LVMH Under the Lens: A New Journey in Quality Luxury Investing?

Analyzing a Luxury Giant’s Resilience Amid Market Shifts.

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way, hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to fuel more, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support!

Come join the conversation on our Global Quality Investing Discord App here and hop on board my Substack for free if you haven’t yet. Let’s grow this journey together!

Introduction

My Quick Scan recently evaluated LVMH, the world’s leading luxury goods conglomerate, and assigned it an Investment Readiness Score of 87.4, signaling a company worthy of a detailed deep dive. LVMH, founded in 1987 through the merger of Moët Hennessy and Louis Vuitton, operates across six business segments:

Wines and Spirits

Fashion and Leather Goods

Perfumes and Cosmetics

Watches and Jewelry

Selective Retailing

Other Activities

Headquartered in Paris, France, this Société Européenne employs over 215,000 people globally and is renowned for its portfolio of prestigious brands, including Louis Vuitton, Dior, and Tiffany & Co. In this extensive analysis, I will explore LVMH’s history, leadership, culture, business model, competitive advantages, financial health, risks, and valuation to determine its potential as a long-term quality investment. Let’s dive in.

History of the Business

LVMH Moët Hennessy - Louis Vuitton, Société Européenne, stands as a titan in the luxury goods industry, its history a rich tapestry woven from the legacies of its founding houses and a series of strategic expansions that have shaped its current global dominance. The company’s origins trace back to 1743, when Claude Moët established the Champagne house that would become Moët & Chandon, laying the foundation for what would later evolve into a cornerstone of LVMH’s Wines and Spirits division. This early venture capitalized on the growing popularity of Champagne in European courts, setting a precedent for luxury branding that persists today. Nearly a century later, in 1821, Louis Vuitton founded his eponymous trunk-making business in Paris, initially catering to the elite with custom luggage designed for practicality and style during the rise of international travel. Vuitton’s innovation, particularly the introduction of flat-top trunks in 1858, revolutionized the industry and established a legacy of craftsmanship that remains central to LVMH’s identity.

The modern entity of LVMH emerged in 1987 when Moët Hennessy, formed by the 1971 merger of Moët & Chandon and Hennessy (a cognac producer founded in 1765),

merged with Louis Vuitton. This union was orchestrated by Bernard Arnault, who joined the board of Financière Agache (Louis Vuitton’s parent company) in 1984 and orchestrated a leveraged buyout to gain control. Arnault’s vision was to create a luxury conglomerate that could leverage the strengths of its diverse brands, and his acquisition of a 43% stake in LVMH through a complex financial maneuver in 1987 marked the beginning of his transformative leadership. This merger combined the heritage of Champagne, cognac, and leather goods under one umbrella, but it was only the starting point of an ambitious growth strategy.

The 1990s marked a period of aggressive expansion as Arnault sought to diversify and strengthen LVMH’s portfolio. In 1991, the acquisition of Christian Dior, a haute couture icon founded in 1946 by the legendary designer, added a powerhouse in fashion and perfumes to the group, enhancing its prestige. This was followed by the purchase of Givenchy in 1993, founded in 1952, which further solidified LVMH’s foothold in high fashion. The decade also saw the acquisition of Kenzo (1993), a brand known for its avant-garde designs, and the 1994 purchase of Loewe, a Spanish leather goods and fashion house established in 1846. These moves reflected Arnault’s strategy of acquiring brands with strong heritage and potential for global scaling, often revitalizing them under LVMH’s management.

The early 2000s brought further diversification into watches and jewelry. The acquisition of TAG Heuer in 1999, a Swiss watchmaker founded in 1860, marked LVMH’s entry into the competitive luxury watch market. This was complemented by the 2000 purchase of Chaumet, a Parisian jeweler with roots dating back to 1780, known for its high jewelry craftsmanship. The most significant move came in 2019 with the $16.2 billion acquisition of Tiffany & Co., an American jewelry icon founded in 1837, which Arnault described as a “sleeping beauty” poised for revitalization. This deal, one of the largest in luxury history, expanded LVMH’s presence in the U.S. market and added a brand with global recognition, despite initial challenges in integrating its operations.

Source: Quartr

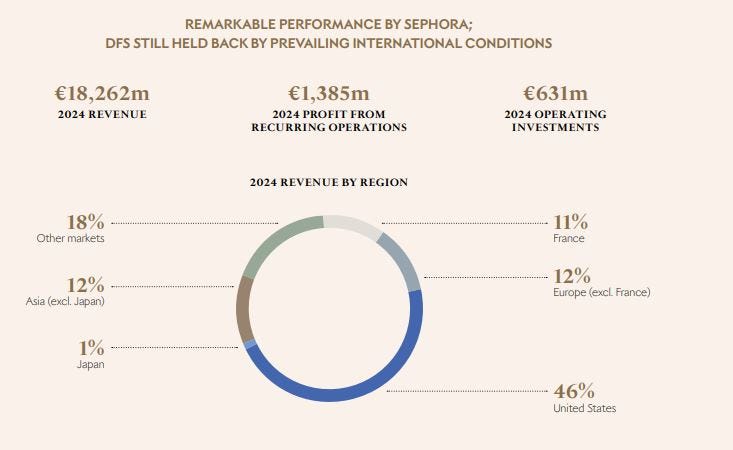

LVMH’s growth also extended into selective retailing with the 1997 acquisition of DFS Group, a luxury duty-free retailer founded in 1960, and the 1999 purchase of Sephora, a beauty retailer established in 1970. Sephora’s transformation under LVMH, growing from €100 million in revenue in 1998 to over €18 billion by 2024, exemplifies the group’s ability to scale and innovate within its subsidiaries. The 2001 acquisition of Le Bon Marché, Paris’s oldest department store founded in 1852, further diversified its retail footprint. Additionally, LVMH ventured into hospitality with the 2011 acquisition of Belmond, a luxury hotel and travel company founded in 1976, and the development of Cheval Blanc hotels, starting with Courchevel in 2006, reflecting a strategy to offer experiential luxury.

Major transformations have punctuated LVMH’s journey. The 2008 financial crisis tested the group’s resilience, with a 2% revenue decline, but it emerged stronger by focusing on high-margin brands and cost management. The COVID-19 pandemic in 2020 posed another challenge, with a 16% revenue drop, yet LVMH’s diversified portfolio and digital acceleration facilitated a robust recovery, with 2021 revenues surpassing pre-pandemic levels by 20%. The 2024 Paris Olympic Games, where LVMH served as a major sponsor, showcased its cultural influence, with bespoke trunks for medals and torches crafted by Louis Vuitton, reinforcing its brand equity despite a €664 million expense impacting operating profit.

Stock market milestones also define LVMH’s history. Listed on the Paris Bourse since 1987, its shares have seen significant growth, with a market capitalization exceeding €235 billion by early July 2025, reflecting investor confidence in its luxury leadership. The 2009 introduction of double voting rights for long-term shareholders, controlled largely by the Arnault family (49% ownership, 64.8% voting rights as of 2024), has ensured strategic stability. Key stock events include a 2019 share buyback program and the 2021 spin-off of Hermès shares, signaling financial flexibility.

These historical developments have positioned LVMH as a global luxury leader, with 2024 revenues of €84.7 billion and a presence in over 80 countries through 6,307 stores. The company’s evolution from a merger of two historic houses to a multi-segment conglomerate underscores its ability to adapt, innovate, and capitalize on its heritage, setting the stage for the detailed analysis that follows.

Source: Quartr

Management

LVMH’s management structure is a critical pillar of its success as the world’s leading luxury goods conglomerate, reflecting a blend of visionary leadership, familial influence, and strategic expertise. At the helm stands Bernard Arnault, the Chairman and Chief Executive Officer, whose tenure and strategic acumen have defined the company’s trajectory since its inception in 1987. Arnault, now 76, has recently secured the potential to remain in his dual role until the age of 85, following a proposal approved by shareholders at the annual general meeting on April 17, 2025, with a resounding 99.18% vote.

Source: LVMH Annual Report 2024

This decision amends LVMH’s bylaws to raise the maximum age limit for the chairman and CEO from 80, extending Arnault’s leadership by nearly a decade. This move, supported by a prior adjustment from 75 to 80 in 2022, underscores his unparalleled influence and the confidence investors place in his ability to navigate the luxury sector, despite growing scrutiny over succession planning. Arnault’s long-term commitment is further bolstered by the Arnault family’s significant ownership, holding 49% of share capital and 64.8% of voting rights as of end of 2024, ensuring stability and alignment with shareholder interests.

Arnault’s leadership style is characterized by a hands-on approach and a keen eye for acquisitions, having built LVMH into a €220+ billion empire through strategic purchases like Tiffany & Co. and Christian Dior. His 40-year career, including roles at Financière Agache and Christian Dior SE, has been marked by a focus on preserving brand heritage while driving innovation. However, this extension also intensifies speculation about succession, as Arnault has not publicly named a successor among his five children, Delphine, Antoine, Alexandre, Frédéric, and Jean, all of whom hold prominent positions within the group. This lack of clarity introduces a layer of uncertainty, though Arnault’s continued presence suggests a deliberate strategy to mentor the next generation internally.

The executive committee, chaired by Arnault, comprises a diverse team of seasoned leaders overseeing LVMH’s six business groups. Stéphane Bianchi, Group Managing Director since 2023, brings over 30 years of luxury experience, having previously led the Watches and Jewelry division. His role involves coordinating strategic initiatives across the conglomerate, reporting directly to Arnault.

Other key members include Pietro Beccari, CEO of Louis Vuitton since 2023, who succeeded Michael Burke and has a track record of revitalizing brands like Dior. Beccari’s leadership has driven Louis Vuitton’s double-digit growth in early 2025 reflecting his focus on product innovation and market expansion.

Recent management changes have reshaped LVMH’s leadership landscape, signaling a strategic realignment amid economic challenges. In March 2025, LVMH announced a series of high-profile appointments. Damien Bertrand, formerly CEO of Loro Piana, was appointed Deputy CEO of Louis Vuitton effective June 10, 2025, joining the executive committee in January 2026. Bertrand, with his expertise in luxury textiles, will oversee product divisions, brand communication, and sustainability, reporting to Beccari. This move strengthens Louis Vuitton’s operational depth, a brand contributing 55% of group profits.

Simultaneously, Frédéric Arnault, previously head of the Watches division, transitioned to CEO of Loro Piana on the same date, succeeding Bertrand. At 30, Frédéric’s appointment, noted for his innovative leadership at TAG Heuer, positions him as a rising star, with a transition period ensuring continuity.

Christian Dior Couture also saw significant shifts. Pierre-Emmanuel Angeloglou, formerly CEO of Fendi, was named Deputy CEO of Dior Couture effective April 15, 2025, reporting to Delphine Arnault, CEO since February 2023 and Arnault’s eldest daughter. Angeloglou, with prior experience at L’Oréal and Louis Vuitton, brings strategic marketing expertise to Dior, which accounts for 14% of group profits and faces pressure to regain momentum.

Additionally, Benedetta Petruzzo, former CEO of Miu Miu, joined as Managing Director of Dior Couture in mid-October 2024, enhancing the brand’s creative and commercial strategy under Delphine’s oversight. These appointments reflect LVMH’s strategy to bolster its top brands amid a luxury downturn.

Red flags are minimal but noteworthy. The challenges at Moët Hennessy, where Alexandre Arnault, appointed Deputy CEO in February 2025 alongside Jean-Jacques Guiony (former CFO), oversees a 13% workforce reduction to address a cognac demand slump. This shift, following Guiony’s 20-year tenure as CFO, indicates adaptability but also potential execution risks.

Overall, LVMH’s management combines Arnault’s enduring vision with a revitalized executive team, positioning the company to navigate current uncertainties while leveraging its familial and professional strengths. The recent appointments enhance operational resilience, though succession clarity and cost management will be critical as Arnault’s leadership extends into the next decade.

Culture

The culture at LVMH Moët Hennessy - Louis Vuitton, Société Européenne, is a cornerstone of its identity as a global luxury leader, reflecting a unique blend of heritage, craftsmanship, inclusivity, and environmental stewardship. This culture, deeply embedded across its 75 Maisons and over 215,000 employees worldwide is meticulously cultivated to align with the group’s mission of creating exceptional products while fostering a workplace that mirrors the exclusivity and excellence of its brands.

Three of the maisons in the Wines & Spritis segment

Drawing from multiple sources I have analyzed LVMH’s cultural landscape to provide a comprehensive understanding, particularly for those new to investing who seek insight into the human dynamics behind this corporate giant.

Employee sentiment, as gauged from Glassdoor, offers a window into LVMH’s workplace culture. As of June 2025, LVMH holds a 4.1 out of 5 rating based on over 2,300 reviews, slightly above the luxury retail industry average of 3.9. CEO Bernard Arnault earns an 82% approval rating, reflecting strong leadership confidence, though this varies by Maison. Employees frequently praise the company’s commitment to craftsmanship and innovation, with comments like “working on iconic brands like Louis Vuitton feels prestigious” and “the focus on training through IME is unmatched.” The Institut des Métiers d’Excellence (IME), launched in 2014, has trained over 3,300 apprentices across eight countries, including France and Japan, emphasizing skill preservation in 280 professions. This initiative fosters a culture of learning and loyalty, with many trainees securing permanent roles, enhancing retention.

However, Glassdoor reviews also highlight challenges. Some employees note a “high-pressure environment” and “long hours,” particularly in retail and production roles, with one review stating, “the pace can be intense during peak seasons like holidays.” Work-life balance scores around 3.5, suggesting room for improvement, especially in fast-growing segments like Sephora, where expansion (e.g., five new UK stores in 2024) may strain resources. Compensation receives mixed feedback, with a 3.8 rating; while base salaries are competitive (e.g., average €45,000 annually for retail staff per Glassdoor), bonuses tied to performance can be inconsistent, particularly outside flagship brands. Diversity is a strength, with 48% of key positions held by women (up from 23% in 2007, targeting 50% by 2025) and 1.9% of the workforce comprising people with disabilities (targeting 2% by 2025). Yet, some reviews suggest limited upward mobility for non-French employees, hinting at a cultural bias that LVMH is addressing through global hiring initiatives.

Cross-referencing with Indeed and the company’s careers page reinforces these insights. Indeed ratings align closely with Glassdoor at 4.0, with employees valuing LVMH’s “prestigious brand portfolio” and “opportunities for international exposure.” The careers page emphasizes values like creativity, excellence, and sustainability, aligning with the LIFE 360 program, which achieved a 55% reduction in energy-related CO2 emissions by 2024, two years ahead of its 2026 target.

This environmental focus resonates with employees, with 93% participating in community initiatives (targeting 100% by 2025), supporting 910 nonprofits and impacting 1.9 million people in 2024. Such engagement fosters a sense of purpose, boosting morale and reinforcing LVMH’s reputation as a socially responsible employer.

The Arnault family’s influence shapes LVMH’s culture profoundly. Bernard Arnault’s extended tenure until 85 instills a familial ethos, with his children holding key roles. This dynastic approach, while stabilizing, can create a hierarchical culture, as noted in Glassdoor reviews citing “favoritism toward family members.” Recent management changes signal a generational transition, potentially refreshing the culture with new perspectives.

This culture, rooted in excellence and innovation, supports LVMH’s brand equity and positions it as an attractive employer in the luxury sector.

For the 21st consecutive year, LVMH has been ranked the most attractive employer in France by business school students, according to the Universum 2025 study.

The company’s ongoing commitment to training, diversity, and sustainability ensures a workforce capable of sustaining its competitive edge, making it a compelling consideration for long-term investors interested in the human capital behind luxury success.

Business model

The business model of a luxury company, such as LVMH Moët Hennessy is fundamentally distinct from mass-market enterprises, emphasizing exclusivity, brand heritage, and premium pricing to cultivate an aspirational image. This model hinges on creating high-quality, limited-availability products that appeal to affluent consumers, leveraging strong brand equity to command significant margins.

Distribution is meticulously controlled through a mix of directly owned stores, selective wholesale partnerships, and e-commerce platforms, ensuring a consistent luxury experience. LVMH enhances this model by allocating substantial capital toward mergers and acquisitions (M&A), driving inorganic growth alongside organic expansion. Historically, M&A has been a cornerstone of LVMH’s strategy. Acquisitions have expanded its portfolio, though recent years have shown a decline in such activity, reflecting a shift toward optimizing existing assets amid a softening luxury market.

Source: Forbes

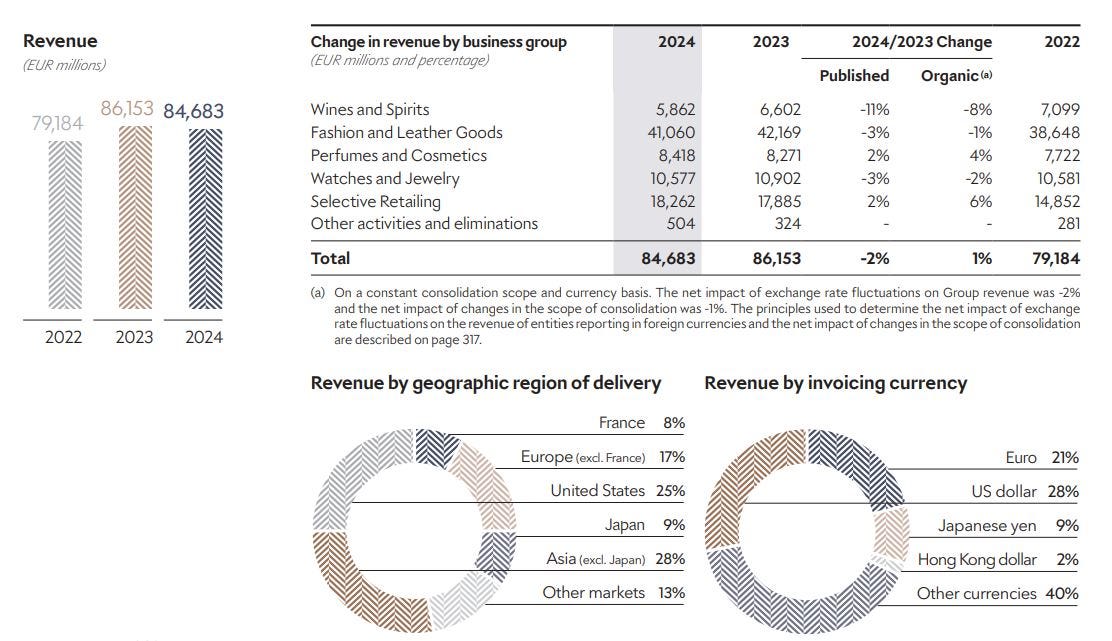

With 2024 revenues of €84.7 billion LVMH balances these approaches across its six business segments: Wines and Spirits, Fashion and Leather Goods, Perfumes and Cosmetics, Watches and Jewelry, Selective Retailing, and Other Activities. Below is an extensive analysis of each segment, detailing their revenue contributions, operational dynamics, and competitive positioning.

Wines and Spirits

The Wines and Spirits segment, encompassing brands like Moët & Chandon, Hennessy, and Dom Pérignon, represents a historic foundation of LVMH, dating back to the 1743 founding of Moët & Chandon. This segment generated €5.9 billion in revenue in 2024, a decline of 11% from the previous year.

The business model here relies on vertical integration, controlling grape cultivation, production, and distribution to ensure quality and brand prestige. The segment’s portfolio includes Champagne (e.g., Krug, Veuve Clicquot) and cognac (e.g., Hennessy), which together account for the bulk of revenue, supplemented by emerging categories like American whisky (SirDavis, via a Beyoncé partnership) and alcohol-free sparkling wine (French Bloom).

Despite a 36% drop in profit from recurring operations due to exchange rate fluctuations and a post-COVID demand normalization, particularly in China, LVMH retains over 22% of the Champagne market share. The segment’s 9% contribution to total revenue (down from 11% in 2023) reflects challenges in cognac demand, yet its high margins (historically around 30%) underscore its premium positioning. Growth potential lies in expanding into new markets and innovative offerings, though macroeconomic headwinds pose risks.

Fashion and Leather Goods

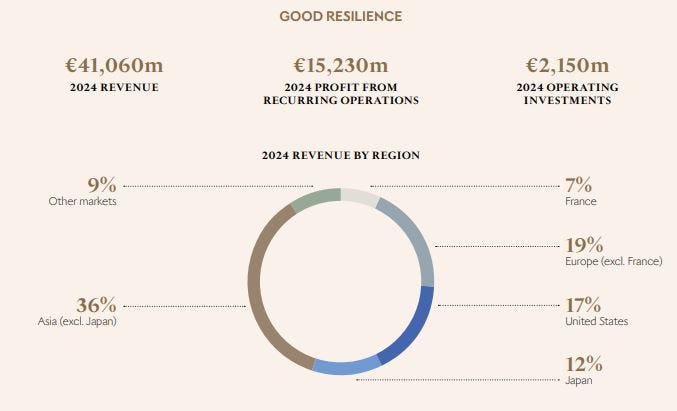

The Fashion and Leather Goods segment is LVMH’s revenue powerhouse, accounting for €41.1 billion in 2024, or 49% of total revenue, despite a 3% decline year-over-year. Dominated by Louis Vuitton, which alone surpassed €20 billion in revenue, this segment also includes Dior, Fendi, and Celine. The business model emphasizes craftsmanship, with 119 production facilities in France employing nearly 40,000 workers, and a focus on limited-edition collections to maintain exclusivity. Vertical integration extends from design to retail, with over 2,000 stores globally, enhancing control over brand experience. The segment’s 37% Adjusted EBIT margin in 2024 highlights its profitability, driven by strong demand for handbags and accessories.

Recent leadership changes, such as Damien Bertrand’s appointment as Deputy CEO of Louis Vuitton, signal a push for innovation. However, the 2024 downturn, partly due to a luxury market slowdown, suggests vulnerability to economic cycles, though Louis Vuitton’s resilience and Dior’s robust performance (e.g., Miss Dior Parfum success) provide stability.

Perfumes and Cosmetics

The Perfumes and Cosmetics segment contributed €8.4 billion in 2024, a 2% increase, bolstered by brands like Christian Dior, Guerlain, and Givenchy. This segment’s business model leverages a selective distribution network, including 3,000 Sephora points of sale, to reach a broad yet discerning audience. Innovation is key, with products like Dior’s Sauvage (the world’s leading fragrance) and Guerlain’s Florabloom driving growth, though profit from recurring operations fell 6% due to rising costs.

The model benefits from vertical integration in fragrance development and packaging, ensuring quality, while partnerships (e.g., Rihanna as J’adore’s new face) enhance market appeal. Contributing 10% to total revenue, this segment thrives on evolving beauty trends and a 4% organic growth rate in 2024. Challenges include competition from niche brands and cost pressures, but its focus on premium lines and sustainability positions it for long-term growth.

Watches and Jewelry

Generating €10.6 billion in 2024, a 3% decline, the Watches and Jewelry segment includes Tiffany & Co., Bulgari, and TAG Heuer. The business model centers on high jewelry and timepieces, with vertical integration covering design, production, and retail. The 2019 Tiffany acquisition quadrupled high jewelry revenue and doubled operating profit since integration, reflecting strategic success. The segment’s 13% revenue share is modest but growing, with Tiffany’s U.S. presence and Bulgari’s Aeterna collection boosting visibility. TAG Heuer’s 2025 Formula 1 timekeeper role and Chaumet’s Olympic medal designs further elevate brand equity. However, competition from Richemont’s Cartier and a 5% Q1 2025 revenue drop indicate pressure. The segment’s future hinges on innovation and market expansion, particularly in Asia.

Selective Retailing

The Selective Retailing segment, featuring Sephora and DFS Group, recorded €18.3 billion in 2024, a 2% increase, making up 22% of revenue. This segment’s model focuses on curated luxury experiences, with Sephora’s 3,000+ stores and DFS’s duty-free operations at 180+ airports. Vertical integration ensures control over store design and product assortment, while partnerships (e.g., Kohl’s collaboration) drive growth, especially in the U.S. and U.K.. Sephora’s double-digit profit growth contrasts with DFS’s struggle to recover to pre-COVID levels, impacted by exchange rates and travel disruptions. The segment’s 6% organic growth and stable profit reflect resilience, though its reliance on travel retail exposes it to geopolitical risks. Expansion into emerging markets and digital channels offers growth potential.

Other Activities

The Other Activities segment, including hospitality (Belmond, Cheval Blanc) and media (Les Echos), contributed a smaller, undisclosed portion of the €84.7 billion total, likely under 5%. This segment’s model diversifies LVMH’s portfolio, with Belmond’s luxury hotels and Cheval Blanc’s experiential offerings targeting affluent travelers. Vertical integration covers property management and branding, while media operations enhance corporate influence. The 2024 Olympic sponsorship falls here, boosting visibility but straining profits. Growth is niche, driven by tourism recovery, but the segment’s scale limits its revenue impact. Its role is strategic, supporting the conglomerate’s luxury ecosystem rather than driving significant income.

Overall Business Model Insights

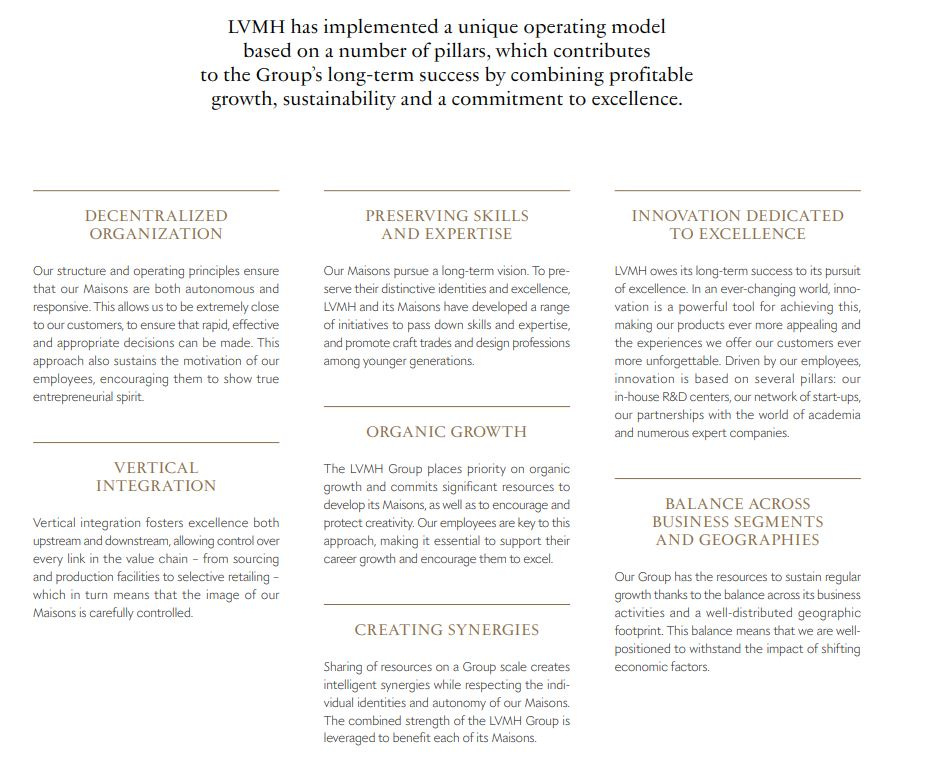

LVMH’s decentralized structure allows each Maison autonomy, fostering creativity, while vertical integration ensures quality and exclusivity, hallmarks of its luxury strategy.

Revenue distribution across segments mitigates risk, with Fashion and Leather Goods as the profit engine and Selective Retailing gaining traction. Geographic balance, with 31% from Asia, enhances resilience. Challenges include a 2% revenue drop in 2024, reflecting luxury market softening, yet the model’s adaptability, via acquisitions and innovation, positions LVMH for future growth.

Strategy and Moat

LVMH Moët Hennessy has built its enduring success on a robust strategy and a formidable economic moat, positioning it as the preeminent player in the global luxury goods market. LVMH’s approach integrates strategic priorities with inherent competitive advantages, ensuring resilience amid economic volatility. This section provides an extensive analysis of LVMH’s strategic framework and its protective moat, offering critical insights for investors evaluating long-term value.

Strategic Framework

LVMH’s strategy is anchored in four major strategic priorities: Brand Enhancement, Global Expansion, Innovation and Creativity, and Sustainability and Responsibility. These pillars guide its operations across their six business segments.

Brand Enhancement: LVMH invests heavily in elevating the desirability and exclusivity of its 75 Maisons, a cornerstone of its luxury positioning. This involves high-profile marketing campaigns, such as Louis Vuitton’s collaboration with Takashi Murakami, Dior’s Olympic Games sponsorship and Tag Heuer’s Formula 1 sponsorship, which reinforce brand equity. The appointment of creative directors like Michael Rider at Celine and Sarah Burton at Givenchy ensures continuous innovation, while store renovations, e.g., Tiffany’s 27% network update, enhance customer experience. This focus maintains LVMH’s premium pricing power, with brands like Louis Vuitton contributing over 55% of group profits.

Global Expansion: LVMH pursues geographic diversification to mitigate regional risks, with a balanced revenue mix of 25% from the U.S., 25% from Europe, and 31% from Asia in 2024. Strategic store openings, such as Bulgari’s flagship in Milan and Sephora’s five new U.K. stores, target high-growth markets. The 2019 Tiffany acquisition bolstered U.S. presence, while investments in Japan capitalize on tourist demand which increased due to a weaker yen. This expansion, though slowed by recent M&A declines, leverages LVMH’s 6,307 stores to penetrate emerging markets like the Middle East and Latin America.

Innovation and Creativity: LVMH fosters a culture of innovation, evident in product launches like Hennessy’s SirDavis whisky and Louis Vuitton’s La Beauté beauty line. The trainings institute IME ensures craftsmanship continuity, while digital initiatives adapt to e-commerce trends. This commitment, supported by recent leadership changes, drives organic growth, though the 2% revenue drop in 2024 signals market saturation risks.

Sustainability and Responsibility: The LIFE 360 program, achieving a 55% reduction in CO2 emissions by 2024 aligns with consumer demand for ethical luxury. Using 31% recycled materials and protecting 3.8 million hectares of biodiversity enhances brand reputation, while 93% employee community involvement boosts morale. This strategy mitigates regulatory risks and appeals to younger demographics.

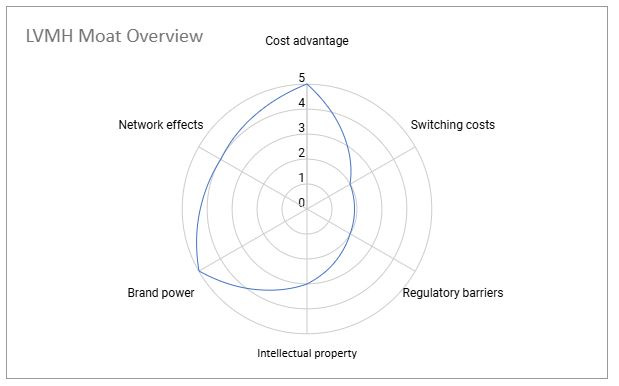

Moats

LVMH’s moat is evaluated across six types, with rankings based on their strength and relevance:

Switching Costs (Rank: 2)

Switching Costs in LVMH’s context are primarily psychological rather than contractual or financial, as customers can easily purchase a competitor’s brand like Chanel or Hermès. The perceived social status and identity tied to LVMH products create a reluctance to switch, but this is more a function of brand loyalty than a tangible barrier like software lock-in. The 2/5 ranking reflects this limited moat strength, as the ease of switching to alternatives reduces its protective power compared to Brand Power.Cost Advantage (Rank: 5)

Vertical Integration and Control form the backbone of LVMH’s Cost Advantage moat. Owning 119 production facilities in France and over 2,000 stores globally reduces reliance on third parties, lowering costs and ensuring quality. This integration enables high margins and shields LVMH from supply chain volatility, outpacing competitors like Kering. The 5/5 ranking underscores its efficiency and scalability.Regulatory Barriers (Rank: 2)

Regulatory barriers offer limited protection for LVMH. While luxury goods face import/export regulations (e.g., tariffs impacting Wines and Spirits), these are industry-wide and not specific to LVMH. Sustainability mandates (e.g., EU Green Deal) encourage compliance but don’t create a moat, as competitors like Richemont adapt similarly. The 2/5 ranking reflects minimal competitive insulation.Brand Power (Rank: 5)

LVMH’s Brand Power moat is unrivaled, driven by 200-year-old legacies like Moët & Chandon and Louis Vuitton and top market positions like Dior and Tiffany. The Arnault family ensures brand consistency, while campaigns like the Olympic medal trunks enhance equity. This 5/5 ranking highlights its near-impenetrable market dominance.Intellectual Property (Rank: 3)

Intellectual Property, including trademarks and design patents, like the Louis Vuitton’s monogram, protects LVMH’s innovations. The IME preserves craft techniques, and new products are patented, deterring imitation. However, luxury IP is replicable by competitors with resources, limiting its moat strength to 3/5, though legal enforcement bolsters its value.Network Effects (Rank: 4)

LVMH’s 6,307 stores and selective distribution create Network Effects, where greater presence drives demand, justifying further investment. This scale, surpassing Richemont’s 1,500 stores, amplifies visibility and loyalty. The 4/5 ranking reflects strength, though saturation in mature markets slightly tempers its impact.

Porter’s Five Forces Analysis

Applying Porter’s Five Forces to LVMH:

Threat of New Entrants: Low. The luxury sector’s high entry barriers like significant capital for brand building, LVMH’s Cost Advantage, and Brand Power deter new players. While digital platforms and niche brands occasionally emerge, the time and investment required keep this threat low. Regulatory hurdles like import tariffs add friction but are not decisive.

Threat of Substitutes: Moderate. Alternatives like high-end fast fashion or artisanal brands challenge LVMH, particularly among price-sensitive luxury buyers. However, the unique craftsmanship and status of LVMH products maintain a moderate threat level, mitigated by Brand Power.

Buyer Power: Low. The exclusivity of LVMH’s offerings reduces buyer influence. Affluent customers, driven by desire for prestige items, have little leverage due to controlled supply and low Switching Costs, justifying a low rating.

Supplier Power: Low to Moderate. Dependence on raw materials (e.g., leather, precious metals) varies, but vertical integration and long-term supplier relationships minimize this risk, keeping power low to moderate.

Competitive Rivalry: High. Intense competition from Kering, Richemont, and Hermès drives rivalry, but LVMH’s scale, Network Effects, and strategic agility provide a competitive edge.

Overall, LVMH’s Cost Advantage, Brand Power, and Network Effects form a durable moat, with Intellectual Property and Switching Costs offering supplementary protection.

Competition

LVMH is positioned as a leader, yet not without challenges. Competitors such as Hermès, Brunello Cucinelli, Kering, and Burberry each bring distinct strategies, market positions, and financial performances that test LVMH’s dominance. This extensive analysis explores their competitive dynamics, recent results, and strategic approaches, drawing on current industry trends and performance indicators to assess how they challenge or complement LVMH’s standing.

Hermès

Hermès, a French luxury house with roots in 1837, stands as LVMH’s closest rival, boasting a market capitalization of approximately €240 billion in mid-2025. Unlike LVMH’s diversified portfolio of 75 Maisons, Hermès operates under a single, ultra-premium brand, focusing on leather goods (e.g., Birkin and Kelly bags), fashion, jewelry, and watches. Its 2024 revenue reached €13.4 billion, a fraction of LVMH’s but with a higher growth rate, reflecting resilience amid a luxury slowdown. The company’s strategy hinges on controlled scarcity, long waiting lists for iconic items enhance desirability, supported by in-house production across 19 French ateliers.

This vertical integration mirrors LVMH’s approach but is more concentrated, yielding operating margins around 40%. Hermès’ family ownership (Dumas family) ensures strategic consistency, appealing to ultra-high-net-worth clients who prioritize exclusivity over volume. Its recent price hikes to offset U.S. tariffs and 13% Q2 sales growth (despite a broader downturn) highlight its ability to weather economic shifts, posing a direct threat to LVMH’s market share among top-tier consumers.

Brunello Cucinelli

Brunello Cucinelli, an Italian brand founded in 1978, has emerged as a niche competitor with a 2024 revenue of €1.28 billion, up 12.4% year-over-year, outpacing the luxury sector’s struggles. Known for cashmere and “quiet luxury,” it targets high-net-worth individuals seeking understated elegance, contrasting with LVMH’s broader appeal. Its business model emphasizes in-house artisanal production in Solomeo, Italy, with a new 48,600-square-foot facility set for 2025, and a balanced global presence (37.3% Americas, 35.7% Europe, 27% Asia). The company’s 10.5% Q1 2025 sales growth and projection of 10% annual growth through 2026 signal robust demand, driven by full-price sales and digital channels (double-digit growth).

Investments in showrooms and marketing (8.5% sales impact in 2024) bolster its brand equity, while its “humanistic capitalism” philosophy, paying employees 20% above average wages, enhances its ethical appeal. Though its scale is modest compared to LVMH, its focus on exclusivity and craftsmanship challenges LVMH’s mid-tier brands and could attract younger affluent buyers shifting from logo-heavy labels.

Kering

Kering, another French conglomerate, oversees brands like Gucci, Saint Laurent, and Balenciaga, with a 2024 revenue of approximately €20 billion and a market cap around €22 billion in mid-2025. This positions it well behind LVMH but as a significant contender due to its focus on fashion and leather goods, mirroring LVMH’s strongest segment.

Kering’s strategy has shifted toward revitalizing Gucci, which saw a 9% sales drop in Q3 2023, prompting executive overhauls and a pivot to quieter luxury aesthetics. Its operating margin (14.9% company-wide) lags LVMH’s 23.1%, reflecting struggles with brand dilution and weaker Chinese demand (down 27% for Richemont’s region). Vertical integration supports production, but Kering’s reliance on fewer, high-profile brands (versus LVMH’s 75) exposes it to single-brand risks. A -10.9% revenue forecast for 2025 indicate vulnerability, yet its agility in adapting to trends could pressure LVMH’s market share if Gucci rebounds.

Burberry

Burberry, a British heritage brand founded in 1856, reported a 2024 revenue of £3.2 billion, with a market cap around £4.2 billion in mid-2025, placing it far below LVMH. Its strategy has faltered recently, with a 22% sales drop in July 2024 due to a failed upmarket shift and over-reliance on trendy designs, alienating core customers. The appointment of Joshua Schulman, ex-Coach CEO, aims to refocus on classic offerings, but Q1 2025 sales remain weak, with analysts predicting losses. Burberry’s operating margin (historically around 15%) is outpaced by LVMH’s segments, and its 124 stores (versus LVMH’s 6,307) limit global reach. Vertical integration exists but is less extensive, increasing reliance on external suppliers. The brand’s discounting in China to clear inventory contrasts with LVMH’s full-price strategy, eroding its premium positioning. While not an immediate threat, Burberry’s potential recovery under new leadership could challenge LVMH’s mid-range brands if it recaptures its heritage appeal.

Richemont

Richemont, a Swiss luxury group founded in 1988, oversees brands like Cartier, Piaget, and Montblanc, reporting €20.6 billion in 2024 revenue, with a market cap of approximately €76 billion in mid-2025. Specializing in jewelry and watches, it competes directly with LVMH’s Watches and Jewelry segment. Richemont’s strategy emphasizes high craftsmanship, with in-house production at 30+ manufacturing sites, and a focus on Asia (40% revenue), where it saw a 6% sales decline in Q4 2024/25 due to a luxury slowdown. Its operating margin (around 22%) nears LVMH’s, supported by Cartier’s dominance in high jewelry. Recent moves include expanding digital sales (up 15% year-over-year) and opening flagship stores in emerging markets. Richemont’s 1,500+ retail points lag LVMH’s scale, but its niche expertise and resilience in watches (e.g., Panerai’s growth) pressure LVMH’s Tiffany and Bulgari brands, especially in Asia.

Competitive Landscape and Strategic Implications

The luxury market’s 2% revenue dip in 2024 and softening Chinese demand create a shifting terrain. Hermès’ scarcity model and 13% Q2 growth challenge LVMH’s elite offerings, pushing it to enhance exclusivity, particularly as Hermès briefly led in market cap in April 2025.

Brunello Cucinelli’s quiet luxury rise, with 10% growth forecasts, opens a lane for LVMH to adapt mid-tier brands to this trend, leveraging its vast resources. Kering’s Gucci pivot and Richemont’s watch strength signal future threats, with Richemont’s Asia focus testing LVMH’s regional dominance. Burberry’s decline offers LVMH a chance to capture share, but its potential turnaround could reintroduce pressure. The shift toward understated luxury and tariff impacts favor Hermès and Cucinelli, while LVMH’s 6,307 stores and 215,000 employees provide a scale advantage to counter Richemont’s niche prowess and Kering’s recovery potential. To stay ahead, LVMH must innovate beyond its current scope, balancing sustainability gains with competitive pricing strategies.

Financials

LVMH’s financial health is a critical factor for investors. That is why I will analyze its income statement, balance sheet, cash flow statement, key ratios, and recent trends, drawing on the latest available data to provide a comprehensive overview.

Balance sheet health

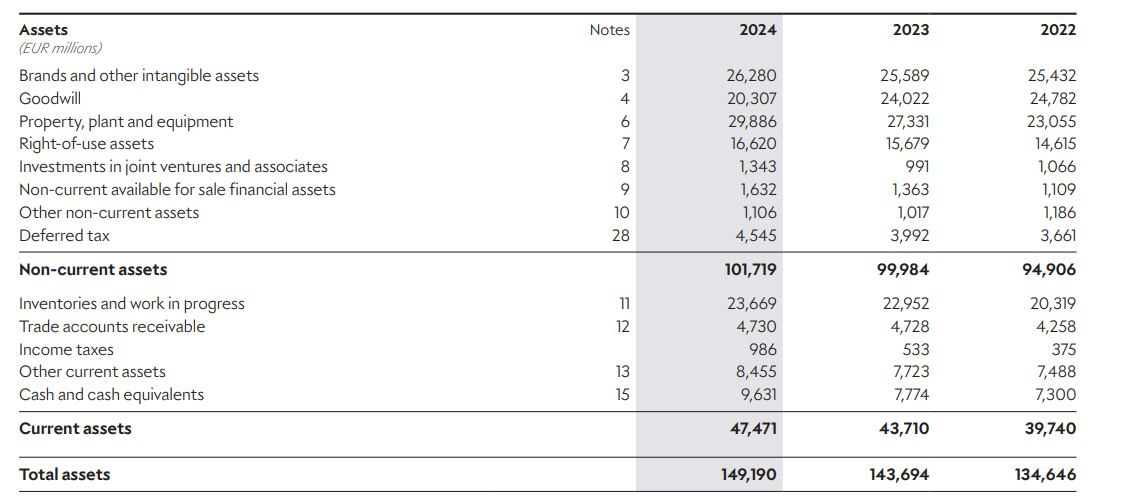

Lets start with the Assets side of the balance sheet, where total assets stood at €149.2 billion, up 4% from 2023, with net property, plant, and equipment at €29.9 billion and intangible assets (e.g., brands like Tiffany) at €46.6 billion.

Non Current Assets

Let’s dive into LVMH’s non-current assets, starting with the goodwill balance, which dropped by €3.7 billion from 2023 to 2024. This decline reflects a combination of factors: €2.4 billion in new goodwill from acquisitions like Swiza and Nuti Ivo, a €1.7 billion impairment on existing goodwill, and a significant €4.4 billion reduction in goodwill arising on purchase commitments for minority interests’ shares. This net decrease warrants a closer look, given my focus on quality businesses with sustainable cash flows.

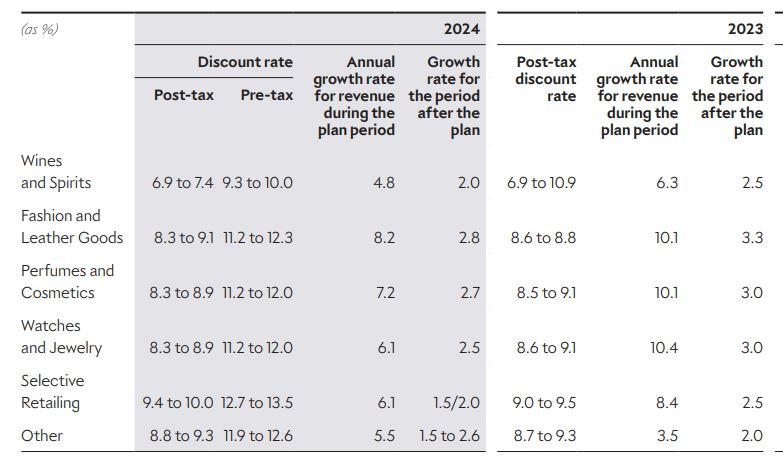

The €1.7B Impairment

An impairment on goodwill is always worth exploring, as it signals a reassessment of future cash flow generation, a key metric for long-term investors like us. The €1.7 billion write-down suggests lowered expectations, aligning with the current luxury market slowdown. LVMH’s annual report confirms this, noting reduced growth rates across most segments, except “Other.” While some dismiss impairments as non-cash items, they matter because they reflect diminished future growth prospects.

The report highlights that the impairment test assumptions remain optimistic, with management stating they are

“not deemed relevant in view of the current economic environment and medium- to long‑term growth prospects.”

However, a four-point decrease in the average revenue growth rate, primarily in the Watches and Jewelry segment, is cited as a pessimistic yet low-probability scenario driving the majority of this impairment. This segment’s struggles, amid tariff pressures and weakening demand, underscore the broader luxury headwinds impacting LVMH. The majority of the impairment of €1.7B was booked on the Watches and Jewelry segment, which carries the highest intangible assets and goodwill balance within LVMH. I think it’s a good sign that quite a significant drop in annual growth rate for the different segments, hardly resulted in an impairment.

The €4.4 Billion Drop in Purchase Commitments

The €4.4 billion reduction in goodwill arising on purchase commitments for minority interests’ shares is equally significant. This drop stems from a lower fair value of these commitments, notably the option granted to Diageo, which holds a 34% stake in Moët Hennessy. Diageo can force LVMH to buy this stake at any time with six months’ notice, and LVMH is obligated to comply. The revaluation reflects decreased operating results at Moët Hennessy and lower share price multiples of comparable firms, likely due to 2024’s wine and spirits market challenges, paralleling the luxury sector’s broader softness. Though no purchase has occurred, this adjustment reduces the goodwill asset, offering insight into LVMH’s valuation resilience amid market turbulence.

Implications for Quality Investing

The wine and spirits industry faces increasing pressure as a declining business, with a growing shift toward non-alcoholic drinks. Global wine consumption fell 3.3% in 2024, and LVMH’s Wines & Spirits segment saw an 11% revenue drop to €5.9 billion, driven by a rise in “sober curious” trends, 49% of Americans plan to drink less in 2025, with non-alcoholic sales nearing $1 billion in the U.S. alone.

This obligation to buy Diageo’s 34% stake in Moët Hennessy could strengthen LVMH’s position in this challenged sector, but the lower goodwill balance (€4.4 billion drop) suggests a reduced fair value, likely due to weakened operating results amid these market shifts. While this might lower the purchase price, it’s a mixed blessing for quality investors, potentially diluting LVMH’s focus on higher-growth segments and exposing the portfolio to a sector with uncertain long-term cash flows.

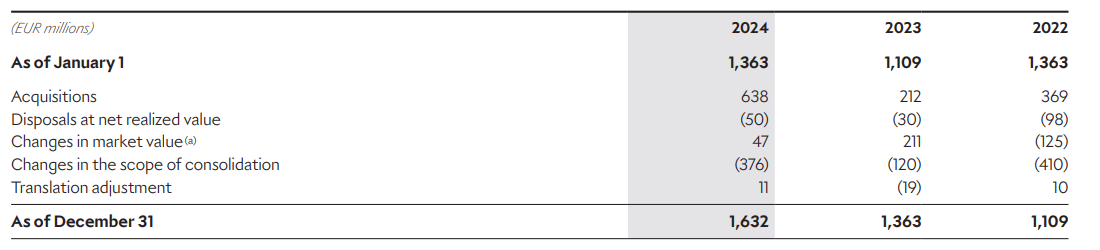

Non-Current Available-for-Sale Financial Assets

LVMH’s non-current available-for-sale financial assets rose to €1.6 billion in 2024, with a €638 million acquisition boost, partly tied to its September 2024 deal to acquire up to 22% of Double R, Remo Ruffini’s vehicle controlling 18.5% of Moncler. This reclassified €376 million from available-for-sale to equity method assets, delaying full consolidation to 2025, reflecting a strategic minority stake. This strengthens LVMH’s luxury dominance and supports Moncler’s growth.

Current Assets

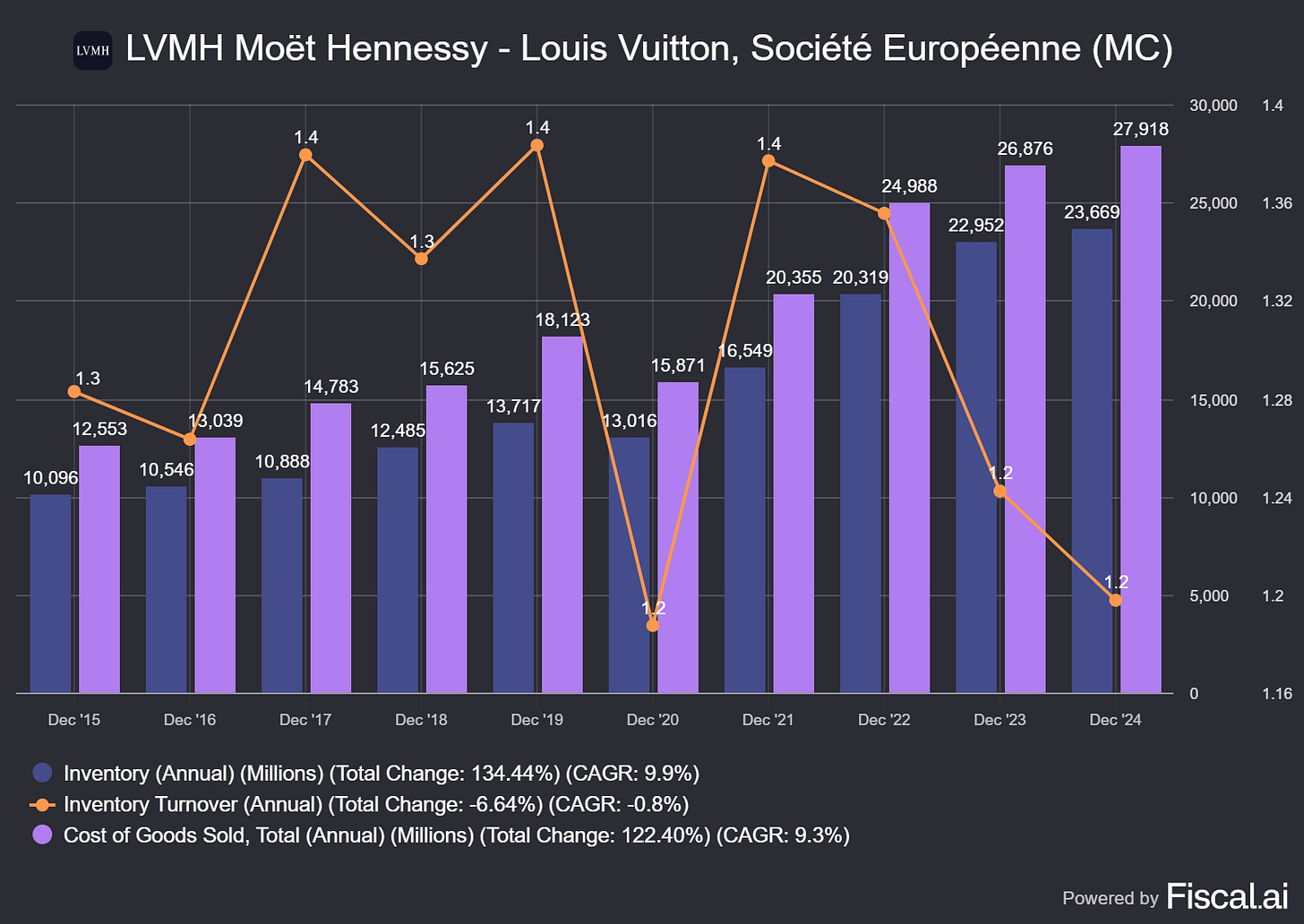

The most striking balance sheet item on the assets side of current assets is inventory. The chart reveals a rise from €10.1B in 2015 to €23.7B in 2024, with a CAGR of 9.9%, compared to COGS growing from €12.6B to €27.9B (CAGR 9.3%).

Comparing inventory growth to Cost of Goods Sold (COGS) reveals a 3% increase (€0.7 billion) in 2024, slightly outpacing COGS stability, indicating cautious restocking amid a luxury slowdown. The inventory turnover of 1.2, stable over recent years, means stock turns over every 10 months, reflecting the slow pace of luxury goods sales. This supports LVMH’s pricing power. All in all, the increase in inventory seems fine.

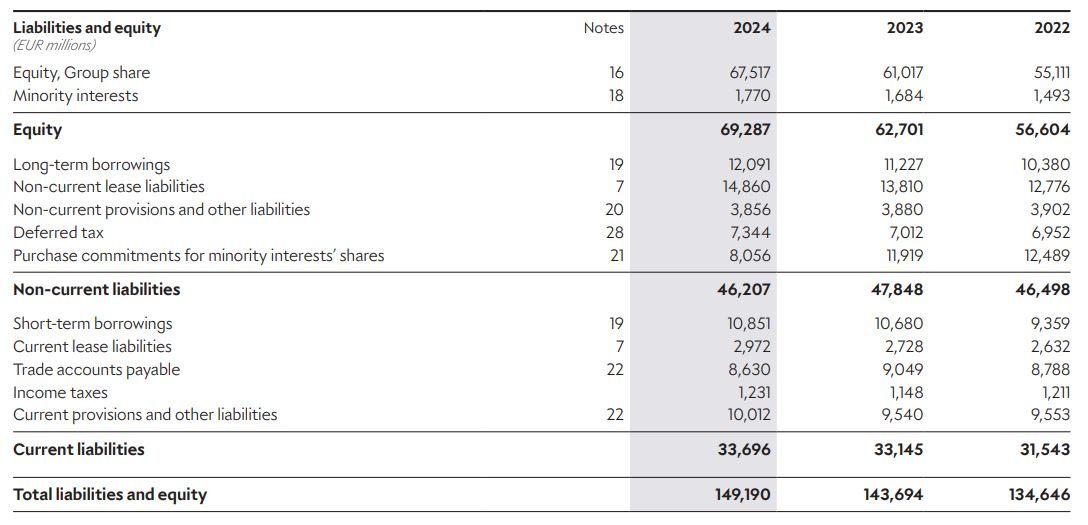

Liabilities and Equity

Moving on to the other side of the balance:

Non Current liabilities

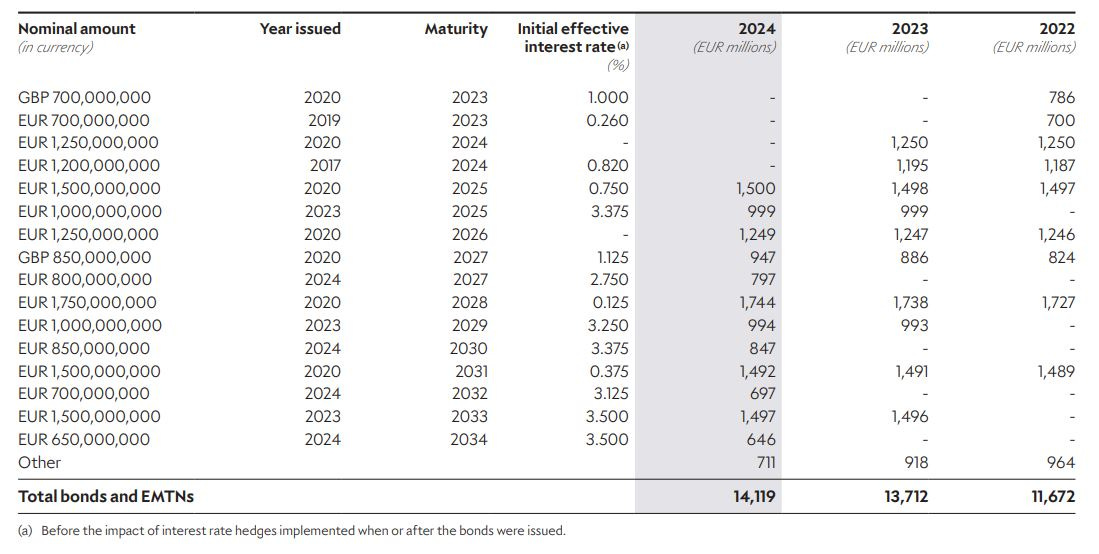

LVMH’s long-term borrowings rose to €12.1 billion in 2024, up €0.9 billion from 2023, with the majority comprising €11.6 billion in bonds and Euro Medium-Term Notes (out of a total €14.1 billion).

Tracking bond maturities is key for quality investors. Bonds due in 2025 (e.g., GBP 700 million issued 2020) are reclassified as short-term debt, leaving the €11.6 billion as the long-term portion. Notably, 2020 bonds issued at near-zero rates (e.g., 0.260%) now face effective rates above 3% due to rising market conditions, increasing interest costs. LVMH’s "AA-" (S&P) and "A1" (Moody’s) investment-grade ratings reflect its strong creditworthiness, supporting the favorable €10 billion credit facility renegotiated in 2024, with €10.8 billion in undrawn lines exceeding short-term debt of €7.2 billion. While some credit lines may have financial ratio requirements, none were significant as of year-end, offering flexibility amid a luxury slowdown.

Additionally, the €8.1B in purchase commitments for minority interests’ shares under non-current liabilities reflects LVMH’s obligation to potentially buy out minority stakes (e.g., Diageo’s 34% in Moët Hennessy), mirroring the goodwill reduction discussed earlier as its fair value declined.

Current liabilities

LVMH’s current liabilities stood at €33.7 billion in 2024, with a current ratio of 1.4, meaning current assets (€47.5 billion) cover liabilities 1.4 times over.

This ratio, down from 1.5 in 2015 (-0.6% CAGR), indicates solid short-term liquidity for a luxury giant, aligning with peers and supporting its moat in a slowing market.

Group Equity and Shares

LVMH’s group equity rose to €69.3 billion in 2024, up €3.7 billion (5.7%) from 2023, closely tracking the total balance sheet’s €5.5 billion increase to €149.2 billion. I love seeing this growth, as it reflects reinvested profits rather than heavy dividend or too heavy share buybacks that can lead to negative equity, a pitfall I avoid in quality investing. The assets-to-equity ratio remains stable around 2.2, signaling robust net worth. Weighted average shares outstanding close to 500M, slightly below the 2015 figureof 504.9M.

Currently LVMH has a running share buyback program which started in February and will be ending in November. They have a mandate for the acquisition of own shares for up to €1B and the shares repurchased are intended to be cancelled. On the total market cap this less than 0.5% of the total outstanding shares.

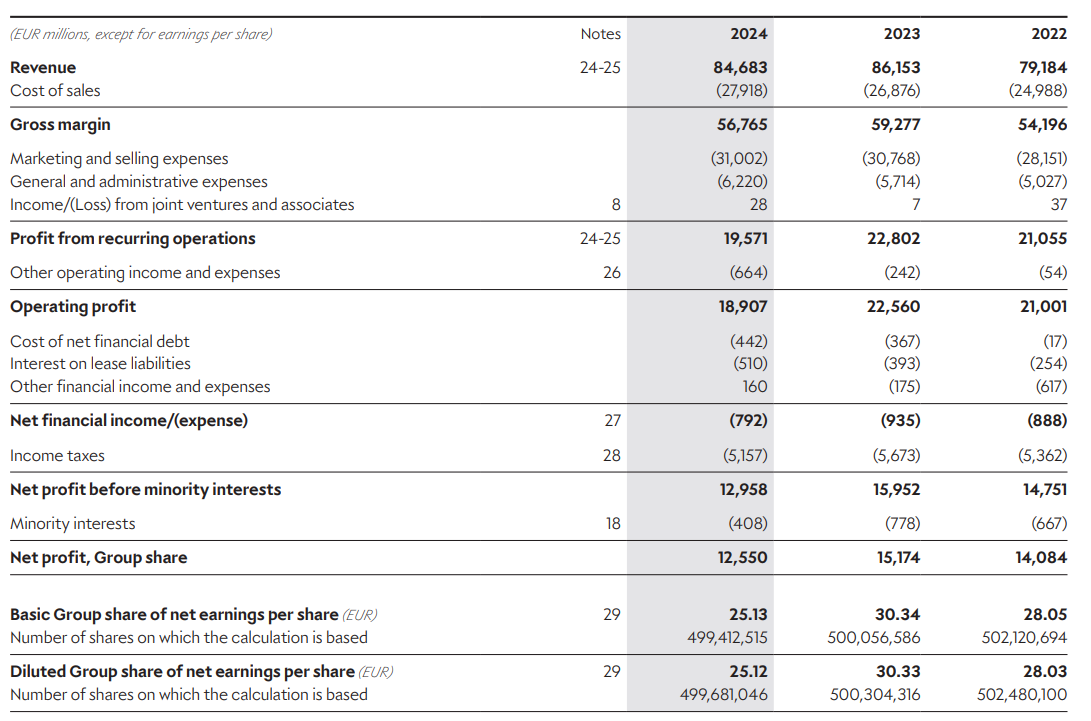

P&L

Let’s move to the P&L. I have already discussed the segments in the Business model section, so not going to discuss revenue and margins by segment again.

Revenue Split

The revenue split by segment and regions shows that on a constant consolidation scope and currency basis the organic growth in total for 2024 versus 2023 was +1%, although Wines & Spirits saw an organic decline in revenue of 8%.

By region it gives a clear picture that LVMH is well diversified across the globe and also that the revenue by invoicing currency is diversified. Japan delivered 9% of the revenue versus 7% in 2023, supported by a low currency. At the same time Asia dropped from 31% to 28%, partially explained by Asian customers buying goods in Japan.

Gross margin

It is clear that gross margin have been on elevated levels since the covid period and are now returning to original gross margin levels of around 67%, which is still at the high end versus the period before 2021.

I expect going forward we should see a gross margin more in line with the 65-67% range.

Selling, General and Administrative Expenses (SG&A)

Marketing and selling costs for LVMH reached €31.0B in 2024, reflecting a 1% rise based on reported figures and a 2% increase when adjusted for consistent consolidation scope and currency effects. These expenses represented 36.6% of total revenue, an increase of 0.9 percentage points from the prior year. The uptick was primarily driven by the expansion of the Maisons’ retail networks, though within these costs, advertising and promotion spending dropped by 3% on a constant basis, accounting for 11.5% of revenue.

Additionally, the total Selling, General, and Administrative (SG&A) expenses as a percentage of revenue rose to 44% in 2024, aligning with pre-COVID levels as the company ramps up operational and marketing efforts. This increase reflects a return to historical cost structures, driven by both the expanded retail network and broader administrative investments.

Other operating income and expense

LVMH’s other operating income and expense line in 2024 includes several one-off items that are non-repeatable, impacting the overall financial picture. Notable among these are gains from asset disposals and restructuring costs, which distort the recurring operational performance. The net loss of €199M is mainly related to the disposal of Off-White.

Cost of Net Financial Debt

LVMH’s borrowing costs rose in 2024 due to higher interest rates, with 2020 bonds originally issued at near-zero rates now facing effective rates above 3%, driven by market shifts. This increase, tied to its long-term debt, underscores the impact of a tightening financial environment. Looking ahead, I anticipate an additional €75 million rise in 2025, reflecting the maturity and refinancing of two bonds at current higher rates.

Capital Efficiency and Allocation

Capital efficiency reveals how well a company turns money into profits. LVMH’s 16.7% calculated return on invested capital (ROIC) exceeds its weighted average cost of capital which is around 10%, signaling value creation.

Capex at 6.5% of sales underscores a capital-light model, freeing cash to allocate, €14.2B in 2024: 6.5B in dividends, 438M in cash acquisitions, 6.6B debt repayments and 312M of stocks repurchased.

LVMH’s dividend payout surged from €1.7 billion in 2015 to €6.5 billion in 2024, a 16% CAGR, with a payout ratio exceeding 50% and a yield of around 2.7%, both historically high. While appealing to income seekers, this consumes ~45% of the €14.2 billion free cash flow, leaving less for reinvestment. I prefer M&A, growth capex, or share buybacks to strengthen LVMH’s moat over dividends, as these drive long-term value.

In 2017 and 2021 LVMH deployed cash to two big acquisitions: Christian Dior and Tiffany. LVMH’s acquisition of Christian Dior in 2017 for €13.1 billion, consolidating full control under Bernard Arnault’s family, proved a shareholder value success. By integrating Dior into its Fashion & Leather Goods segment, LVMH leveraged synergies, boosting revenue from €22.2 billion in 2019 to €41 billion in 2024 with operating margins at 37%. This strengthened LVMH’s luxury dominance, enhancing shareholder returns through organic growth and brand equity.

Conversely, the $15.8 billion Tiffany acquisition in 2021, completed after pandemic negotiations, has shown mixed results. While it elevated Watches & Jewelry revenue from 7.5% to 12.5% of total sales, post-acquisition challenges like unachievable sales targets and lower commissions have underperformed expectations. Vogue Business notes Arnault’s “sleeping beauty” vision, with the reopened NYC flagship signaling potential, but shareholder value remains uncertain amid the current luxury slowdown.

Bernard Arnault’s capital allocation prowess has been (and will be) a cornerstone of LVMH’s ascent as a luxury titan. His strategic acquisitions showcase a knack for timing, securing Dior for €13.1 billion to boost margins and negotiating Tiffany down from $16.2 billion to $15.8 billion amid COVID-19. Reinvesting profits into high-ROIC segments like Fashion & Leather Goods and minority stakes like Moncler reflects disciplined growth.

Shareholder Value and LVMH’s Ownership Structure

LVMH’s shareholder value is significantly shaped by its ownership structure, where the Arnault family, alongside Agache SCA, maintains a dominant position as of December 31, 2024. The family holds 49.00% of the company’s share capital (245,173,934 shares) and commands 64.81% of voting rights, securing robust strategic oversight. This control is distributed with 41.87% of capital and 56.77% of voting rights channeled through Christian Dior SE, supplemented by an additional 7.13% capital and 8.04% voting rights held directly by the family and its affiliates, creating a layered influence that aligns long-term growth with their vision, as depicted in the organizational chart.

This dual-layered structure, illustrated in the organizational chart, amplifies the Arnault family’s influence, aligning long-term growth with their vision.

The company’s approach to stock options and bonus share plans further supports shareholder interests with minimal dilution risk. No share purchase or subscription option plans have been active since the 2009 plan expired in 2019, effectively eliminating any dilution from options. Meanwhile, bonus share plans, which have awarded 869,823 shares since 2020, saw 161,235 shares vest in 2024, leaving 658,239 shares pending. These awards, tied to performance metrics like profit growth and sustainability goals, are drawn from existing shares rather than new issuances, preserving shareholder value.

Stock-based compensation (SBC) at LVMH, however, invites some scrutiny. The LVMH Shares employee ownership plan has engaged nearly 50,000 employees, with costs embedded in the €6,220 million general and administrative expenses, up 9% in 2024. While specific SBC figures aren’t isolated, the plan’s success hints at strong alignment with shareholder goals. Still, its impact on 2024 earnings merits ongoing attention. The Arnault family’s 49% insider ownership, combined with the CEO’s proven capital allocation skills, reinforces this alignment, making it a feature I highly value in a quality company.

Risks

LVMH faces a spectrum of risks that could impact its ability to execute its luxury goods strategy. These risks are categorized into operational and business, external environment, and financial risks, with severity ratings from 3 (moderate) to 1 (critical).

Operational and Business Risks

Products or Communication Misalignment (Severity: 1): The €44.6 billion in brand value (down from €47.8 billion in 2023) is vulnerable to image-damaging products or marketing, mitigated by strict quality controls, brand protection, and media monitoring.

Raw Material Access and Pricing (Severity: 2): Dependence on scarce materials (e.g., grapes, leather, gold) and price volatility due to climate change or geopolitics is managed through in-house sourcing, traceability (LIFE 360), and hedging precious metals.

Cybersecurity (Severity: 2): Rising cyberattacks threaten data and operations, countered by a robust framework including SOC/CERT 24/7 monitoring, vulnerability management, and cloud security enhancements.

Talent Management (Severity: 3): Loss of expertise in leather goods or watchmaking is addressed via training, internal mobility, and LVMH Métiers d’Art support, preserving craft traditions.

Risks Related to the External Environment

Geopolitical and Economic Instability (Severity: 1): Disruptions from tariffs, tourism drops, or economic downturns are offset by global diversification and brand appeal, though import tariffs remain a concern.

Climate Change (Severity: 1): Ecosystem depletion and supply chain interruptions are tackled with LIFE 360, Scope 1-3 emissions targets, and regenerative agriculture, aiming for 5 million hectares protected by 2030.

Business Interruptions (Severity: 2): Risks from fires or natural disasters are minimized through HPR standards, audits, and the BCP Accelerator program for continuity.

Counterfeiting and Parallel Networks (Severity: 2): Brand erosion from counterfeits or unauthorized sales is combated with IP registration, cooperation with e-commerce platforms, and traceability initiatives.

Legal and Regulatory Compliance (Severity: 2): Complex global regulations (e.g., GDPR, EU Green Deal) are managed via a global legal network, compliance training, and a dedicated vigilance governance structure since 2024.

Financial Risks

Foreign Exchange (Severity: 1): Currency fluctuations (e.g., USD, CNY) impacting €84.7 billion revenue are hedged at 73% for key currencies, reducing exposure.

Liquidity and Interest Rates (Severity: 3): With €10.9 billion short-term debt covered by €13.6 billion cash and €10.8 billion undrawn lines, liquidity is strong, though rising rates (e.g., 3%+ on 2020 bonds) are managed with swaps.

Tax Policy (Severity: 3): Global tax complexity and double taxation risks are mitigated by a transparent tax policy, country-by-country reporting, and a 2022 French tax partnership.

While LVMH’s risk management is robust, the critical severity of geopolitical, climate, and forex risks underscores vulnerability in a slowing market.

Invert: Exploring the Worst-Case Scenarios for LVMH

Charlie Munger’s wisdom, “All I want to know is where I’m going to die, so I’ll never go there,” guides my investment approach, prompting me to invert and uncover potential pitfalls before backing LVMH. Its luxury moat and growth allure me, but I must consider what could unravel this opportunity.

A supply chain collapse could be catastrophic. Beyond raw material shortages (e.g., leather, gold), a prolonged disruption might force price cuts, eroding LVMH’s 23.1% operating margin and alienating its exclusivity-driven clientele, leaving me questioning its resilience.

A weakening moat is a concern. If fast fashion or digital rivals outpace LVMH’s adaptability, its brand prestige, underpinning 48% of revenue from Fashion & Leather Goods, could fade, risking a stock that loses its edge and prompting a portfolio rethink.

Regulatory shifts pose a threat. Stricter EU sustainability laws or U.S. tariffs could raise costs or limit sales, stalling growth and trapping me in an overvalued asset if I’ve misjudged its future.

Management execution is critical. If Bernard Arnault’s succession falters or acquisitions misfire, returns could stall, challenging my faith in LVMH’s compounding potential despite the 64.81% Arnault voting control.

Market exuberance could ensnare me. Buying without a safety margin might leave me exposed in a downturn. This inversion demands a cautious entry, ensuring LVMH’s value justifies its risks. This exercise refines my due diligence, urging vigilance until these risks subside. With this in mind, let’s have a look at the valuation.

Valuation

Valuing a stock is a deeply personal part of my investing journey, where I’ve learned firsthand that overpaying can erode even the best returns.

As a start let’s have a look at LVMH’s 2025 revenue growth outlook, which reflects a mixed landscape across its segments, shaped by Q1 2025 trends and market uncertainties:

Wines & Spirits segment, down 11% to €5.9 billion in 2024, faces a challenging 2025 with a base case decline of 5% (-7% conservative, -3% optimistic), driven by China’s 11% Q1 drop and “sober curious” trends as 49% of Americans cutting alcohol. China’s brandy ruling, no duties if prices are met, offers slight relief, but tariffs and weak demand persist. Recovery starts in 2026 (+2%, 0-5%), rising to +5% (3-8%) beyond, fueled by innovation (e.g., French Bloom) and emerging markets.

Fashion & Leather Goods, down 3% to €41.1 billion in 2024, faces a 2025 base case decline of 1% (-3% conservative, +1% optimistic), driven by China’s 11% Q1 drop, offset by U.S. stability. Recovery starts in 2026 (+4%, 2-6%), rising to +7% (5-9%) beyond, fueled by innovation (e.g., LV Piker) and emerging markets. Tariffs pose a 1-2% risk, but Louis Vuitton’s resilience and new leadership bolster growth.

Perfumes & Cosmetics, up 2% to €8.4 billion in 2024, faces a 2025 base case of 1% (-1% conservative, +3% optimistic), driven by China’s 11% Q1 drop, offset by U.S. resilience. Growth resumes in 2026 (+4%, 2-6%), rising to +6% (4-8%) beyond, fueled by innovation (e.g., Rose Verde) and emerging markets. Tariffs pose a 0.5-1% risk, but Sephora’s scale bolsters recovery.

Watches & Jewelry, up 3% to €10.6 billion in 2024, faces a 2025 base case growth of +2% (0% conservative, +4% optimistic), driven by Tiffany’s U.S. strength, offset by China’s 11% Q1 drop. Growth accelerates in 2026 (+7%, 5-9%), rising to +8% (6-10%) beyond, fueled by innovation (e.g., Titan) and emerging markets. Tariffs pose a 0.5-1% risk, but store renovations bolster recovery.

Selective Retailing, up 2% to €18.3 billion in 2024, faces a 2025 base case of 1% (-1% conservative, +3% optimistic), driven by Sephora’s U.S. deceleration (-3% Q1) and DFS lag, offset by resilience. Growth resumes in 2026 (+4%, 2-6%), rising to +6% (4-8%) beyond, fueled by travel recovery and digital expansion. Tariffs pose a 0.5-1% risk, but new stores boost potential.

Other Activities I expect quite flat between -1% decline and 3% growth. Beyond 2025, 2-6% growth is plausible by 2026 and 4-8% thereafter, fueled by niche luxury travel demand and media influence, though its scale limits impact.

I have put my expectations in an overview and will use these revenue growth assumptions to determine my year 1 free cash flow. This is the base case:

Beyond organic growth, LVMH’s 2025 valuation hinges on inorganic gains from acquisitions, a hallmark of Bernard Arnault’s strategy. Historically, deals like Tiffany (€4 billion) and Belmond (€0.3 billion) added 1.5-2.5% to revenue annually, with an average €1-2 billion from 1-2 mid-sized buys yearly. For 2025, I anticipate 2% additional new revenue, potentially rising to 2.5% with a major deal, based on recent trends. This 2.5% I will include in my Optimistic case.

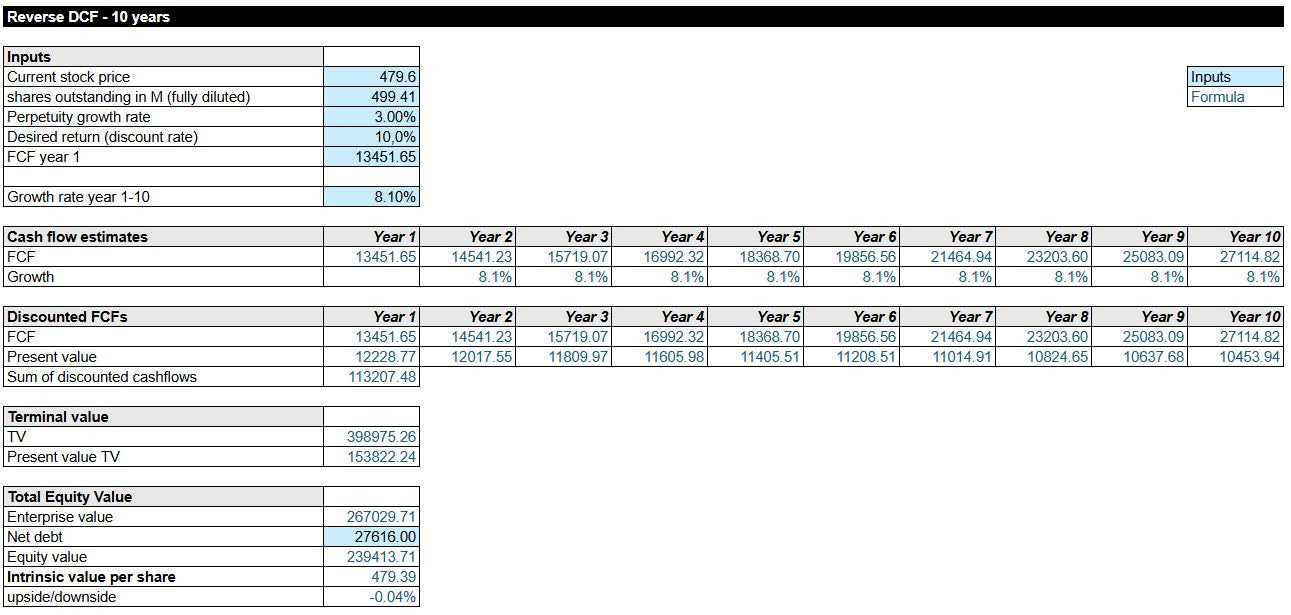

Reverse DCF - What Growth is Priced In?

Starting with known data points and working backwards to assess market expectations and judge whether these expectations are realistic.

I start by working backward with a Reverse DCF, using known data to uncover the market’s growth expectations and test their realism. With a 10% discount rate and a 3% perpetuity growth rate, the model reveals LVMH must grow its free cash flow by 8.1% annually over the next decade to justify today’s price. I think this is completely fair, especially given the economical headwind LVMH has been facing last year and this year and a recovery after two years of slowdown can be expected.

If you are interested in the forecast and valuation model in Google Sheets you can join my Discord app for free and get it. There will be more detailed information available in the app, also around other stocks.

DCF Model: What’s the Intrinsic Value?

Next, I calculate LVMH’s intrinsic value using a 8.9% base case for the growth of FCF to see where it stands.

The DCF suggests LVMH is undervalued by 5.9%, yielding a 12.4% annual return over ten years, including dividends. For a luxury company with strong brand moats this feels compelling, but let’s explore the optimistic and pessimistic scenarios:

The bull case at 11.7% FCF growth offers an intrinsic value of €855.1 and a 17.75% annual return.

The bear case at 5.4% FCF growth drops the intrinsic value to €391.8 with a 9.8% annual return.

Given these outcomes, LVMH feels interesting at current levels. Historically LVMH has grown it’s Free Cash Flow by 16.25% CAGR the last ten years. My bull case is more than 4% lower. Assuming LVMH could keep historical pace of 16.25% growth, the annual return would grow to 17.4%. Let’s call this the ultra bull case. Because of the tariffs, the economic situation in China and the Covid period which resulted in (temporary) higher margins for LVMH I think this is too optimistic. I think my expectations for the base case are realistic.

Actually I am satisfied with the current price as an entry point, so my buy below price is €475.00 which results in a 12.5% annual result. A 12.5% gain for the next ten years might not be whopping, but I think you shouldn’t bet against a company with very strong brands and a CEO who has proven to be one of the world’s best capital allocators.

Forward P/E

LVMH’s forward P/E tells a similar story. Its median over recent years sits at 23.1, and currently it is 21.8 showing it’s trending just below it’s average.

Free Cash Flow Yield

The Free Cash Flow (FCF) yield provides a crucial lens for evaluating LVMH’s value. With a current FCF yield of close to 5.0%, based on 2025 expectations (below image is based on a bit higher FCF) like a €12.1 billion FCF against a €239.3 billion market cap, it surpasses the U.S. 10-year Treasury yield of 4.5%. This premium signals a compelling return, especially with projected FCF growth of ~9% annually the next ten years,lifting the yield significantly. This underscores LVMH’s moat-driven cash generation.

Final Conclusion

LVMH stands out as a premier long-term investment, aligning seamlessly with Compound & Fire’s mission to build wealth through high-quality businesses. Its rich history, dating back to 1743 with Moët & Chandon and solidified by Bernard Arnault’s visionary leadership since 1987, has created a global luxury titan with €84.7 billion in 2024 revenue across six diverse segments. Arnault’s strategic acquisitions alongside a robust management team and a culture of craftsmanship underpin its 55% CO2 reduction and strong brand equity. Financially, a 16.7% ROIC, €14.2 billion in free cash flow, and a stable €69.3 billion equity base highlight resilience, despite challenges like a €1.7 billion goodwill impairment and a luxury market slowdown.

The company’s formidable moat, driven by unmatched Brand Power and Cost Advantage, combined with a DCF-implied 12.4% annual return, positions it for sustained growth. While risks such as geopolitical instability, succession uncertainty, and tariff pressures loom, LVMH’s global diversification and Arnault family control mitigate these concerns. This deep dive confirms LVMH as a cornerstone for financial freedom and early retirement. The total Deep Dive IRS shows a score of 7.8:

I will consider opening a position in LVMH, as it perfectly fits into my portfolio with capital light businesses run by the owner-operator and/or with a very strong moat. And as investors aren’t doint the conga line for LVMH, this might be the right time to buy.

If you’d like to explore these rankings further or discuss LVMH with fellow investors, join the Compound & Fire Discord community. We’re always ready to explore quality picks together!

Hopefully you have enjoyed this deep dive. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

Really solid analysis - love the deep dive. Ended up here from PitchStack.

Unlike Hermes, companies like LVMH and Kering have been over-pricing esp the key leather goods in the aftermath of Covid. The write-up, while very broad but not very deep, does not really address the key strategic challenges - what drives your forecast of a return to growth in 2026? what are your assumptions regarding pricing, volume, and why? what will change the demand from the Chinese customer (in China and abroad)? etc…