Why I’m Passing on YouGov and Removing It from My Watchlist

A Quick Scan Reveals Why YouGov Doesn’t Make the Cut for Quality Investing

Welcome to Compound & Fire, where we’re on a mission to build wealth the smart way—hunting for top-quality businesses that grow shareholder value over the long haul, paving the road to financial freedom and early retirement.

This community is free, but if you’re enjoying the deep dives and want to support more content, you can treat me to a coffee on Buy Me a Coffee. Every bit helps keep the fire burning, and I’m truly grateful for your support! Let’s grow this journey together—join the conversation on our Global Quality Investing Discord App and subscribe to my Substack for free if you haven’t yet!

Hello, fellow wealth-builders!

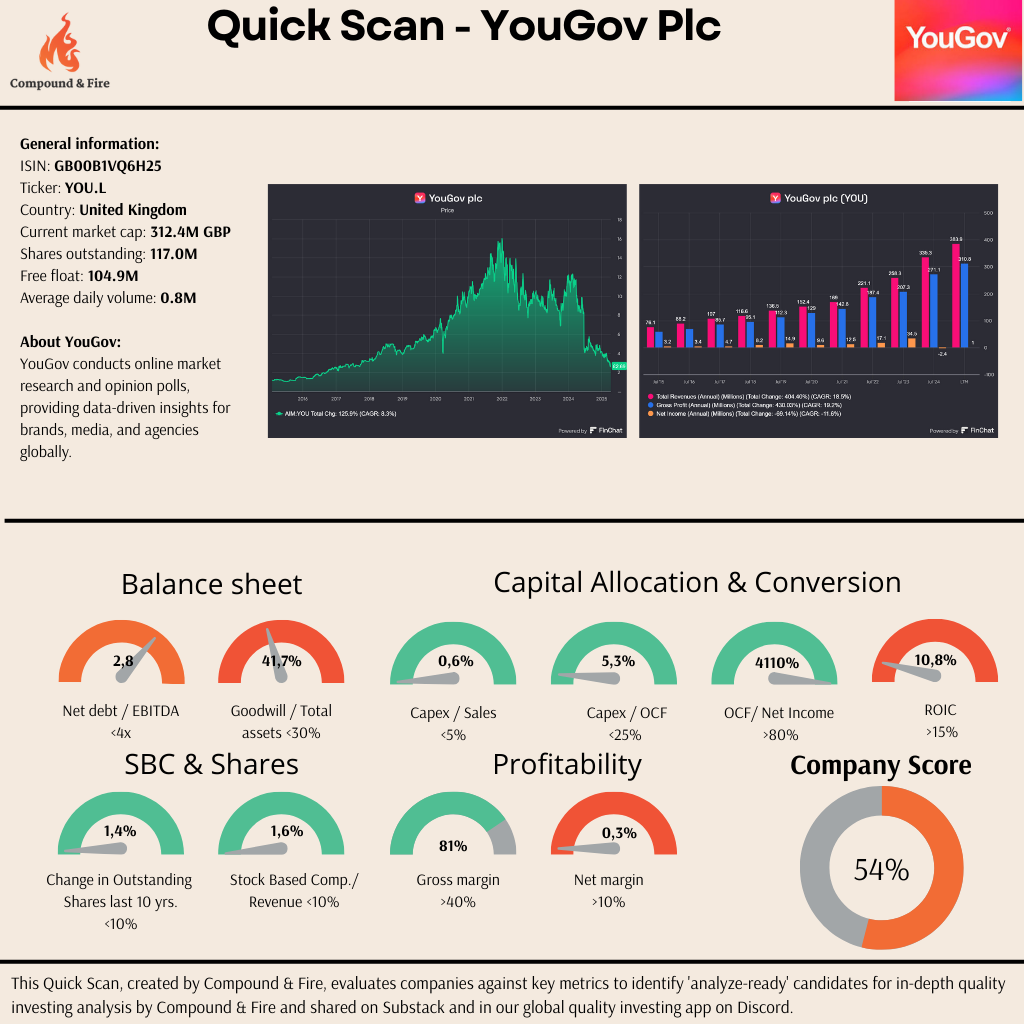

As part of my ongoing hunt for top-quality businesses that can compound value over the long term, I recently evaluated YouGov Plc, a company that’s been on my watchlist as a potential quality investment. YouGov, a UK-based company (Ticker: YOU.L), conducts online market research and opinion polls, delivering data-driven insights to brands, media, and agencies globally.

To determine whether YouGov warrants a deeper analysis, I prepared a Quick Scan to assess its key metrics and overall quality. My process is simple: I use these scans to decide if a company deserves an in-depth review, which helps me determine if and when I might invest. After reviewing YouGov’s results, I’ve decided to pass—and I’m also removing it from my watchlist. Let me break down why.

My Quick Scan: A Snapshot of YouGov

Here’s a look at the key metrics from the Quick Scan I prepared:

The scan highlights YouGov’s stock performance, showing a sharp rise and fall over recent years, with revenue and profit growth inconsistent since 2017.

The Pros: What I Like About YouGov

YouGov has some qualities that initially landed it on my watchlist:

Asset-Light Business: With a Capex/Sales ratio of 0.6% and Capex/OCF at 5.3%, YouGov doesn’t require heavy capital investment to operate—a hallmark of a scalable business.

High Gross Margins: At 81%, YouGov demonstrates strong pricing power or cost efficiency in its core operations, which is a green flag for quality investors like me.

The Cons: Why I’m Hesitant

Despite these strengths, the deeper metrics reveal cracks that don’t align with my quality investing philosophy:

Low Net Margins: A net margin of just 0.3% is a major concern. While gross margins are high, the company is struggling to convert revenue into meaningful profits—likely due to high operating costs or inefficiencies. For a quality business, I’d prefer net margins consistently above 10% for such a company.

High Goodwill on the Balance Sheet: Goodwill accounts for 41.7% of total assets, which is a red flag. This suggests YouGov may have overpaid for acquisitions, and there’s a risk of future write-downs that could erode shareholder value. I prefer companies with cleaner balance sheets.

Inconsistent Financials: The Quick Scan’s charts show volatile revenue and profit growth over the past several years. Quality businesses should demonstrate steady, predictable growth—not wild swings.

A Turnaround or Acquisition Candidate?

Here’s an interesting development: YouGov’s co-founder Stephan Shakespeare returned as interim CEO after activist pressure, effective immediately. This leadership change could signal a potential turnaround story, especially for a company with YouGov’s brand recognition and market position. Additionally, its asset-light model and global reach might make it an attractive acquisition target for a larger player in the market research space.

But here’s the thing—I’m not a turnaround investor. As a quality investor, I focus on businesses with strong fundamentals, consistent growth, and clean balance sheets that can compound value over decades. YouGov, while intriguing, feels more like a speculative play right now.

Why I’m Removing YouGov from My Watchlist

The final nail in the coffin for YouGov is its Company Score of 54%. In my process, I typically reserve in-depth analysis for companies scoring above 80%—those are the ones most likely to meet my strict quality criteria. With a score of 54%, YouGov falls well short of that threshold. As a result, I won’t be diving deeper into this company, and I’m also removing it from my watchlist to make room for more promising candidates. I’d rather focus my time and capital on businesses that are already exceptional, not those that might become exceptional with the right changes.

Final Thoughts

YouGov initially caught my attention with its asset-light model and high gross margins, which is why it made my watchlist. But after running it through my Quick Scan, the low net margins, high goodwill, and inconsistent financials make it a clear pass for me. Quality investing is about discipline—sticking to high standards and focusing on the best opportunities. I’ll keep searching for my next compounding gem, and YouGov won’t be it.

What do you think about YouGov? Are you more optimistic about its turnaround potential with the co-founder back at the helm? Let’s discuss in the comments—I’d love to hear your thoughts! And if you’re enjoying these deep dives, consider subscribing for more quality investing insights. Let’s keep compounding together!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

Crazy what happened to the stock. I had it also on my WL a while ago. good that I did not buy.