on other Substacks covering Dino Polska (I find the Portuguese chain (+Poland & Colombia ops) Jeronimo Martins SGPS SA (ELI: JMT / FRA: JEM / OTCMKTS: JRONY / JRONF) to be interesting + there was the recent IPO of Zabka Group SA (WSE: ZAB / FRA: 9M1) - Largest chain of convenience stores (often in apartment buildings) in CEE.):

1) The funds got into Dino Polska early and lately they have been profit taking...

2) Alot of podcasters and Substackers etc have been talking about the stock compared to other so-called EM stocks just as the "smart money" was getting out or taking profits...

3) Its not clear where future growth will come from. At some point, they will have Poland saturated - if not already as they already have one store for every so many Poles (sorry, can't remember the figures I have seen...). Expansion eastward to Russia and Belarus is probably out along with Ukraine given its a war zone rapidly loosing population.... Germany, Czech, Slovakia etc would be completely new markets with probably different retail laws even though they are EU...

4) At some point, the stores will need to be remodelled by somebody e.g. landlord, tenant or Dino if they are the owner... Same with any refrigeration etc equipment as it will need to be replaced - not sure the lifespan of such equipment - definitely longer than the junk sold to consumers...

With that said, they do have the right business model when it comes to format size. Here in Malaysia, Speedmart and K.K. no frills smaller format chain stores have saturated every neighbourhood and housing estate selling mostly the shelf stable basics (and it seems like at higher prices than supermarkets!) while Indomaret and Alphamart have done the same in Indonesia (albeit there is still room for growth there given Indonesia's size and they have multiple formats + the latter expanded into the Philippines)... And of course, the USA has its dollar store chains (that are now struggling as lower income people struggle + Temu etc competition)...