LVMH Quick Scan: A Luxury Giant Under the Quality Lens

Unveiling LVMH’s Financial Strength and Quality Metrics for Investors

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way—hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to support more content, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support! Let’s grow this journey together—join the conversation on our Global Quality Investing Discord App and subscribe to my Substack for free if you haven’t yet!

Hello, fellow quality investors!

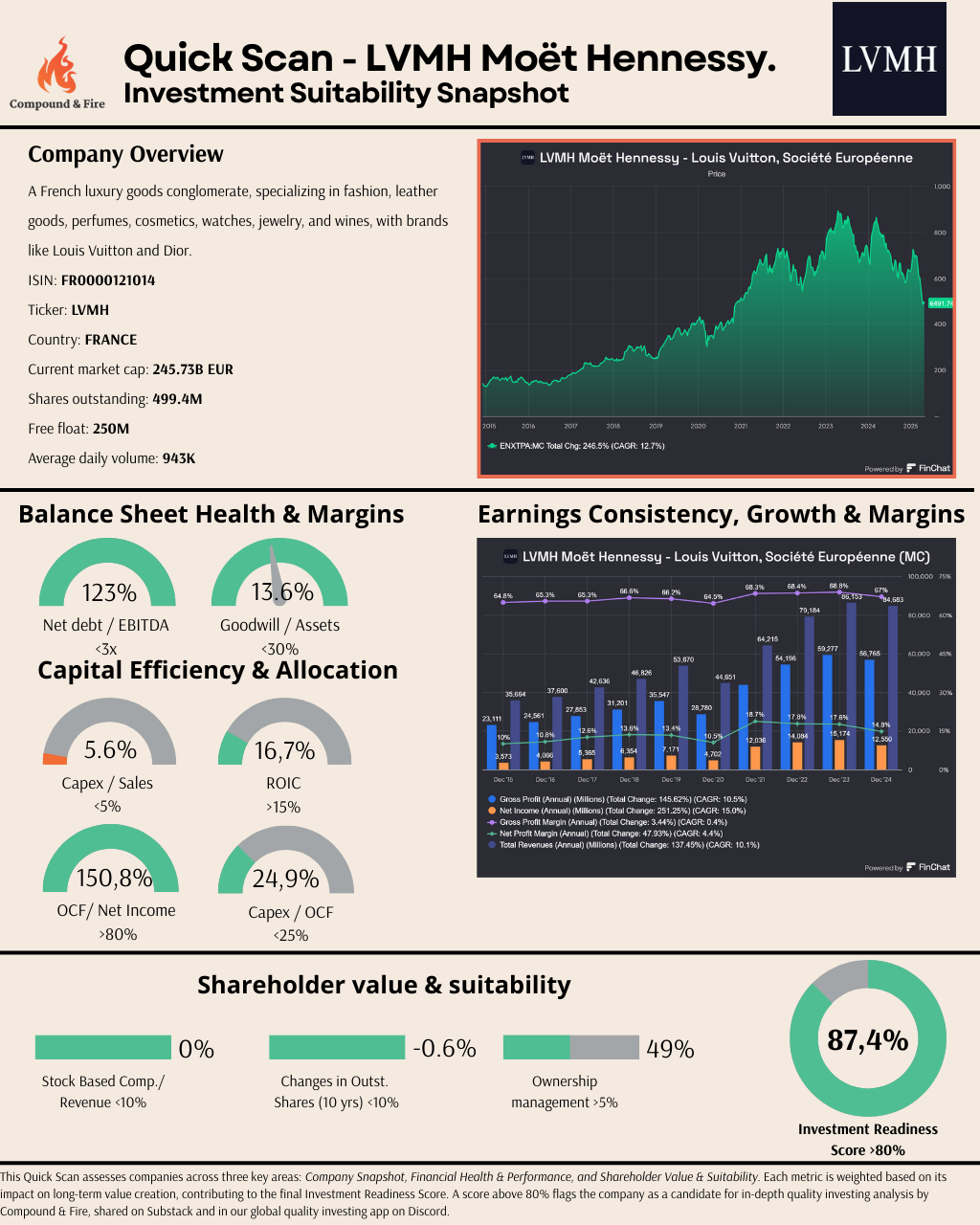

I’m excited to share my latest Quick Scan on LVMH Moët Hennessy Louis Vuitton SE (LVMH.PA), the French luxury goods conglomerate that’s a titan in fashion, leather goods, perfumes, watches, and more. With iconic brands like Louis Vuitton and Dior, LVMH has long been a benchmark for quality investing—but does it meet our strict criteria for Compound & Fire? Let’s find out!

In this Quick Scan, I dive into LVMH’s key financial metrics as of December 31, 2024:

Gross Margin: A robust 67.03%, in line with luxury peers, reflecting strong pricing power despite a diversified portfolio.

Net Margin: 14.82%, solid but mid-range for the sector, impacted by lower-margin segments like Wines and Spirits.

ROIC: 16.7% showcasing efficient capital use

OCF to Net Income: 1.51, signaling strong cash conversion and earnings quality.

LVMH’s strengths lie in its diversified luxury portfolio and global reach (6,307 stores worldwide), but challenges include currency headwinds and weaker demand in key markets like China. The company’s IRS Score (calculated on our Discord server) reflects its quality attributes—with a score of 87.4% it passes our minimum 80% score!

Want to dive deeper? Join the discussion on our Global Quality Investing Discord (free to join), where you can access the full Quick Scan, IRS Score calculation, and share your thoughts on LVMH in the #stock-pipeline Forum Channel. Is LVMH a quality compounder for your portfolio, or does its diversification dilute its potential? Let’s discuss in the comments below—I’d love to hear your take!

If you’re enjoying these Quick Scans, consider subscribing to Compound & Fire for more quality investing insights:

And if you liked this update, feel free to share it with friends:

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

LVMH was the first stock added to our Guru Gems portfolio. A few Superinvestors still believe in its long-term performance:

https://gurugems.substack.com/p/cloning-the-worlds-best-investors