M&A Research Institute H1 FY25 Earnings: Growth Amid Challenges

Consulting Growth Meets M&A Headwinds and a Bold Buyback

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way—hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to fuel more, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support!

Come join the conversation on our Global Quality Investing Discord App here and hop on board my Substack for free if you haven’t yet—let’s grow this journey together!

M&A Research Institute ($9552.T) recently released its financial results for the six months ended March 31, 2025, revealing a mixed performance. As Japan’s leading SME M&A intermediary, MARI is navigating a challenging landscape with declining M&A deal closures, a little offset by robust consulting growth. Here’s a breakdown of the key figures, outlook, and what it means for quality-focused investors.

H1 FY25 Results: Consulting Shines, M&A Struggles

MARI reported net sales of ¥7,658M, down 10.2% year-over-year (YoY) from ¥8,526M, reflecting a tough environment for M&A deals. Operating profit fell sharply to ¥2,480M (-49.8% YoY), driven by fewer deal closures (114 vs. 123 in H1 FY24) due to increased competition. Net profit followed suit at ¥1,568M (-50.6% YoY), with an EPS of ¥26.81 (-50.6% YoY). The operating margin compressed to 32.4%, a steep decline from 57.9% last year, as costs rose significantly—SG&A expenses jumped 41.1% to ¥2,289M, fueled by advisor growth (329 advisors, +36.0% YoY).

On the bright side, MARI’s consulting (incubation) segment soared, with revenue up 1,211.0% YoY to ¥563M, though it remains loss-making (¥-166M operating loss). This diversification highlights MARI’s strategic pivot to offset M&A cyclicality, but cost pressures from rapid headcount expansion continue to weigh on profitability.

Full-Year 2025 Outlook: Cautious Optimism

MARI revised its full-year forecast downward, reflecting M&A challenges. Net sales are now expected at ¥17,950M (down 22.6% from the initial ¥23,200M), with operating profit at ¥5,732M (-44.9%) and net profit at ¥3,960M (-40.9%). EPS is projected at ¥67.65, a significant drop from the initial ¥115.19. The company anticipates closing 275 M&A deals (down from 367), implying 161 deals in H2—a tall order given the competitive landscape. Consulting revenue is a bright spot, raised to ¥1,450M (+20.8% from initial), though losses are expected to persist (¥-668M).

The steep revision and H2 dependence introduce execution risk, but MARI’s growing pipeline and consulting momentum provide some optimism. The decline in results is much higher than I had anticipated and I will have to adjust my valuation models.

Capital Allocation: Buybacks and Dividends

MARI announced a significant ¥7.5 billion share buyback program, targeting up to 7,500,000 shares (more than 12% of issued shares!) from May 1, 2025, to September 30, 2025. This aggressive move signals strong confidence in undervaluation and could boost EPS by ~14.6%, assuming no share price change—a meaningful tailwind for shareholders. The dividend policy has changed after the announcement of the buybacks and the payout ratio will go to 10% with the aim of maintaining a stable and consistent dividend.

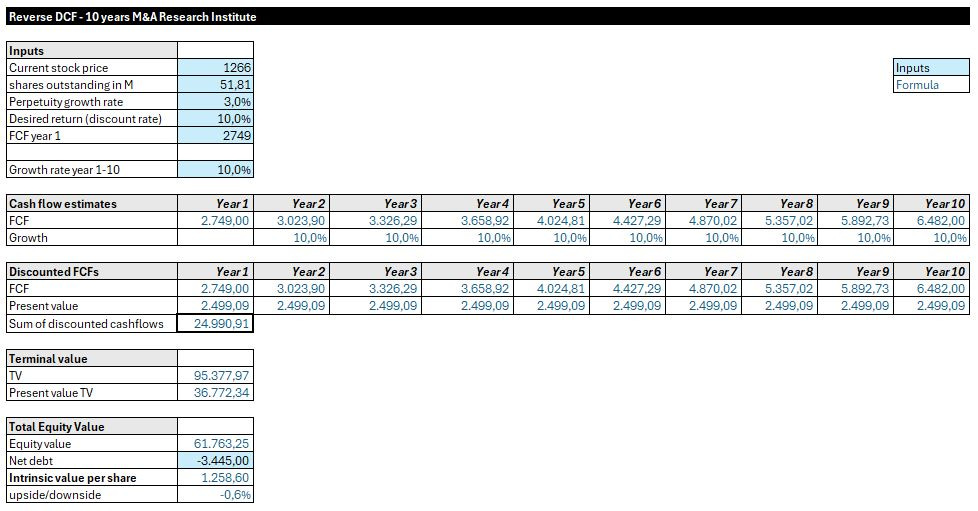

Valuation model

Based on the reduced earnings and steep decline in expected net income and free cash flow I have adjusted the Reverse DCF model, also considering the high buybacks which will result in a lower share count and a lower cash position. At current share price the market is expecting a 10% annual growth based on the depressed cash flow levels for 2025.

Quality Assessment: Growth Potential with Risks

For Quality Investors, MARI presents a mixed picture:

Strengths: Consulting growth (+1,211.0% YoY) showcases diversification, while a ¥7.5 billion buyback and consistent dividends reflect capital discipline. Financial strength is robust, with total assets at ¥12,930M and an 82.0% equity-to-asset ratio.

Weaknesses: Margin compression (32.4% vs. 57.9%), M&A volatility (114 deals vs. 123), and cost pressures (advisors +36.0% YoY) highlight operational challenges. The severe forecast revision (-44.9%) adds uncertainty.

MARI offers growth potential if you are comfortable with cyclicality, but stability-focused quality investors may find the volatility and risks less appealing.

Investment Takeaway

MARI’s consulting growth, aggressive share buyback, and capital allocation make it an intriguing option for growth-oriented quality investors. Margin pressure and M&A cyclicality warrant caution and results are much worse than I expected. The bold share buyback program is a relief. Investors should monitor H2 deal execution and margin trends closely. For now, growth investors may see value long-term, while stability seekers might wait for clearer signs of recovery. Because of the high Investment Readiness Score, the low valuation and the growth perspective I had initiated a 1% position earlier this month. Given the high volatility in the earnings I am not planning to increase this position.

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.