Watches of Switzerland Group ($WOSG.L) Deep Dive - Update

Compound & Fire Watches of Switzerland Analysis for Long-Term Shareholders

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way, hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

Come join the conversation on our Global Quality Investing Discord App here and hop on board my Substack if you haven’t yet. Let’s grow this journey together!

Introduction

As an investor captivated by the allure of luxury, I’m sharing this updated deep dive on Watches of Switzerland Group (WOSG) following their FY25 full-year results, which shed new light on their trajectory. The FY25 earnings, released last month, met my revenue expectations at £1.65 billion (up 7.4%) but fell short on margins triggering a 10% share price drop.

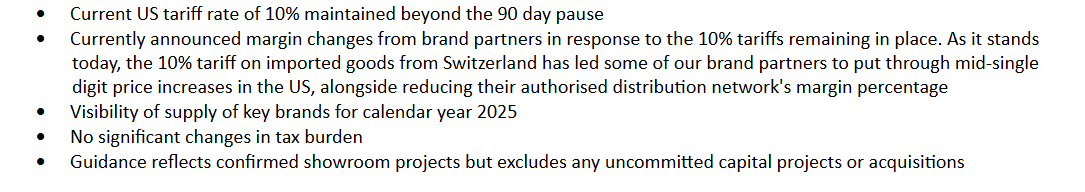

Management’s FY26 guidance projects 6-8% revenue growth with flat to -100 basis point EBIT margins, reflecting tariff pressures but confidence in US expansion. I’ve adjusted my deep dive and valuation model to account for these headwinds.

The company’s strategic focus on showroom expansion, the Rolex Certified Pre-Owned programme, and the recent acquisition of Roberto Coin Inc. positions it to capture further market share in both watches and jewellery. WOSG is entering FY26 with cautious optimism:

“As we look ahead, whilst we are of course remaining mindful of the broader macroeconomic and consumer environment, including potential US tariff changes, we remain confident in the strength of our diversified business model, our strong pipeline of showroom openings and growth projects, and the resilience of the luxury watch and luxury branded jewellery categories.”

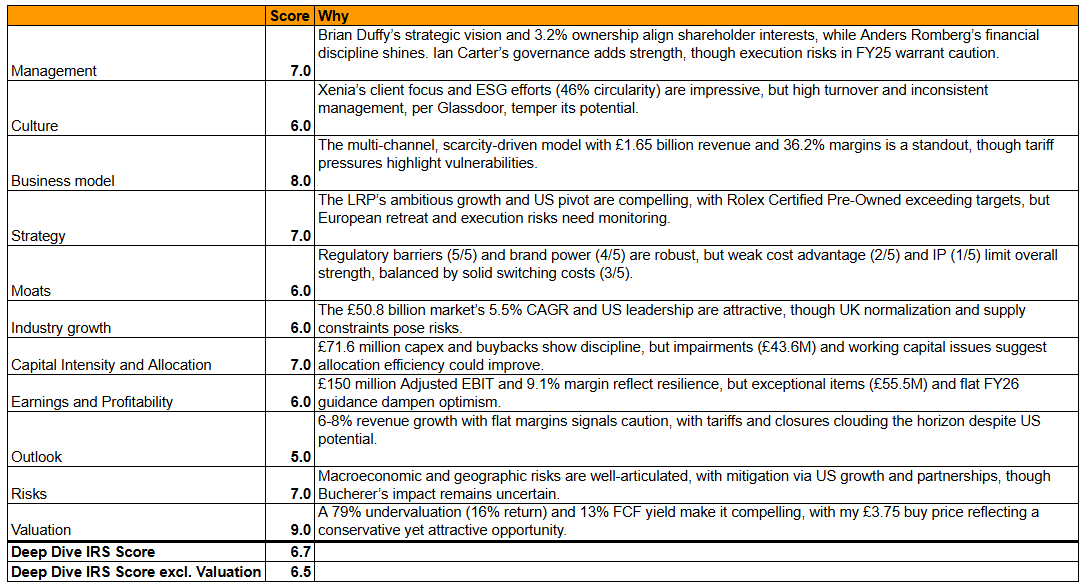

This deep dive explores WOSG’s journey from a single UK showroom to a global luxury retail powerhouse, dissecting its management, culture, business model, competitive moats, financial performance (2025 update), risks, and a valuation update.

History

My fascination with WOSG’s story begins in 1924, when the Watches of Switzerland brand opened its first London showroom, laying the foundation for a century of horological excellence. Initially focused on Swiss watches, the company quickly became a trusted partner for brands like Rolex and Patek Philippe, capitalizing on the UK’s growing appetite for luxury timepieces.

The acquisition of Mappin & Webb, a jeweller with a 250-year legacy, broadened its scope into luxury jewellery, creating a dual-pillar business model that remains a cornerstone today. Throughout the 20th century, WOSG expanded its UK footprint, establishing a network of showrooms renowned for expertise and client service.

The early 2000s marked a turning point as I noted the company’s shift toward professionalization and global ambition. In 2013, WOSG acquired Mayors, a US-based luxury retailer, entering the world’s largest luxury watch market and setting the stage for significant growth.

The 2019 IPO on the London Stock Exchange provided the capital to accelerate this expansion, with WOSG opening 20 net new showrooms in FY25, including 13 in the US and 4 in the UK. Recent milestones underscore WOSG’s adaptability. In FY24 the company opened 22 showrooms and acquired 15 from Ernest Jones, strengthening its UK presence.

The 2023 launch of the Rolex Certified Pre-Owned programme, now in 36 showrooms, tapped into the booming pre-owned market, while the $130 million acquisition of Roberto Coin Inc. in May 2024 marked a bold push into luxury jewellery, particularly in North America.

In FY25, WOSG’s US sales hit $1 billion, a testament to its strategic focus on this high-growth market. Despite challenges like US tariffs impacting margins, WOSG’s 100-year journey from a single showroom to a 234-showroom global network reflects its ability to balance heritage with innovation, positioning it as a leader in luxury retail.

Management - CEO

As an investor, I place significant weight on the quality of a company’s leadership, and WOSG’s management team inspires confidence with its proven track record and strategic vision.

At the helm is Brian Duffy, Chief Executive Officer since 2014, whose leadership has been instrumental in transforming WOSG from a UK-focused retailer into a global luxury powerhouse. Duffy, a seasoned retail executive with prior roles at Ralph Lauren and Kering, brings a deep understanding of luxury branding and international markets. His strategic foresight drove the US expansion, with US sales reaching $1 billion in FY25 (60% of group revenue), and the $130 million acquisition of Roberto Coin Inc. in May 2024, which I see as a bold step to diversify into luxury jewellery.

Image & Source: CEO Brian Duffy

Despite FY25’s margin pressures from US tariffs and higher credit costs, Duffy’s focus on high-return showroom projects and the Rolex Certified Pre-Owned programme demonstrates his ability to navigate challenges while capitalizing on growth opportunities.

His Long Range Plan (LRP) to double sales and adjusted EBIT by FY28 remains on track, reinforcing my belief in his execution capabilities. Supporting Duffy is Anders Romberg, Chief Financial Officer, who joined in 2021 from Kingfisher PLC. Romberg’s financial discipline has been critical in maintaining WOSG’s capital efficiency, with a FY25 adjusted EBIT of £150 million and a return on capital employed (ROCE) of 19.5% in FY24.

His oversight of the balance sheet ensured liquidity headroom of £209.3 million in FY24, providing flexibility amid tariff-related uncertainties. Romberg’s role in refinancing debt, including a new $115 million term loan for the Roberto Coin acquisition, underscores his strategic approach to capital allocation.

A CEO with skin in the game is very important and Duffy has 3.2% ownership in WOSG, which means the interests with shareholders are aligned.

The board is chaired by Ian Carter, whose experience as President of Hilton International and a non-executive director at Burberry lends global perspective and governance rigor. Carter’s emphasis on diversity and sustainability, evidenced by WOSG’s top-10 ranking in the FTSE 250 Women Leaders Review, aligns with my values as an investor seeking long-term resilience.

Source & Image: Ian Carter

The executive team is complemented by key figures like David Hurley, Deputy CEO, who oversees US operations and brand partnerships, and Craig Bolton, Executive Director, who drives UK growth. Their collective expertise in luxury retail and operational excellence positions WOSG to weather macroeconomic headwinds while pursuing ambitious growth targets.

Culture

As an investor, I view WOSG’s culture as a key driver of its competitive edge, blending a client-centric ethos with efforts to engage its 3,000-plus colleagues. Central to this is the Xenia Client Experience Programme, which I consider a standout in luxury retail. Built on the pillars of Know Me, Wow Me, and Remember Me, Xenia ensures personalized, memorable interactions across WOSG’s 234 showrooms and its Luxury Watch and Jewellery Virtual Boutique.

In FY24, WOSG hosted 500 client events, entertaining over 13,400 guests, which I believe strengthens loyalty in a market where relationships drive repeat purchases. Extending Xenia to Support Centres in FY24, embedding client service into back-office functions, signals a holistic approach that I expect will bolster FY25 margins, despite challenges like US tariffs.

However, culture extends beyond clients to colleagues, and here, employee feedback from Glassdoor and Indeed reveals a mixed picture. WOSG promotes an inclusive, development-focused environment, offering in-house training, a contributory pension scheme, staff discounts, and 24/7 wellbeing support. Its accreditation as a UK Real Living Wage Employer in FY24 and partnerships like the Prince’s Trust ‘Time to Inspire’ event underscore a commitment to colleague growth and community impact.

The Watches of Switzerland Group Foundation, donating £7.5 million to local charities, further enhances its social responsibility credentials, aligning with my ESG priorities.

Yet, employee reviews highlight challenges. Glassdoor ratings, averaging 3.5 out of 5 based on ~170 reviews, show 54-60% of employees recommending WOSG, with praise for friendly teams, career development, and access to prestigious brands like Rolex. However, criticisms include high staff turnover, stressful workloads (especially during peak seasons), and a commission structure perceived as uncompetitive, with some watches excluded from commissions despite profitability.

Employees report inconsistent management, with some stores fostering a supportive culture while others suffer from micromanagement or a “boys club” mentality at senior levels. Indeed reviews echo concerns about low pay relative to long hours, ineffective management, and a “toxic” culture in certain showrooms, particularly at Heathrow.

WOSG’s sustainability efforts, such as doubling UK watchmaking capacity and achieving a 46% circularity KPI in FY24 (watches repaired, serviced, or resold as a percentage of new sales), align with my interest in circular economy practices. Its improved CDP Climate Change score (from “C” to “B”) and net-zero emission targets tied to loan facilities reflect environmental responsibility. However, employee concerns about work-life balance (rated 3.0-3.3 on Glassdoor) and diversity at senior levels suggest areas for improvement. I believe WOSG’s culture, while strong in client engagement and ESG, must address these internal challenges to fully realize its potential as a luxury retail leader.

Business Model

WOSG’s business model elegantly leverages scarcity, expertise, and premium retail to generate high-margin revenue in the luxury watch and jewellery markets. WOSG operates as an international retailer, generating £1.65 billion in FY25 revenue through a multi-channel approach that spans 234 showrooms across the UK and US, e-commerce platforms, and a growing portfolio of mono-brand boutiques.

The company’s core revenue stream comes from retailing luxury watches (82% of FY25 sales), with brands like Rolex, Patek Philippe, and Cartier driving demand that consistently exceeds supply.

This scarcity, coupled with selective distribution agreements, allows WOSG to command premium pricing and maintain strong net margins (36.2% in FY25).

WOSG makes money by curating an extensive selection of luxury timepieces and jewellery, sold through a network of multi-brand showrooms (e.g., Watches of Switzerland, Mayors), mono-brand boutiques in partnership with brands like Rolex and TAG Heuer, and online channels, including the Luxury Watch and Jewellery Virtual Boutique.

In FY25, the US contributed $1 billion (60% of revenue, up 16% year-on-year), reflecting the success of its expansion strategy, while the UK and Europe grew 2% despite macroeconomic challenges. The launch of the Rolex Certified Pre-Owned programme in 2023 has boosted pre-owned sales, tapping into a growing market segment where authenticity and value retention are paramount.

The $130 million acquisition of Roberto Coin Inc. in May 2024 has accelerated WOSG’s push into luxury branded jewellery, a category with higher average selling prices and self-purchase frequency, contributing to diversified revenue streams.

The business model hinges on three key inputs: brand partnerships, colleague expertise, and client experience. Long-standing relationships with Swiss watchmakers and emerging jewellery brands, forged over decades, secure exclusive access to high-demand products. Colleagues, trained extensively through brand collaborations, deliver expert service.

WOSG’s investments in luxurious, browsable showrooms, 20 net new in FY25, and digital platforms enhance accessibility, while repairs and servicing (3% of watch sales) support a circular economy, adding incremental revenue. Despite FY25’s margin pressure from US tariffs and credit costs, I see WOSG’s model as resilient, capitalizing on scarcity and expertise to deliver consistent profitability (adjusted EBIT of £150 million in FY25).

Source: FY25 Results WOSG

Strategy & Moats

WOSG’s strategy is a disciplined blend of growth, exclusivity, and client-centricity, designed to maintain its edge in the £50.8 billion luxury watch market and the growing luxury jewellery sector. The company’s Long Range Plan (LRP) targets doubling sales and adjusted EBIT by FY28 from an FY23 base, driven by showroom expansion, strategic acquisitions, and enhanced brand partnerships.

In FY25, WOSG opened 20 net new showrooms (13 in the US, 4 in the UK) and plans flagship projects like the Rolex boutique on Old Bond Street and a Patek Philippe store at Old Billingsgate Market. The Rolex Certified Pre-Owned programme and Roberto Coin acquisition are exceeding LRP expectations, while a pivot from lower-return European markets to the UK and US reflects disciplined capital allocation. Despite tariff-related challenges in FY25, I believe WOSG’s competitive moats provide a sustainable edge.

Moats

Cost Advantage (Score: 2/5) WOSG’s cost advantage is limited, earning a 2/5. As a retailer, WOSG doesn’t manufacture products, relying on brand partners for inventory, which restricts cost control compared to an integrated model. In 2024 WOSG communicates a high FY24 net margin (36.2%), driven by premium pricing in a supply-constrained market, but FY25’s margin compression from US tariffs and rising interest-free credit costs highlights vulnerability to external cost pressures.

Investments in scale (e.g., 15 Ernest Jones showrooms acquired in FY24) and operational efficiencies like doubled repair capacity help, but high showroom operating costs (FY24 showroom costs: £289.1 million) and colleague turnover, noted in Glassdoor reviews, limit cost leadership. I see WOSG’s pricing power as a strength, but its retailer status caps this moat.Switching Costs (Score: 3/5) WOSG’s switching costs are solid but not exceptional, meriting a 3/5. Registration-of-interest lists for scarce products create stickiness, as waitlisted clients are unlikely to switch. Xenia’s personalized approach, with 500 events in 2024 and strong client feedback fosters loyalty. The Rolex Certified Pre-Owned programme locks in pre-owned buyers. However, Glassdoor and Indeed reviews note turnover and inconsistent service risking client loss to competitors or brand boutiques. Without churn data, I assume low churn due to scarcity, but service gaps temper this moat.

Regulatory Barriers (Score: 5/5) WOSG’s strongest moat is regulatory barriers, earning a 5/5. Selective Distribution Agreements limit retail points and enforce strict standards, creating high entry barriers. Showroom approval requirements for online sales deter digital disruptors. The Rolex Certified Pre-Owned programme reinforces exclusivity. I see these agreements as a powerful, sustainable barrier in a fragmented market.

Intellectual Property (Score: 1/5) Intellectual property is WOSG’s weakest moat, scoring 1/5. As a retailer, WOSG relies on brand partners’ designs, lacking patents. Xenia and showroom designs are proprietary but not patented, and employee turnover risks expertise loss. WOSG has minimal IP control, limiting this moat.

Brand Power (Score: 4/5) WOSG’s brand power is strong, earning a 4/5. Its 100-year heritage and partnerships with Rolex and others make its brands iconic, especially in the UK. High-profile events and centenary collaborations boost equity. However, reliance on third-party brands, and inconsistent store experiences, slightly limit control. I see this as a formidable moat.

Network Effects (Score: 3/5) WOSG’s network effects are moderate, scoring 3/5. Its 234 showrooms and client base (13,400 event attendees in FY24) attract more clients, enhancing visibility and waitlists. Partnerships like American Express Centurion amplify reach. However, the fragmented market limits network strength.

Competition

I find WOSG’s competitive landscape both challenging and reassuring, given its leadership in the UK luxury watch market and its growing presence in luxury jewellery. Operating in a fragmented yet supply-constrained industry, WOSG faces competition from independent retailers, brand-operated boutiques, online platforms, and large luxury conglomerates, each vying for a share of a market where demand for key brands like Rolex and Patek Philippe consistently outstrips supply.

Despite achieving record FY25 revenue of £1.65 billion, WOSG must navigate threats from competitors while leveraging its scale, brand partnerships, and client-centric model to maintain its edge. Below, I break down the key competitive forces and assess WOSG’s position.

Independent Retailers

The luxury watch retail market is highly fragmented, with a large number of small, independent jewellers competing in the UK and US. These retailers, often family-owned, lack WOSG’s scale and access to selective distribution agreements, which restrict their ability to stock high-demand brands like Rolex or Cartier.

WOSG’s acquisition of 15 Ernest Jones showrooms in FY24 and its multi-brand portfolio (Watches of Switzerland, Mappin & Webb, Mayors, Goldsmiths, Betteridge, Analog:Shift, Hodinkee) give it a significant advantage in market coverage and brand breadth. However, independents can compete on local relationships and niche offerings, particularly in smaller markets. WOSG’s service can be inconsistent due to turnover, potentially allowing independents to capture clients seeking personalized experiences. I see independents as a low-to-moderate threat, as WOSG’s scale and exclusivity outweigh their localized appeal.

Brand-Operated Boutiques

Major Swiss watch brands, such as Rolex, Patek Philippe, and Cartier, operate their own mono-brand boutiques, posing a direct competitive threat. The 2023 acquisition of Bucherer, a Swiss luxury watch retailer, by Rolex raised concerns, as it strengthened Rolex’s control over its distribution network, potentially diverting inventory from WOSG to Bucherer’s showrooms. However, WOSG’s long-standing partnership with Rolex, evidenced by the Rolex Certified Pre-Owned programme mitigates this risk. Selective distribution agreements ensure WOSG’s access to Rolex inventory, and its multi-brand model reduces reliance on any single brand. Still, brand boutiques benefit from direct brand equity and control, appealing to clients seeking an “official” experience. I view brand boutiques as a moderate threat, but WOSG’s diversified portfolio and Rolex partnership provide a strong defense.

Online Platforms and Pre-Owned Market

Online platforms like Watchfinder, Chrono24, WatchBox, and eBay compete in the pre-owned and new watch markets, offering convenience and competitive pricing. WOSG’s acquisition of Hodinkee, a leading digital platform for watch enthusiasts in FY25 strengthens its digital presence, complementing its showroom-driven model. The Rolex Certified Pre-Owned programme, exclusive to authorized retailers, gives WOSG a significant edge in the pre-owned segment, where authenticity concerns deter clients from unregulated platforms.

However, online players can undercut prices, potentially pushing clients to digital alternatives. There is a WOSG’s showroom approval requirement for online sales, limiting pure-play digital disruption. I consider online platforms a moderate threat, but WOSG’s certified pre-owned offering and digital expansion via Hodinkee position it well.

Luxury Conglomerates and Department Stores

Luxury conglomerates like LVMH (owning TAG Heuer and Bulgari) and Richemont (Cartier, IWC) compete indirectly by controlling brand distribution and operating their own boutiques. Unlike WOSG, these groups manufacture and retail, giving them greater control over pricing and inventory. Department stores like Harrods and Selfridges in the UK and Neiman Marcus in the US also compete, offering luxury watches alongside broader product ranges. However, WOSG’s specialized focus on watches and jewellery, combined with its scale and partnerships with non-conglomerate brands like Rolex and Patek Philippe, sets it apart. The Xenia Client Experience Programme creates a bespoke experience department stores struggle to match. Conglomerates and department stores pose a low-to-moderate threat, as WOSG’s expertise and exclusivity outweigh their broader reach.

Emerging Challenges

Two external factors intensify competition in FY25. First, US tariffs, prompting mid-single-digit price increases by brand partners, pressure WOSG’s margins and could shift consumer preferences to lower-priced competitors or pre-owned markets. Second, the closure of 16 UK showrooms in April 2025, may weaken WOSG’s UK presence, potentially ceding market share to independents or boutiques, though the FY25 update notes a return to UK growth in H2 (12% revenue increase). These challenges underscore the need for operational efficiency and client retention.

WOSG’s Competitive Edge

I believe WOSG’s differentiated business model, scale, leadership in chosen markets, and collaborative brand partnerships, positions it as a leader. Its 208 showrooms, $1 billion US sales, and 108% jewellery growth via Roberto Coin in FY25 demonstrate resilience. The Rolex partnership, selective distribution agreements, and Hodinkee acquisition counter competitive threats, while Xenia’s client focus mitigates service risks noted in Glassdoor reviews. Despite tariffs and showroom closures, WOSG’s ability to gain market share in a fragmented, supply-constrained market makes it a formidable player, though vigilance is needed to maintain its edge.

Financials

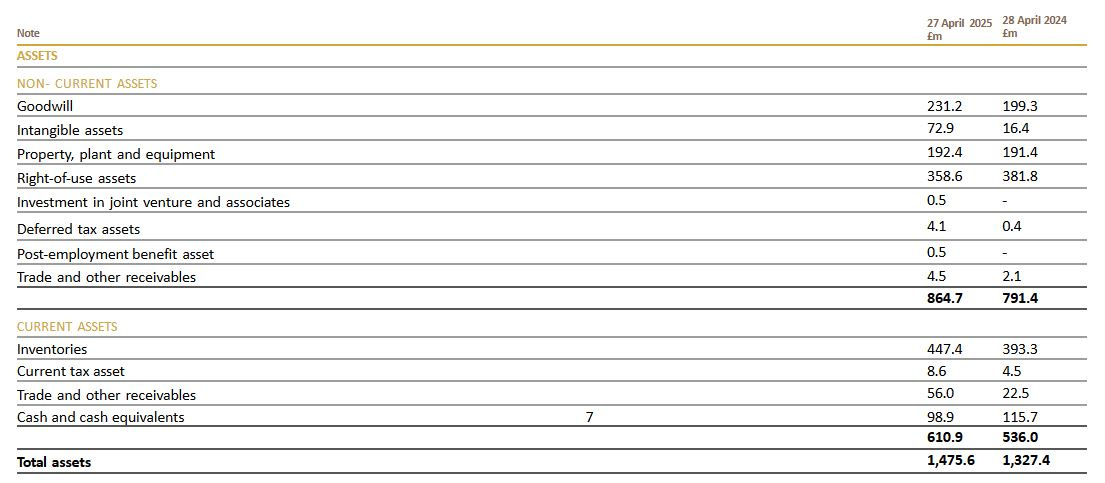

I will dive into WOSG’s financials to understand the backbone of its £1.65 billion FY25 revenue machine, starting with the Balance Sheet’s Assets side, which reveals key shifts driving its luxury retail strategy. The FY25 results highlight a company navigating growth through acquisitions and inventory management, with assets reflecting both opportunity and challenge in a tariff-impacted market.

Assets

Goodwill & Intangibles

The goodwill and intangibles category saw a significant increase of £88.4 million, a move that catches my eye as a signal of WOSG’s acquisitive growth strategy. This rise stems from two major acquisitions: Roberto Coin Inc. in May 2024, contributing £28.6 million in goodwill, and Hodinkee in October 2024, adding £8.9 million. Together, these deals generated £98.1 million in goodwill and intangibles, offset by £1.1 million in brand and agency agreement amortization and a £9.8 million adverse exchange impact.

A standout is the £57.2 million non-amortizing supply agreement licence with Roberto Coin S.p.A., extending into perpetuity, which I see as a long-term value anchor for WOSG’s jewellery push. Additionally, £3.6 million in computer software additions supported IT developments, tempered by £2.2 million in amortization and £0.2 million in disposals.

This £88.4 million jump reflects WOSG’s aggressive expansion into high-margin segments, though currency fluctuations and amortization warrant monitoring for future earnings impact.

Inventory

Inventory levels rose by £54.1 million (14%) compared to FY24, a development I analyze closely given its role in WOSG’s supply-constrained model. The increase includes £53.9 million from the Roberto Coin acquisition and £13.3 million from expanded pre-owned watches and Rolex Certified Pre-Owned volumes, offset by a reduction in underlying inventory to maintain stock turns.

WOSG’s inventory turnover ratio stands at 3.4, calculated as cost of goods sold (COGS) divided by average inventory, aligning with luxury retail norms where turnover is slower due to high-value, low-volume sales.

The turnover suggests efficient management despite the inventory hike. The low obsolescence risk, driven by strong demand for Rolex and pre-owned stock, reassures me, but the 14% increase, against a 7.4% revenue growth, hints at potential overstocking or strategic stockpiling ahead of tariff-driven price hikes.

Overall, the Assets side paints a picture of a company investing heavily in growth, through acquisitions, showrooms, and inventory, while managing currency and impairment risks, a balance I’ll assess further as I explore WOSG’s liabilities and capital efficiency.

Liabilities & Equity

Moving from the Assets side to the Liabilities and Equity section. With a focus on Borrowings.

Borrowings

WOSG’s borrowing strategy reflects a calculated approach to financing its expansion, and they have recently refinanced in December 2024. The Group refinanced and repaid its $115.0 million term loan facility, originally secured to fund the Roberto Coin Inc. acquisition in May 2024, with a new £150.0 million facility. This new structure comprises a £100.0 million term loan and a £50.0 million multicurrency revolving credit facility. The £100.0 million was drawn down as USD $125.0 million on the same date, with no further drawdowns permitted, running coterminously with the existing £225.0 million UK bank facility.

This refinancing, likely prompted by currency dynamics and acquisition costs, increases WOSG’s total committed borrowing capacity to £375.0 million, providing flexibility to support its US-centric growth strategy, where sales hit $1 billion in FY25.

The covenant tests attached to these facilities are critical to my assessment. The key metrics are the net debt to EBITDA ratio and the Fixed Charge Cover Ratio (FCCR), tested at each April and October on a pre-IFRS 16 basis, excluding share-based payment costs. Net debt to EBITDA, defined as total net debt at the reporting date divided by the last 12 months’ Adjusted EBITDA, must not exceed 3. The FCCR, calculated as Adjusted EBITDA plus rent divided by the total finance charge and rent over the same period, ensures debt servicing capability.

At both October 2024 and April 2025, WOSG comfortably met these covenants, with FY25 Adjusted EBITDA at £188 million (up 7.3%) and net debt managed below the 3x threshold, given the £209.3 million liquidity headroom. This compliance reassures me of WOSG’s financial health. The refinancing’s timing and structure intrigue me. The shift from $115.0 million to £100.0 million (USD $125.0 million at drawdown) suggests a strategic hedge against currency fluctuations, given the US’s 60% revenue contribution in FY25. The additional £50.0 million revolving facility enhances liquidity, supporting capital expenditures and potential further acquisitions like Hodinkee.

However, the fixed £100.0 million term loan, with no further drawdown option, limits flexibility if unexpected costs arise, such as those from the 16 UK showroom closures in April 2025. With interest rates remaining a concern, FY25 saw higher credit costs impacting margins, I’m cautious about the cost of this debt, though WOSG’s strong cash flow (£98 million in FY25) and covenant headroom mitigate this risk.

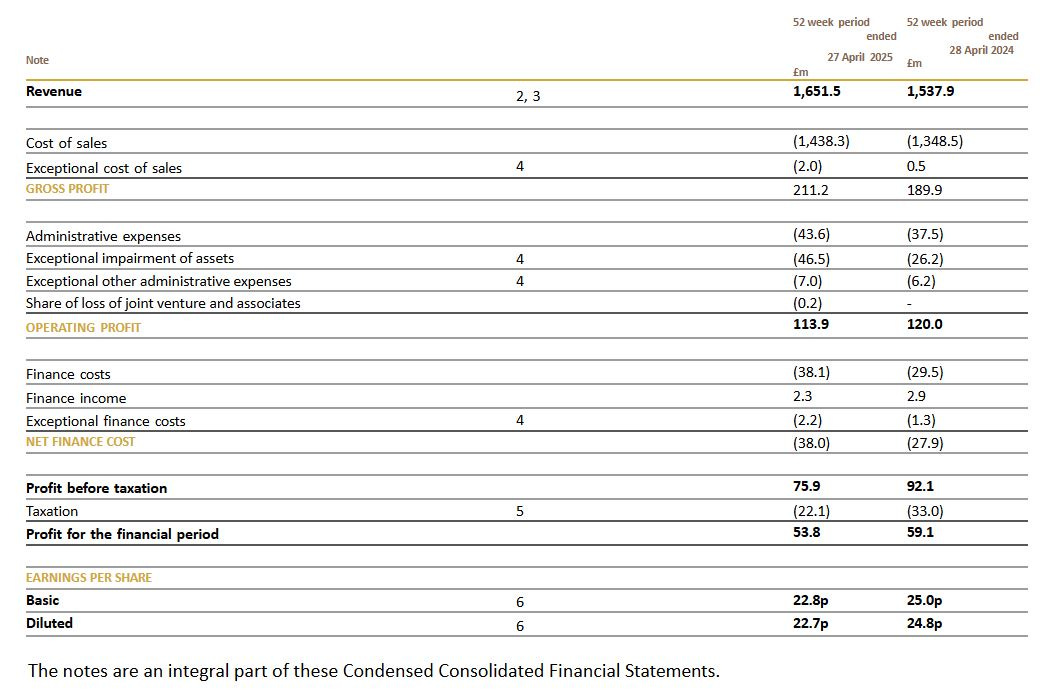

Profit & Loss

I will now turn my attention to WOSG’s Profit and Loss statement to gauge the profitability driving its £1.65 billion FY25 revenue, especially in a year marked by acquisitions, impairments, and tariff pressures.

P&L, Balance Sheet & Cash Flow

Let’s start with the P&L.

Revenue

When I examine the revenue growth to £1.65 billion, it aligns precisely with my forecasted figure for the year, reflecting a 7.4% increase. However, this growth is heavily influenced by the acquisitions of Roberto Coin (£111.9 million) and Hodinkee (£3.1 million), totaling a £115.0 million boost. Excluding these, organic revenue growth was effectively flat at -0.1%, a subtle decline that underscores the challenge of sustaining growth without acquisitions.

The segment breakdown reveals the US driving 16% growth to $1 billion (60% of revenue), entirely fueled by Roberto Coin’s wholesale contribution, while the UK and Europe managed a modest 2% rise, hampered by 16 showroom closures.

Cost of Goods Sold

The gross margin, excluding exceptional cost of sales, holds steady at 12.9% this year versus 12.8% last year.

The £2.0 million exceptional cost of sales ties to the Rolex Old Bond Street 7,200 sq ft showroom, opened on 14 March 2025. These costs, deemed exceptional due to the project’s unique scale and delays beyond WOSG’s control, reflect the investment in this flagship. I view this as a strategic expense, though it slightly dilutes gross profit in the short term.

Operating Expenses

The operating expenses are dominated by exceptional administrative costs linked to showroom impairments and closures:

Operating expenses stand out due to exceptional administrative costs, which drove a £40.1 million shortfall against my forecasted operating margin of £154.0 million, landing at £113.9 million. The culprits are clear: a £43.6 million non-cash impairment charge from a tough macroeconomic environment, high interest rates, and inflation, paired with a £1.6 million onerous contract provision and offset by a £0.7 million lease surrender gain, netting £44.5 million.

This write-down, targeting less productive stores, strikes me as prudent but signals vulnerability. Additionally, the closure of 16 UK showrooms in April 2025 added £1.2 million for asset write-downs, provisions, and redundancies, aligning with efficiency goals but raising resilience concerns. These exceptional costs, totaling £55.5 million, explain the gap, though I note underlying cost control efforts amid tariff pressures.

Adjusted EBIT and Outlook

To reconcile operating profit of £113.9 million to Adjusted EBIT, I add back the £55.5 million in exceptional costs and deduct £19.7 million in IFRS 16 adjustments, arriving at £149.7 million, slightly below my projected £154.0 million. This yields an Adjusted EBIT margin of 9.1% (up from 8.8% in FY24), a modest improvement. For FY26, WOSG guides revenue between £1,751 million and £1,817 million (6-8% growth), with Adjusted EBIT margins flat or down 100 basis points (range £141.8 million to £165.4 million, mid-point £153.6 million). This wide range are driven by:

This outlook contributed to the 10% stock decline WOSG faced after announcing their earnings. WOSG absorbing some tariff pain reinforces my Cost Advantage moat score of 2/5. For valuation, I’ll adopt the mid-range £153.6 million as a base case, reflecting management’s cautious stance and market sentiment.

Cash Flow

I will now shift my focus to WOSG’s Cash Flow statement to understand how its £1.65 billion FY25 revenue translates into cash generation, especially amid acquisitions and showroom closures. The cash flow picture reveals a company managing growth investments and one-off challenges, with key insights into its financial flexibility. Let’s dive into the details.

WOSG’s free cash flow (FCF) dropped by £19.8 million to £97.8 million in the year ending 27 April 2025, a decline that immediately caught my attention. This translates to a free cash flow conversion rate of 51%, down from 66% in FY24, primarily due to a higher working capital outflow. The culprit? Timing of trade creditor payments and a change in payment terms from certain suppliers, which tied up cash more than anticipated. Excluding this payment terms adjustment, conversion would have been a healthier 71%, suggesting the underlying cash generation remains robust. On the earnings call, management assured me that working capital will return to normal levels, framing this as a one-off event. I interpret this as a temporary shift, likely a negotiation with suppliers to align payment schedules during the Roberto Coin and Hodinkee integrations, rather than a structural change, though I’ll monitor FY26 to confirm this stabilizes. This one-off nature is critical, as it directly influences unlevered free cash flow (UFCF), which I calculate and use in my valuation model, making the 71% conversion a more reliable baseline for valuation once normalized.

Expansionary cash capex totaled £72.6 million, down from the prior year, reflecting fewer new showroom openings and refurbishments. With only four new showrooms and 11 refurbished, compared to 20 net new in FY25, this reduction aligns with the £43.6 million impairment and 16 UK closures, signaling a strategic pullback to optimize returns.

WOSG also allocated £11.3 million to share buybacks in FY25, part of a £25 million programme completed in June 2025. This move, reducing shares outstanding, boosts earnings per share and signals confidence, though it consumed cash that could have bolstered liquidity amid tariff pressures.

Exceptional cash items of £8.6 million include pre-opening rent for Rolex Old Bond Street, acquisition/integration costs for Roberto Coin and Hodinkee, and showroom exit costs. This aligns with the £55.5 million total exceptional impact in the P&L, with £8.6 million as cash outflow. I view these as one-off investments in growth and efficiency, consistent with management’s optimization focus.

Overall, WOSG’s cash flow reflects a year of transition, lower FCF due to working capital timing, tempered by strategic capex and buybacks. The one-off payment terms change, set to normalize, reassures me of underlying strength.

Risks

It is always important to look at the risks for an investment in WOSG:

The company faced challenges due to the macroeconomic environment, particularly in the UK market. High inflation and interest rates led to increased cost-of-living pressures for UK consumers, affecting their discretionary spending on luxury watches and jewellery.

The Group's performance is heavily reliant on the luxury watch market, which can be subject to fluctuations in demand and supply. The UK market, in particular, experienced a period of normalization following a COVID-induced boom.

The strength of the Swiss Franc led to significant price increases from luxury watch brands, potentially impacting consumer demand.

While the US market showed strong growth, the UK market experienced a decline. This highlights the risk of geographic concentration, with the company's performance being significantly affected by regional economic conditions.

The luxury watch industry is characterized by supply-driven dynamics, with demand often exceeding supply for key brands. This could potentially limit growth opportunities if supply constraints persist.

The company operates in a market with high barriers to entry, but maintaining market share and competitive advantage requires continuous investment in showroom enhancements, strategic acquisitions, and client experience initiatives.

The company's Long Range Plan involves ambitious growth targets, including more than doubling sales and Adjusted EBIT by the end of FY28 (versus 2023). There's a risk associated with the successful execution of this strategy, particularly in new areas like luxury branded jewellery.

Brexit-related changes, such as the withdrawal of VAT-free shopping for tourists in the UK, have impacted the company's business, highlighting the potential risks from regulatory and political changes.

Potential higher tariffs in US compared to the, by WOSG management expected of 10%, could further reduce margins.

Acquisition of Bucherer by Rolex

On top the Bucherer acquisition by Rolex could impact some of these risks as well. It could potentially lead to increased competition in the luxury watch retail market. Watches of Switzerland Group has a strong partnership with Rolex, but the Bucherer acquisition may alter the competitive landscape. There's also a risk that the acquisition could impact the supply of Rolex watches to other retailers like Watches of Switzerland. The annual report mentions that "Demand continues to exceed supply for key luxury watch brands", indicating that any changes in supply dynamics could be significant.

Rolex's acquisition of Bucherer does represent a significant move towards more direct control over retail sales, but with some important nuances:

Increased retail presence: By acquiring Bucherer, which has over 100 sales outlets worldwide (53 of which distribute Rolex), Rolex gains a much larger direct retail footprint.

Maintaining independence: Rolex has stated that Bucherer will keep its name and continue to operate independently, at least initially. This suggests Rolex is not immediately converting all Bucherer stores to Rolex-only boutiques.

Strategic control: The acquisition gives Rolex greater control over a major distribution channel and access to valuable customer data and insights.

Vertical integration: This move represents a form of vertical integration for Rolex, allowing them to have more influence over the entire sales process and customer experience.

Potential shift in strategy: While Rolex has traditionally relied on authorized dealers, this acquisition marks a significant departure from that model and could signal a longer-term shift towards more direct-to-consumer sales.

Industry impact: The move is seen as potentially reshaping dynamics between watch brands, authorized dealers, and consumers across the luxury watch industry.

Preserving partnership: Rolex framed the acquisition partly as a way to preserve its long-standing partnership with Bucherer, following succession planning challenges for the Bucherer family.

While Rolex is not immediately transitioning to a fully direct sales model, this acquisition does give them significantly more control and options for direct retail in the future. It represents a major step in that direction, even if executed gradually and while maintaining Bucherer's existing multi-brand structure for now.

In my opinion if Rolex even wants a next step in a fully direct sales model, they will have to acquire another luxury watch retailer. This could be WOSG or one of their competitors. Till that time, I don’t think a lot will change for WOSG, however the markets was afraid (last year) it will and hence share price has fallen significantly. I think the fear already got reduced a bit, one year later. Especially as Rolex supports WOSG growth trajectory in US.

Valuation

Reverse DCF - What Growth is Priced In?

Starting with known data points and working backwards to assess market expectations and judge whether these expectations are realistic.

I start by working backward with a Reverse DCF, using known data to uncover the market’s growth expectations and test their realism. With a 10% discount rate and a 3% perpetuity growth rate, the model reveals WOSG over the next decade doesn’t have to grow FCF to justify today’s price. Even with the current economic situation and the potential tariffs ahead, it seems to me the market is too conservative.

If you are interested in the forecast and valuation model in Google Sheets you can join my Discord app for free and get it. There will be more detailed information available in the app, also around other stocks.

DCF Model: What’s the Intrinsic Value?

Next, I calculate WOSG’s intrinsic value using a 6% base case for the growth of FCF to see where it stands.

The DCF suggests WOSG is undervalued by 79.0%, yielding a 16.0% annual return over ten years. At this stage this seems to be the margin of safety you want for a stock like WOSG. It is always good to look at a bear and bull case scenario as well:

The bull case at 9% FCF growth offers an intrinsic value of £8.7 and a 18.75% annual return.

The bear case at 3% FCF growth drops the intrinsic value to £5.1 with still a 13.1% annual return.

Given these outcomes, WOSG feels interesting at current levels. Historically WOSG has grown it’s Free Cash Flow by 18% CAGR, so from that perspective even the bull case is significantly lower at 9%.

As I would definitely want a 16% annual return on WOSG, I will lower my buy below price to £3.75 (from £5.17). This clearly indicates why the market reacted so negatively on the earnings update of WOSG. My personal purchase price for the portfolio was £3.90 last year and when I bought the stock in August 2024 my expectation was to make an annual return of 20% for the next ten years. Now, a year later, the stock is trending lower and my new expectation for the next ten years is (just) 16%.

Forward PE

WOSG’s forward P/E tells a similar story. Its median over recent years sits at 15.3, and currently it is 9.0 showing it’s trending significantly below it’s average.

Free Cash Flow Yield

The Free Cash Flow (FCF) yield provides a crucial lens for evaluating WOSG’s value. With a current FCF yield of close to 13.0% it surpasses the U.S. 10-year Treasury yield of 4.5%. This premium signals a compelling return.

Final Conclusion

WOSG’s blend of heritage, strategic growth, and undervaluation excites me, though their earnings update showing risks and execution challenges temper my enthusiasm. I see it as a strong long-term hold, with my adjusted valuation offering a safety margin.

Hopefully you have enjoyed this deep dive. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

Great Deep Dive - Update