Kinsale Capital Group: Owner-Operator & Brilliant Underwriters

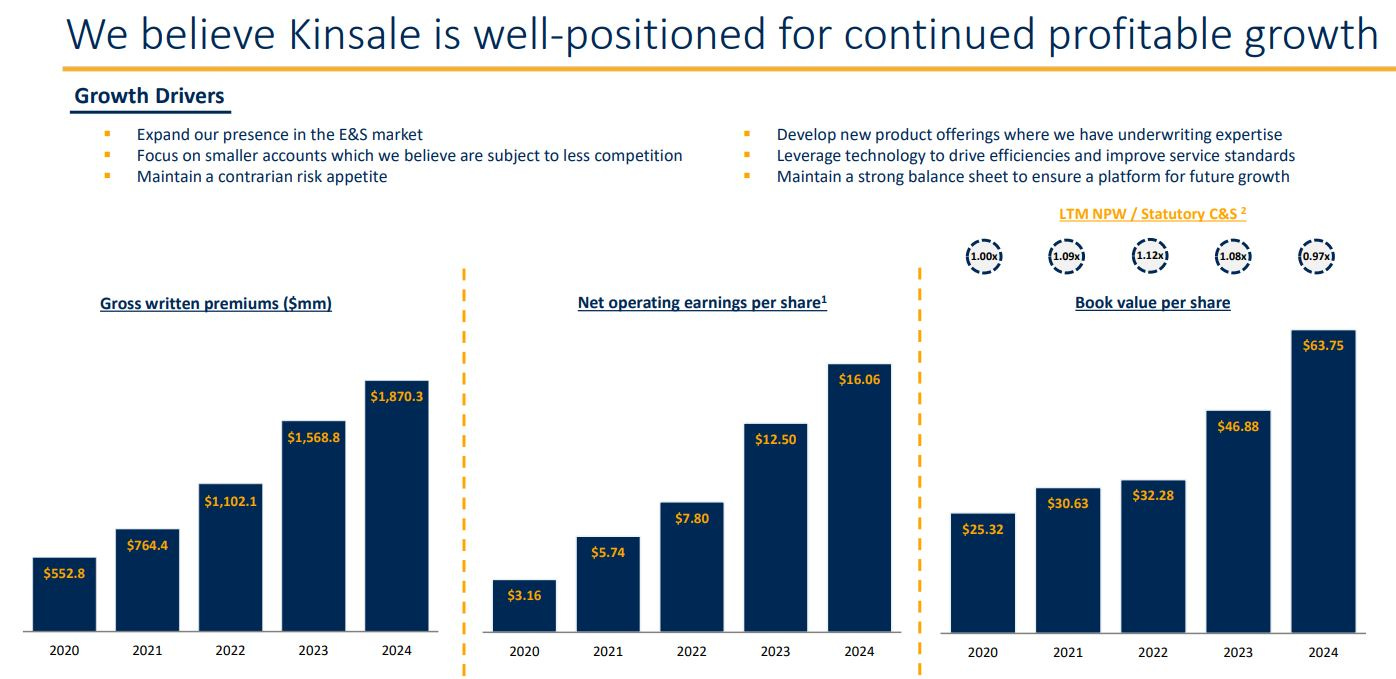

A Deep Dive into Kinsale’s Profit Powerhouse, showing a potential annual return of 14%!

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early.

This community is free, but if you’d like to support my time in providing deep analysis, you can Buy Me a Coffee. Every contribution helps keep this community thriving and is highly appreciated!

Join our global quality investing app on Discord here and join my Substack for free if you haven’t subscribed yet.

In this deep dive I will explain why I hold a long-term position in Kinsale Capital Group. Enjoy reading!

General information

Name: Kinsale Capital Group

Logo:

ISIN: US49714P1084

Ticker: KNSL

Country: United States

Current market cap: 10.2B USD

Share price: 439.28 USD

Outstanding shares: 23.153 million

Free float: 22.05 million

Average daily volume: 174.17k

About: Kinsale Capital Group is a U.S.-based specialty insurer focusing on the Excess and Surplus (E&S) lines market, targeting small to mid-sized businesses with hard-to-place risks. Founded in 2009 by Michael Kehoe, Kinsale has grown steadily, leveraging its underwriting expertise to carve out a niche in a high-growth segment of the insurance industry. The company operates as an owner-operator stock, with its headquarters in Richmond, Virginia, employing 660 staff as of late 2024.

Source: Kinsale IR presentation

Quick Scan

"Protecting your money is like guarding a castle: it's easier to keep invaders out than to reclaim lost territory.”

That is why I look for moat companies which protect my castle. I want to minimize the risk of losing money and maximize the chance a company is compounding. Compounding is like a snowball rolling downhill, getting bigger and faster as it goes, just as a company's profits grow faster when they reinvest their earnings into high-return projects, making even more money to reinvest again and again.

Balance sheet

A low Net debt / EBITDA ratio indicates that a company can repay its debt faster, potentially leading to better long-term shareholder return:

Net debt / EBITDA: 0.1x (Net debt / EBITDA < 4x ✅)

A rule of thumb suggests that companies with a goodwill to assets ratio higher than 30% should be carefully analyzed to ensure the risk of potential write-offs is low:

Goodwill / Total assets: 0% (Goodwill / Total assets <30% ✅)

Impairments last 10 years: 0 (Impairments / Goodwill < 10% ✅)

This seems like a healthy balance sheet!

Cash Flow

“A business that doesn't take any capital and grows and has almost infinite Returns on required Equity capital is the ideal business” (Warren Buffett)

That is why I look for asset-light companies.

Capex / Sales: 1.5% (Capex / Sales <5% ✅)

Capex / Operating Cash Flow 2.4% (Capex / Operating Cash Flow <25% ✅)

Operating Cash Flow (OCF) / Net Income 235% (OCF / Net Income >80% ✅)

Kinsale is a capital-light company. The Operating Cash Flow versus net income for an insurance company is typically higher as customers pay their premiums in advance.

Capital Allocation

“Capital allocation is the CEO’s most important job” (Warren Buffett)

The metric which most often tells most about capital allocation is ROIC. However, insurance companies generate profits from two main sources—underwriting (premiums minus claims and expenses) and investment income (from premiums invested before claims are paid). ROE captures the combined efficiency of these activities relative to the equity base, which is critical for shareholders.

ROE could be inflated by high debt, but as Kinsale hardly has any debt, I will look at ROE and not ROIC.

Operating Return on Equity: 29.2% (ROE >15% ✅ )

This shows Kinsale is allocating their capital very well. Here is the trend for the last years:

Source: Kinsale IR presentation

Profitability

A high gross margin provides significant insights into a company's competitive advantage and potential for long-term shareholder returns.

For insurance companies, the concepts of gross margin and net margin differ from those in traditional product-based businesses because insurers don’t produce goods with raw material costs. Instead, their "product" is risk coverage, and their profitability hinges on premiums, claims, expenses, and investment income.

For insurance companies often the underwriting margin is used, which shows the premiums earned minus the claims. Below I will share an overview, showing the combined ratio which adds together the loss and expense ratio.

Source: Kinsale IR presentation

The underwriting margin for 2024 is 1 minus the combined ratio, so this is 23.6%. For Kinsale this combined ratio is a very important metric, as it shows the quality of the underwriting.

To judge whether Kinsale does a good job, we have to compare this with their competitors. In the graph below you will see the average combined ratio versus their competitors for the period 2021-2023:

Source: Kinsale IR presentation

As you can see Kinsale has the lowest combined ratio of all and hence the highest underwriting margin in their market!

Underwriting Margin: 23.6% (Higher than competition ✅)

As you can see, for the Profitability I can’t take just a P&L and compare it with a standard metric. I already have to dig deeper to understand their business.

Stock-Based Compensation (SBC)

95% of Restricted Stock Units (RSUs) are sold on vest, which potentially defeats the purpose of giving employees long-term skin in the game (Bill Gurley, a well-known venture capitalist).

Companies offering stock-based compensation plans can benefit shareholders through higher stock prices, but only if the level of dilution is not excessive.

Two different views, but opposite. In general I want to see the stock-based compensation below 5%, else it will dilute my stake in a company.

SBC to revenue: 0.9% (SBC < 5% ✅)

Change in Shares Outstanding 7 yrs: 8.3% (Change in Shares Outstanding <10% ✅)

Kinsale Capital Group had it’s IPO in 2016, so I will take the increase in outstanding shares from the year after till now. The capital has been increased, but the capital infusion allowed Kinsale to maintain its underwriting discipline while growing its investment income, setting the stage for future profitability.

Conclusion Quick-Scan

The quick scan shows a perfect score for Kinsale Capital Group! It’s a very interesting business which, compared to competitors, is a star in underwriting. It has a strong balance sheet and a great capital allocator too.

Management

Michael P. Kehoe has been a central figure at Kinsale Capital Group since founding the company in June 2009, initially serving as President and CEO until March 2024, when he transitioned to Chairman and CEO. His career spans decades in the insurance industry, beginning with various senior roles at Colony Insurance Company from 1994 to 2002, culminating as Vice President of Brokerage Underwriting. From 2002 to 2008, he was President and CEO of James River Insurance Company, giving him deep experience in specialty insurance before launching Kinsale. Kehoe holds a B.A. in Economics from Hampden-Sydney College and a J.D. from the University of Richmond School of Law, blending business acumen with legal insight—valuable for navigating the regulatory landscape of insurance.

As the founder and long-time leader, Kehoe has shaped Kinsale into a standout player in the excess and surplus (E&S) lines market, emphasizing disciplined underwriting, low costs, and technology-driven efficiency. His leadership has driven the company’s growth from a startup to a public entity with a market cap exceeding $10 billion (based on recent stock performance trends), and he remains a significant shareholder, owning approximately 3.6% of the total shares.

Why Michael Kehoe is a Strong CEO

Kehoe’s strengths as a CEO are evident in Kinsale’s financial and operational success, which can be attributed to several key factors:

Visionary Leadership and Founding Expertise:

As the founder, Kehoe identified a niche in the E&S market, targeting small and mid-sized businesses with hard-to-place risks. This strategic focus has allowed Kinsale to achieve a net loss and LAE ratio consistently below 60% (e.g., 54.6% in 2023), far outperforming the P&C industry (76.1%) and surplus lines sector (64.4%).

His experience at James River and Colony equipped him with the know-how to build a lean, efficient operation, a model he’s replicated at Kinsale.

Disciplined Underwriting:

Kehoe has instilled a culture of underwriting excellence. Kinsale’s combined ratio of 76.4% in 2024 reflects this discipline, translating to an underwriting margin of 23.6%—exceptional in an industry where many rely on investment income to offset losses.

His cautious approach to risk selection has protected Kinsale during volatile periods, such as the 2020 pandemic, where the company reported a 47% increase in written premiums and a combined ratio of 84%.

Capital Management and Growth:

Kehoe’s decision to raise capital through stock issuances (e.g., $76M in 2016, $142M in 2022) has fueled Kinsale’s growth, with gross written premiums growing at a CAGR of over 30% since its IPO. This capital has supported expansion into new E&S segments and technology investments, maintaining a low expense ratio (around 20.7% in 2024).

His preference for balancing a 15% ROE with 15% growth over a higher ROE with slower growth (as noted in the 2024 meeting) reflects a long-term perspective, aligning with Kinsale’s 8x book value growth since 2014.

Team Building:

Kehoe has assembled a strong management team, including Brian Haney (President since 2024) and Bryan Petrucelli (CFO), both of whom have deep industry experience. This delegation suggests confidence in his leadership structure, allowing him to focus on strategy while others execute operations.

Kehoe’s track record—turning Kinsale into a high-growth, profitable insurer with a market share rising from 1.7% to a projected 3.4% in the E&S market—underscores his effectiveness. His personal stake in the company (worth hundreds of millions) aligns his interests with shareholders, a sign of commitment.

Here is an overview of their management team:

Source: Kinsale IR presentation

Market Attractiveness

The Excess and Surplus (E&S) lines insurance market stands out as an attractive segment within the broader Property & Casualty (P&C) insurance landscape, offering unique opportunities and challenges that shape its appeal for insurers like Kinsale Capital Group. Here’s an overview of its external market dynamics:

Growth Potential

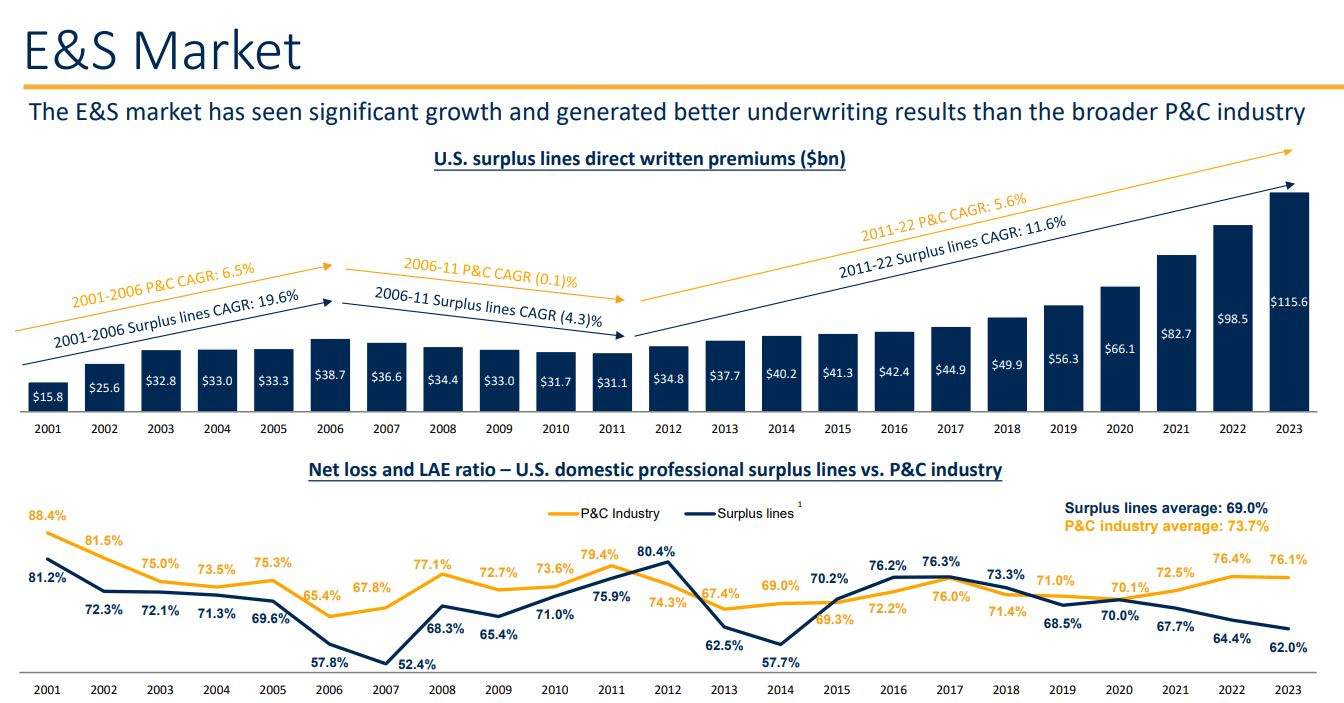

The E&S market has experienced robust growth, with a compound annual growth rate (CAGR) of approximately 8-10% over the past decade, outpacing the P&C industry’s 4-6% CAGR.

Source: Kinsale IR presentation

This expansion is fueled by rising demand for specialized coverage as businesses grapple with emerging risks—such as cybersecurity threats, climate-related perils (e.g., wildfires, floods), and niche commercial exposures that standard insurers avoid. The market’s ability to absorb hard-to-place risks ensures a steady influx of opportunities, particularly as global risk complexity increases.

However, growth could face headwinds from economic downturns or shifts in risk appetite among reinsurers, which might limit capacity and moderate expansion in the coming years.

Profitability

E&S lines offer the potential for higher profitability compared to the admitted market, driven by greater pricing flexibility and the ability to target underserved niches.

During hard market cycles—periods of reduced capacity and rising rates, such as 2019-2023—insurers can achieve underwriting margins exceeding 20%, well above the P&C industry average of 5-10%. The float, or premiums held before claims are paid, also generates investment income, especially in a high-interest-rate environment (e.g., 4-5% yields on fixed-income securities in recent years).

That said, profitability is cyclical, and soft market phases (e.g., if rates drop in 2025) could compress margins as competition intensifies. Catastrophic losses or unexpected claim spikes also pose risks to sustained profitability.

Competitive Landscape

The E&S market remains fragmented, with no single dominant player, creating an accessible arena for niche specialists.

Source: Kinsale IR presentation

This fragmentation allows smaller, agile insurers to carve out market share by focusing on specific risks or regions, often with lower overhead than larger competitors.

However, the lack of consolidation also means intense rivalry, with traditional E&S players, new fintech entrants, and even large P&C firms expanding into the space. The market’s attractiveness hinges on an insurer’s ability to differentiate—through technology, underwriting discipline, or customer service—amid this competition, which could intensify as the sector matures.

External Economic and Regulatory Factors

The E&S market benefits from its non-admitted status, offering pricing and coverage flexibility that standard insurers lack, which is a key draw in a regulatory environment increasingly focused on consumer protection in the admitted space.

Rising claim costs—driven by inflation (up 10-15% annually for some lines)—and evolving risks (e.g., cyber, climate) further bolster demand for E&S solutions. Yet, this flexibility comes with less oversight, raising the risk of underpricing or disputes.

Economic factors, such as interest rate fluctuations or recessionary pressures, also impact attractiveness—high rates enhance investment returns, while downturns could reduce business insurance demand.

Risks and Considerations

While the E&S market is appealing, it’s not without challenges. The sector is sensitive to natural catastrophes, which can spike loss ratios (e.g., Hurricane Ian in 2022 cost the industry billions). Competitive pressures may lead to price wars during soft markets, eroding margins.

Additionally, the market’s reliance on reinsurance capacity means that shifts in reinsurer appetite—due to capital constraints or global events—could limit growth opportunities. These factors require insurers to maintain robust capital reserves and risk management practices to thrive.

Company’s Strategy

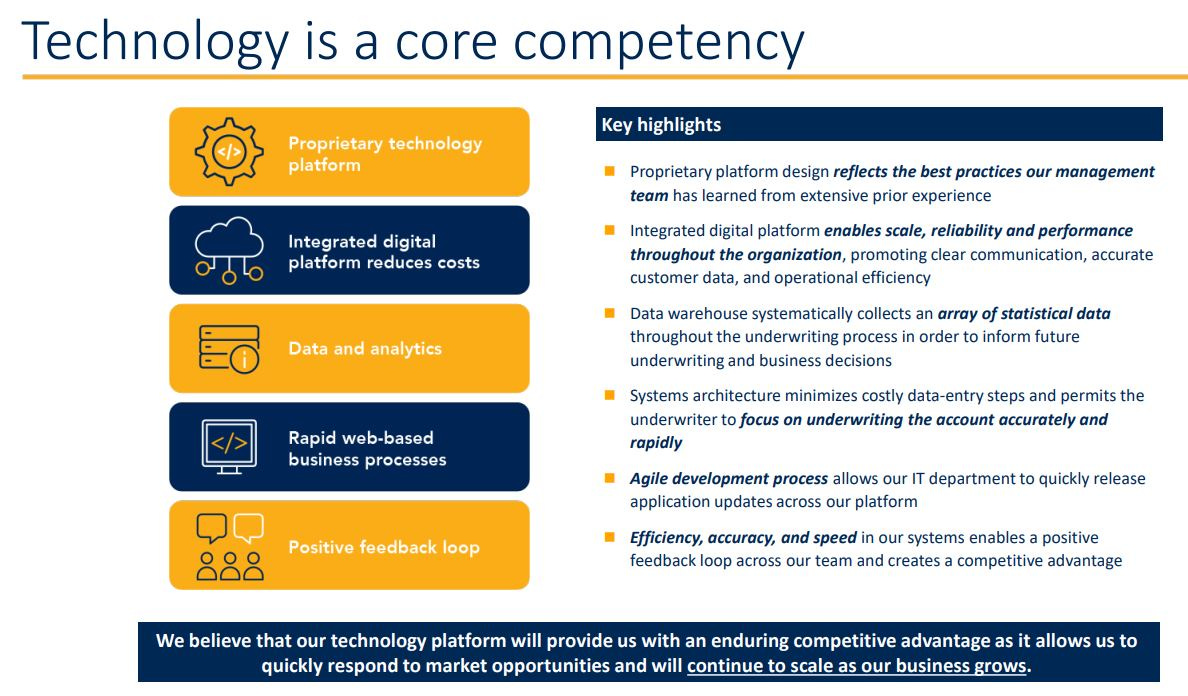

Kinsale’s strategy centers on disciplined underwriting, targeting small to mid-sized E&S accounts with average premiums of $14,700 (excluding personal lines). It leverages proprietary technology to streamline operations, achieving a 69.3% quote ratio on new submissions (419,000 quotes from 605,000 submissions in 2023). Kinsale has a competitive advantage with their technology resulting in a faster time-to-market.

Source: Kinsale IR presentation

Management aims for 10-20% annual growth, focusing on profitability over volume, while investing premiums conservatively to ensure long-term stability.

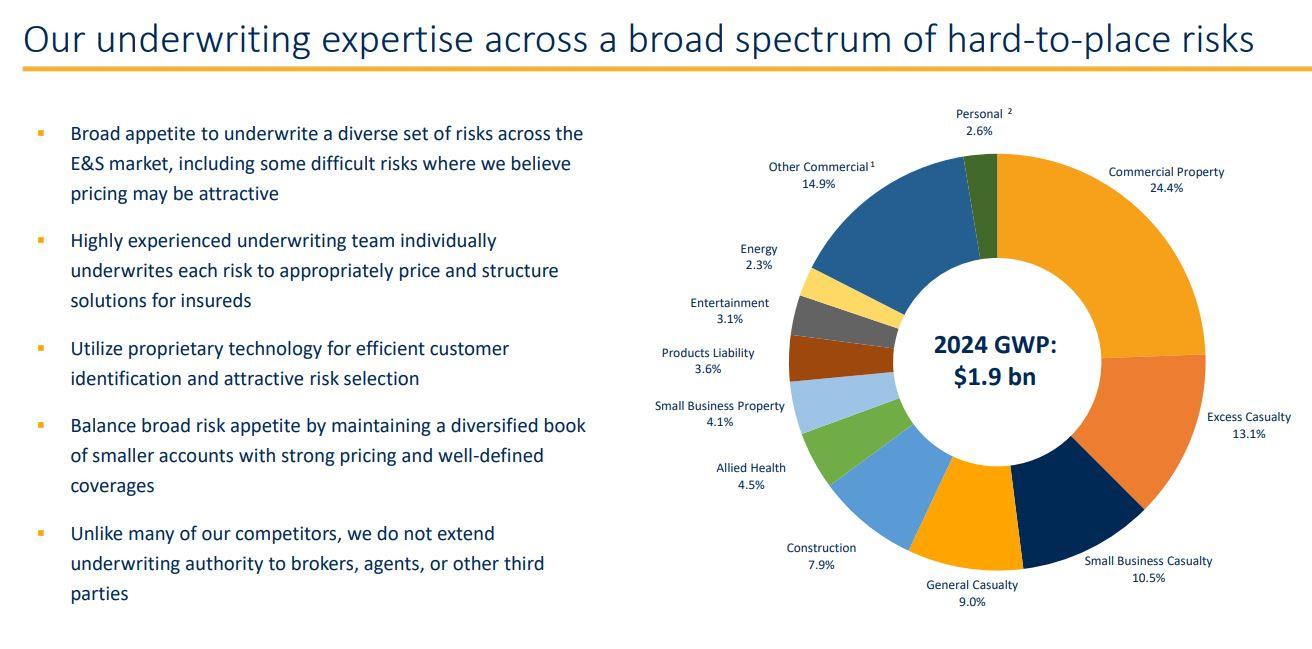

Kinsale’s strategy for new product development reflects a deliberate approach to expand its addressable market while maintaining its core strengths. The company focuses on small to mid-sized accounts ($25K-$250K premiums), which make up a significant portion of the E&S market, and targets niche, hard-to-place risks that standard insurers often avoid.

Business Model

Kinsale provides E&S insurance for hard-to-place risks that standard insurers reject due to their complexity or high risk, generating revenue through premiums (77.2% casualty, 22.8% property). It uses independent brokers like RSG Specialty (18.4% of premiums) and AmWINS (16.2%), paying around 15% commission rates. Kinsale writes policies across 50 states in the US, Puerto Rico and the US Virgin Islands.

Important is the disciplined underwriting expertise across a broad spectrum of hard-to-place risks and no delegated underwriting authority. This means Kinsale retains full control over risk assessment, avoiding outsourcing of underwriting to third parties, which ensures quality and consistency.

Source: Kinsale IR presentation

Revenue stream

Premiums: Kinsale earns revenue from gross written premiums, which grew 12.2% to $1,668.0 million in 2024.

Investment Income: The “float” (premiums collected before claims are paid) is invested, generating $141.8 million in net investment income in 2024, up 47.1% from 2023, thanks to higher yields and a larger portfolio.

As mentioned earlier Kinsale has a 73.4% combined ratio (losses + expenses as a percentage of premiums), which is one of the lowest among peers, signaling strong underwriting profitability.

Operational efficiency

Technology is a cornerstone, driving a “best-in-class expense ratio: proprietary systems streamline underwriting and claims, keeping costs low—expenses were $228.8 million in 2024, or ~18% of earned premiums.

This 17.8% expense ratio is far below industry averages, reinforcing the efficiency of Kinsale

Growth strategy

Kinsale aims for “long-term value” through profit and growth. The E&S market’s expansion supports this, with U.S. surplus lines premiums growing from $40 billion in 2016 to $90 billion in 2023, outpacing the broader P&C industry.

Kinsale is targeting diverse commercial lines: construction, excess casualty, professional liability, and more, targeting underserved niches.

Source: Kinsale IR presentation

Capital management

Kinsale maintains a lean balance sheet with $48.5 million in net debt according to their 10-K and returned $13.9 million to shareholders in 2024 via dividends. Their buybacks of $10M are mainly used to cover Shared Based Compensation. Excess capital supports growth without heavy leverage.

Kinsale’s moat lies in its low combined ratio (78% average), technology-driven efficiency, and focus on small accounts with less competition. Reinsurance and catastrophe modeling (e.g., 100-year hurricane risk) further mitigate exposure.

Valuation

In order to have an understanding of the valuation of the company it is good to look from multiple angles.

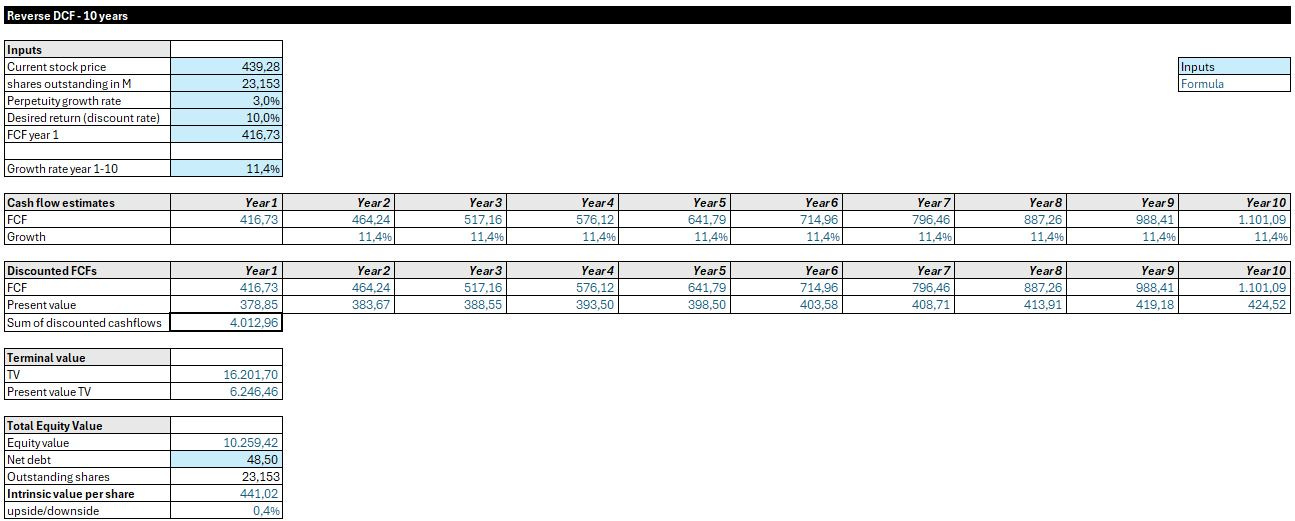

Reverse DCF

Starting with known data points and working backwards to assess market expectations and judge whether these expectations are realistic.

Let’s first have a look at the reverse DCF.

To start with, it is very important for an insurance company to work with an Adjusted Free Cash Flow, because of the premiums collected upfront by Kinsale, claims paid out later, and significant investment income from their float.

That is why I will take Net Operating Earnings + Depreciation & Amortization - Maintenance Capex.

I am leaving out the gain / loss on investments. This is the Buffett way where I will ignore these as these will fluctuate a lot over the years and disturb the view of how the operations are running. On the long-term these investments should add shareholder value if Kinsale invests the cash in a wise way!

For 2024 I have calculated a number of 372.1M (374.8M + 5.8M - 8.5M). This Adjusted Free Cash Flow number is key, as it is the starting point for the model. For year 1 I assume their growth will be 12%, as management communicated to expect a growth between 10 and 20% for the long-term, which is much lower than their historic growth.

The reverse DCF is showing that at the current price a growth rate for the next 10 years of 11.4% is calculated to get a 10% annual return on your investmebt. I think this 11.4% is fair and even a bit at the low end.

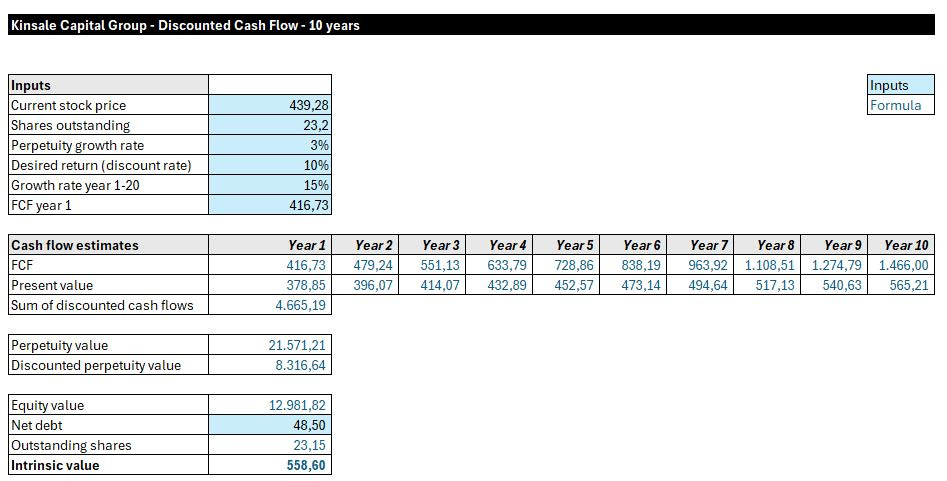

DCF-model

Now let’s take the regular discounted cash flow, where I will calculate the intrinsic value per share. I will take a growth rate of 15%, the mid range of what management has communicated for the long-term.

The outcome is an intrinsic value of 558.60 which is an upside of 27.2% to today’s stock market price, where you can expect a 10% annual return on top.

When I tweak the growth rate to 10% and 20% to share also the low and high end outcomes for the intrinsic value I will get to respectively $402.3 and $774.44.

As you can see, this has a huge impact on the stock price. I think 15% is realistic and the 10% would be a pessimistic scenario, given the competitive advantages of Kinsale and the new markets they are adding in the US.

Forward P/E

The average Forward P/E last years was 27.8 versus a forward P/E of 25.8 today. Personally I think the Reverse DCF and DCF are of more value, versus looking at the historical average forwrd P/E versus today’s level. Especially as the long-term growth of Kinsale is expected to be lower than in the past.

Heatmap

The heatmap for Kinsale shows the return which one might expect depending on the growth in Adjusted free cash flow and the growth or decline in the Price to Adjusted Free Cash Flow.

For Kinsale the expected return with a 15.0% annual growth of the Adjusted free cash flow and a decrease of the Price / Adj. Free Cash Flow ratio towards 25 (currently 28) will result in an annual return of 14%. I think this heatmap is a great view to see the different scenario’s.

Risks

High reserves for unpaid losses could impact cash flow if claims exceed estimates. Dependency on broker relationships (e.g., RSG Specialty) poses concentration risk.

Key-man risk: CEO Kehoe is unvaluable for this business.

Kinsale’s exclusive E&S focus lacks diversification. Divisions like Allied Health (26.5% growth) and Construction are strong, but a downturn in these sectors could hit premiums hard.

Catastrophe exposure, particularly hurricanes, could lead to significant losses, despite reinsurance. Rising competition in the E&S market from players like Arch Capital may pressure pricing. However, the low combined ratio as a result of excellence in underwriting is an advantage for Kinsale.

Investment income from the float ($141.8M in 2024) is a big profit driver, fueled by higher interest rates in recent years. If rates drop, as some economists predict post-2025, yields on Kinsale’s investment portfolio could shrink.

Final Conclusion

The quick scan resulted in a perfect score for Kinsale Capital Group

Very strong CEO with aligned interest to shareholders, but key person risk

Management expecting long-term growth of 10-20%

Continuation of market share gain in E&S market

Strong underwriting expertise results in combined ratio which is the lowest among peers

Technological advantage resulting in a fast time-to-market

Attractive valuation potentially resulting in 15% return the next 10 years

Hopefully you have enjoyed this deep dive. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

I agree that Kinsale looks good. The valuation multiples are high, but factoring in growth they may look too cheap when looking back a decade from now. I have some interviews with the CEO in my write up if interested hearing directly from the founder: https://rockandturner.substack.com/p/kinsale-capital-riding-a-long-wave

Thanks for the interesting report. What do you think about the latest quarterly results with a combined ratio of 82.1%?