Medpace: A High-Science CRO Compounder in a Dynamic Market

Explaining the Growth, Moat, and Risks of a Biotech-Focused Clinical Research Leader

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way—hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to fuel more, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support!

Come join the conversation on our Global Quality Investing Discord App here and hop on board my Substack for free if you haven’t yet—let’s grow this journey together!

General information

Name: Medpace

Logo:

ISIN: US58506Q1094

Ticker: MEDP

Country: United States

Current market cap (May 14, 2025): 8.38B USD

Share price (May 14, 2025): 291.73 USD

Outstanding shares: 30.5 million

Free float: 24 million

Average daily volume: 392.49K

About: Medpace Holdings is a global, full-service clinical research organization (CRO) based in Cincinnati, Ohio, founded in 1992 by August J. Troendle. It provides Phase I-IV clinical development services to biotechnology, pharmaceutical, and medical device industries, focusing on accelerating the development of safe and effective medical therapeutics. With approximately 5,900 employees across 44 countries Medpace leverages deep therapeutic expertise in areas like oncology, cardiology, metabolic disease, and central nervous system disorders. Operating under a full-service model, it offers integrated solutions, including clinical trial management, regulatory affairs, data management, and laboratory services. Its disciplined, high-science approach ensures quality and efficiency in clinical research.

Quick Scan

"Protecting your money is like guarding a castle: it's easier to keep invaders out than to reclaim lost territory.”

That is why I look for moat companies which protect my castle. I want to minimize the risk of losing money and maximize the chance a company is compounding. Compounding is like a snowball rolling downhill, getting bigger and faster as it goes, just as a company's profits grow faster when they reinvest their earnings into high-return projects, making even more money to reinvest again and again.

Balance sheet

A low Net debt / EBITDA ratio indicates that a company can repay its debt faster, potentially leading to better long-term shareholder return:

Net debt / EBITDA: -1.1x (Net debt / EBITDA < 4x ✅)

A rule of thumb suggests that companies with a goodwill to assets ratio higher than 30% should be carefully analyzed to ensure the risk of potential write-offs is low:

Goodwill / Total assets: 31.5% (Goodwill / Total assets <30% ❌))

Impairments last 10 years: 1.4% (Impairments / Goodwill < 10% ✅)

You can see that Medpace’s goodwill versus their total assets dropped from more than 60% towards 31.5% end of 2024. This is a healthy development and shows that the total assets versus their goodwill has increased significantly in recent years.

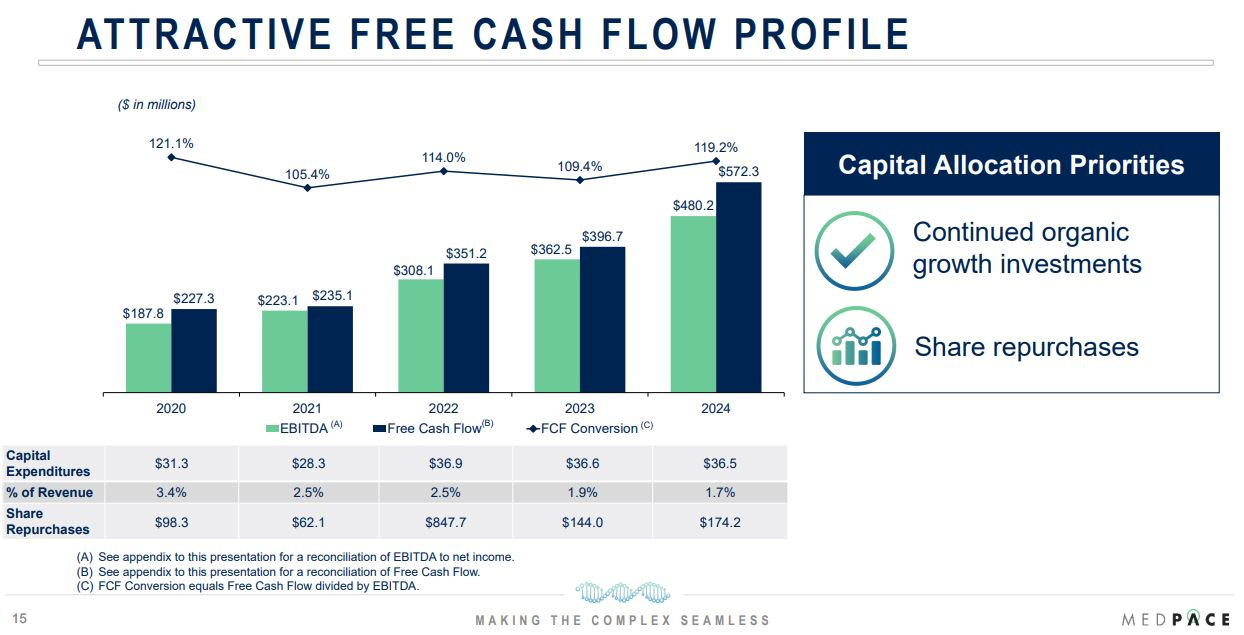

Cash Flow

“A business that doesn't take any capital and grows and has almost infinite Returns on required Equity capital is the ideal business” (Warren Buffett)

That is why I look for asset-light companies.

Capex / Sales: 1.7% (Capex / Sales <5% ✅)

Capex / Operating Cash Flow 10.0% (Capex / Operating Cash Flow <25% ✅)

Operating Cash Flow (OCF) / Net Income 150% (OCF / Net Income >80% ✅)

Medpace is a capital-light company as their maintenance capex is low. The Operating Cash Flow versus Net Income is high, which means Medpace turns profit into cash.

Capital Allocation

“Capital allocation is the CEO’s most important job” (Warren Buffett)

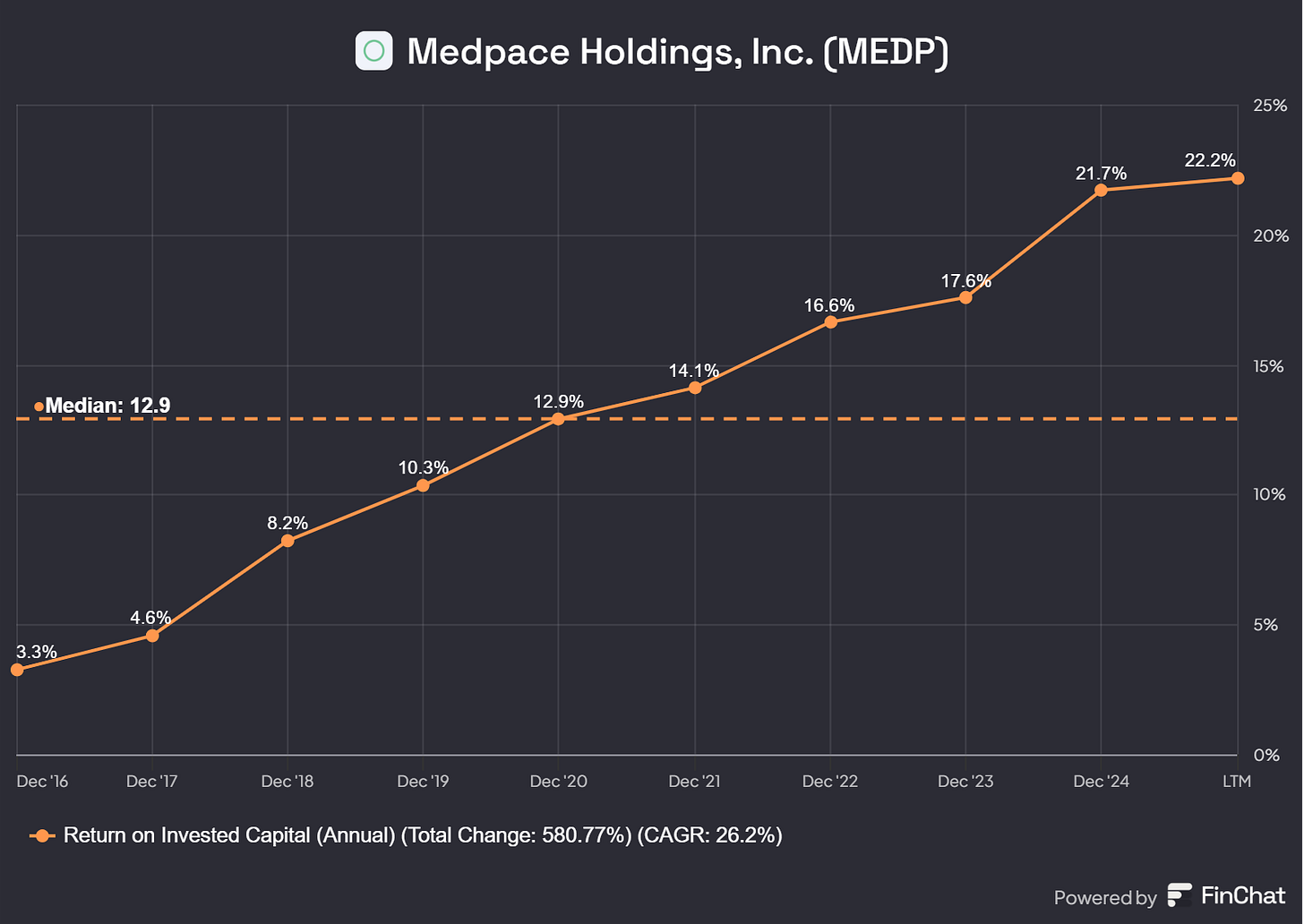

The metric which most often tells most about capital allocation is ROIC.

Return on Invested Capital: 21.7% (ROIC >15% ✅ )

Why do I take last years ROIC? Because their ROIC was impacted in the earlier years by the Amortization of Goodwill and Intangible Assets and these need to be excluded to get a fair view on Medpace’s true ROIC. That is why I think the last year(s) give a fair view and last three years the ROIC was always above 15%.

Medpace has a history of prudent capital allocation, balancing growth investments with shareholder returns. Last month the company announced an additional $1 billion share buyback program, signaling confidence in its long-term growth and a belief that the stock is undervalued at current levels. At a stock price of approximately $300, this program could repurchase around 3 million shares, reducing the diluted share count from 31.8 million (as of Dec’24) to roughly 29.5 million shares after accounting for share-based compensation. This reduction in shares outstanding should enhance earnings per share (EPS) over time, further boosting Medpace’s compounding potential for investors.

Profitability

A high gross margin provides significant insights into a company's competitive advantage and potential for long-term shareholder returns.

Gross margin: 67.7% (Gross Margin >40% ✅)

Net margin: 19.2% (Net margin >10% ✅)

Stock-Based Compensation (SBC)

“95% of Restricted Stock Units (RSUs) are sold on vest, which potentially defeats the purpose of giving employees long-term skin in the game” (Bill Gurley, a well-known venture capitalist).

“Companies offering stock-based compensation plans can benefit shareholders through higher stock prices, but only if the level of dilution is not excessive.”

Two different views, but opposite. In general I want to see the stock-based compensation below 5%, else it will dilute my stake in a company.

SBC to revenue: 1.2% (SBC < 5% ✅)

Change in Shares Outstanding 10 yrs: -1.0% (Change in Shares Outstanding <10% ✅)

Medpace is buying back shares, mainly to cover their SBC program.

Conclusion Quick-Scan

Medpace shows a near perfect score. The Investment Readiness Score comes in at 93.9, which is very high. The only metric showing a red cross is the goodwill / assets ratio. But the good news here is that this ratio is trending in the right direction.

Management & Leadership

Dr. August J. Troendle, M.D., founded Medpace in July 1992 and has served continuously as CEO & Chairman, applying over three decades of industry leadership to guide strategic direction and corporate culture. His early career as a Medical Review Officer in the FDA’s Division of Metabolic and Endocrine Drug Products (1986–87) and as Associate/Senior Associate Director at Sandoz (Novartis) (1987–92) provides Medpace with deep regulatory insight and credibility with sponsors and health authorities. Under Troendle’s stewardship, Medpace has grown from a single-office startup to a global CRO with facilities in 44 countries.

Source: Website Medpace

Jesse J. Geiger serves as the company’s president; he joined Medpace in October 2007 as Corporate Controller, was promoted to CFO in March 2011, and assumed the newly created role of President on August 1, 2021, enabling the CEO to focus on long-term strategy while Geiger drives operational excellence. He spearheaded Medpace’s laboratory operations as COO (2014–21), building the integrated central-lab platform that differentiates Medpace by reducing handoffs and accelerating trial timelines.

Moreover, Kevin M. Brady, CPA, was appointed CFO effective August 1, 2021, after serving as Executive Director of Finance & Treasurer since joining Medpace in 2018. He previously held VP-Finance roles at Myriad Genetics (2015–18) and Royalty Pharma, and began his career at Procter & Gamble and Ernst & Young—experience that fortifies Medpace’s FP&A, tax, treasury, and investor-relations functions.

Beyond the core C-suite, Medpace’s senior leadership team is rounded out by seasoned functional heads whose deep tenures reinforce the company’s integrated mode. Susan Burwig, MA, BSN, has served as Executive Vice President of Operations since 1993, overseeing clinical trial management and lab operations for over 30 years. Weimin Gai, MS, Senior Vice President of Biometrics, also joined in 1993 and leads one of the industry’s most experienced data-science teams.

Reinilde Heyrman, MD, Chief Medical Officer since 2017, brings critical therapeutic and regulatory insight to study design; similarly, Gina Leisring, MPH, Senior Vice President of Clinical Monitoring (joined 2002), and Traci Turner, MD, Vice President of MRL Operations & MARC (joined 2011), ensure rigorous oversight across monitoring and mechanism-of-action research. This breadth of expertise in operations, data, medical, monitoring, and corporate functions enhances Medpace’s “one-stop shop” model while highlighting the long tenures that both drive consistency.

Insiders hold around 21.5% of the total shares of Medpace, where owner-operator Dr. August J. Troendle holds the fast majority of around 6M shares or 20.9% of the total according to Finchat data. This significant insider ownership aligns the interests of management and shareholders.

Tenure & Culture

Medpace’s leadership bench is seasoned, with average management tenure of 6.2 years and board tenure of 6.7 years, surpassing biotech/CRO industry norms (~4–5 years). Dr. August Troendle’s 32.8-year CEO tenure, coupled with his 20.9% ownership, ensures strategic continuity and shareholder alignment, a rarity among public companies.

Medpace’s culture blends high-science rigor with rapid growth, shaped by its Cincinnati headquarters and low-cost hiring strategy. By recruiting college graduates, Medpace offers competitive salaries, early responsibility, and robust training for roles like Clinical Research Associate, serving as a launchpad for industry expertise. Many employees value the structured career progression and global exposure, with some teams reporting strong camaraderie in a high-stakes environment.

However, employee feedback on platforms like Glassdoor (2.7/5, 31% recommend) and Indeed (2.6/5, culture 2.4/5) highlights challenges, including micromanagement, high turnover (some report 6–12 months), and workload pressures. These ratings, lower than peers like IQVIA (3.6/5), may reflect a vocal minority, as review platforms often attract dissatisfied voices. While these issues could impact retention and productivity, Medpace’s 5,900 global employees and strong performance (23% revenue CAGR) suggest operational resilience. Investors should monitor turnover trends, but leadership stability and training investments mitigate cultural risks.

Market Attractiveness & Growth Potential

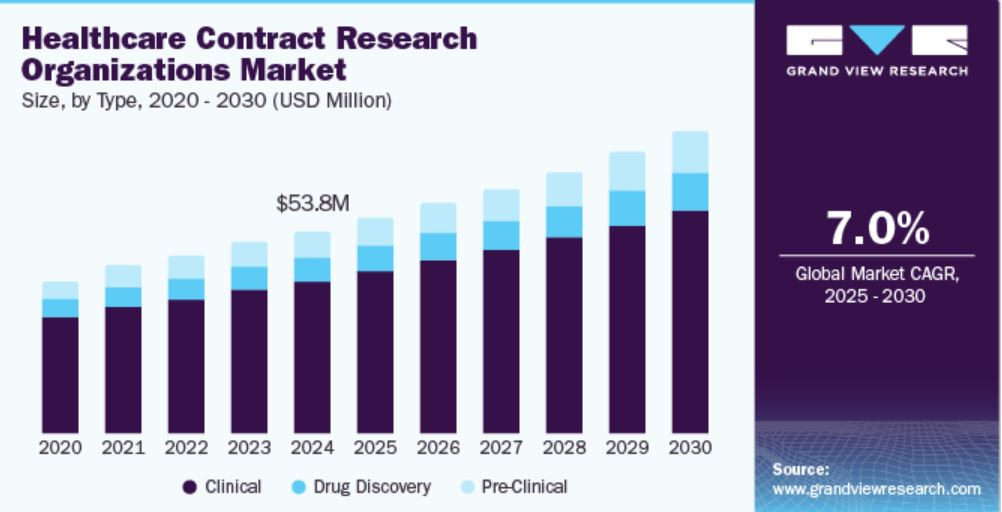

The global pharmaceutical CRO market has been subject to varying size estimations, but projections consistently point to robust growth. Grand View Research estimates the healthcare CRO market at USD 53.84 billion in 2024, projected to grow at a 7.0% CAGR through 2030, driven by increasing R&D investments and the complexity of clinical trials.

Source: Grand View Research

But there are many other research companies with a different market size and different growth expectation. I have summarized the expectation of six different research companies in a table:

While these estimates vary in scope and definition, they (and other research) collectively indicate a mid-to-high single-digit growth trajectory for the CRO industry, ranging from 7.0% to 9.6% CAGR over the next 5–10 years.

Clinical trial outsourcing penetration has risen significantly, reaching approximately 53% of total pharmaceutical R&D spending in 2024, up by about 4% annually over recent years, as sponsors increasingly rely on external expertise to manage complex trials. This trend is fueled by factors such as the growing prevalence of chronic diseases, the rise of personalized medicine, and the need for cost-efficient drug development, with CROs offering specialized services like decentralized clinical trials (DCTs) and AI-driven data analytics.

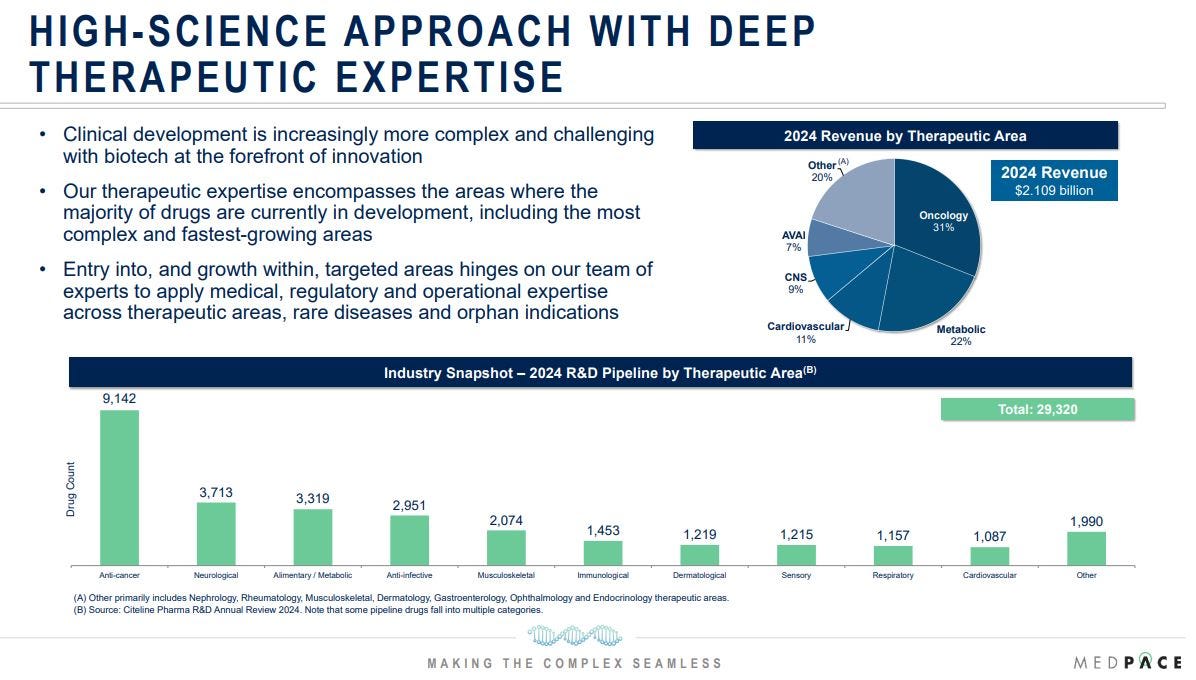

Analysts suggest the CRO total addressable market (TAM) will expand by 5–6% annually through 2028–29, providing a strong tailwind for pure-play CROs like Medpace. Additionally, the oncology segment, a key focus area for Medpace, is expected to remain a leading driver of growth, where Medpace held a 38.4% market share in 2024 and is projected to grow at a CAGR of 10.17% through 2030, reflecting the high demand for cancer-related clinical research.

Medpace is well-positioned to capitalize on this growth due to its specialized, full-service model and expertise in high-science areas like oncology and metabolic diseases. The company’s disciplined approach and founder-led leadership—highlighted by a 3-year revenue CAGR of 22.6% and EPS CAGR of 37.2%—enhance its competitive edge.

However, a concerning trend is the decline in Medpace’s book-to-bill ratio, a key indicator of future growth. Historically at 1.25x, the ratio has been trending downward, signaling that new business bookings are growing more slowly than revenue recognized. This decline, shown in the graph below, could indicate challenges in securing new contracts, potentially due to increased competition or biotech funding pressures, which may slow the growth of Medpace’s $2.85 billion backlog and impact future revenue conversion.

Source: Medpace Investor Presentation 2025

In the first quarter the net book-to-bill dropped further to 0.9 versus 1.2 in the first quarter of 2024. For context, IQVIA, a larger and more diversified CRO, reported a trailing twelve-month book-to-bill ratio of 1.14x in Q1 2025, compared to Medpace’s 0.98x over the same period. This gap highlights IQVIA’s stronger backlog growth, likely due to its broader client base and diversified services, including data analytics, which are less exposed to biotech funding pressures. While Medpace’s niche focus on small to mid-sized biotechs allows for specialized expertise, it also makes its growth more vulnerable to market conditions, as evidenced by the lower ratio.

Market dynamics present challenges: the CRO industry faces increasing competition, regulatory complexities, and pressure to adopt advanced technologies like AI and remote monitoring, which could strain margins if not managed effectively. Additionally, external factors like the Trump Administration’s policies could pose risks. The administration’s focus on reducing drug prices and university research costs may pressure biotech funding, particularly for the small to mid-sized firms Medpace serves. Reduced NIH funding (~$47B annually) or tighter R&D budgets could slow trial initiations, impacting Medpace’s backlog growth. Given that 96% of Medpace’s revenue comes from these biotechs, a 10–15% reduction in their R&D budgets could translate to a $200–300 million revenue hit for Medpace, based on its 2024 revenue of $2.109 billion. This represents a severe scenario, such as a 10–15% NIH funding cut combined with sustained VC declines, though Medpace’s diversified clients and late-stage trial focus mitigate milder impacts.

Despite these hurdles, the global CRO market’s expansion, particularly in North America (59.3% share in 2024) and the fast-growing Asia-Pacific region (7.16% CAGR), underscores significant opportunities for Medpace to drive topline growth through 2030.

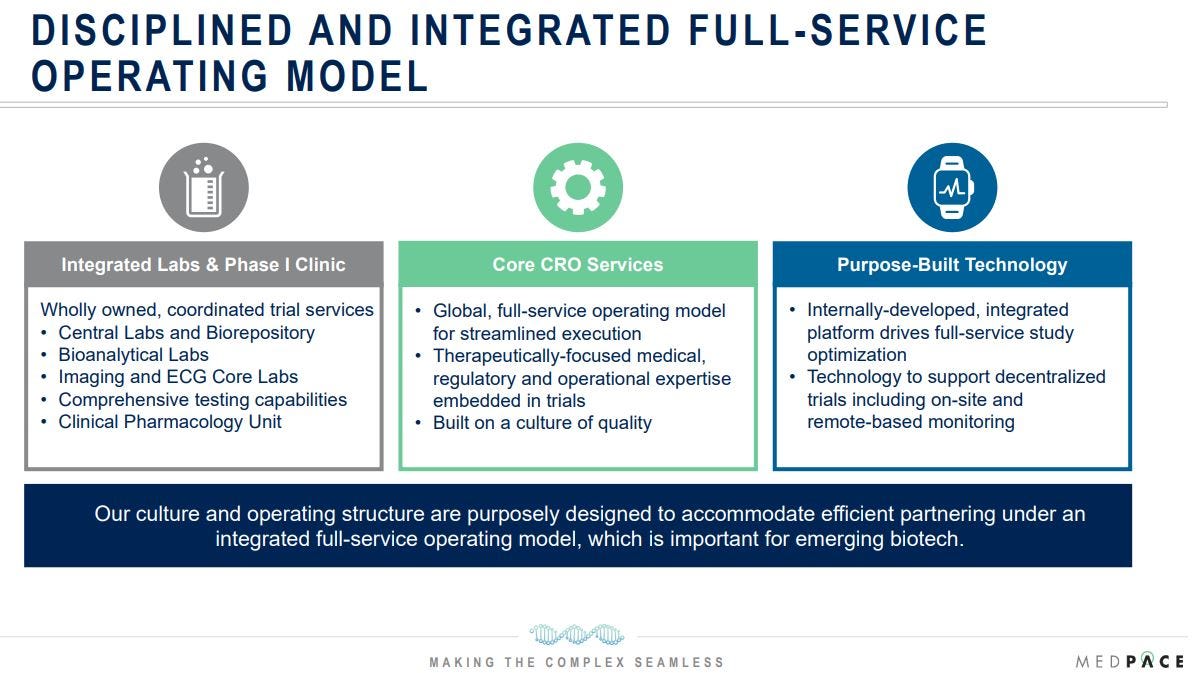

Strategy & Business Model

Medpace operates as a scientifically driven, full-service Contract Research Organization (CRO), providing end-to-end clinical development services for biotech, pharmaceutical, and medical device companies, with a strategic focus on small to mid-sized biotech firms. Its integrated, single-vendor model spans Phase I-IV trials, covering first-in-human studies, central labs, bioanalysis, imaging, ECG safety, and regulatory submissions. This "one-stop shop" approach streamlines execution, enhances data integrity, and reduces handoffs, enabling Medpace to achieve higher margins—labs typically yield 30–40% EBITDA—and foster stickier client relationships with retention rates exceeding 95%. Unlike competitors who often operate as functional service providers (outsourcing specific trial components), Medpace exclusively delivers full-service solutions, a key differentiator, aligning with the needs of smaller biotech firms that lack the infrastructure for in-house trials.

As a full-service provider, Medpace offers a comprehensive suite of services across the clinical trial lifecycle. Therapeutic experts provide medical oversight, guiding study design, monitoring trials, and engaging with regulatory agencies to ensure compliance. Clinical trial management oversees all aspects of study execution, leveraging Medpace’s proprietary ClinTrak system to coordinate teams and timelines.

ClinTrak positions Medpace to harness artificial intelligence (AI) for significant gains. Already a leader in AI-driven imaging analysis through its Core Imaging Lab, Medpace uses machine learning to enhance lesion detection and biopsy scoring, reducing variability and accelerating trial timelines. AI’s potential extends to predictive analytics, optimizing patient recruitment, and designing adaptive trials, particularly in complex areas like oncology and rare diseases where Medpace excels. By automating data management and leveraging real-world evidence, AI could further boost Medpace’s operational efficiency, potentially cutting trial costs by up to a third and enhancing margins. While regulatory hurdles and data standardization pose challenges, Medpace’s scientific expertise and global infrastructure make it well-placed to lead in AI adoption, reinforcing its edge in a data-driven CRO market.

The company also provides strategic regulatory guidance, managing submissions to global authorities, and develops tailored patient recruitment and retention strategies to address participation challenges, ensuring trials run smoothly from start to finish.

Source: Medpace Investor Presentation 2025

A cornerstone of Medpace’s strategy is its vertical integration, which provides a significant cost advantage over competitors. The company wholly owns and operates critical infrastructure, including Global Central Laboratories in Cincinnati, Leuven, Singapore, and Shanghai (using a unified Laboratory Information Management System for data consistency), GLP-compliant Bioanalytical Labs with PhD-led teams, Imaging and ECG Core Labs for oncology, cardiovascular, and neurology studies, and a Phase I Clinical Pharmacology Unit on its Cincinnati campus for expedited SAD/MAD studies. Additionally, Medpace develops its own purpose-built technology (which reminded me of Kinsale Capital Group, although a total different business) , supporting decentralized trials with on-site and remote monitoring capabilities, enhancing flexibility for clients.

Medpace’s customer base predominantly comprises small to mid-sized biotech firms, which account for approximately 90% of its clients and 96% of its 2024 revenue. The company maintains low customer concentration, with the top ten customers representing 29% of 2024 revenue and no single customer exceeding 10%, reducing dependency risk.

Source: Medpace Investor Presentation 2025

Contracts are typically long-term, either fixed-price or unit-based, fostering consistent client relationships and predictable revenue streams. As of Q1 2025, Medpace reported a backlog of $2.85 billion, with $1.65 billion expected to convert to revenue within the next 12 months, reflecting strong demand.

Therapeutically, Medpace concentrates on high-growth areas like oncology and metabolic diseases, which together account for 53% of revenue. Oncology aligns with industry trends, commanding the largest share of the 2024 R&D pipeline, while metabolic services have grown at a 30% rate, outpacing oncology’s average growth.

Source: Medpace Investor Presentation 2025

Medpace’s global reach, spanning 44 countries with 5,900 employees, ensures it can navigate local regulations and cultures, a critical factor for multinational late-stage trials. Financially, Medpace has demonstrated organic growth, compounding revenue at an 23% CAGR from $359 million in 2015 to $2.1 billion in 2024, while expanding adjusted EBITDA margins to 22.8% in 2024. In 2024, the company generated $572 million in free cash flow (~27% of revenue), with capital expenditures at 1.7% of sales, reflecting an asset-light model and strong cash conversion.

Source: Medpace Investor Presentation 2025

The broader CRO market’s growth—driven by a long-term outsourcing trend that began in the 1970s and now sees around 52% of R&D spend outsourced (up from earlier decades)—underscores Medpace’s favorable position. Medpace holds a 7% market share in a fragmented $29 billion addressable market for the small and mid-sized CRO market.

Source: Medpace Investor Presentation 2025

However, external factors like the Trump Administration’s policies could pose risks. The administration’s focus on reducing drug prices and university research costs may pressure biotech funding, particularly for the small to mid-sized firms Medpace serves. Reduced government grants or tighter R&D budgets could slow trial initiations, impacting Medpace’s backlog growth. Given that 96% of Medpace’s revenue comes from these biotechs, a 10–15% reduction in their R&D budgets could translate to a $200–300 million revenue hit for Medpace, based on its 2024 revenue. While Medpace’s cost advantage and full-service model may help it retain clients over competitors, prolonged funding constraints could still challenge growth.

Competitive Landscape

Medpace operates in a highly fragmented Contract Research Organization (CRO) market, currently valued at $71 billion in 2024, with $42 billion attributed to large pharmaceuticals and $29 billion to small and mid-sized firms .

The industry comprises a mix of large, integrated players, mid-sized firms, and hundreds of smaller, niche specialists, creating a competitive environment where quality differentiation and cost efficiency are critical. Medpace positions itself as a pure-play, full-service CRO, distinguishing itself through its integrated model and focus on small to mid-sized biotech clients.

Among its main publicly traded peers, Medpace faces competition from several larger and more diversified firms:

IQVIA (IQV): With a market capitalization of $26.6 billion and an enterprise value of $38.9 billion, IQVIA is a market leader, offering a broad suite of services beyond CRO, including analytics and real-world data solutions. Its scale and technological capabilities allow it to serve a diverse client base, including large pharmaceutical companies, but this diversification can dilute its focus on smaller biotech firms, where Medpace excels.

ICON Plc (ICLR): ICON holds a market cap of $11.8 billion and an enterprise value of $14.9 billion, with strengths in Phase I-IV trials and late-stage regulatory submissions. ICON competes directly with Medpace in the full-service CRO space, but its broader client mix, including larger pharma, contrasts with Medpace’s biotech focus.

PPD (now part of Thermo Fisher, TMO): Acquired by Thermo Fisher for $17.4 billion in December 2021, PPD is integrated into a parent company with a $160 billion market cap. This acquisition enhances PPD’s scale but reduces its independence. Medpace, as one of the few remaining independent full-service CROs, leverages its agility to differentiate itself.

Fortrea (FTRE): Spun out of PPD, Fortrea is a pure-play CRO with an enterprise value of $1.6 billion and a market cap of $0.5 billion. It serves a mix of small biotech and mid-sized pharma sponsors, directly overlapping with Medpace’s target market, but its smaller scale and recent spin-off status may limit its stability.

Charles River Laboratories (CRL): With a market cap of $10.1 billion and an enterprise value of $13.5 billion, Charles River focuses primarily on pre-clinical and early-phase services, overlapping with Medpace in lab capabilities but not in later-phase trials.

Beyond these larger players, hundreds of niche CROs target specialized indications or geographies, intensifying pricing pressure. Medpace’s integrated infrastructure and focus on biotech clients allow it to maintain higher margins (22.8% EBITDA in 2024) compared to industry averages of 15–20%.

Medpace’s MOAT

Medpace has carved out a durable competitive moat in the Contract Research Organization (CRO) industry through its clinician-led leadership, vertically integrated infrastructure, and strategic focus on small to mid-sized biotech firms. These elements create significant barriers to entry, cost leadership, and client lock-in, ensuring a sustainable advantage in a fragmented market.

Integrated Laboratory Infrastructure and Low-Cost Advantage

Medpace’s vertically integrated infrastructure forms a core pillar of its moat, providing both operational excellence and a low-cost advantage that competitors struggle to replicate. By wholly owning its laboratories and Phase I unit, Medpace avoids the inefficiencies and costs of outsourcing, a common practice among other CROs. This integration creates a high barrier to entry, as building and maintaining such infrastructure requires substantial capital investment and expertise. The resulting cost efficiencies allow Medpace to maintain EBITDA margins of 22.8% in 2024, well above the industry average of 15–20%, and labs yield 30–40% EBITDA, reinforcing its cost leadership. This economic advantage enables Medpace to offer competitive pricing while preserving profitability, making it a preferred partner for cost-sensitive biotech clients.

Full-Service Provider for Small and Mid-Sized Biotechs

Medpace’s full-service, single-vendor model creates a strong moat by fostering client lock-in, particularly for small to mid-sized biotech firms, which often lack the resources for in-house trial management. Unlike competitors who operate as functional service providers, Medpace delivers end-to-end solutions, consolidating all trial phases under one roof.

Source: Medpace Investor Presentation 2025

This reduces complexity and ensures continuity, creating high switching costs for clients who would face disruptions and inefficiencies by moving to another provider. Medpace’s 30-year track record with biotech clients and focus on their specific needs—such as expertise in complex areas like rare diseases and orphan indications—further deepen client relationships. This specialization aligns with the growing demand for outsourced clinical development, solidifying Medpace’s position as a trusted partner in a high-stakes industry.

Clinician-Led Differentiation

Medpace’s clinician-led leadership, emphasized by its "scientifically-driven" approach, adds another layer to its moat.

Source: Medpace Investor Presentation 2025

This high-science focus ensures precision and reliability in trial execution, particularly for complex studies, which is a key differentiator in an industry where errors can be costly. Competitors without such deep therapeutic expertise struggle to match Medpace’s quality, further enhancing its competitive advantage and client trust.

In summary, Medpace’s moat is built on its integrated infrastructure, cost leadership, and full-service model tailored to small and mid-sized biotechs, creating barriers to entry and fostering client loyalty. These factors position Medpace to sustain its industry-leading growth in a competitive landscape.

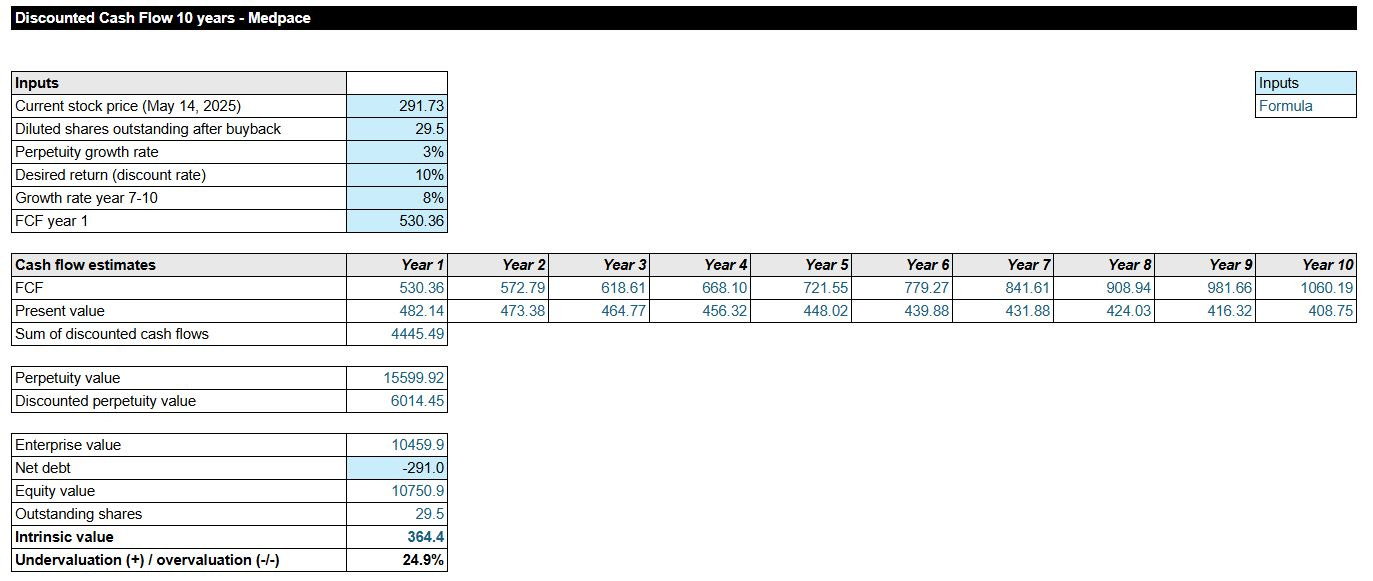

Valuation

In order to have an understanding of the valuation of the company it is good to look from multiple angles.

Reverse DCF - What Growth is Priced In?

Starting with known data points and working backwards to assess market expectations and judge whether these expectations are realistic.

Let’s start with a Reverse DCF to understand what growth rate Medpace’s current stock price implies.

Revenue Forecast: The CRO market is expected to grow a 5-6% CAGR through 2028-2029. I will put Medpace at a 6% growth due to funding pressures for small and mid-size biotechs and the decline in book-to-bill ratio. Medpace’s focus on oncology, which expects to grow faster at at 10% CAGR puts them at the high end of the growth range. For 2025 I will take 2.19B revenue followed by a 8% increase in the years after. The 8% base case assumes moderate NIH and VC funding pressures, as seen in the 0.90x book-to-bill ratio, but expects stabilization driven by Medpace’s oncology leadership and backlog conversion. My bull case would be a 12% growth and my bear case a 4% growth. Note that this is all below the historical revenue growth of Medpace with a 23% CAGR last ten years.

Gross margin : I don’t increase margins in my model, as Medpace already has high margins versus competitors.

Unlevered Free Cash Flow (UFCF): From NOPAT, I subtract capex and the change in working capital. The UFCF calculated for 2025 is the basis for my valuation model.

If you are interested in the forecast and valuation model in Google Sheets you can join my Discord app for free and get it. There will be more detailed information available in the app, also around other stocks.

Reverse DCF Outcome: Using Medpace’s current market cap the Reverse DCF implies a 10-year UFCF growth rate of 5.8% to achieve a 10% annual return.

DCF Model: What’s the Intrinsic Value?

Now, let’s calculate Medpace’s intrinsic value per share using my base case forecast of 8% growth of unlevered free cash flow. I will calculate with a lower Fully diluted shares outstanding amount, given the announced $1B share buybacks. This reduces the fully diluted shares to ~29.5M.

The DCF shows that Medpace is undervalued based on an 8% growth till 2030. My annual return would result in a 12.2% return on my investment. Note that the market in recent years has become a bit more conservative on the total CRO market. I will also share my bull and bear cases:

Bull case: a growth of 12% would result in an intrinsic value of $470.2 and a 14.9% annual return on my investment.

Bear case: a growth of 4% would result in an intrinsic value of $283.7 and a 9.7% annual return on my investment.

Based on these scenarios Medpace looks like an attractive investment at the moment.

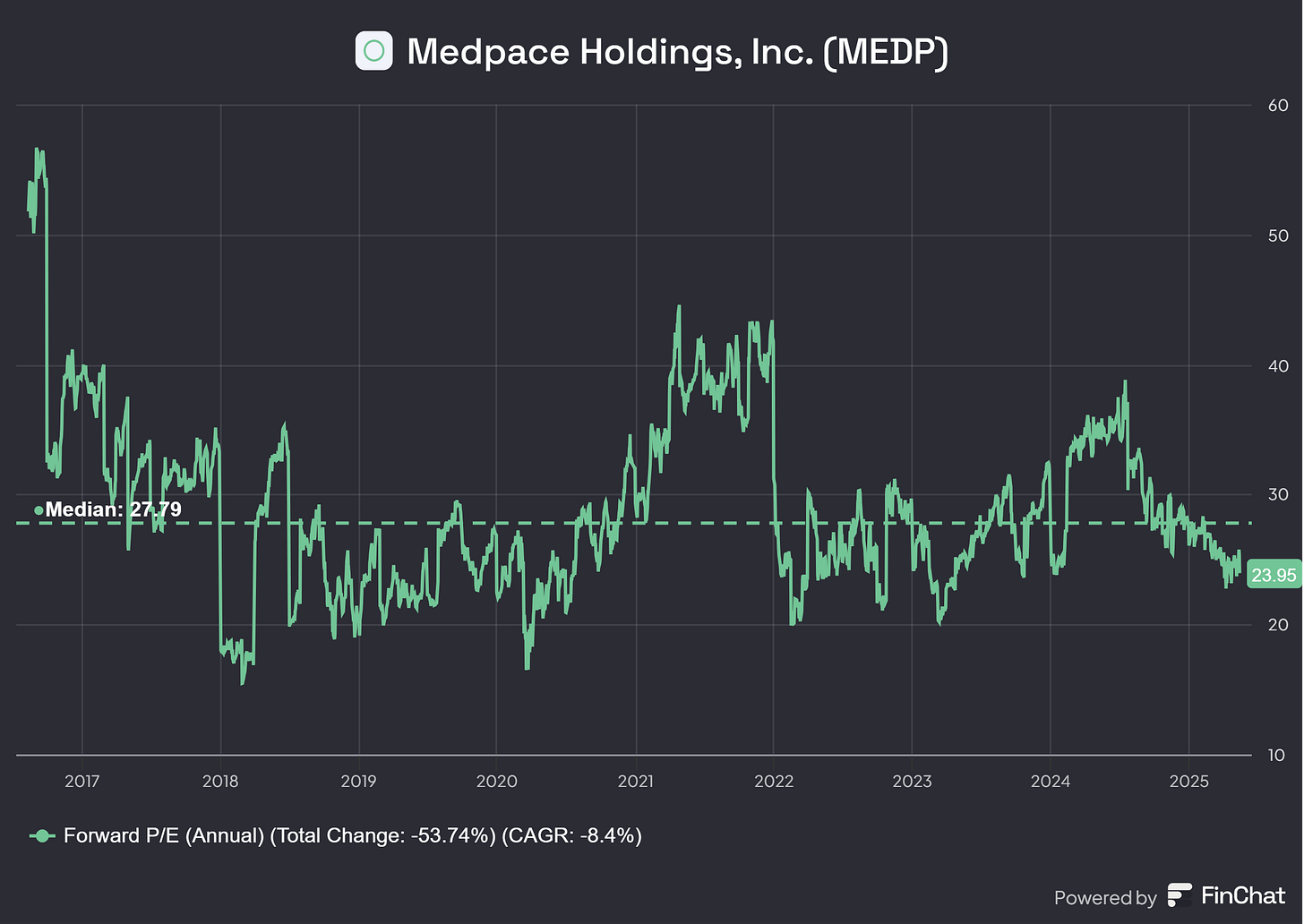

Forward P/E

Medpace’s median forward P/E over recent years is 27.79, compared to 23.95 today. This shows Medpace is trending below historical Forward P/E metrics, which makes sense given the difficult market circumstances currently and the lower book-to-bill ratio of Medpace signaling weaker growth in revenue.

While Medpace’s current forward P/E suggests a conservative market outlook, reflecting challenges like the declining book-to-bill ratio and broader market pressures, these factors also highlight the importance of understanding the risks that could further impact its valuation. Even a well-positioned CRO like Medpace, with its integrated model and strong historical growth, faces a range of risks that could affect its ability to sustain its growth trajectory, maintain margins, and deliver on investor expectations. Let’s explore these risks to assess Medpace’s resilience in a dynamic and competitive landscape.

Risks

Even a differentiated CRO like Medpace—with its vertically integrated labs, high client retention, and strong cash flow—faces a spectrum of risks that can materially affect its growth trajectory, margins, and valuation. These risks span from the cyclical nature of biotech funding and evolving global regulations to operational challenges, competitive pressures, and financial volatility. Understanding these risks is critical for assessing Medpace’s resilience and long-term investment appeal.

Biotech Funding Cycles and Client Dependency

Medpace’s heavy reliance on small to mid-sized biotech firms, which account for 96% of its 2024 revenue, makes it particularly sensitive to fluctuations in biotech funding cycles, including NIH grants and venture capital. In Q3 2024, net new business awards fell 12.7%, driving the book-to-bill ratio down to 1.00x from 1.24x the prior year, signaling flat new wins versus billings. This trend worsened in Q1 2025, with the ratio dropping to 0.90x and net awards declining 18.8% year-over-year. Global venture funding in Q3 2024 dropped 16% year-over-year to $66.5 billion, and NIH funding volatility (~$47B annually) further constrains early-stage programs that Medpace supports. Larger peers like Charles River Laboratories have also cut 2024 guidance due to a biotech funding crunch amid higher interest rates. For Medpace, this cyclicality introduces volatility in bookings and potential backlog contraction, which could hinder revenue growth if funding conditions don’t improve. A severe NIH funding cut (~10–15%) could lead to a temporary revenue decline, though Medpace’s $2.85B backlog and global reach reduce this risk.

Regulatory and Compliance Complexity

Evolving regulatory requirements from agencies like the FDA and EMA can increase operational complexity, lengthen trial timelines, and pressure margins. Late 2024 FDA guidance on decentralized clinical trials (DCTs) mandates enhanced oversight, new technology platforms, and risk-based monitoring, adding to Medpace’s operating costs. In Europe, the upcoming Diversity Action Plan, effective mid-2025, requires public disclosure of demographic enrollment strategies, introducing additional reporting burdens and potential delays. The EU Clinical Trial Regulation’s transition to a single CTIS portal, while aimed at streamlining, has caused interim workflow challenges for multi-country trials. These heightened compliance demands may increase per-study costs, squeezing margins unless Medpace can pass these expenses to clients or improve operational efficiencies.

Operational Execution Challenges

Medpace’s ability to turn its $2.85 billion backlog—essentially a pipeline of future work—into actual revenue depends on running clinical trials smoothly. However, challenges in starting and managing these trials can create delays and increase costs, which could hurt the company’s profits and cash flow. For example, finding and setting up the right locations (like hospitals or clinics) to conduct trials often takes longer than expected. In 2024, the time to get these sites ready ranged from 78 to 313 days, much longer than the ideal target of 90 days set by the National Cancer Institute. These delays can be costly—industry estimates suggest that each day a trial is delayed can cost around $600,000 due to lost time and resources.

Additionally, there aren’t always enough staff to manage the trials, and many doctors who help with research are so busy that they can only work on one trial per year. This creates a bottleneck, as there aren’t enough experienced professionals to handle multiple trials at once. Poor communication between teams can also slow things down, making it harder to start trials or keep them on track. In fact, about 80% of clinical trials face at least a one-month delay, which adds up quickly. If Medpace can’t address these issues by improving how it manages trial sites and hires staff, these delays could reduce its profits, slow down revenue growth, and make it harder to generate cash for future growth.

Competitive Dynamics and Pricing Pressure

Medpace faces intensifying competition in a consolidating CRO market, where large players and tech-enabled entrants create pricing headwinds. The $82 billion CRO services market in 2024 is projected to grow at a 9.4% CAGR to 2029, but over 50% of the market is dominated by IQVIA, ICON, PPD (Thermo Fisher), and Charles River, whose scale allows them to offer bundled, tech-driven solutions at competitive rates. IQVIA’s 2024 Pharma Deals Review highlights ongoing M&A and platform investments, enhancing its ability to undercut smaller peers on fees. Analysts project a median EV/EBITDA of 14.5x for CRO transactions, but large integrators often trade at a premium, pressuring independents like Medpace. As data and analytics become increasingly critical in clinical development, Medpace risks losing market share if it cannot match the technological capabilities of larger competitors while maintaining its premium pricing.

Financial Volatility and Currency Exposure

Operating across 44 countries, Medpace is exposed to currency fluctuations and geopolitical risks that can impact financial performance. Medpace reported $0.5 million in net FX losses from intercompany revaluations in 2024, showing that currency movements can (materially) affect P&L line items. Political instability or rapid currency devaluations in key emerging markets could further erode margins and cash flows if not adequately hedged, adding a layer of financial uncertainty.

Trial-Related Liabilities and Operational Risks

Medpace’s direct involvement in clinical trials, including patient interactions and operation of a Phase I clinical facility, introduces potential liabilities. Errors or adverse events during trials could lead to legal claims, damaging Medpace’s reputation and financial position. Additionally, the handling and disposal of hazardous substances in its labs pose environmental and liability risks, which could result in fines or cleanup costs if not managed properly. These operational risks, while inherent to the CRO industry, require robust risk management to minimize their impact on Medpace’s results.

Leadership Dependency

Medpace’s success has been significantly shaped by its founder and CEO, Dr. August J. Troendle, who has led the company for over 32 years and holds 20.9% of shares. His deep industry experience and strategic vision have been instrumental in Medpace’s growth, but this concentration of leadership poses a succession risk. A change in leadership, whether planned or unexpected, could disrupt strategic continuity and impact investor confidence, particularly given Troendle’s significant ownership and influence.

Final Conclusion

Medpace emerges as a compelling player in the clinical research organization landscape, blending the traits of a high-quality compounder with a disciplined, science-driven approach that resonates with the ethos of Compound & Fire. Its vertically integrated model, full-service offerings, and laser focus on small to mid-sized biotech firms have fueled impressive historical growth—a 23% revenue CAGR from 2015 to 2024—while delivering robust profitability, with a 22.8% EBITDA margin and a capital-light structure generating $572 million in free cash flow in 2024. The company’s moat, built on cost leadership, client lock-in, and therapeutic expertise in high-growth areas like oncology, positions it to capitalize on a CRO market expected to grow at a 6.1% to 9.6% CAGR through 2030, driven by rising outsourcing trends and demand for complex trials.

Yet, Medpace is not without its challenges. A declining book-to-bill ratio—down to 0.90x in Q1 2025—signals near-term headwinds, exacerbated by funding pressures for its biotech clients, which could impact backlog growth and revenue. Competitive dynamics, regulatory complexities, and operational risks further test its resilience, while currency fluctuations and leadership dependency add layers of uncertainty.

Despite these challenges, my valuation analysis indicates that Medpace is slightly undervalued, assuming an 8% growth rate through 2030. This growth rate reflects the current stressed market environment, where Medpace faces more difficult conditions impacting its near-term performance. My intrinsic value range spans $283.7 to $470.2 per share across bear and bull case scenarios, presenting a balanced risk-reward profile for long-term investors. Given these dynamics, I’ve set a buy-below price of $285, which delivers a 12.5% return on investment. Such a return I find acceptable considering the unfavourable market conditions Medpace is currently navigating.

For those seeking a quality compounder in the healthcare space, Medpace offers a strong case: a proven business model, a defensible moat, and exposure to a growing market. However, investors should remain vigilant, monitoring biotech funding trends, competitive pressures, and Medpace’s ability to maintain its operational edge. As with any compounder, patience and a long-term perspective are key—Medpace has the potential to be a cornerstone in a portfolio aimed at building wealth the smart way, but it requires careful stewardship to navigate the road ahead.

Hopefully you have enjoyed this deep dive. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

You are not worried about the culture and demand more margin of safety? Medpace has hands down the absolute worst reviews on glassdoor compared competitors.

Good write up, thanks. I have a quite big position in MEDP. Including DCA’ing, my price was $ 330. I am down 12.3% since then, so this could actually be a good entry point indeed. Because of the current size and the lack of cash I won’t be adding 😬