FICO vs Moody's: The Analytics Titans Clash

A Battle in Financial Precision and Rating Power. Who wins in this Quality Investing Arena?

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way. Hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to support more content, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support! Let’s grow this journey together and join the conversation on our free Global Quality Investing Discord App and subscribe to my Substack for free if you haven’t yet!

Hello, fellow quality investors!

Welcome to another thrilling showdown at Compound & Fire! Today, we dive into the world of financial analytics and credit assessment, pitting two industry heavyweights against each other: Fair Isaac Corporation (FICO) and Moody's Corporation (MCO).

FICO is the pioneering force behind credit scoring, delivering analytics software and solutions like the iconic FICO Score that help businesses assess risk, optimize decisions, and manage credit effectively. Meanwhile, Moody's stands as a pillar of financial intelligence, providing credit ratings, risk assessments, and analytics to support investment decisions and risk management in global markets.

Both are titans in their domains. This Quick Scan is more than a numbers game; it’s a narrative of financial resilience and strategic brilliance. FICO’s journey reflects a company with impressive margins and shareholder-friendly practices, while Moody's tale is one of steady growth and capital efficiency, though with some intangibles weighing on the balance sheet. As I unravel both stories, I’ll explore how these financial strengths and subtle challenges shape their appeal.

Will FICO’s scoring precision or Moody's rating authority claim victory? Let’s dive into their financial odysseys and crown the ultimate winner!

Quick Scan Overview: Investment Readiness Scores

This Quick Scan assesses companies across three key areas: Company Snapshot, Financial Health & Performance, and Shareholder Value & Suitability. Each metric is weighted based on its impact on long-term value creation, contributing to the final Investment Readiness Score. A score above 80 flags the company as a candidate for in-depth quality investing analysis by Compound & Fire, shared on Substack and in my global quality investing app on Discord.

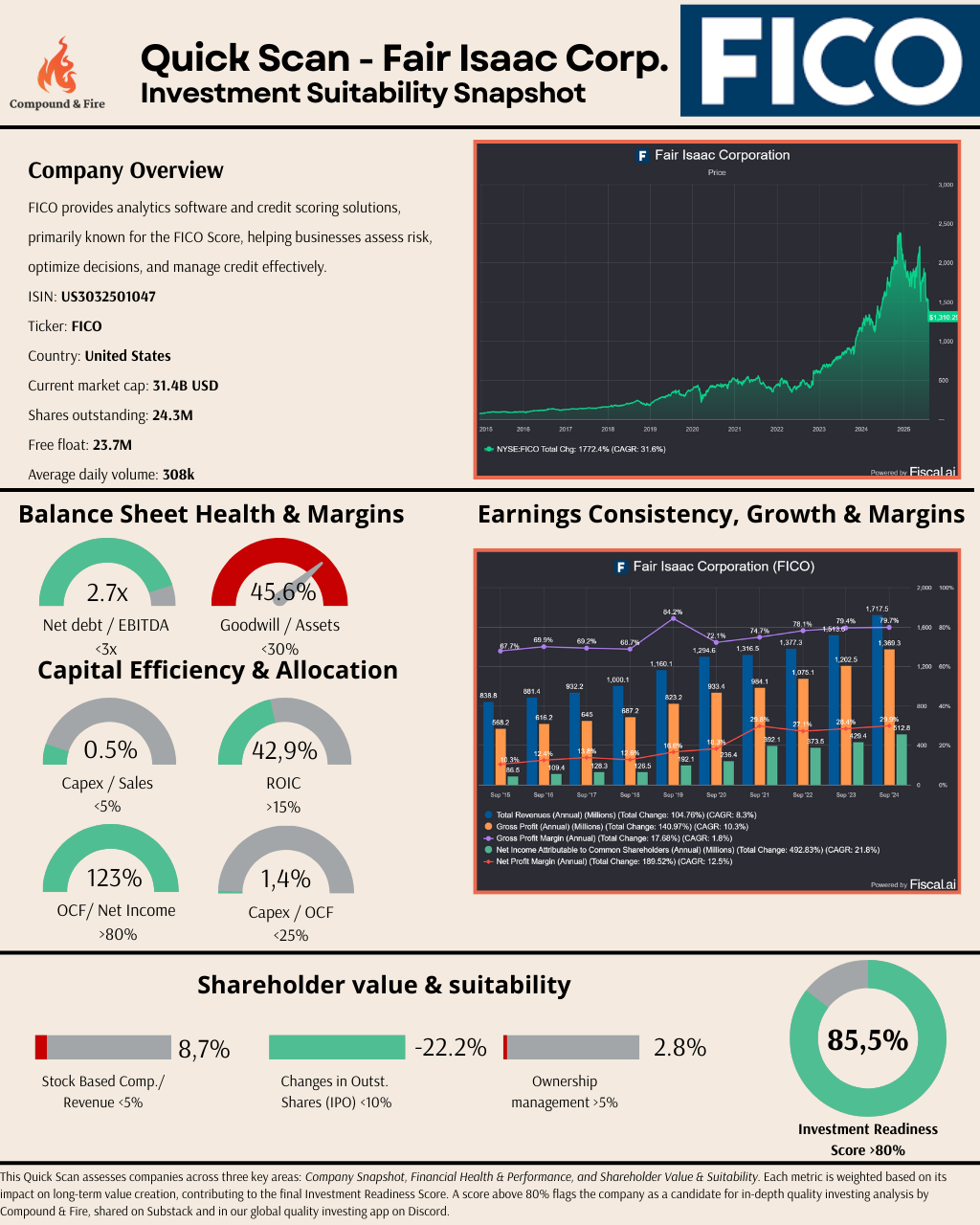

FICO: Quick Scan

For a better picture of the Quick Scan click here. The calculation of the IRS score is available in our Discord app

Summary and Highlights: FICO’s story is one of analytical dominance and compounding efficiency. I see a company with a balance sheet that balances moderate leverage with exceptional capital returns, free from excessive debt burdens but carrying a notable load of intangibles. Its margins are stellar, a testament to its moat in credit scoring and analytics, turning data into high-profit outcomes, while its growth over the past decade showcases consistent expansion. What truly elevates FICO is its commitment to shareholders, evidenced by significant share reductions and solid operating cash flows exceeding net income. Even with some stock-based compensation, it feels like a precision engine for value creation. With an Investment Readiness Score of 85.5, FICO stands as a reliable scorer, navigating economic cycles with data-driven prowess.

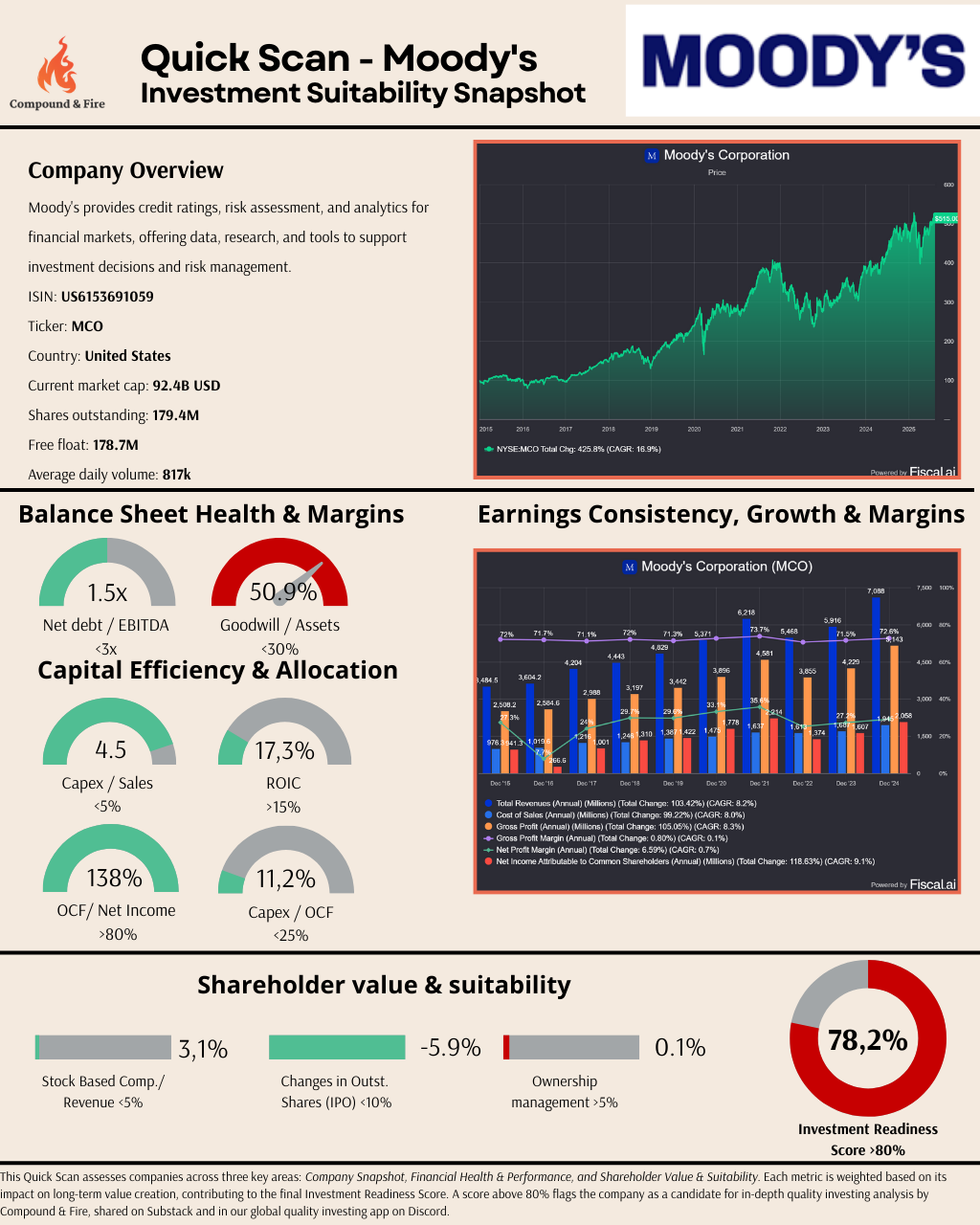

Moody’s: Quick Scan

For a better picture of the Quick Scan click here. The calculation of the IRS score is available in our Discord app

Summary and Highlights: Now, I turn the page to Moody's, a venerable institution with a narrative of insightful stability. Its balance sheet shines with low leverage and strong cash generation, though goodwill and intangibles form a substantial portion of assets, hinting at acquisition-driven growth. Margins are robust, reflecting its authoritative position in ratings and analytics, with steady revenue compounding over the years. Moody's excels in capital allocation, boasting high ROIC and OCF well above net income, but ownership alignment is minimal, and share reductions are modest. It's a story of reliable performance with room for more shareholder focus. With an Investment Readiness Score of 78.2, Moody's offers a measured path, but it falls just short of the threshold for deeper scrutiny.

The Battle: Head-to-head comparison

In this clash of financial titans, FICO and Moody's both demonstrate strengths in profitability and growth, but divergences emerge in balance sheet health, capital efficiency, and shareholder alignment.

Balance Sheet Health: FICO carries higher net debt/EBITDA at 2.7x compared to Moody's 1.5x, but both are below 3x. However, intangibles weigh heavier on Moody's (50.9% of assets) than FICO (45.6%), dragging Moody's score lower.

Margins and Growth: FICO edges out with superior gross margins (79.73% vs. 72.58%) and slightly higher 10-year revenue CAGR (9.12% vs. 7.75%). Net profit margins are neck-and-neck at around 29-30%.

Capital Efficiency: FICO dominates with a stellar ROIC of 42.96% against Moody's 17.28%, and ultra-low capex/sales (0.52% vs. 4.47%). Both generate strong OCF exceeding net income, with Moody's at 138% and FICO at 123%.

Shareholder Value: FICO shines in reducing outstanding shares by 22.2%, far outpacing Moody's 5.9%. Stock-based compensation is higher for FICO (8.70% of revenue vs. 3.10%), but management ownership is better at 2.8% vs. Moody's 0.1%.

Overall, FICO's higher scores in key areas like ROIC and share buybacks give it the edge, reflected in its superior IRS of 85.5 vs. Moody's 78.2.

The Verdict

After this intense battle, FICO emerges victorious! Its exceptional capital returns, margin strength, and shareholder focus make it the clear winner, earning a spot for deeper analysis. Moody's puts up a strong fight with its low leverage and cash generation but falls short of the 80% threshold due to intangibles and ownership issues. Both are quality players in financial analytics, but FICO's precision wins the day.

Winner: Fair Isaac Corportation

But is the market telling a different story? Let’s explore.

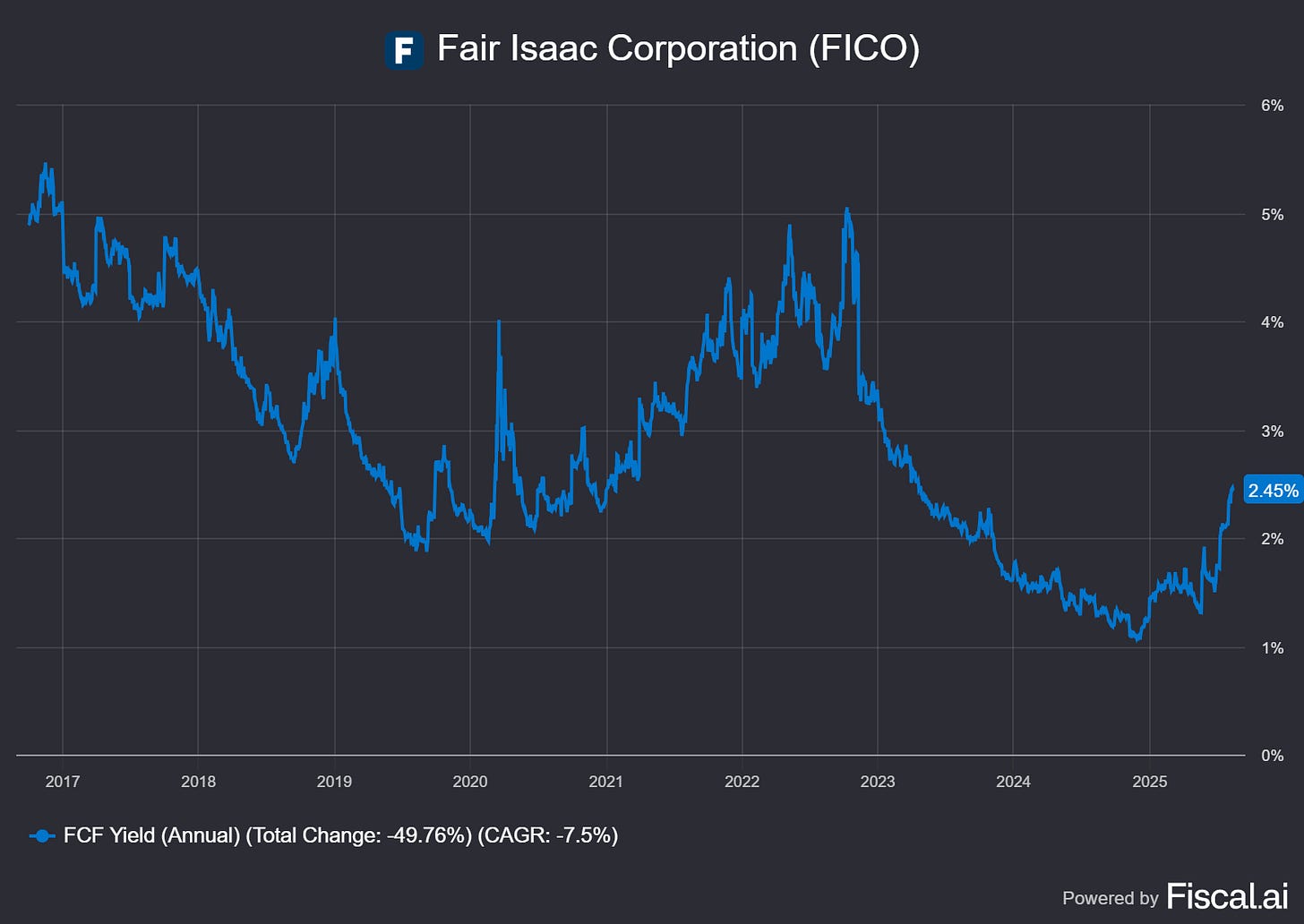

Market Reality Check: FCF Yield

In the realm of quality investing, the free cash flow (FCF) yield serves as a crucial benchmark, offering a reality check on a company's valuation relative to its cash-generating prowess. It's calculated as FCF per share divided by the share price, providing insight into the return an investor might expect from the company's cash flows.

Looking at the historical trends, both companies have seen their FCF yields decline significantly over the past eight years, reflecting rising valuations amid strong performance. For FICO, the yield has dropped from around 5-6% in 2017 to 2.45% in 2025.

Similarly, Moody's yield has fallen from higher levels of 6-7% to 2.53%.

These declines highlight how market enthusiasm has outpaced FCF growth, compressing yields.

For context, let's compare these yields to a risk-free alternative: the 10-year US Treasury bond yield which stands at approximately 4.25%.

This comparison helps gauge whether the equity's cash yield compensates adequately for the additional risk.

FICO: With an FCF yield of around 2.45%, FICO offers a yield notably below the Treasury rate, signaling that investors are banking on robust future growth and its dominant moat in analytics to deliver superior returns over time.

Moody's: Moody's FCF yield at about 2.53% is also under the bond yield, reflecting a similar premium valuation driven by its stable ratings business and analytics expansion.

While both companies exhibit FCF yields below the bond rate, their growth prospects, high margins, and economic moats can justify the premium valuations in a quality investing framework. However, this underscores the importance of sustained growth in driving future returns, as current yields alone don't cover the risk premium without it.

Join the Quality Edge!

Which of the two US based companies aligns with your strategy? How do you look at both Quick Scans and valuations? Share your thoughts in the comments below or join the debate on my Global Quality Investing Discord.

Share this article

If you enjoyed reading my article, feel free to share it with friends:

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

What about $SPGI. $SPGI seems to be the biggest competitor/rival to $MCO…